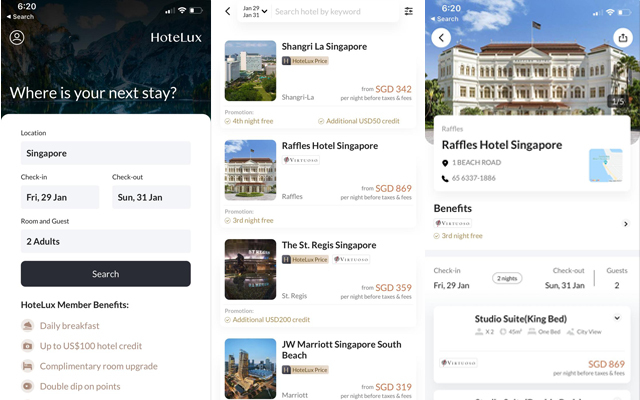

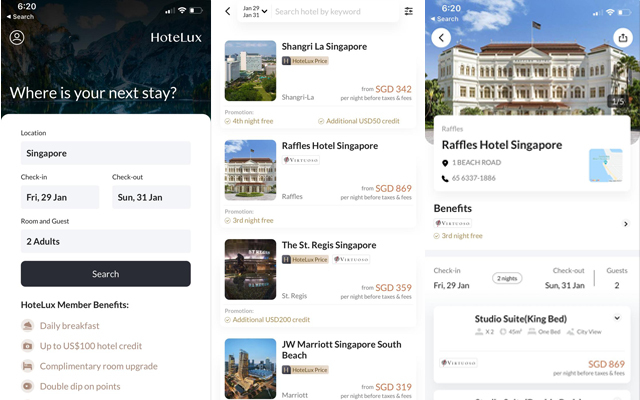

New app HoteLux spices up luxury stays with elite-status perks

HoteLux, a membership-based luxury hotel reservation app with over 4,000 luxury hotel properties worldwide, has launched in Singapore.

For an annual fee of S$99 (US$75), users who book via HoteLux will be able to enjoy benefits – typically offered to travellers who book through luxury programmes – such as complimentary room upgrades, daily breakfasts, and US$100 hotel credits.

On top of that, unlike other OTAs, HoteLux awards bookers with two sets of points – HoteLux’s rewards points, and points with the respective hotel company’s own proprietary programme (i.e. Hilton Honours, Marriott Bonvoy).

For this year, HoteLux is focusing on building a strong brand in Singapore, starting with the staycation market. Currently, new users are eligible for an annual fee waiver on their first two hotel bookings.

Yihao Shi, managing director of HoteLux, explained: “People are desperate to travel, and staycations are the closest to travel they can get.”

Shi shared that since the app’s launch a few days ago, already 400 people have signed up – an indication that the app is moving in the right direction.

His aim is to build customer loyalty to earn repeat business. “In Singapore, right now, the borders are closed, but our members can make use of HoteLux to book staycations. In future, when borders reopen, and our members go to Bangkok, for example, they will think of HoteLux for their Bangkok hotel bookings,” he said.

This is built on his prediction that borders will not reopen until perhaps 2022. He added that 2022 will most likely see a “large volume of travel”, but for 2H2021, it’ll most likely be essential and business travel.

As such, from 2022 onwards, the focus will then be shifted to top inbound markets to Singapore such as Indonesia, Malaysia, Australia, and India.

When travel returns, HoteLux plans to scale up the app accordingly. Given that HoteLux’s parent company runs a similar app in the country under a different branding and name, building in more features – such as allowing restaurant and limousine bookings – into HoteLux in the future will be “easy” with the existing infrastructure.

When asked why HoteLux chose to enter the market during these uncertain times, Shi said: “Why not? No one is talking about travel now, so now is the best time to educate consumers about the brand and app.”

Covid temporarily shuts Makati Shangri-La’s doors

After nearly 30 years of operation, Makati Shangri-La Hotel in Manila will suspend operations beginning February 1, and let go off a number of staff, as part of a reorganisation exercise due to the pandemic’s financial impact.

In a statement, a Shangri-La Group spokesperson said that “the prolonged recovery timeline has resulted in increasing financial pressure on the company here in the Philippines”.

“Owing to continued low business levels and having considered all viable options over weeks of consideration and deliberation, we unfortunately must now make the extremely difficult decision to reorganise our workforce and operations in the Philippines as we continue to navigate an uncertain business environment,” read the statement.

Since the Covid-19 outbreak, the hospitality group has implemented several cost-cutting measures, including salary reductions at management level, shorter work weeks, hiring freeze and cuts in non-essential spending.

All affected employees will receive a fair compensation package that is “higher than local statutory guidelines”, as well as healthcare coverage and grocery support until the end of this year.

Shangri-La said that it would reopen Makati Shangri-La “at a later date when business conditions have improved”.

APAC destinations face uneven recovery through 2023

The Pacific Asia Travel Association (PATA) has released the Executive Summary of the Asia Pacific Visitor Forecasts 2021-2023, which makes three growth prospects for international visitors arrivals (IVAs) into and across 39 Asia-Pacific destinations, covering mild, medium and severe scenarios.

The report shows that even under a mild scenario, the Asia-Pacific region in 2023 is likely to still have around four per cent fewer arrivals compared to 2019. The medium scenario suggests that foreign visitor numbers in 2023 could be only three-quarters of the 2019 volume, while under the severe scenario, that proportion is predicted to reach less than half of the 2019 volume of international arrivals.

The results are very uneven as well, not just under each scenario, but also for the major destination regions of Asia-Pacific. The Americas for example, after reaching a total of 45.36 million foreign arrivals in 2020 into the four destinations covered by this region, is unlikely to see any annual increase in IVAs until 2022.

Calendar year 2021, in particular, is projected to be another difficult year for the Americas. A further annual decline in foreign arrival numbers is expected, with annual losses ranging from 3.59 million to as much as almost 23.76 million, depending upon the scenario conditions at the time.

IVAs into and across Asia, on the other hand, are expected to show an increase in 2021 over the 70.64 million received in 2020, but only under the mild scenario. From 2022 onwards, however, annual increases are forecast to gradually improve in volume under each of the three scenarios.

The only differing characteristic is the volume of the annual increase in each case.

The Pacific is expected to be in a similar position as the Americas in 2021, with IVAs falling from the 5.85 million received in 2020 under each of the three scenarios. While that decrease may be relatively minor under the mild scenario, it could still represent a contraction of almost five million IVAs under the severe scenario.

Calendar years 2022 and 2023, however, show some return to annual growth under each of the scenarios.

The three main visitor generating regions of Asia, the Americas and Europe are likely to remain as such, in terms of the additional volume of IVAs delivered into and across Asia-Pacific between 2020 and 2023, differing only in their respective relative strengths.

Interestingly, as each scenario becomes a little more difficult and volatile, the relative proportion of IVA growth out of Asia between 2020 and 2023 becomes slightly more significant, even as the absolute numbers diminish somewhat.

However, these proportions differ significantly across the three main destination regions of Asia-Pacific.

Intra-regional traveller flows from the Americas, for example, dominate arrivals into the Americas, rising in relative significance as the scenarios become increasingly difficult and volatile.

For the destination region of Asia, it is that region itself that generates the sheer bulk of the additional IVAs into the region between 2020 and 2023, with its relative share of additional arrivals rising from around 84 per cent under the mild scenario to more than 87 per cent under the severe scenario.

Additional IVAs into the Pacific are likely to be sourced largely out of Asia and the Americas, with those two source regions combined expected to account for over 70 per cent of the increase in IVAs into this region between 2020 and 2023, under each of the scenarios.

PATA CEO Mario Hardy pointed out: “While growth in international visitor arrivals into and across Asia-Pacific remains difficult in 2021, there are promising signs for 2022 and 2023. A return to near pre-Covid-19 levels of arrivals, while possible by 2023, appears now to be feasible, at least if conditions as they are now, abate quickly and permanently. Much, however, will depend on events during this present northern winter and the arrival and management of the more traditional flu season.

“Given the speed with which conditions can change, the PATA forecast report this year does not have the same destination-specific detail as previously published in the past, but rather focuses on regions and sub-regions. They are, however, more flexible as they will be updated twice over the coming 12 months to factor in developments as and when they occur.”

Hardy concluded: “Domestic travel will, in many cases, fill some of the void left by the loss of foreign arrivals, and as much care and attention to those travellers needs to be given as to those from overseas. Furthermore, for both types of visitor, perhaps the future will depend more on length of stay and visitor satisfaction, than on a generic and simple headcount of arrivals. Metrics that track such indicators will possibly become a new standard for determining tourism potential and performance in what is likely to continue being a volatile world.”

The Executive Summary is available here.

Second virus wave forces Thai AirAsia to furlough 75% of staff

As domestic travel in Thailand dries up in the midst of a resurgent pandemic, Thai AirAsia has said it will retain only one-fourth of its workforce, with the remaining staff asked to go on unpaid leave for four months, starting next month.

Tassapon Bijleveld, executive chairman of Asia Aviation (AAV), the largest shareholder of the airline, was quoted by the Bangkok Post as saying on Monday that the airline is downsizing to match real demand. According to the latest AAV annual report, the airline had 5,974 employees in 2019.

“Before the Covid-19 resurgence, we had 40 planes serving domestic flights. But since the re-emerging of the outbreak, some provincial lockdowns have made it impossible for people to travel and passenger demand has dropped significantly at every airport,” said Tassapon.

Of its 62 aircraft, the budget carrier currently flies only 10 planes, due to subdued air travel demand.

According to the report, Tassapon said the company had no layoff plans for now, but it was difficult to predict when the market would recover. He said the furlough will allow the employees to find other revenue sources and resume work immediately if the situation improves. This is the airline’s second – and larger-scale – furlough amid the pandemic, after its first round late last year.

Tassapon also predicted that the international market will slowly start to recover in 4Q2021. “Half of the global population must be vaccinated before international travel can resume,” he said.

During the first nine months of 2020, the airline carried 6.68 million passengers, a 60 per cent fall compared to the same period in 2019.

New hotels: JW Marriott Gold Coast Resort & Spa, Hilton Clark Sun Valley Resort, and more

JW Marriott Gold Coast Resort & Spa, Australia

Located close to the Gold Coast’s golden beaches and unspoilt hinterlands, the resort is home to 223 guestrooms and suites, along with six F&B venues. Signature Japanese restaurant Misono features an Izakaya sushi bar, tearoom and whisky bar; while all-day diner, Citrique, boasts a show kitchen where guests can enjoy live cooking presentations. Forming part of Citrique, JW Market, the hotel’s café and provedore, serves freshly ground coffee and grab-and-go bites. Located in the lobby, Chapter & Verse is a lounge by day and a bar in the evenings, where guests can sip on handcrafted cocktails. As well, the resort’s very own JW Garden offers farm-to-table dining experiences, cooking classes and specialty drinks.

A tropical aquatic area, a resort highlight, includes both a saltwater lagoon and a freshwater pool, with private cabanas lining the lagoon edge. A poolside cocktail delivery from the Pool Bar is available, as are light meals, snacks and other refreshments. For an indulgent experience, Spa by JW offers customised treatments, while Family by JW programmes engage young guests in fun and creative experiences during their stay. Guests can also participate in a series of five- to 10-minute relaxation rituals and activities daily, such as guided meditation sessions.

Located minutes from the beach, the resort offers a coastal venue for weddings, meetings and events with 2,000m2 of function space, featuring ten scalable spaces. The pillarless 715m2 JW Ballroom allows vehicle access, geared for large-scale exhibitions and product launches; while the junior ballroom provides a space for creative meetings and events.

Hilton Clark Sun Valley Resort, Philippines

Owned by Donggwang Clark Corporation, the 308-key Hilton Clark Sun Valley Resort is located in the Clark Freeport Zone, and is a 12-minute drive from Clark International Airport. For relaxation, there is a fitness centre, an outdoor pool, walking and jogging path, and a soon-to-open wellness centre. The resort has three F&B outlets: all-day diner, Olive, serves international buffet and a la carte options from open kitchens; Cantonese restaurant XI offers private dining options; while Treat is a coffee shop by day and a cocktail and wine bar by night.

Featuring over 1,800m2 of meetings space, the resort is ready to play host to meetings, weddings and social gatherings. The pillarless Grand Ballroom, measuring 1,010m2, can accommodate up to 1,200 guests in theatre-style seating. In addition, there are seven flexible meeting rooms for events, ranging from business meetings to team-building sessions.

Holiday Inn Express Kota Kinabalu City Centre, Malaysia

Situated in the heart of Sabah’s capital city, Holiday Inn Express Kota Kinabalu City Centre is a 13-minute drive from Kota Kinabalu International Airport. The 250-room hotel comprises of queen and twin-bedded rooms, with the option of rooms with a sofa bed that can house up to three guests. Amenities include a 24-hour fitness centre, a self-service business centre and laundry room, and meeting room that seats up to 12 persons.

Hyatt opens first five UrCove hotels in China

UrCove, the new hospitality brand developed under a joint venture between Hyatt and BTG Homeinns Hotel Group affiliates, has opened its first five properties across China. All UrCove hotels are located in the heart of bustling cities. They are: UrCove Shanghai Jing’an, UrCove Shanghai Lujiazui Expo, UrCove Shanghai Wujiaochang, UrCove Chengdu City Center and UrCove Nanjing South Railway Station. Each hotel features an all-day dining restaurant, a 24-hour gym, a self-service laundry room and meeting rooms. New smart service facilities support self-service check-in and checkout, and all hotels feature the signature UrCove Space, which offers guests a multi-functional space for business and social gatherings.

SIA restarts flights between Munich and Singapore

Singapore Airlines (SIA) has resumed operating thrice-weekly flights between Singapore and the Munich hub, marking the German city’s first link to Asia since the pandemic started.

The airline operated its first flight from Singapore to Munich yesterday (January 20). Using an Airbus A350-900, flights from Singapore will take place on Wednesdays, Fridays and Sundays, while those from Munich will depart on Mondays, Thursdays and Saturdays.

Sek Eng Lee, SIA regional vice president for Europe, said that the development “affirms our confidence of incipient market recovery”.

Jost Lammers, Munich Airport CEO, added: “Resuming the non-stop link between Munich and Singapore sends a very important signal, especially in these challenging times. Providing a well-established connection for business travellers and an efficient route for cargo, the Singapore Airlines flights will help to bring back some semblance of normality.”

SIA, Collinson trial Covid-19 pre-departure testing

All Singapore Airlines (SIA) passengers flying outbound from Singapore and Indonesia (bound for Singapore) will be able to book pre-departure polymerase chain reaction (PCR) and serology tests as part of a trial service.

The pre-departure test service – conducted in partnership with Collinson – is currently available to Singapore Airlines and SilkAir passengers departing from Singapore, Jakarta and Medan, as part of its pilot test phase. The pilot will run until mid-March, and there are plans to expand this service to more cities in the SIA and SilkAir network over the next few months if it is successful.

With pre-departure testing becoming a mandatory requirement for more countries, this new service allows SIA customers to book their test appointments on an online booking portal after making their flight bookings.

Customers can make an appointment for a pre-departure test with their preferred in-city clinic from a given list of testing facilities. Upon completion of their test, customers will automatically receive notification of their test results within 36 hours through the same portal, which if negative, can be presented upon check-in at the airport.

These test results will come with a QR code that enables airport check-in staff and Singapore immigration authorities to verify under the new digital health verification process that SIA is piloting with the International Air Transport Association. The portal will also be able to house digital Covid-19 status.

Todd Handcock, Asia-Pacific president of Collinson Group, said this will enable the safe reopening of key routes for travellers.

“While there’s optimism that the roll-out of vaccines will help bring an end to the pandemic, there remains a complex road ahead. In order to restore confidence in travel, the implementation of safe and robust testing protocols remains key,” he added.

A Hotel Indigo will rise atop Sydney’s City Tattersalls

InterContinental Hotels Group has signed an agreement with City Tattersalls Club (CTC) to open a Hotel Indigo in Sydney, as part of a 49-story mixed-use tower that will be perched atop the club’s premises.

The tower, which is currently being constructed, will also include restaurants, event space, an exclusive business lounge, retail outlets, as well as health and wellbeing facilities.

Scheduled to open in 2025, Hotel Indigo Sydney Centre will feature a neighbourhood story concept inspired by the 125-year history of CTC, one of the oldest community clubs in Sydney.

Amenities will include a café, bar and gym. Hotel guests will also benefit from access to the facilities within the broader development, including meeting and event space, and the exclusive lounge.

Hotel Indigo Sydney Centre will be located within the Pitt Street frontage, just a stone’s throw away from Pitt Street Mall, the heart of Sydney CBD, and the city’s premier shopping, food and entertainment precincts.

Emirates to trial IATA Travel Pass in April

Emirates has partnered with the International Air Transport Association (IATA) to trial the IATA Travel Pass – a mobile app to help passengers securely manage their travel in line with any government requirements for Covid-19 testing or vaccine information.

The app enables Emirates passengers to create a ‘digital passport’ to verify that their pre-travel test or vaccination meets the requirements of the destination. They will also be able to share the test and vaccination certificates with authorities and airlines to facilitate travel. Travellers will also be able to manage their travel documentation digitally on the app.

Prior to a full roll-out, Emirates will implement phase one in Dubai for the validation of Covid-19 PCR tests before departure. In this initial phase, expected to begin in April, Emirates customers travelling from Dubai will be able to share their Covid-19 test status directly with the airline before reaching the airport through the app, which will then auto-populate the details on the check-in system.

Within the app, the integrated registry of travel requirements will also enable passengers to find accurate information on travel and entry requirements for all destinations regardless of where they are travelling from.

It will also include a registry of testing and eventually vaccination centres – making it more convenient for passengers to find testing centres and labs at their departure location which meet the standards for testing and vaccination requirements of their destination. The platform will then enable authorised labs and test centres to securely send test results or vaccination certificates to passengers.

Nick Careen, IATA senior vice president for airport, passenger, cargo and security, said: “This is the first step in making international travel during the pandemic as convenient as possible giving people the confidence that they are meeting all Covid-19 entry requirements by governments.

“As borders re-open, IATA Travel Pass will be further enhanced with more capabilities to meet all governments testing or vaccination verification requirements and Emirates customers will be among the first to have these services.”

Bangkok-based Minor Hotels has signed an MoU to form a joint venture with Funyard Hotels & Resorts, a core alliance enterprise of Country Garden Group, to expand its portfolio of brands across China.

The brands include Anantara, Avani, Oaks, Elewana, Tivoli and NH – many of which will be making their debut in mainland China.

The announcement comes at the time when the growth of China’s travel sector is expected to accelerate post-pandemic. With demand for leisure and resort services shifting from overseas to domestic, optimism about China’s tourism and resort market is at all-time high.

At the recent virtual MoU signing ceremony, Ji Hongjun, president of Funyard Hotels & Resorts, said: “The pandemic is further accelerating the process of the Chinese economy shifting towards the domestic market. This means new opportunities in domestic tourism and hospitality.” He added that the partnership seeks to “tap into the Chinese resort market and bring new energy to Chinese and even global tourism.”