RedDoorz has just stepped into the midscale accommodation playground with the launch of Sunerra. Was this something you had imagined RedDoorz would eventually do when the company first started out on budget hotels?

RedDoorz has just stepped into the midscale accommodation playground with the launch of Sunerra. Was this something you had imagined RedDoorz would eventually do when the company first started out on budget hotels?

Sunerra is an extension of our customer base. When we started in 2015, we had a whole bunch of youngsters as our customers. Over the last six years they have progressed in their lives. As a business, we see an opportunity to grow with them, and offer something slightly more than the basic property.

The other thing is, over a period of time, we felt that some other asset owners could benefit from the technology we have developed – the kind of hardcore technology that never happened in the hospitality industry before.

How much farther will the company go with its multi-brand strategy?

One thing I’ve learnt over the years is never say never (laughs), but for sure I don’t think we will go beyond Sunerra any time soon and in a hurry.

What’s in it for property owners that decide to go with RedDoorz instead of other traditional multi-brand hospitality companies that you now compete with?

The number one concern asset owners have is performance. RedDoorz is a mass consumer brand, so it gets a lot of direct traffic.

If we were to draw parallels between traditional hospitality companies and RedDoorz, the former have a fairly significant revenue stream that can continue to generate (income) even if the properties don’t do well. In our case, revenue is very much aligned with the property performance. Hence, we are very aggressive with customer acquisition although we charge a small fee.

When the customer is acquired, we have a revenue share. We moved away from traditional forms of revenue sharing with hotel asset owners.

Will growing into economy lifestyle with SANS, co-living with KoolKost and midscale accommodation with Sunerra take RedDoorz’s focus away from the no-frills product the company set off with?

No. When you look at the number of properties we have, our focus will continue to be on our no-frills accommodation. Ninety-five per cent of our portfolio is still made up of no-frills RedDoorz properties. That is our bread and butter.

In Indonesia, Gojek (ride-hailing service) started off first with motorcycles, not cars. We are like Gojek.

Having said that, there are opportunities in the hospitality industry that we should not ignore. Such opportunities would include the rise in economy lifestyle, extended stay, and so on.

While we will continue to evolve our brands in a concerted manner, the core will continue to be no-frills RedDoorz.

Getting back to Sunerra, what is the story behind the name?

I don’t have a grand story to tell, if you are hoping for one (laughs). Sunerra means ‘golden’ in Hindi. We thought that from that standpoint, it would make an interesting name.

Our other brand, SANS, is derived from the Bahasa Indonesian word ‘santai’, which means ‘to chill’. So, Sunerra is a better offering compared SANS. While we are not Marriott and do not have The Ritz-Carlton, Sunerra is RedDoorz’s golden product for our customers.

The name Sunerra has an exotic tinge to it, don’t you think?

Yes, and I can imagine a Hollywood baby being named Sunerra. You have chosen to debut Sunerra, SANS and KoolKost in Indonesia. Why such great faith in Indonesia?

Let’s put the hospitality industry aside for a year or two, during this very bad period. Besides hospitality, South-east Asia is benefitting a lot from investments coming in from overseas, technology adoption, etc. South-east Asia itself is a huge and exciting market with 650 million people, and Indonesia is the largest market.

If you want to create a South-east Asia business, you need to have a strong Indonesia strategy. We have great faith in other South-east Asia markets too, like the Philippines where we operate in as well, but there is no taking away the fact that Indonesia is the largest real economy in this region. There are 250 to 270 million people across at least 100 viable cities.

The domestic consumer is our primary audience, and Indonesia has a great domestic audience. This segment repeats a lot and understands a brand very well, so we can build strong loyalty out of them.

Your decision to launch three new brands during some of the toughest times the travel and tourism industry is facing must mean you are seeing more opportunities than challenges. What’s feeding your confidence

One, asset owners have found it very difficult to go alone. So, independents will need to get banded together.

Two, the consumer concept of service has changed. Today, touch-less service is desired. Consumers don’t want to see you (the service staff), they just want to get right into their room.

The combination of these situations presents the perfect opportunity for a technology-enabled business like us. We are a technology company at heart, and we chose to enter an industry that has not been penetrated by technology innovations.

I used to be an hotelier, and then I joined MakeMyTrip which was a pure technology-driven OTA. I hear a lot of talk about technology in hospitality but the actual implementation is very poor, even in the larger brands. Hence, we see growth opportunities in this space.

Three, if you look at what has happened in China, South Korea, the US and Europe, you will see that people will travel once they can. Like it or not, governments will have to reopen their borders in the next six months. Travel will resume with a vengeance then, and we want to be ready with different solutions for different asset owners before that happens.

SANS is expanding into the Philippines this month. Will we see Sunerra and KoolKost elsewhere in Asia?

KoolKost is going to be very Indonesia focused, while SANS and Sunerra were conceptualised to be available across geographies.

I see Sunerra going into leisure destinations, like Bali and Jogjakarta. Perhaps even the main cities will see a Sunerra presence in the future, but intuitively now I think leisure destinations have the strongest potential.

As RedDoorz scales up, how do you see the company shaping up as a travel and tourism industry employer?

I expect more people to work for us on the platform in roles handling technology, product development, human resource, relationship training, etc. However, RedDoorz will remain asset-light, which means we will never have a huge workforce working for us directly.

As a company, we are enablers – we give skills to locals to improve their employability in the hospitality industry. When we enter a smaller city with our property, we teach the local staff the importance of hygiene, basic language skills including English, standard customer service, such as how to greet the customer, etc. Many who started with a RedDoorz property were unskilled labour, but they have been able to move on to bigger properties later.

We have a vision of providing a formal certification for staff who undergo the RedDoorz hotel training programme, so that they can get employed elsewhere in future.

Do you find your leadership approach changing as a result of the pandemic and resulting challenges in the travel and tourism landscape?

I think our entire leadership has become a lot more patient.

People in the army often feel that once they get into battle, nothing scares them anymore. Once the first shot is fired, there is no going back. In our case, the pandemic has forced so many changes upon us; many shots have been fired. I think we have learnt to take everything in our stride.

In the past year we have worked very, very hard to improve our systems internally. The launch of the new brands is a manifestation of that improvement in how we operate. We are now more efficient, more revenue-centric than ever.

Lastly, if you possessed the power to do one thing – except making Covid-19 disappear, what would you do to speed the travel and tourism industry towards pre-pandemic recovery?

I will make it easier for people to travel. The way some governments have responded to the pandemic has been rather weird. They have made it very difficult (for people) to get into the country.

The Phuket Sandbox arrangement, for example, is complex even though it sounds so good on paper. To get into Phuket, one needs to be on a list of approved countries, secure a visa and (medical clearance), etc.

Safety first, of course. The PCR test is the gold standard, but we have to simplify the process so more people can come and go with ease.

RedDoorz has just stepped into the midscale accommodation playground with the launch of

RedDoorz has just stepped into the midscale accommodation playground with the launch of

The crash in international tourism due to the coronavirus pandemic could cause the global economy to lose more than US$4 trillion for the years 2020 and 2021, according to a recent United Nations Conference on Trade and Development (UNCTAD) report.

The estimated loss has been caused by the pandemic’s direct impact on tourism and its ripple effect on other sectors closely linked to it.

The report, jointly presented with the UN World Tourism Organization (UNWTO), said international tourism and its closely linked sectors suffered an estimated loss of US$2.4 trillion in 2020 due to direct and indirect impacts of a steep drop in international tourist arrivals.

UNCTAD warned that a similar loss may occur this year, and that the tourism sector’s recovery will largely depend on the uptake of Covid-19 vaccines globally.

“The world needs a global vaccination effort that will protect workers, mitigate adverse social effects and make strategic decisions regarding tourism, taking potential structural changes into account,” UNCTAD acting secretary-general Isabelle Durant said.

UNWTO secretary-general Zurab Pololikashvili said: “Tourism is a lifeline for millions, and advancing vaccination to protect communities and support tourism’s safe restart is critical to the recovery of jobs and generation of much-needed resources, especially in developing countries, many of which are highly dependent on international tourism.”

The report also noted that tourism losses are reduced in most developed countries where Covid-19 vaccinations are more pronounced, but vaccine inequality has left developing countries still reeling in the doldrums.

Covid-19 vaccination rates are uneven across countries, ranging from below one per cent of the population in some countries to above 60 per cent in others.

According to the report, the asymmetric rollout of vaccines magnifies the economic blow tourism has suffered in developing countries, as they could account for up to 60 per cent of the global GDP losses.

A faster tourism recovery is expected in countries with high vaccination rates, such as France, Germany, Switzerland, the UK and the US, said the report.

However, UNWTO highlighted that experts don’t expect a return to pre-Covid international tourist arrival levels until 2023 at the earliest, due to travel restrictions, slow virus containment, low traveller confidence and a poor economic environment.

While a rebound in international tourism is expected in the second half of this year, the UNCTAD report still showed a loss of between US$1.7 trillion and US$2.4 trillion in 2021, compared with 2019 levels.

The report assessed the economic effects of three possible scenarios – all reflecting reductions in international arrivals – in the tourism sector in 2021.

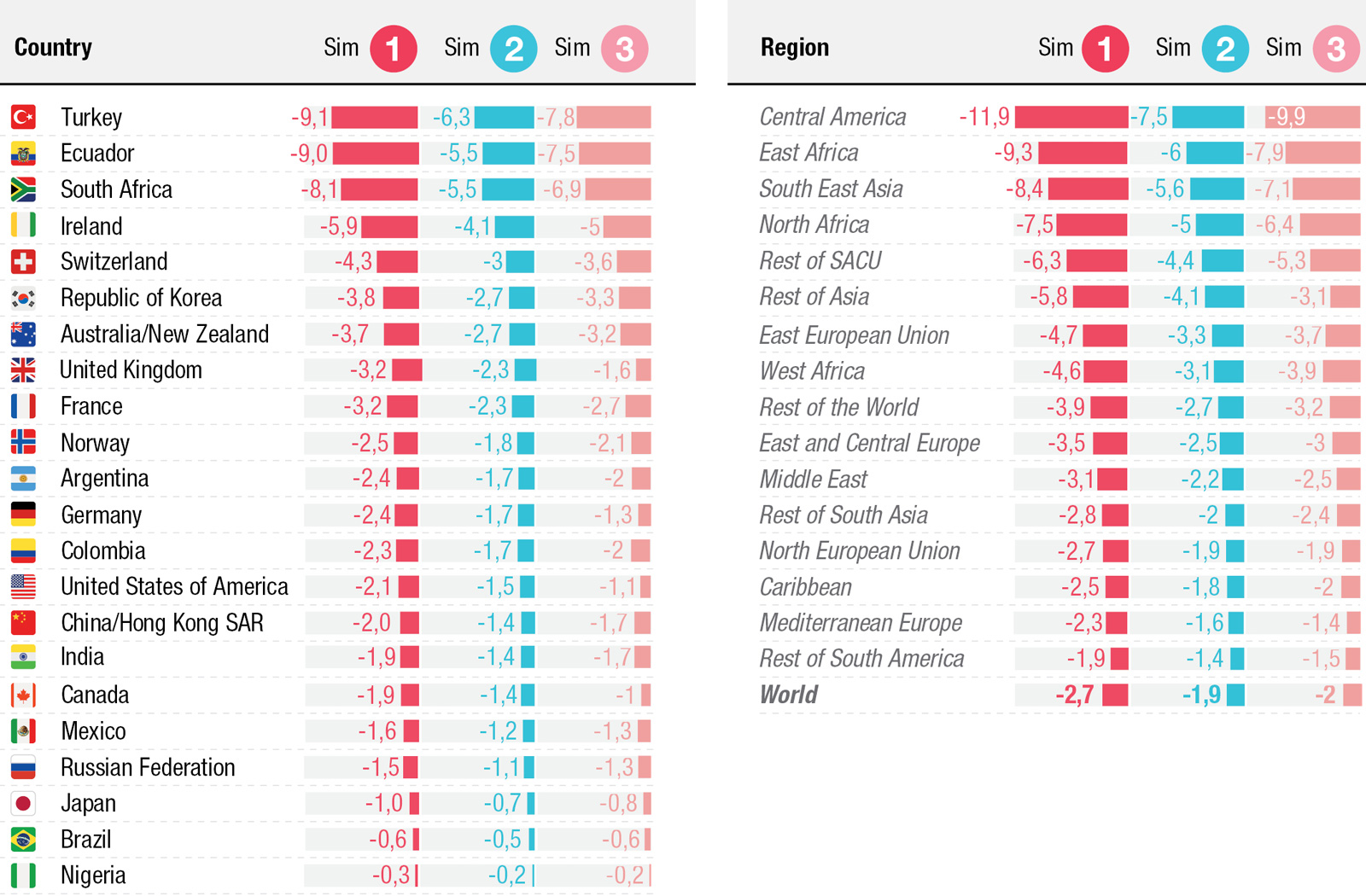

Figure 1: As tourism falls world GDP takes a hit in 2021 (3 alternative scenarios)

The first one, projected by UNWTO, reflects a reduction of 75 per cent in international tourist arrivals – the most pessimistic forecast – based on the tourist reductions observed in 2020.

In this scenario, a drop in global tourist receipts of US$948 billion causes a loss in real GDP of US$2.4 trillion, a two-and-a-half-fold increase. This ratio varies greatly across countries, from onefold to threefold or fourfold.

Figure 2: Estimated losses in GDP by region from reduction in tourism (percentage)

The second scenario reflects a 63 per cent reduction in international tourist arrivals, a less pessimistic forecast by UNWTO.

And the third scenario, formulated by UNCTAD, considers varying rates of domestic and regional tourism in 2021.

It assumes a 75 per cent reduction of tourism in countries with low vaccination rates, and a 37 per cent reduction in countries with relatively high vaccination rates, mostly developed countries and some smaller economies.

UNCTAD said that losses are worse than previously expected. In July last year, the conference estimated that a four- to 12-month standstill in international tourism would cost the global economy between US$1.2 trillion and US$3.3 trillion, including indirect costs.

But that projection has turned out to be “optimistic”, as international travel remains low more than 15 months after the pandemic started, UNCTAD said.

According to UNWTO, international tourist arrivals declined by about one billion or 73 per cent between January and December 2020. In the 1Q2021, the UNWTO World Tourism Barometer points to a decline of 84 per cent.

Figure 3: International tourist arrivals (in thousands)

Developing countries have borne the biggest brunt of the pandemic’s impact on tourism. They suffered the largest reductions in tourist arrivals in 2020, estimated at between 60 per cent and 80 per cent.

The most-affected regions are North-east Asia, South-east Asia, Oceania, North Africa and South Asia, while the least-affected ones are North America, Western Europe and the Caribbean.