Singapore tourism sector draws up battle plan for “long winter” ahead

• International tourism recovery could take “three to five years”, says Singapore’s tourism chief

• Agility and creative innovation key enablers to drive tourism recovery

• Businesses that harmonise tech and human touch will be more prepared to play in the new normal of travel

Nine months into the Covid crisis, which has rewritten the playbook for Singapore’s tourism industry, local players have proven their agility in adapting to a new reality. In this changed landscape, brands have had to seek out new growth opportunities, retune their business plans, unlearn old habits and adopt new ones.

However, tackling the pandemic and its aftermath will be a marathon, not a sprint. And more needs to be done to ensure the long-term survival of the tourism sector as it braces itself for recovery.

Painting a gloomy forecast of the path forward, Singapore Tourism Board CEO Keith Tan said “there is a long road to recovery ahead” and “frankly, from where I stand, I am not sure I see any light at the end of the tunnel”.

He predicted that even if a vaccine was found by year-end or at the start of 2021, it would take “possibly three to five years” for international arrival numbers to return to 2019 levels.

“We must be prepared for a long winter,” he said, but stressed that in the interim, “we cannot simply be in hibernation”. Rather, Singapore needs to continue working to ensure that the destination remains top of mind for high-value business and leisure travellers.

Tan was speaking to industry stakeholders at the SG Tourism Roundtable: Navigating the Covid Storm webinar organised by PATA. The two-hour session saw players from the hotel, retail, travel agency and attractions sectors sharing how Covid-19 has disrupted their industry, and lessons learnt.

In his opening remarks, Tan urged tourism stakeholders to identify their existing capabilities that set Singapore apart from her competitors, and pledged the government’s support to sustaining those capabilities.

He also encouraged players to be creative in finding new revenue streams, such as pivoting to digital platforms, and called on businesses traditionally reliant on foreign visitors to reposition their business to target locals more effectively.

Tan warned stakeholders not to expect the tourism industry to return to pre-Covid normal, even after travel rebounds. “There will be permanent, lasting changes to the mindsets and expectations of travellers. So we must change, we must improve or else many of us will not survive,” he said.

Predicting that in the new normal where people will travel less and seek unique travel experiences, Tan said the industry needs to be prepared to meet that thirst for more exclusive and smaller-scale experiences.

Likewise, Kevin Cheong, chairman, Association of Singapore Attractions, urged local attraction operators to create unique, authentic and original experiences.

“Nobody came to Singapore to see more of China… For too long a time, we have been copying (from our foreign counterparts). We need to develop our own unique content (and) our own local stories (that) really pull the heartstrings of our guests,” he said.

Creating new revenue streams

With sustained international border closures, the hotel industry remains in “critical financial crisis”, said Margaret Heng, executive director, Singapore Hotel Association (SHA).

However, she noted, nimble-minded hotels in Singapore have been quick to pivot to incremental revenue streams, such as creative takeaways, F&B delivery services, online gift shops, and most recently, ‘workations’ – a staycation for work – to boost weekday demand.

The pandemic has also forced brick-and-mortar brands to rethink their business model. In light of current capacity limits due to safe distancing measures, local cinema operators have struggled to break even, according to Terence Heng, vice president, Shaw Theatres.

This will still be the case when capacity limits at cinemas are raised from October 1. Large cinema halls with more than 300 seats will be allowed to admit up to 150 patrons in three zones of 50 patrons, while smaller cinema halls will be permitted to up their capacity to 50 per cent of their original operating capacity or stick to the current limit of up to 50 patrons per hall.

Adding on to the woes of cinema operators is the move by many studios to push back movie release dates, or air titles on streaming services.

To diversify its business, Shaw Theatres in July launched a virtual cinema, KinoLounge, streaming indie, arthouse flicks not screened in local theatres. Unlike its physical counterpart, the online platform can showcase Q&A sessions with the directors and filmmakers, offering “a new level of in-depth interaction”, Heng said.

He added that the company is on a constant hunt for alternative content for its physical cinemas. It also has plans to expand its F&B offerings, with the possibility of pivoting to home delivery, he said.

Stronger together

During times of crisis, it becomes all the more crucial for industry stakeholders to band together for a stronger fight.

Tan urged various establishments to come together to create meaningful and exclusive packages and bundles to appeal to more discerning travellers, including locals.

Collective synergies play a key role in recovery, said SHA’s Heng, noting that “without the government’s support, the private sector alone cannot survive the crisis”. She added that collaboration has helped Singapore “to emerge stronger in comparison to many other countries”.

Singing the same tune, Steven Ler, president, National Association of Travel Agents Singapore (NATAS), urged agents to be more open to sharing resources and working collaboratively. There is room for greater collaboration, even across sectors, he stressed.

Looking ahead, NATAS plans to create more collaborative platforms for agents to work together to explore new opportunities such as jointly developing back-end solutions, Ler shared.

In the retail sector, collaboration between landlords and tenants needs to be strengthened, opined Rose Tong, executive director, Singapore Retailers Association. “There should be more equal sharing of responsibilities in shopper traffic and sales acquisitions. We will be looking and expecting more flexible lease structures, shorter lease periods, and less onerous lease terms,” she said.

Marrying high-tech and high-touch

Technology has become a critical enabler for businesses across the tourism value chain to continue engaging with customers and generating revenue amid the pandemic.

This point was driven across by Tan, who urged the industry to step up to create more seamless and digitally-enabled experiences for visitors. “To survive and to thrive, all of us have to be armed with the right data, insights and the abilities to scale new products and experiences faster,” he said.

He urged stakeholders to leverage STB’s suite of smart services that allow businesses to tap into data to target customers more smartly and to guide their business decisions.

But while Covid has hastened the shift to contactless interactions, panellists stressed that high-touch still play a key role in a high-tech world.

“The relationship between offline and online retail is now more important than ever, and brands that cannot combine or marry the two will find it hard to sustain or even be profitable,” Tong said.

Stressing the importance of human touch, Ler said the role of travel agents has become “more relevant in this critical time” where uncertainty surrounding travel has thrown up a lot of questions for aspiring travellers. “We (agents) can be better prepared to have (relevant travel) information (on hand) to share with the customers as we guide them through the booking process,” he said.

At the end of the day, the sector must unite to push for growth, and accept that the new normal is here to stay.

Double Covid testing, travel insurance among Crystal Cruises’ new protocols

Crystal Cruises has expanded the set of health and safety measures for its Crystal Clean+ protocols to include Covid-19 testing for all guests and crew, mandatory travel insurance, in-port guidelines, and more.

The new Crystal Clean+ 3.0 protocols build on Crystal Clean+ 2.0, the initial set of enhanced health and safety procedures released in July, and comes even as the cruise operator has voluntarily extended its suspension of global voyages until year-end.

The new protocols incorporate the current recommendations provided by CLIA to the Centers for Disease Control and Prevention.

Under the new protocols, guests will now be required to complete a Covid-19 test prior to departure for their cruise and provide a printed copy of their negative result at check-in – failure to do so will result in denial of boarding. In addition, guests will take a second Covid-19 test upon arrival at the pier and must test negative prior to boarding. Guests will be required to purchase travel insurance, either via Crystal or a third-party.

While on board, guests will have to observe social distancing of at least two metres of those outside of one’s travel party, including dance partners. As a result, Crystal’s Ambassador Host dance programme as well as Crystal’s Junior Activities programming and in-suite babysitting services will be suspended until further notice.

Furthermore, guests will only be permitted to disembark the ship in port if participating in Crystal’s shoreside activities or excursions, and shuttle buses into town will not be provided when in port – guests who fail to comply will be barred from reboarding the ship.

All crew will be tested for Covid-19 prior to leaving their home location to join the ship and must receive a negative result. They must also take a Covid-19 test at embarkation, quarantine for seven days upon arrival, and take a test at the end of that seven-day period and must receive a negative result before beginning their duties. In addition, crew will be tested periodically during their rotations.

Expanded measures were released across the entire Crystal fleet, including Crystal Cruises, Crystal River Cruises, Crystal Yacht Cruises and Crystal Expedition Cruises.

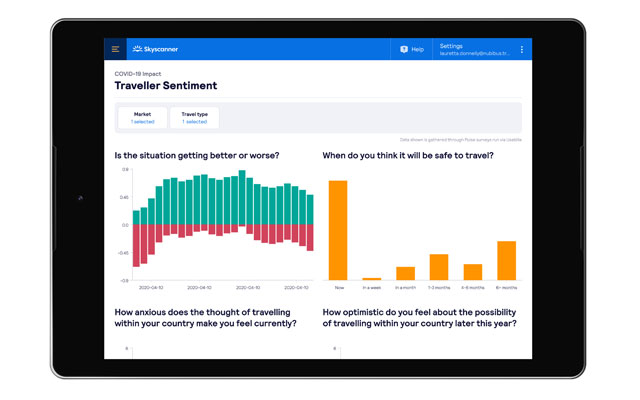

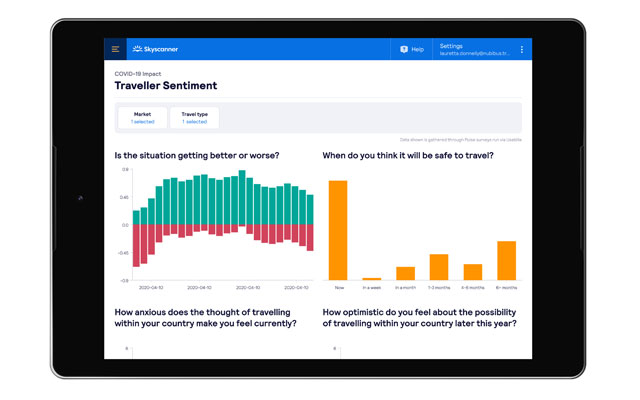

Skyscanner monitors flight demand in real-time

Skyscanner has launched Travel Insight Vision, a business intelligence tool which analyses traveller behaviour by capturing flight search and intent data in order to help airlines, airports and DMOs navigate an ever-changing travel landscape.

With analysing travel demand now more important than ever, the Saas platform features a new dedicated Covid-19 impact module, tracking the changes in flight demand amid the fluid pandemic situation. Travel Insight Vision provides data within less than 12 hours from the previous day.

The module looks at market and route trends, up to 12 months ahead, and provides insights into traveller mindset and willingness to travel in the near future, broken down by market. Airlines can decipher the best strategies to return routes to market, adjust inventory algorithms accordingly and navigate their way towards recovery from Covid-19 impact.

Michael Docherty, commercial lead for data products at Skyscanner, said: “The way the aviation sector worked before simply won’t work anymore; pricing strategies can no longer rely on the booking curves of last year, capacity decisions are being driven by open borders and quarantine restrictions, and travel demand is changing every day.

“Our sector is facing unparalleled dynamics. It has never been more essential to have insights from real-time data to respond quickly to potential business opportunities and mitigate risks. Every day, we are unveiling new trends within the travel landscape – from a massive rise in demand for domestic travel to a growing popularity of shorter booking windows as travellers wait until the last minute to book their trips. We want to empower our partners to truly understand this new world of travel and sharpen their vision of the future.”

In addition, the new SaaS offering features a Performance module, which provides competition analysis for airlines and airports, looking at evolution and competitiveness. Travel Insight Vision will allow airlines and airports to analyse the competitor landscape in relevant markets and on specific routes, as well as monitor price evolution.

China domestic flights soar past pre-Covid levels as Golden Week approaches

Bucking the trend of slow air travel recovery, the volume of domestic flights in Mainland China during this year’s annual Golden Week holiday, from October 1 to 8, looks set to push well past last year’s record, according to Cirium data.

Often called “the world’s largest annual human migration,” the peak travel period for this year’s Golden Week will be between September 30 and October 11. A snapshot of Cirium Core data taken on September 23 shows more than 164,700 domestic flights scheduled during the period, representing an increase of more than 11 per cent compared with the same time in 2019 when approximately 148,000 flights flew.

This year’s passengers will fill more than 27.8 million domestic aircraft seats during Golden Week, with the busiest day being October 7, when over 13,800 domestic flights are scheduled to take to the air. That is an increase of 9.6 per cent over the busiest day in 2019 (October 6) when more than 12,600 domestic flights were operated.

Rahul Oberai, Cirium managing director for APAC, said: “Covid-19 has clearly had a major impact on Mainland China’s international and domestic flight schedules. Between January 1 and September 23, 2020, 18 per cent of scheduled international flights and 17 per cent of scheduled domestic flights were not flown. However, when it comes to year-on-year growth, the story is completely different, with international registering a 77 per cent drop, while domestic suffered a more modest 16 per cent decline.

“Some regions are showing signs of recovery as travel restrictions begin to ease. However, those with large domestic markets, such as China, are the ones most likely to see capacity bounce back or even achieve some level of positive growth.”

This year, the most popular Golden Week destination for domestic air travellers is Shanghai. Its two airports – Shanghai Pudong International and Shanghai Hongqiao International – will welcome more than 10,800 flights between September 30 and October 11, and over 900 on October 7 alone.

The capital, Beijing, is a close runner-up. It will see some 9,840 flights fly in between September 30 and October 11, and close to 830 arriving at its Beijing Capital International and Beijing Daxing International airports on the busiest day of the annual break (October 7).

The third most popular Golden Week domestic air travel destination will be Guangzhou. Guangzhou Baiyun International Airport will be the country’s busiest individual airport, with more than 7,280 flights arriving between September 30 and October 11, and more than 600 on the busiest day. It will be followed by Chengdu, Shenzhen, Kunming, Chongqing, Xi’an, Hangzhou and Nanjing rounding out the top 10.

Oberai said: “The positive Golden Week domestic traffic figures are good news for Mainland China and an encouraging sign for other regions. They also demonstrate what Cirium has been saying since the start of the pandemic – that during the recovery, travel patterns may be fragmented, with VFR (visiting friends and relatives) traffic driving journeys ahead of business traffic.”

Cleared for take-off: gearing the industry for revenge travel

As global travel restrictions continue to ease, anybody who can will start packing their bags again. In fact, the resurgence in travel is expected to be so pervasive that the term “revenge travel” was coined to describe consumers hastening to make up for disrupted 2020 plans, which will likely cause a growth spurt in the travel industry.

Tourism has become a key driver of many of the region’s economies, with the sector accounting for 12.1 per cent of South-east Asia’s gross domestic product in 2019. Globally, Asia was once again the biggest growth driver in the international tourism market during the first eight months of 2019, before the pandemic dealt a severe blow to its rise.

To prevent further losses, governments are now looking intently at reigniting aviation by cautiously allowing cross-border business travel and by introducing mandatory Covid-19 testing for inbound travellers.

But is the travel industry ready to fully capitalise on this upcoming return to the skies?

Travel players may be eager to emerge from the crisis, but the truth is, they may not be looking at the same landscape they used to know. As uncertainty looms, companies need to find new ways to gear up their business to pre-pandemic levels and come out stronger than ever.

This involves not only addressing new travel risks and anxieties, but also taking the golden opportunity to reimagine their operations — from travellers’ experiences, to the business’ processes — so that they don’t fall into old traps.

Understanding new travel realities

One of the lasting legacies of this pandemic will be a greater emphasis on sustainability and health as the public becomes more conscious of the impact of their travel choices.

The pandemic presents an opportunity for industry players to rethink their customer’s journey — from when they book their first flight, to the moment they return — and integrate more sustainable practices throughout the cycle.

All travel stakeholders including governments, businesses and industry associations should also look to adapt to the changing habits and pain points in this new era.

Fully digital passports and e-passports with embedded smart chips, for example, can ease immigration procedures and checks. These chips leverage biometrics technology, and contain the passport holder’s photograph and personal information (e.g., full name, date of birth).

Governments around the globe have already started using e-passports so as to securely authenticate the identity of travellers. E-passports that integrate near-field communication (NFC) functionality to read the information from the e-passport chips can further negate the need for travellers to pass around their physical IDs at airline gates, thus easing some anxieties as we seek out a more contactless society.

Digital health IDs are also being explored to streamline travellers’ health declarations. These IDs can incorporate recent Covid-19 test results, health declaration forms and contact tracing data to validate and verify that the traveller is negative. This provides airports and hotels with a safe way to reopen, while protecting travellers’ health and safety.

Plugging gaps in operations

It is also crucial to remember that some of the challenges that existed in the industry well before the pandemic have not disappeared.

One of the biggest impediments to growth for companies is high booking abandonment rates from online travel sites. A study by SalesCycle showed that abandonment rates in Asia stood at a whopping 85.5 per cent. And this, despite Asia reporting the lowest levels of abandonment in the world!

Mitigating this issue means creating a smoother and more user-friendly booking experience that eliminates tedious form-filling, slow load times and repeated requests for the same information.

An effective solution to encourage follow-through is streamlining the capture of data, including passport and payment information. Additionally, the use of sophisticated technologies such as real-time identity verification and liveness detection (to prevent against online spoofing schemes) can create more efficient check-in processes at airports, ferry terminals, and hotels.

Fraud is another hurdle that has not disappeared, with pre-pandemic projections estimating that US$11 billion could be lost to travel fraud by 2020.

For businesses in the travel industry, it is essential to be able to verify the customer’s identity with a high degree of accuracy without adding too much friction to the booking experience. Traditional forms of authentication, such as emailing documents or video calls are time-consuming for consumers and aren’t scalable.

A new approach to solving this problem uses the consumer’s smartphone camera to authenticate their identity against a government-issued ID card or passport in a process that is seamlessly integrated into the provider’s app or website. This ensures that the customers transacting are really who they say they are, without creating any additional identity proofing steps.

Optimising your customer’s journey and bolstering business security are important business drivers in any sector. That said, for the travel industry, it may be tempting to fall back to the status quo without considering the benefits to the industry and the consumer by adopting these new technologies now.

However, as a sector that’s just beginning to chart its path to recovery, it is especially essential to delve into these areas, which would prove to uplift the experience for consumers while future-proofing the business for the years to come.

Silversea enriches online training courses

Silversea Cruises has enhanced its digital training platform Silversea Academy to now offer 18 training modules, and has made it available to travel agents in Asia for the first time.

Now accessible to travel partners globally, including those in the US, Canada, LATAM and Asia for the first time, the training hub enables advisors to learn more about Silversea’s product offerings, visited destinations, ships, and itineraries with an interactive learning experience.

Each module takes an average of 20 minutes to complete. Travel partners are invited to participate in a quiz at the end of each module and are awarded a certificate upon their successful completion. Moreover, those participating in Australia, New Zealand and Asia will obtain two CLIA accreditation points for each module completed.

Among the training modules are “Selling Silversea”, offering a comprehensive understanding of the cruise line, its ships, and its visited destinations; “Expedition Cruise Expert”, delivering an in-depth knowledge of the luxury expedition cruise experience; and various modules that cover ships’ public spaces, restaurants, suites, and voyages. Plus, several modules are dedicated to visited destinations, from Africa and the Indian Ocean to South America, and more.

Rise in early and cautious bookers

• Expatriates are driving staycation bookings as they seek replacements for holidays back home

• Relaxing resorts and inclusive packages most in demand

• Cautious travellers are also resulting in a late-booking trend

Holiday bookings for the year-end are streaming in earlier than expected for some Asian hoteliers, as consumers look to confirm domestic vacations and staycations as stand-ins for their usual Christmas and New Year’s Day trips amid continuing international travel suppression.

Avani Hotels and Resorts is already getting bookings for the holiday season even though the Asian domestic markets typically book one or two months ahead. The lack of festive packages at this moment has not stopped couples and families from confirming their accommodation bookings, according to Avani spokesperson Adhiyanto Goen.

A spokesperson for The Ritz-Carlton, Kuala Lumpur and JW Marriott Hotel Kuala Lumpur told TTG Asia that enquiries on festive stays were coming in much earlier than the previous years, largely from expatriates planning to celebrate their Christmas and New Year in town instead of back home.

Early interest could have been driven by special offers for the festive season at both hotels, opined the spokesperson, adding that new F&B outlets opening at The Starhill luxury retail complex, which the hotels are part of, this year-end would bring additional gastronomic variety to the guest experience.

Long-term foreign residents or expatriates based in Thailand, Malaysia and Sri Lanka are also credited for driving early bookings with ONYX Hospitality Group, according to president and CEO, Douglas Martell.

The early forward booking trend for the year-end has been picked up by SiteMinder’s World Hotel Index, published on September 21. Hotel bookings for the Christmas and New Year’s Eve period have spiked in multiple countries, including Singapore, Thailand, the Philippines and Vietnam in Asia; and Australia and New Zealand in the Pacific, noted the study.

“It seems the world is keen to end 2020 on a high note, and usher in a fresh new year,” said Mike Ford, managing director at SiteMinder.

Bookings are likely to further improve over the three months leading up to Christmas.

Adhiyanto is pinning his hopes on Thailand and Vietnam’s recent decision to facilitate long-haul arrivals soon, which could lead to a stronger festive period performance.

Cautious bookings

Early birds are, however, not flocking everywhere. Fluctuating state of infections are causing some travellers to approach their holiday plans with caution, leading to short booking lead times, a contrasting trend to the rise in early bookers.

Kristel Joseph, director of sales with The Majestic Hotel and Hotel Stripes, both in Kuala Lumpur, Malaysia, expects year-end bookings to be strong but dominated by late bookings.

“A key observation for 2020 is that travel bookings are made with even shorter lead times than the years before, with many consumers taking a wait-and-see approach with hopes that more borders might reopen,” said Martell.

Martell added that consumers are also investing in “more detailed research and asking more specific questions before they commit”. Those questions are streaming in via social media direct messaging platforms and phone lines – and at a higher volume than usual.

“It is important that we are ready to answer questions not just about our hotels, but the real picture of the area around us, such as whether a popular local cafe or restaurant is still open and whether their full menu is still being offered,” Martell told TTG Asia.

Among secured bookings, resort options and packages with F&B and activity inclusions are clear winners.

Joseph said a preference for room and dining deals are high as locals prefer to make full use of their time in the hotel.

Martell observed that there has been stronger interest in resort and coastal properties than city hotels, with up to 70 per cent of year-end bookings in Thailand going to resort destinations like Pattaya and Hua Hin. Inclusive offers as well as new and refurbished hotels are deemed most appealing too.

Offers everywhere

To stimulate greater domestic interest and bookings, hoteliers have had to take a different commercial tack.

Describing 2020 as a “year like no other”, Martell said ONYX Hospitality Group had to alter its commercial strategy to “balance the short-term opportunities from domestic bookings and staycation market in countries like Thailand, China, Malaysia and Sri Lanka, with (continued engagement of) the medium- and long-haul markets in hopes for an eventual reintroduction of international travel”.

Martell said: “While many of our travellers from the Western hemisphere have cancelled their bookings for the winter season, there are still a handful of optimistic consumers who continue to hold onto their bookings in the hope that travel restrictions will be lifted before Christmas.”

The Majestic Hotel and Hotel Stripes would be launching festive deals through digital marketing earlier than usual to score advance bookings.

YTL Hotels, which has never offered domestic deals for Pangkor Laut Resort during peak season, has bucked tradition to roll out residents package for a minimum stay of three nights this time round.

“Crafting strategic room and dining offers to cater to the domestic traveller is key in securing the business during the festive season, and a powerful marketing campaign is essential in ensuring success,” the spokesperson of The Ritz-Carlton, Kuala Lumpur and JW Marriott Hotel Kuala Lumpur said.

Unfortunately, with offers aplenty and rates depressed to drive demand, hoteliers do not think that a strong performance this year-end would yield as beautifully as pre-Covid times.

STA Travel shuts down

Tour agency STA Travel, which has three retail outlets in different universities across Singapore, has ceased operations, after its parent company in Switzerland filed for insolvency last month.

Its closure will affect as many as 682 customers who are listed as creditors, according to a report by The Straits Times.

On behalf of STA Travel, audit firm Deloitte and Touche issued a notice last week that listed the potential creditors, with the biggest sum of S$84,088 (US$61,342) said to be owed to an individual.

The notice also lists organisations, including the National University of Singapore, Singapore Management University, Nanyang Technological University, and Republic Polytechnic. Other named creditors are the CPF Board, the Esplanade, the Singapore Scouts Association and Singtel.

According to the report, many university students who had booked flights with the travel agency, such as for exchange programmes, were affected. Some were given travel vouchers after their flights were cancelled amid the pandemic.

STA Travel offices in other countries such as Australia and New Zealand have also been placed in liquidation.

Hygiene front of mind for travellers

Daily room disinfection tops the list of hygiene and safety measures that travellers are looking out for when booking hotels and other types of accommodations, according to a recent Agoda survey.

Travellers are raring to travel again, but needs the reassurance of the implementation of hygiene and safety measures at accommodations, found the Agoda Hygiene Survey, which was conducted in June 2020 and surveyed more than 2300 people across eight markets.

Globally, “daily room disinfection” followed by “daily disinfection (of general areas)” rank as the most important hygiene measures travellers expect to be implemented by hotels and other accommodation providers.

Other measures in the top five include “providing hygiene standard listings”, “providing personal hygiene kit (masks, gloves, etc.)” and “hygiene certification from the government”.

The study comes as Agoda launches HygienePlus, a new verification feature that shows travellers the health and hygiene measures taken by accommodation providers on its travel platform.

The tool is designed to give travellers peace of mind by identifying hotels or homes that meet a checklist of standardised measures, including contactless check-in/out, temperature checks for staff and guests, daily disinfection at property and room level, provision of face masks, sterilising equipment and hand sanitiser for guests, safe dining set up and signs to ensure physical distancing, among others.

For travellers from South Korea, Taiwan and Thailand, “daily room disinfection” tops the priority list, while travellers from Taiwan, the US, Thailand, Australia and Saudi Arabia prioritise “daily disinfection (of general areas)” as the most important measure to get them booking again.

Younger travellers in the 18- to 24-years-old category are more inclined to prioritise “daily room disinfection”, while “daily disinfection (of general areas)” are the most important measure for global respondents in the 35- to 44-years-old age group.

“Hygiene standard listings” is a priority for Thai and Taiwanese travellers, and the most important hygiene measure for travellers aged 18- to 24-years-old globally. Hotels that provide “personal hygiene kits (masks and gloves, etc.)” are valued most by Indonesians, Saudi Arabians and Vietnamese travellers. Bucking the global trend, only Indonesians value “hygiene certification from government” as one of the top three measures to start travelling again.

Roberto Bruzzone has joined Silversea Cruises as its new senior vice president of marine operations, reporting directly to president and CEO, Roberto Martinoli.

Bruzzone will be responsible for the marine and technical operations of the fleet, oversee newbuilding and refitting activities, as well as handle the technical procurement and crew management functions.

He has extensive experience in the shipbuilding industry, having held various positions at major international cruise lines in a successful career that has spanned almost 20 years.

Following a five-year stint as vice president of technical operations at a major cruise corporation – part of a 14-year period at the same company – Bruzzone took the position of COO to oversee the company, acting as the newbuilding division of another major cruise line holding.