Brought to you by ASEAN Sustainable Tourism Solutions Expo

JAL, ANA set out new accessibility measures

Japan Airlines and All Nippon Airways have introduced a new set of accessibility guidelines for passengers requesting special assistance at the airport and during their flight.

Created under the direct supervision of The Nippon Care-Fit Education Institute, the guidelines are designed to ensure a safe and accessible journey for passengers amid Covid-19, the airlines said in a joint statement.

In providing assistance involving physical contact with travellers, the airlines will strengthen initiatives to ensure hand disinfection and sterilisation, and approaching diagonally or from the side to prevent direct transmission.

As well, the airlines’ ground staff will wear gloves when providing assistance in close quarters, for example, when helping customers move between a wheelchair and seat or providing guidance through physical contact. They will also wear gowns upon request or at their own discretion.

To avoid the risk of droplet infection, the airlines’ staff will also keep conversation outside of that necessary for assisting purposes to a minimum and position themselves diagonally in front when providing assistance to avoid face-to-face situations.

Service equipment such as wheelchairs, baby strollers and assist seats are sanitised before each use, as are braille/large-print copies of the airlines’ printed guidance (such as safety instruction cards and drink menus).

The new measures also aim to strengthen the airlines’ ability to provide timely information on infection prevention measures to those with visual and/or hearing impairment. As part of efforts to improve communications, the carriers will provide visual aids at the airport to overcome the difficulties that masks create for the hearing impaired.

The guidelines follow the IATA’s Guidance on Accessible Air Travel in Response to Covid-19, which lays out the basic principles for airlines to follow on special assistance requests, and the Ministry of Land, Infrastructure, Transport and Tourism of Japan’s updated measures to adjust to today’s travelling environment.

Singapore, Germany establish reciprocal green lane

Singapore and Germany have agreed on a reciprocal green lane allowing essential travel for business or official purposes via direct flights between both countries.

This is the first such agreement between Singapore and a European country amid the pandemic, and could pave the way for similar arrangements with other European countries including the UK.

Operational details of the green lane, including the procedural requirements, health protocols and application process, will be announced at a later date, the Ministry of Foreign Affairs and the German Federal Foreign Office said in a joint statement.

Germany also announced yesterday that Singapore residents will be able to enter the European country again for short-term stays, without the need for quarantine on arrival.

This follows the European Council’s recommendation this week that member countries of the European Union gradually lift entry restrictions for Singapore residents.

Singapore also has travel arrangements with 10 other countries such as Malaysia and Australia, with varied restrictions.

International tourism projected to rebound in 3Q2021: UNWTO

Persistent travel restrictions due to the pandemic continue to hit global tourism hard, with international arrivals plunging by 70 per cent in the first eight months of 2020, the UNWTO’s latest data have shown.

According to the newest UNWTO World Tourism Barometer, international arrivals plunged 81 per cent in July and 79 per cent in August, traditionally the two busiest months of the year and the peak of the Northern Hemisphere summer season.

The drop until August represents 700 million fewer arrivals compared to the same period in 2019 and translates into a loss of US$730 billion in export revenues from international tourism. This is more than eight times the loss experienced on the back of the 2009 global economic and financial crisis.

“This unprecedented decline is having dramatic social and economic consequences, and puts millions of jobs and businesses at risk,” warned UNWTO secretary-general Zurab Pololikashvili. “This underlines the urgent need to safely restart tourism, in a timely and coordinated manner”.

All world regions recorded large declines in arrivals in the first eight months of the year. Asia and the Pacific, the first region to suffer from the impact of Covid-19, saw a 79 per cent decrease in arrivals, followed by Africa and the Middle East (both -69 per cent), Europe (-68 per cent) and the Americas (-65 per cent).

Following its gradual reopening of international borders, Europe recorded comparatively smaller declines in July and August (-72 per cent and -69 per cent, respectively). The recovery was short-lived however, as travel restrictions and advisories were reintroduced amid an increase in contagions. On the other side of the spectrum, Asia and the Pacific recorded the largest declines with -96 per cent in both months, reflecting the closure of borders in China and other major destinations in the region.

Demand for travel remains largely subdued due to the ongoing uncertainty about the pandemic and low confidence, UNWTO said. Based on the latest trends, the UN agency expects an overall drop close to 70 per cent for the whole of 2020.

Looking ahead, UNWTO’s panel of experts foresee a rebound in international tourism in 2021, mostly in the third quarter of 2021. However, around 20 per cent of experts suggest the rebound could occur only in 2022.

Travel restrictions are seen as the main barrier standing in the way of the recovery of international tourism, along with slow virus containment and low consumer confidence. The lack of coordinated response among countries to ensure harmonised protocols and coordinated restrictions, as well as the deteriorating economic environment, were also identified by experts as important obstacles for recovery.

ASEAN Sustainable Tourism Solutions Expo to be Held on 5–6 November 2020

After just two years of organizing the ASEAN Sustainable Tourism Solutions (ASTSE) on the ground in Laos, the event has expanded and made itself accessible worldwide by going online. ASTSE is the region’s leading specialized fair for the tourism industry to celebrate, explore, and exhibit the latest trends, insights, and technology in sustainable tourism and hospitality practices.

Twenty exhibitors from around Southeast Asia and further abroad will showcase their products, services, and initiatives over the course of the event, which takes place on 5–6 November 2020. The virtual expo, which is free to attend, is powered by the vFairs platform, which has held similar events for companies and institutions such as Unilever, T-Mobile, and New York University. The exhibitors represent several categories relevant to the theme of the event: eco-friendly hotel supplies, plastic alternatives, water and energy conservation systems, as well as initiatives and projects.

One of the most enriching parts of the expo will be its symposia program, bringing together renowned thinkers to discuss topics that matter greatly to the regional tourism industry. On Thursday, 5 November 2020, there will be four live panel discussions, namely, “The Future of Tourism in ASEAN,” “Crisis Communications for Tourism Destinations,” “Using Technology to Improve Sustainability in Hospitality Businesses,” “How Can We Come Together to Support Tourism-Dependent Communities?,” as well as a workshop entitled “Reducing Plastic Waste While Keeping Your Guests Safe.” On the second day of the expo, 6 November 2020, visitors can attend the panel discussion “What to Do Now to Build Back Stronger and Greener?,” or the workshop “Cutting Operation Costs through Resource Efficiency.”

There will also be several on-demand webinars that visitors can access any time during the expo. Among them, a presentation on waste-water treatment will be led by Epurtek, HotelMinder will present various ways to increase hotel bookings, while Cloversoft will introduce to visitors their array of eco-friendly products for different types of hospitality businesses.

For tourism industry professionals based in Laos, an in-person expo will be held on 6–7 November 2020 at the Crowne Plaza Vientiane, and will feature an additional 35 exhibitors, panel discussions, and a networking event.

The ASEAN Sustainable Tourism Solutions Expo is organized by the Ministry of Information, Culture, and Tourism, with support from the Ministry of Natural Resources and Environment, the Lao National Chamber of Commerce and Industry, and supported by the German Development Cooperation. The expo’s generous sponsors include USAID, the Lao/029 Skills for Tourism Project, TTG Asia, and the Mekong Tourism Coordinating Office.

For a complete list of exhibitors, a full schedule, or details about symposia and speakers, please visit the website of the virtual ASEAN Sustainable Tourism Solutions Expo: astse.vfairs.com or follow the expo’s Facebook page for regular updates: www.facebook.com/ASEAN.STSE.

Indonesia grants financial aid to tourism businesses in priority districts

The Indonesian government will disburse Rp3.3 trillion (US$224 million) in grants to help tourism-related businesses, especially hotels and restaurants, cushion the impact of the pandemic as well as to finance improved health protocol implementation at tourist destinations.

Wishnutama Kusubandio, minister of tourism and creative economy, said at a web-press conference last week: “This is the first of various recovery programmes that are expected to help the hotel and restaurant industry, which is facing financial difficulties as well as local administrations that are losing out on tourism revenue due to the pandemic.”

The grant is expected to be disbursed until December as part of the National Economic Recovery programme.

Recipients of the grant includes 10 priority tourism destinations and five super-priority destinations, provincial capitals, branded destinations and regions that are included in the ministry’s calendar of events. Monetary assistance will also be given to regions where revenue from hotel and restaurant tax accounted for at least 15 per cent of its locally generated income during the 2019 financial year.

The bulk of the grant – 70 per cent – will be channelled to hotels and restaurants, while the rest will be set aside for regional cash injection.

Maulana Yusran, deputy chairman of the Indonesian Hotel and Restaurant Association, said the grant would be allocated based on the hotel or restaurant’s tax contribution in 2019, and businesses need to show proof of their 2019 tax payment to qualify for assistance.

As there is still much curiosity about the procedures to access the grant, Andhy Irawan, CEO of Dafam Hotel Management, urged the government to improve its communications.

He emphasised the risk of complication should different regions in Indonesia interpret the grant distribution differently.

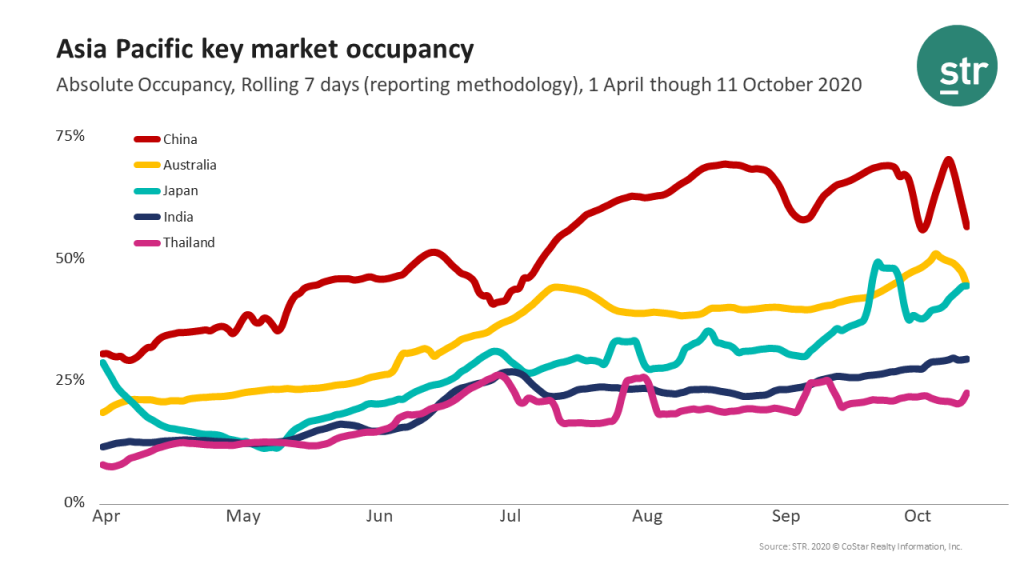

APAC shows continued hotel performance recovery: STR

The Asia-Pacific hotel industry has reported continued performance improvement from Covid-19 low points thanks to strong domestic demand and holidays, according to a performance outlook presentation by Jesper Palmqvist, STR’s area director for the region during last week’s Hotel Investment Conference Asia Pacific 2020.

“Unlike the declines we’ve seen in the US after Labour Day or Europe after the summer holidays, Asia-Pacific markets have continued seeing growth,” Palmqvist said.

“For instance, in September, 70 per cent or better occupancy levels were registered in key China markets such as Sanya, Shenzhen, Chengdu and Xi’an. What is more noteworthy is that these markets are showing year-over-year growth in the metric, which is not common for most of the world right now.”

China’s demand has grown consistently over the months due to strong domestic demand and national holidays. On October 3, during the extended Golden Week period – a result of National Day coinciding with Mid-Autumn Festival – the market posted an 83 per cnet occupancy, almost reaching levels last seen in 2019.

During Silver Week (September 19 to 22), Japan witnessed an occupancy boost driven mainly by domestic demand. The market posted its highest occupancy level on September 23 (67 per cent). Similar to other markets around the globe, regional and leisure destinations like Hokkaido and Okinawa have begun to see more substantial occupancy growth, while Tokyo and Osaka are starting to see gentle initial growth.

Hotel occupancy in New Zealand is also just 25 per cent shy of 2019 levels.

In many of the key markets in Asia-Pacific, weekends continue to produce the highest occupancy levels.

Resort locations in Vietnam have posted occupancy as high as 40 per cent during the weekends.

Weekdays in South Korea are still showing low occupancy levels (20-25 per cent) compared to weekends (60 per cent) in the market.

Hong Kong is another market displaying a similar trend as occupancy levels during weekends reached as high as 55 per cent along with weekdays rising to 40 per cent.

Palmqvist noted that “all eyes are on the success rate of the recently declared government agreement with Singapore for a quarantine-free travel bubble, expected to produce direct travel between the two markets before the end of year”.

Frequent, more extravagant vacations lead travel trends in China

Trapped within their borders, Chinese consumers are channelling their overseas travel budgets to more frequent and longer domestic holidays as well as premium accommodation with add-ons.

Speaking on a panel at the annual Hotel Investment Conference Asia Pacific 2020 last week, Shimao Group’s vice president, Tyrone Tang, shared his observations that domestic travel is no longer confined to public holidays, and instead is taking place every weekend.

Compared to pre-pandemic times, the Chinese are vacationing more within their home region, indicating a preference for nearby, accessible destinations. They are also travelling with children and parents.

“Travellers, especially those from the luxury segment, are willing to splurge on premium accommodation and meals in place of overseas travel,” Tang said, adding that Chinese customers with greater spending power have been driving the increase in hotel occupancy and room rates.

Fosun Tourism Group, overseas expansion, managing director, Alessandro Dassi, has also witnessed a strong preference for weekend getaways to luxurious retreats close by, adding that Club Med’s new resort near Beijing – Club Med Joyview Yanqing Beijing – have been a hit with city-dwellers.

Customers are now planning for their winter retreats, fuelling demand for ski packages. Club Med’s winter packages that were launched last week got snapped up within minutes, revealed Dassi, who predicted that ski destinations like Changbai Mountains in Jilin would “get a lot of success” with the snow-seekers.

Sharing findings from a recent Horwath HTL survey, project director, Yichen Zhu said five-star hotels are recovering better than four-star ones, as people with limited time to travel this year are choosing to make the best of their time with upgraded experiences. At the same time, high-end hotels often promise better health and safety measures along with a less crowded environment, all of which appeal to consumers today who prioritise personal safety.

Not only are travel patterns changing, Chinese consumers are altering their purchasing habits, noted Dassi.

“Customers are prioritising refundable rates and flexible booking terms as they want to make sure their money is safe should something happen (to disrupt travel plans),” he said, adding that hotels have also become more creative in their selling process by turning to live-streams to engage customers and push for sales.

With the growing acceptance of hotel vouchers among customers, booking platforms in China have also added on redemption features to their sites.

Host community sentiments: the new tourism X-factor

As the most prominent face of a destination, local population attitudes can shape visitor experience and satisfaction, as well as provide signals of continued support or rejection of future tourism developments.

In this fourth article by TTG Asia Media for the PATA Crisis Resource Center, Olivier Henry-Biabaud, CEO of TCI Research, talks about an available tool to measure host community sentiments, and explains why it is critical for destination managers and marketers to have a clear understanding of how their residents regard tourism.

Henry-Biabaud also highlights some outstanding examples of tourism boards that have successfully roped in their local residents in the creation of effective tourism content and messaging.

The new tourism X-factor is now available at the PATA Crisis Resource Center.

World Dream ready to make waves in Singapore

Dream Cruises will be the first cruise company to restart cruising service in Singapore with its megaship, World Dream. Intense health and safety measures, including thorough cleaning and sanitisation as well as a 14-day quarantine of all crew, have been taken ahead of her planned Super Seacation sailings on November 6.

The crew will undergo a further series of mandatory Covid-19 testing as stipulated by the local authorities and are required to test negative before signing-up for active duty.

![Dream-Cruises-SG-DJI03_0018[1]](https://ttgasia.2017.ttgasia.com/wp-content/uploads/sites/2/2020/10/Dream-Cruises-SG-DJI03_00181.jpg)

IHG has signed an agreement with Sukhumvit Centre Point Co. to rebrand the Grand Sukhumvit Bangkok hotel to the Crowne Plaza Bangkok Grand Sukhumvit by the end of 2021 following an extensive refurbishment.

Additional rooms will be added to the 386-key hotel by 2023, which will make it the country’s largest Crowne Plaza hotel and the flagship for the brand, said IHG in a press release.

The centrepiece of Crowne Plaza Bangkok Grand Sukhumvit will be the Plaza Workspace, a new take on the traditional hotel lobby, which will afford both residents and visitors alike a space to work, meet and socialise.

Other amenities include a ballroom, boardroom, four meeting rooms, an executive club lounge, two dining outlets, swimming pool, fitness room and spa.