Riu rolls out new website for agents

Riu Hotels & Resorts has launched its new website, Riu Pro, designed to equip travel agents with all the sales and information tools required to market the brand, alongside up-to-date corporate information.

Recognising that travel agents play a key role in the growth and marketing process of Riu, the hotel chain committed to developing this agile and versatile tool, aimed at facilitating agents’ work as much as possible.

It entails significant innovation in Riu’s marketing area, as well as major optimisation of time and resources for both the hotel chain and agents.

The new tool incorporates the Riu Partner Club loyalty programme and access to the Riu Brand Centre database and image bank, as well as all the information, news and announcements about Riu that are relevant to travel agents. Agents can go to www.riupro.com and enter their usual passwords to access all the functions and new features.

Australia’s regional hotel markets outperform capital cities

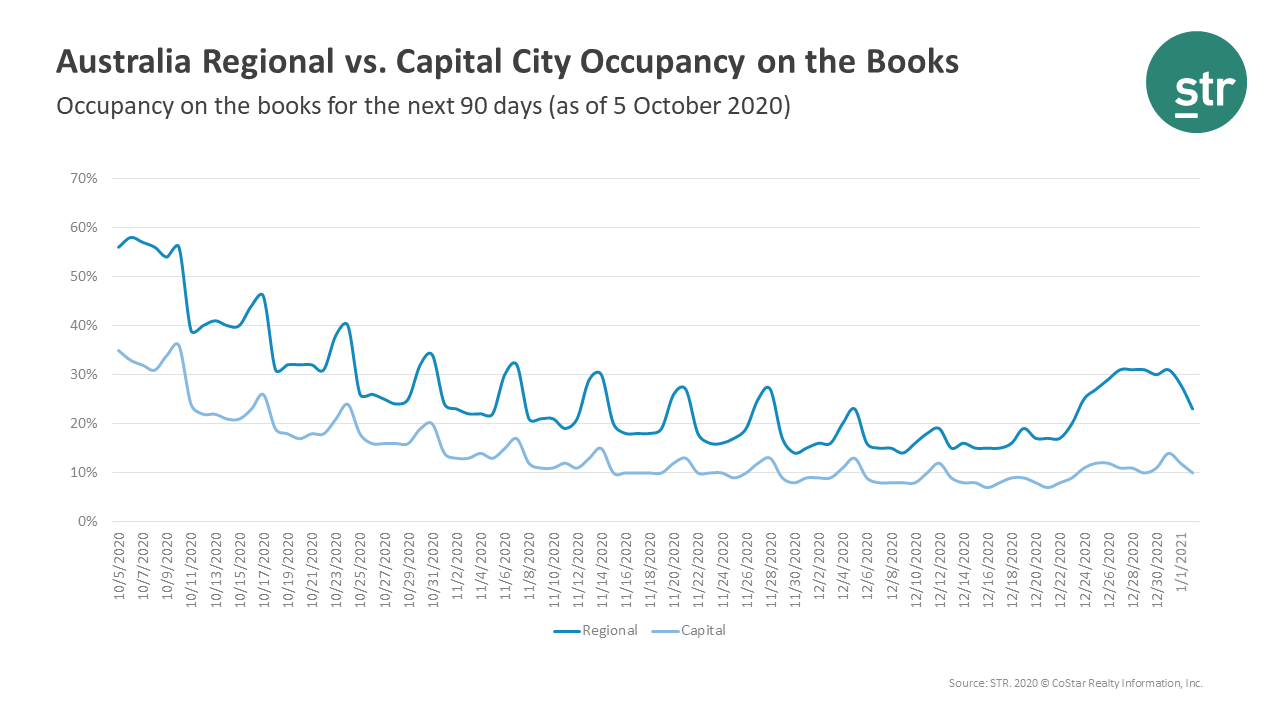

Australia’s short-term hotel performance will remain similar to recent months, with regional areas outperforming capital cities over the next three months, according to STR’s latest data.

Parallel to other countries across the world, higher occupancy in regional areas is especially pronounced on weekends, and occupancy-on-the-books data for the next 90 days (as of October 5) shows a similar pattern.

Data for October 17, for example, shows regional Australia’s occupancy on the books at 46 per cent, while the capital cities show 26 per cent in the metric. November and December data follows suit, with regional Australia data sitting between 14-32 per cent and capital cities between 8-17 per cent. Post-Christmas is where the trend begins to shift slightly, with more Australians set to head out of town for their summer vacations.

“Regional Australia has benefited from intrastate travel as Australians have elected to take short breaks on weekends and during the school holiday periods,” said Matthew Burke, STR’s regional manager, Asia Pacific.

“Airline capacity remains low as corporate travel is restricted, and even as state borders reopen, our capital city markets will see limited midweek travel. To date, as reflected by the occupancy on the books for the capital cities, corporate travel has not recommenced, and it looks more unlikely that it will before the end of 2020.”

Over the next 12 months, the Sydney surrounding market, as defined by STR, shows higher occupancy on the books when compared to the greater Sydney market. Sydney surrounding is a key drive-to market, so it is expected to benefit from those travellers wishing to take weekend leisure trips.

The highest monthly occupancy on the books for both markets is in October: Sydney surrounding (46 per cent) and Sydney (16 per cent). Closing out the year, occupancy on the books for Sydney surrounding remains above 20 per cent, while the Sydney market is showing the metric under 10 per cent.

“Brisbane, Perth and Canberra lead bookings for the coming weeks,” said Burke. “Cancellations are limited compared with the beginning of the year, but pick-up is still much weaker than we would expect to see under a normal trading environment. However, pick-up for the past month has been quite consistent, which shows there is travel activity happening and sustaining the current trading levels we have seen most recently.”

Even with some level of activity, performance data remains well below historical averages. Preliminary September data for the country shows occupancy came at 43.1 per cent, representing a decrease of 42.3 per cent year-over-year. Average daily rate was down 17.9 per cent to A$147.50 (US$105.21), while revenue per available room fell 52.6 per cent to A$63.51.

Indonesia sees uptick in travel demand to Turkey and Dubai

A combination of pent-up wanderlust and lockdown fatigue is driving demand for international travel among Indonesian travellers, with a pick up in outbound tourism bookings, following the reopening of borders in Turkey and the UAE.

Fonny Wijaya, general manager at Tripuri Wisata, said that the agency has sent more than 10 tour groups to Turkey since the end of July, even last month when Jakarta reimposed large-scale social restrictions across the capital city.

“At first, it was a bit difficult to sell Turkey because people were still worried about Covid 19. (However,) after the first and second groups travelled, demand began to increase, especially bookings for departures in October to December,” she said, adding that the pandemic has not deterred Indonesian tourists from travelling to destinations open to foreign visitors.

Interestingly, the demand is not only flowing from Jakarta, but also, small cities in Java, such as Bondowoso in East Java. While the number is still small, with only 15 to 20 people per departure, “there is always a group that leaves every week,” Fonny said.

She believes that the end of the year could be the peak season, as Turkey starts to enter winter, with the country gaining appeal in recent years as an alternative destination among Indonesian tourists desiring to see snow.

To build up hype, Kanomas Travel and Tour has crafted tour packages featuring famous clerics and celebrities. The tour is scheduled to depart at the end of October, with a target of 50 participants.

Dian A Rachmat, general manager of Kanomas Travel and Tour, elaborated: “With people afraid to travel amid the pandemic, the package has to be compelling. A beautiful destination alone isn’t going to cut it, so we try to provide the added value by (inviting) the clerics (to be) tour guides so the participants will have a unique experience.”

Dubai is another favourite destination among Indonesian travellers, with Golden Rama Tours & Travel reporting that the agency has began accepting reservations to the UAE’s most populous city. Its director, Edhi Sutadarma, said that enquiries have started to roll in about which destinations are safe and welcoming travellers during this time.

Edhi elaborated: “Many Indonesian travellers have expressed that they miss travelling. There are also those who are tired of being locked down for too long. It is a good sign for the industry.”

Even though travel demand to Dubai has picked up, Edhi admitted that the numbers are not as significant as those to Turkey.

He explained that the strict entry procedures required by the UAE government make Turkey a preferred destination over Dubai. Edhi added: “Also, tour packages to Turkey are cheaper than Dubai. As a destination, Turkey is also more attractive, especially since the Hagia Sophia was turned back into a mosque (this year).”

Malaysia budget hotels aim to boost occupancy through digitalisation

With the pandemic accelerating consumer demand for contactless payment solutions, budget hotels in Malaysia are looking to switch their operating models in order to capitalise on the contactless economy.

The Malaysia Budget Hotel Association (MyBHA) is encouraging its members to shift to contactless payment methods to boost their hotels’ occupancies, through the launch of the Jom Nginap (which means Let’s Stay in Malay) campaign, in collaboration with e-wallet provider Touch ‘n Go (TNG) and local digital payment solution provider Gkash.

MyBHA’s national president, Emmy Suraya Hussein, shared: “We will be the first hotel association to initiate and engage with 14 million TnG eWallet users in the country.”

Under the campaign, TnG will exhibit and promote all participating hotels in the TnG eWallet app, while Gkash will provide digital wallet solutions through business apps at zero-entry costs.

MyBHA will initially engage with 200 hotels nationwide to participate in this campaign which will run from November 15 to December 31, 2020. Looking ahead, the association will encourage more hotels to participate in similar eWallet cashback campaigns in the future.

Banyan Tree checks into extended stay space

In light of the rising remote work trend and evolving travel patterns, Banyan Tree Group has rolled out a new extended stay product across multiple destinations.

Dubbed Habitat, the new offering enables guests to enjoy long-term stays at properties in more than 30 destinations across the globe under the group’s house of brands: Banyan Tree, Angsana and Cassia.

With greater flexibility and the possibility of experiencing multiple destinations with a single pass, Habitat aims to offer a new way of living, working and travelling for seasonal travellers, families and remote workers.

With a Habitat Pass, guests can book their stays in ‘units’ of seven nights, with the choice to hop from one property to another within the same brands in different locations. In addition, savings increase up to 60 per cent with each additional unit purchased, where each unit can be redeemed at a different property during the period of their stay.

Each pass is valid for 12 months and guests may book up to four units per brand, ranging from seven to 28 nights’ stay, with the flexibility to redeem each unit at a different time.

Pass holders are also given credits of up to US$700 based on the number of units purchased, which can be used across multiple inclusions, including F&B, spa, wellness activities, and airport transfers. Other inclusions are free breakfast and Wi-Fi, alongside 24-hour fitness centres in most properties.

Domestic travellers can choose from nine Banyan Tree hotels in China and four in Thailand. When international travel reopens, guests may travel to properties across China, Indonesia, Laos, Malaysia, the Maldives, Mexico, Morocco, Thailand and Vietnam.

Coronavirus fears feed soaring private jet demand

The private jet industry is set for a quicker recovery than commercial aviation, as wealthy leisure passengers switch to private flights to reduce the risk of contracting Covid-19.

Even though the start of the pandemic sent shockwaves through the private jet industry – similar to the rest of the aviation sector – a promising rebound in recent months looks set to recover some of those losses, according to a GlobalData report.

Ralph Hollister, travel and tourism analyst at GlobalData, commented: “According to GlobalData, international business arrivals are expected to decrease by 40.7 per cent year-on-year in 2020. This dramatic reduction in business travel will likely take a prolonged amount of time to regain pre-pandemic levels. In order to stay viable, private jet companies need to now strengthen their focus on the growing leisure market while corporate travel remains bleak.”

Business tourism now looks to be one of the last types of tourism to recover, as businesses look to cut costs and reduce the risk of their employees contracting the virus, which makes online events and meetings much more of an attractive proposition for at least the short-term.

Against that backdrop, it is in fact leisure travellers who have helped private jet companies on their path to recovery. Some passengers that would have flown commercially are now paying a premium to fly private to meet their needs of safety and security, said the report.

Hollister added: “Privacy, safety and flexibility needs to be the key strength of private jets that are marketed to uncertain leisure travellers that sit in the higher socio-economic classes.”

He cited the example of Jet It, a business jet fractional ownership company, that has recently experienced a sharp increase in demand for private travel, allowing its owner Glenn Gonzales to expand his company and private charter company Jet Club. Gonzales stated that he has seen his business grow 300 per cent in Q2 and Q3.

Hollister concluded: “This increase in demand spurred by leisure travellers may permanently change the business models of many private jet companies. The more purposeful targeting of leisure travellers may be undertaken in order to attract a more diverse customer base going forward, assisting to achieve a successful post-Covid-19 recovery.”

Hyatt set to make Phnom Penh debut

Hyatt has signed a deal to double the number of hotels it manages in Cambodia, with a new hotel in the capital city of Phnom Penh.

Slated to open in 1Q2021, the Hyatt Regency Phnom Penh will complement the Park Hyatt Siem Reap, which is expected to start welcoming guests again on November 5, after a forced closure due to Covid-19.

With 247 guestrooms including 43 suites, the Hyatt Regency Phnom Penh will be located in the heart of Doun Penh, Phnom Penh’s cultural and business district, within walking distance to the Royal Palace, National Museum and the riverside.

Conceived by Singapore-based SCDA Architects, Hyatt Regency Phnom Penh will feature five dining venues, including The Attic, a speakeasy-style bar; and an open-plan dining concept called FiveFive Rooftop Restaurant & Bar, where guests can enjoy refreshing cocktails and DJ performances.

In addition, the hotel will feature 1,400m2 of meeting space as well as a slew of recreational facilities including a 24-hour fitness centre, tropical infinity pool, spa and the Regency Club Lounge.

Renewed lockdown deals fresh blow to Malaysia’s tourism sector

Hotels, attractions and tour agencies in Malaysia have been hit by a wave of cancellations, as the country’s major cities enter a partial lockdown once again following a recent spike in coronavirus cases.

The conditional movement control order (CMCO), which kicked off on October 14 in Kuala Lumpur, Putrajaya, and Selangor, will be in place over the next two weeks until October 27. The CMCO in Sabah, which started a day earlier on October 13, will end on October 26.

The move has had a spillover effect on domestic tourism in neighbouring states, according to tourism players whom TTG Asia spoke to. With the majority of bookings made up of travellers residing in the Greater Kuala Lumpur area, sector players have been deluged with a wave of cancellations, while new bookings have dried up.

Terengganu-based Ping Anchorage Travel & Tours CEO, Alex Lee, said that he has received more than 60 per cent cancellations following the CMCO announcement, mainly from the Klang Valley, which is affected by the CMCO.

The company also received booking cancellations from other states that were not under the CMCO, due to the current uncertainty of travel coupled with safety fears amid rising virus cases in recent weeks, he shared.

He added: “It would take months for domestic tourism to recover after the CMCO is lifted. The momentum will be slow initially and it is now vital for the government to continue supporting the tourism industry with fresh financial aid.”

Lee, who also runs the 22-villa Terrapuri Heritage Village in Terengganu, shared that current occupancy at Terrapuri stood less than 20 per cent, and the resort staff have been doing their best to persuade guests to postpone rather than cancel their holidays.

He predicted future losses in the coming months will be huge as the resort will still have to bear operating costs. Adding to its woes were unlicensed accommodation providers that were competing for domestic business by undercutting rates.

Likewise, Langkawi-based Megawater Sports & Holidays have also been hit with cancellations for jet ski tours, accommodation and ground tours in Langkawi, with the majority from Kuala Lumpur and Selangor, shared its director of sales and marketing, Sharmini Violet.

She said: “We tried to persuade guests to postpone their bookings, but they wanted to cancel. No one knows when the government will allow inter-state travel to resume from Kuala Lumpur and Selangor.

“Our marketing efforts are now focused on Kuching as AirAsia will resume its Kuching-Langkawi service from November 13. We are also looking at building our customer base from Johor and Penang.”

While the pandemic has slowed business at Megawater Sports & Holidays, Sharmini said the staff are using the downtime to upskill themselves with courses offered by the Human Resource Development Fund.

Also staring at a bleak outlook is Mutiara Taman Negara Resort in Pahang, who lost 90 per cent of its customer base, as they were from Kuala Lumpur, said its director of sales and marketing Kingston Khoo.

While the remaining 10 per cent of guests were from Penang, Johor and from within the state of Pahang, the current uncertainty made it very difficult to convince guests to postpone their bookings, Khoo added.

With recovery remaining deeply unpredictable, he said the resort’s priority now is to find ways and means to further reduce operational costs.

Under the CMCO, all tourism activities to and from the affected areas are banned. Those travelling by air through Kuala Lumpur International Airport, klia2 and Subang Airport are required to get police approval beforehand.

Nightclubs, pubs, recreational places, theme parks, indoor and outdoor playgrounds, cinemas and daycare centres are not allowed to operate during this period.

Physical seminars and conferences, workshops, courses, trainings and exhibitions are prohibited. Official and unofficial government and private events, gatherings, weddings, engagement ceremonies, birthday celebrations and similar social activities are also now allowed.

Meanwhile, dine-in at eateries are limited to two people per table; while food delivery, takeaway and drive-through are encouraged. Taxis, e-hailing and food delivery services are allowed to operate from 06.00 to midnight; with only two individuals allowed at a time in a taxi or e-hailing vehicle.

Skål Samui launches tourism recovery initiative

A new destination video along with a series of public relations activities are part of a new tourism recovery initiative led by Skål Samui to win over domestic and international tourists.

Debuting under the banners #RediscoverSamui and ‘prepare to fall in love’, the new promotional video contains never-before-seen footage of the best experiences the island has to offer, from white sandy beaches to ethical nature experiences.

The campaign targets mainstream media, bloggers and influencers who will be invited to experience the destination for themselves.

Some of the key messages conveyed by the campaign includes Samui’s clean and safe attractions and environment, improved state of wildlife during the tourism freeze, unrivalled choice of hotels and private villas, huge variety of restaurants and entertainment, and excellent access.

Lutz Mueller, president of Skål Samui, said: “Samui is lucky to have a fantastic collection of world-class hotels, resorts and spas, and now is the time to make sure Thailand’s travellers take advantage of what’s right on their doorstep.”

The campaign, which is being driven by members of Skål Samui, a chapter of the global hospitality and travel organisation SKAL International, underscores the organisation’s overall mission, Connecting Global Tourism.

The new video is available to all Skål Samui members and partners for their own promotional use and can be customised on demand at an extra charge.

Tourist arrivals to Macau are gradually picking up pace, with the special administrative region welcoming 156,000 visitors over the National Day Golden Week holiday, which took place between October 1-8, following the reopening of its borders to mainland visitors.

Although the figure marked a year-on-year fall of 86 per cent in average daily visitor arrivals, according to provisional statistics from the Macao Government Tourism Office (MGTO), it signalled a post-Covid rebound.

The city recorded 145,000 visitors from the mainland, which was the major source of visitors, constituting 93.1 per cent of total visitor arrivals with an 84 per cent decline in average daily visitor arrivals from last year.

Owing to virus containment measures, Macau registered only 9,614 and 1,231 visitor arrivals from the Hong Kong and Taiwan regions, respectively, as well as 13 visitor arrivals coming from international markets.

Visitor arrivals from the mainland have gradually risen in recent months as the pandemic situation stabilises in Macau and the mainland.

The rebound can also be attributed to MGTO’s active campaign to promote the reinstatement of travel permit issuance for mainland residents to Macau. From the first week after travel permit issuance was resumed up to the Golden Week, the average daily visitor arrivals rose from around 6,000 to nearly 20,000.

Figures provided by industry operators revealed that local hotel establishments (hotels and guest houses) saw an average occupancy rate of 43.6 per cent during the Golden Week, a year-on-year decrease of 50.4 percentage points. To date, the supply of local hotels and guest houses has reached a total of 42,441 rooms.

Industry figures show that the average occupancy rate for five-star hotels was 43.2 per cent, down 52.0 percentage points; for four-star hotels, 45.2 per cent, down 47.4 percentage points; for three-star hotels, 51.9 per cent, down 42.8 percentage points; for two-star hotels, 21.4 per cent, down 61.0 percentage points; and for guest houses, 23.9 per cent, down 51.7 percentage points.

The average room rate of hotel establishments in Macau was 1,290.5 patacas (US$161.9) during the Golden Week, a year-on-year decline of 30.0 per cent. The average room rates for five- and four-star hotels were 1,634 patacas and 605.2 patacas respectively, down 26.9 per cent and 49.4 per cent respectively; for three- and two-star hotels, 821.6 patacas and 285.7 patacas respectively, a decrease of 32.2 per cent and 69.7 per cent; for local guest houses, 240.3 patacas, down 65.7 per cent.