As the world’s fight against Covid-19 stretches on, the fallout has been markedly different across countries. Asia-Pacific has had some success in dealing with the pandemic – nations such as Japan and New Zealand have been lauded for their handling of the virus, and just this week, thanks to its containment efforts, Singapore announced plans to re-establish cross-border business and essential travel with Malaysia.

At the same time, the world is by no means clear of the crisis, and second waves are a distinct possibility, as seen in South Korea and Hong Kong. Despite the air of doom and gloom across the globe, an underlying sentiment of cautious optimism about travel is building in some parts of Asia-Pacific (like Singapore).

Adara’s spike analysis also reveals that, for the month of June 2020, flight searches to China from all countries reached an all-time high since the beginning of the year – suggesting that individuals are already beginning to make plans to travel overseas.

While the situation will continue to evolve, various elements of traveller activity and behaviour can be examined to prepare for the near future. Significant gating events such as infection rates and lockdowns are key factors travel brands need to understand. Brands should create scenarios that examine each layer of gating events across different timelines. With analytics resources, companies can lay out potential futures, and create action plans for marketing, staffing, and capacity management based on the timing and strength of individual rebounds.

Leveraging data to better target consumers

There is a danger that travel marketers try to create a single timeline of the future, with a unifying outcome. For example, Adara travel booking data reveals small signs of increases in the US, where leisure travellers are making bookings 90 days out. However, small inflection points will not add up to a single bottoming out and rebound of the curve – there will be fits and starts, with each slice telling its own story.

As positive trends arise, a logical framework – using data to analyse micro-trends – can prepare travel marketers for more personalised targeting. It is important for travel brands to get the inflection point just right, to optimise ad spend and accurately time their messaging and communication directly to prospective travellers in a relevant and considered manner. Notably, individualised messaging, pricing and services will be more relevant to travellers than a blanket campaign – the latter could come across as tone-deaf at best, and irresponsible at worst.

Individual travellers will respond differently to ad messaging depending on a complex interaction of past booking behaviour, demographics, and emotions. Older people, for example, are more anxious about travelling because of the personal risk of being harmed by the virus, compared to younger people, notes Lori Pennington-Gray of the University of Florida.

Discerning future upswings to stay ahead of the curve

Widely-held assumptions about how travel is likely to rebound over the course of the next 12 months are gaining traction. For example, international travel is expected to lag behind domestic travel, and outdoor destinations such as national parks are expected to be more popular than other attractions that tend to draw dense crowds. These forecasts seem logical and align with indications of consumer sentiment.

However, it is particularly important to challenge logic when there is a lack of historical precedent. Adara has tracked actual consumer behaviour that defies seemingly logical assumptions – for example, the notion that people will avoid destinations that cater to crowds is proving to be false, with the city of Las Vegas seeing a nearly 200 per cent uptick in bookings for late summer.

Travel marketers can leverage data from many companies that make their insights publicly available, including Smith Travel Research which tracks hotel performance, International Air Transport Association which provides scenario forecasts and BCG’s Travel Recovery Dashboard which provides a snapshot of key recovery indicators.

Adara’s free dashboard tracks consumer intent and booking trends for travel, with additional data for other discretionary activities such as dining and entertainment rolling out soon. Utilising this wealth of data enables brands and marketers to develop a shared, cross-functional plan to coordinate go-forward messaging, media buying, pricing and service as these micro-trends arise.

Having a sensible approach to data analysis and a coordinated marketing effort sets the stage for success. Having a compassionate approach to the individual needs of each traveller ensures it.

The Global Sustainable Tourism Council (GSTC) has awarded Greenview Portal for the Hospitality Industry the GSTC-Recognized System status, making it the first sustainable tourism management system to achieve the accreditation.

This marks GSTC’s formal expansion of its recognition programme to apply to not only standards but also management systems. Last year, the council awarded Hilton LightStay the GSTC-Recognized status for its own portfolio, helping pave the way for expanded use of GSTC.

GSTC CEO Randy Durband said: “By using GSTC-Recognized systems, hotel and tourism companies will now be able to embed the GSTC Criteria, which includes the full range of environmental and social considerations specifically developed for the tourism sector, throughout their management processes and set them on the path of continuous improvement and towards certification.”

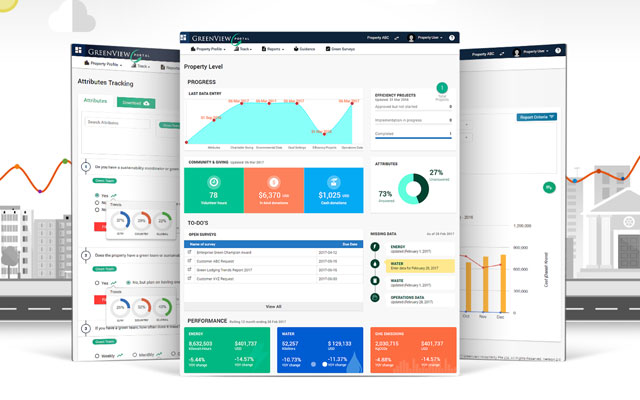

The Greenview Portal is an industry-specific system developed by Singapore-based consultancy Greenview that allows hotel companies to track, measure and improve in areas of environmental sustainability and social responsibility at property or multi-site level. The online platform allows hotel owners, operators, and affiliations to track, benchmark, report and improve on various aspects of environmental and social performance.

Greenview founder and CEO, Eric Ricaurte, said: “The investor community’s interest in environmental, social and governance performance is growing and we are seeing governments proactively pursue solutions to destination management across the value chain. In addition, consumer demand for clearly identifiable sustainable products is increasing, and as a result so is OTA interest in providing relevant content.

“The GSTC provides the consistent framework under which results can be achieved. This recognition will enable our hotel and hotel company clients to ensure their sustainability programmes are fully aligned with the GSTC Criteria and address this stakeholder interest, while delivering tangible value with a practical system.”

Users of the Greenview Portal that have made significant progress in their adherence to the GSTC Criteria, will be able to achieve certification following an external audit by a GSTC-Accredited Certification Body.