Klook gains US$200 million in Series E funding round

Travel and leisure booking platform Klook has raised US$200 million in additional funding through a Series E round led by Aspex Management and other investors.

Sequoia Capital China, Softbank Vision Fund 1, Matrix Partners China, and Boyu Capital, who are existing investors, also participated in this round of funding.

Investment confidence in Klook stems from its “resilience and adaptability despite the market headwinds”, said Hermes Li, CIO and Founder of Aspex Management.

“We believe the transition toward digital bookings will only accelerate post Covid-19, and that Klook’s ability to reinvent itself as a one-stop-shop for experiences and services across the region puts it in prime position to capitalize on this trend,” Li added.

Throughout 2020’s travel crisis, Klook re-prioritised its core strategic strengths to tackle the impact of the pandemic on the business. The company focused on two main areas – digitising the experiences booking sector, and launching new verticals such as staycations and car rental.

Some of the new tools piloted in 2020 included a free-to-use Contact Tracing System for Philippine partners, Attractions Plus module to support attractions and major establishments, and Klook Live!: Interactive livestream mobile feature, which allows users to experience merchants’ offerings up-close through entertaining and interactive instant video content.

At the height of the pandemic, Klook onboarded 150 per cent more activities compared to the same period in 2019.

Key markets where Covid-19 restrictions have eased, such as Singapore, Hong Kong, and Taiwan, have witnessed increased spending on local experiences, with bookings reaching near pre-pandemic levels as locals start exploring domestically.

“Despite a challenging 2020, we have shown our mettle, turning challenges into growth opportunities with agility and constant innovation. We’ve observed over the past year that consumers have a pent-up desire to explore and enjoy themselves, despite international travel being paused. Instead, they are turning inwards – exploring new and unique experiences right in their backyard,” said Ethan Lin, CEO and co-Founder at Klook.

“This new capital further strengthens our leading position to take us from defense to offense, as domestic tourism becomes ubiquitous and international travel gradually returns.”

With this new capital, the company will accelerate the development and roll-out of its merchant SaaS solutions, which will empower any merchant to build, manage, and scale their business with Klook.

“We are setting out to reimagine the next digital leap for the experiences sector which has traditionally been fragmented with offline practices or legacy systems that do not truly address the realities of a post-Covid world. Since day one, Klook has been working closely with our merchants, both big and small, to identify common pain points that we can solve together. With this new funding, we have additional ammunition to accelerate our technology innovation, and truly transform and empower this space for future growth,” added Eric Gnock Fah, COO and co-founder at Klook.

Thailand targets US$100m from foreign film productions in 2021 to lift travel recovery

Thailand’s tourism authorities have been wooing regional and international film crews to the country’s shores, with a goal of generating three billion baht (US$100 million) from hosting such productions this year.

Film productions with a budget of over 100 million baht, featuring well-known directors or A-list actors, are being targeted, reported the Bangkok Post.

According to recent data from the Tourism and Sports Ministry, Thailand welcomed a mere 6.7 million international visitors last year, generating 332 billion baht – down 82.63 per cent from the previous year.

The Chinese market accounted for the biggest fall, with visitor numbers plummeting from nearly 11 million in 2019 to just 1.2 million.

Thailand’s plan to attract foreign film companies to shoot productions in the country is one of many measures taken by the country to reboot its once-booming tourism sector ravaged by the pandemic.

Anant Wongbenjarat, director-general of the Tourism Department, was quoted by the report as saying that international productions can “generate income for locals, despite the tourism slowdown”.

According to the Tourism Department, Thailand hosted 176 foreign film productions in the country last year, raking in 1.73 billion baht for the local economy. The bulk came from China, followed by India, the UK, the US and South Korea.

The number of foreign productions was a far cry compared with the 4.86 billion baht generated by the 740 foreign film crews in the country in 2019.

After the Centre for Covid-19 Situation Administration granted special entry permission to film crews last August, 53 film productions were based in Thailand during August and December, contributing 1.14 billion baht to the economy, according to the report.

This month, four more film productions are underway, set to generate 186 million baht, it added.

Another nine productions, accounting for a combined budget of 850 million baht, have sought to film in Thailand during 1H2021, which would help create 800 jobs for locals.

Maldives revives calendar of fam trips

Journalists representing leading publications in the Middle East arrived in the Maldives on Tuesday, the first of many fam trips to be hosted by Visit Maldives this year as the destination ramps up tourism recovery efforts.

The six-day study trip is focused on family, safety and affordability, and demonstrates stringent Covid-19 safety measures that are in place.

Visit Maldives said the resulting editorial coverage would be circulated physically more than 95,000 times, with an online reach of more than 3.7 million.

Other marketing activities aimed at the Middle East will include joint promotions with notable tour operators and prominent airlines, participation in key travel trade fairs in the Middle East and roadshows covering the GCC&KSA region. Additionally, Arabic-language focused digital, social media and virtual activities are in the pipeline, aiming to maintain the destination presence and promote the Maldives as the most preferred destination within the market.

In 2020, 26,288 tourists visited the Maldives from the Middle East, which was a considerable drop from 2019’s 60,003 footfalls.

However, with core markets from the region leading post-lockdown tourism growth in the Maldives, and with arrivals growing day by day, Visit Maldives is confident of achieving pre-pandemic arrival numbers this year.

Thailand to warmly welcome inoculated travellers

Foreigners who have been vaccinated against Covid-19 will be welcomed with open arms by Thailand through a new campaign set to launch in 3Q2021.

Titled Welcome Back to Thailand Again, the campaign is the country’s bid to reclaim lost international arrivals throughout the pandemic. According to Chamnan Srisawat, president of Tourism Council of Thailand, Thai travel operators have started talks with agencies in potential markets, such as China, to restart destination marketing and prepare for future trips.

More than one billion people across the world are expected to be vaccinated by the end of June 2021, which could bring about a return in travel demand.

If the campaign proves successful, it could save up to 400,000 hotel jobs and 400,000 in related businesses across Thailand.

In 2020, 6.9 million foreigners travelled to Thailand, down from 40 million in 2019. It is predicted that Thailand will only see 10 million footfalls this year.

The way forward

By Mimi Hudoyo and Pamela Chow

Indonesia

The Covid-19 vaccine roll out across the world has raised hopes of business recovery among Indonesian travel agents, most of whom are regarding 2021 with cautious optimism.

Budijanto Ardiansjah, vice chairman of the Association of the Indonesian Tours and Travel Agencies (ASITA), said the widespread availability of Covid-19 vaccines is the turning point for the industry, as inoculated consumers will have confidence to return to travel.

Budi Tirtawisata, group CEO of Panorama Group, hopes people in the travel and related industries will get vaccinated early, as they are in direct contact with customers and travellers. He revealed that the private sector is discussing the possibility of purchasing vaccines for their employees. Should the government give the nod, this would enhance the national vaccination programme.

However, the current optimism barely masks the fact that travel agencies are among the worst hit by the pandemic in Indonesia’s travel and tourism industry.

Both ASITA and the Indonesian Travel Agents Association (ASTINDO) have reported that more than 90 per cent of their members are in a very bad shape, and some five per cent have given up on their business.

Pauline Suharno, secretary general of ASTINDO, said members in the secondary cities are suffering the most, as they do not get as many staycation and corporate travel business compared to those in Jakarta.

“Even (travel agencies in) a big city like Surabaya are suffering,” she said.

To ride out the storm, many have chosen to shrink operations. Pauline, who is also the commissioner and director of her own agency, Elok Tour, has had to close a number of brunch offices.

Budijanto said retrenchment was usually the last option, as travel companies wanted as many staff on deck as possible to ramp up operations quickly when conditions improve.

“Many companies are surviving on their savings,” he added.

To maintain staff morale, travel agencies and industry associations have rolled out various training programmes on topics such as digital marketing and destination updates.

At ASTINDO, education is centred on Indonesian product updates to help members make the best out of domestic tourism opportunities. According to Pauline, most ASTINDO members specialise in ticketing and outbound.

Temporary diversification into other businesses has also proven useful to keep staff occupied. Elok Tour has created a marketplace for staff to sell food products, and arranged to support a number of hospitals with their PCR test service.

Similarly, Panorama Group started the Orange Kitchen marketplace, which initially sold only food products and has now opened up the platform for clients to sell their products, such as cosmetics.

“This is a way for us to maintain our close relationship with our clients and business partners,” said Budi Tirtawisata, CEO, Panorama Group.

Singapore

Members of the community in Singapore have found reprieve in pivoting towards new business models and, in some cases, entirely new segments altogether. DMC Discova, which has offices in Asia and the Americas operating under the Flight Centre Group, is supporting its staff through a variety of remote retraining and alternative business courses.

Its managing director for Asia, Suyin Lee, shared: “We’ve had to right-size our operations and reduce our cost base, which has impacted some of our great people. However, we’ve continued to train our people and our guides, and are providing financial support and business skills training to those wanting to launch a side business in the interim. We’re also helping our communities launch programmes which will provide alternative work and revenue in the absence of international tourists.”

Lee revealed that Discova’s travel partners have been “seeing an uptick in travel enquiries for the second part of the year”, but in the meantime, it has retrained a core part of its workforce in Asia to support domestic tourism and prepare for travel resumption.

Meanwhile, homegrown and household name Dynasty Travel has also adeptly adapted its workforce to cater to the burgeoning domestic market. During the quarantine last year, its staff engaged in a charity baking drive in order to raise funds and foster team morale.

With Singapore loosening activity restrictions, product development planners – who once handled destinations such as Europe, America, Australia, Japan and South Korea – now plan sightseeing tours for local residents.

“Local itineraries include staycations and visiting a mask factory (for guests to) learn how to wear the right mask to protect ourselves. We also work with tourism boards in Australia, Hong Kong, Japan, Taiwan, South Korea and New Zealand to keep our customers informed of the latest news through webinars and video streaming,” described Alicia Seah, director, public relations & communications, Dynasty Travel.

It has combined its Group Tours and Free and Easy departments, retraining its staff to sell across a range products, and partnered with private healthcare provider Raffles Medical Group. The latter allows future travellers who sign up for Dynasty Travel packages to pre-book and perform their swab tests at any of the group’s 36 clinics in Singapore.

“The role of travel agencies will become more critical as we begin to offer an entire travel package focused on meeting safety requirements before and after the trip,” expressed Seah.

For agencies struggling with transforming their businesses, the National Association of Travel Agents Singapore (NATAS) is mediating a series of discussions between its members and government agencies to facilitate cross-business collaborations.

President of NATAS, Steven Ler, told TTG Asia: “Since July last year, many agencies have been working on how to create more local tours and variations of virtual tours. Some members have gone into hibernation, while some have transformed their businesses to get into the domestic market.”

Ler said that although NATAS runs at cost and has not been able to provide funding support, it has worked with government agencies, such as Singapore Tourism Board, to help push out schemes to subsidise affected industry members.

Since April 2020, the Singapore government has provided wage support for employees of impacted sectors – including tourism and aviation – covering up to 75 per cent of their monthly wages last year, and up to 50 per cent for 1Q2021.

Ler added: “In the next six to 12 months, we will continue to look at how agencies can collaborate with businesses in other sectors, and work with the government to get more support. We would like to see a collaborative effort from (our member) agencies and government ministries, in order to fund some bridging resources to help agencies transform – and perhaps even move beyond local into regional partnerships.”

Thai hotel outlook remains bleak for 2021

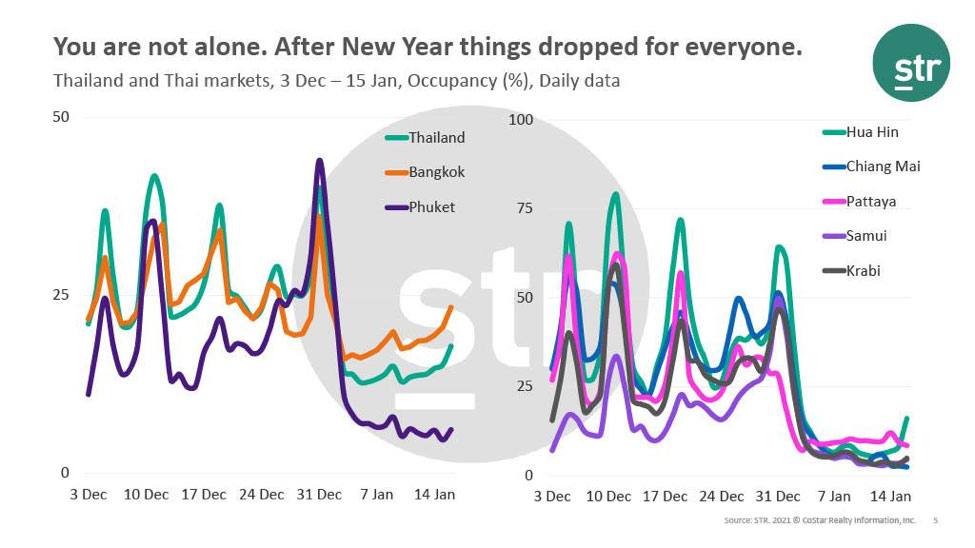

Sharp drops in hotel occupancy as a result of January’s soft shutdown to deal with Thailand’s second Covid-19 outbreak as well as various challenges, including unequal domestic travel rebound and vaccination limitations, have led travel analytics firms STR, Inc and C9 Hotelworks to predict a slow year for the Kingdom’s hotel industry.

According to Jesper Palmqvist, area director Asia Pacific for STR, Thailand occupancy for the full year of 2020 ended at 23.5 per cent, compared to 72 per cent in 2019, using Total Room Inventory (TRI) Occupancy, where the metric includes hotels that are temporarily closed.

With Standard Occupancy (excluding hotels that are closed), those numbers become 29.3 per cent and 72.9 per cent, respectively.

Palmqvist noted that occupancy rates dropped sharply for all major markets in Thailand after the New Year, as the government imposed measures to restrict the spread of Covid-19 following the second outbreak at end-January 2021.

Presently, five per cent of hotel rooms across Thailand are temporarily closed, an improvement from six months ago when over 30 per cent went into hibernation, shared Palmqvist, who added that STR is forecasting Thailand occupancy to rise to 37.7 per cent in 2021. This is a downgrade from previous forecasts, “primarily due to the combination of time frames for the rollout of vaccines in the country and continued measures of restriction movements”.

Marisa Sukosol Nunbhakdi, president of the Thai Hotels Association (THA), remains gravely concerned and has described the year 2021 as a “dangerous one” because many more hotels will soon run out of cash.

A Covid-19 surge in the middle of Thailand’s traditional peak in December 2020 had severely crippled travel and tourism players, and another wave soon after will push stakeholders deeper into the abyss.

Marisa expects more hotel operators to decide whether or not to shut their doors following the January wave of infections, which will deepen job losses; half of the hotel workforce – or about 200,000 – has been laid off since the start of the pandemic.

“This second wave of infection is hurting us even more,” she said, adding that the small domestic market will not be able to plug the loss of international arrivals and hotels will continue to feel the impact of depleted business for the next two years.

According to THA, only 30 to 40 per cent of hotels in major Thai destinations such as Phuket, Koh Samui, Phang Nga, Pattaya and Chiang Mai, are still in operation.

Hopes for upcoming holidays

With infections under better control, the Thai government eased restrictions on 13 types of businesses and venues in the capital on January 22, and lifted the 14-day quarantine for visitors to Phuket from Bangkok and Samut Prakan.

“This was driven in expectation of a strong opportunity for domestic visitors over Chinese New Year and another long government mandated holiday in February,” shared Bill Barnett, founder of C9 Hotelworks.

The Thai government has added eight holidays to the 2021 calendar, including, for the very first time, Chinese New Year, and according to Barnett, “consensus is that the current restrictions will ease by March prior to Songkran holiday.”

Both Barnett and Palmqvist anticipate drive-to holiday markets like Hua Hin and Pattaya to fill up more quickly.

“Chinese New Year is so far not showing any major movements outside drive-to markets from Bangkok, and we are yet to see concrete plans on what any incentivising projects before and after Songkran will lead to,” said Palmqvist.

He blames “domestic travel patterns” for the lack of interest in inbound-tourism geared destinations.

“While markets like Hua Hin and Pattaya quickly saw good weekend demand from larger Bangkok, and over time this was also seen in Chiang Mai during 4Q2020, it’s a much more challenging situation for Phuket and Khao Lak and other destinations that over time have become hugely popular with overseas visitors – and not much at all from a domestic Thai perspective. Destinations like Krabi and Samui have seen slightly more (travellers) in 4Q2020, but it is still very limited and behind other markets up north,” he elaborated, adding that vouchers and an incentive scheme will not be able to alter traditional domestic travel patterns, particularly in Thailand.

C9 Hotelworks anticipates that Phuket can look forward to 150,000-160,000 travellers a month, but a considerably lower average length of stay.

“A lower average length of stay for the domestic market is a reality of the marketplace, given shorter holidays and friends and family travel patterns. For Phuket hotels though, they would gladly want 20 to 30 per cent annual occupancy in 2021 given the single digit start of the year after the Bangkok shutdown,” opined Barnett.

Confidence restoration is key to recovery

Barnett observed the countrywide situation remains volatile, as long as there is no vaccination for the communities where tourists frequent.

“There has to be a national priority to vaccinate and (correct) the negative sentiment of Thai people (and their fear) of incoming tourists. This is key to a (successful) reopening,” he said.

Vichit Pragobgosol, president of the Association of Thai Travel Agents, agrees that Thailand’s Covid-19 vaccination programmes are critical for the industry’s survival. He expects a rebound to normalcy only in late-2022 or early-2023, in line with air travel projections.

Considering current challenges, Palmqvist finds it “hard to see imminent projections of rapid growth”.

“While we expect a gradual increase of key economic factors in the country in 2021, Thailand’s current plans of the vaccine rollout via the Covax programme make it reasonable to believe that travel-inhibiting restrictions to some degree will remain in place even beyond the first half of 2021,” he concluded. – Additional reporting by Suchat Sritama

Jean-Philippe Jacopin joins Parkroyal Collection Pickering

Pan Pacific Hotels Group has appointed industry veteran Jean-Philippe Jacopin as general manager of Parkroyal Collection Pickering.

Jacopin hails from a family of hoteliers, and his thirty-year career has seen him hold senior management positions for some of the world’s leading hospitality brands in Europe and Asia-Pacific.

A 22-year stint with Hilton International took the French national from the UK and Ireland to Japan, South Korea and China before joining Shangri-La Hotels and Resorts in Xi’An.

Jacopin went on to manage The Pavilions Hotel Resorts in Thailand for two years and, most recently, was general manager of Orchard Hotel Singapore.

Samit Ganguly moves to Indonesia to helm Westin Jakarta

The Westin Jakarta has appointed Samit Ganguly as general manager of the 256-key luxury hotel in Jakarta.

Over the last two decades, Ganguly has held key management roles in various aspects of management and operations of hotels. Prior to joining the team at The Westin Jakarta, he was general manager of Hyatt Regency Phuket Resort.

This assignment marks his return to Marriott International after beginning his journey back in 2012 with The Ritz-Carlton Jakarta Pacific Place as director of sales & marketing, and later as hotel manager.

His journey in the hospitality industry began in 2000 with The Oberoi Grand, Calcutta, soon after he concluded his studies. He then moved to join Hyatt Hotels & Resort Kolkata, then Hyatt Regency Dubai and Galleria in 2007 as director of convention sales.

Olympic hopes dim for Tokyo

Prospects for Tokyo 2020 look increasingly bleak amid speculation on the feasibility of the Games and declining public support as Japan grapples with a third wave of Covid-19.

Despite growing speculation that the event may have to be cancelled, organisers remain adamant that it will be held as scheduled this summer.

International Olympic Committee (IOC) member Dick Pound admitted there is no guarantee that Tokyo 2020 would go ahead, but there is “a very, very good chance” it will.

“I think the IOC and the organisers are committed to going ahead with the Games, if at all possible. And so they’re not going to cancel unless there’s a consensus among the government, health authorities and IOC that it would be too dangerous,” he told Kyodo News.

Following the one-year postponement of the Games, the IOC and Tokyo Organizing Committee (TOC) agreed in June 2020 to hold a “simplified” Olympics that would limit the financial impact of the delay and ensure the safety of all those involved. However, uncertainty on the feasibility of that plan is growing.

Toshiro Muto, TOC CEO, said implementing the anti-coronavirus rulebook is the organisers’ biggest challenge, according to a report by SFP.

“If we don’t plan this thoroughly, we can’t hold a safe and secure Olympics,” he said, but added that organisers are “unwavering” in their commitment to hold the Games this summer. They have also not discussed making the vaccine a condition for athletes or fans.

Additional measures to reduce contact points at the Games have been suggested in recent days. Hosting spectators, for example, is a “nice-to-have” and not a “must-have”, according to IOC’s Pound.

With Tokyo reporting some 90,000 Covid-19 cases so far, people in Japan are increasingly opposed to holding the Games. More than 70 per cent surveyed in Japan on January 24 by the Japan Press Research Institute said the event should be cancelled or postponed. Of those, 83 per cent said the event would attract many people to Japan, leading to more infections, and 64 per cent thought the pandemic could not be contained by July 2021.

The IOC maintains that a further postponement of Tokyo 2020 is impossible.

The five-star Hotel Equatorial Penang, which has been in operation for more than 30 years, is set to shut its doors for good by March 31, the latest hospitality casualty of Covid-19.

In an internal memo to employees, general manager Alan Ong said the decision was made due to the “adverse business conditions caused by Covid-19”, reported the Malay Mail.

The hotel’s last day of operations has yet to be decided, but it will be before March 31, he added.

“Until we officially cease operations, all of you shall remain as employees of the hotel and we remain committed to upkeep the strong heritage and name of Hotel Equatorial Penang,” Ong said in the letter dated January 25.

Despite having chalked up “huge losses”, the company said that it will still pay severance benefits to employees, with details to be announced later.