Brought to you by Wyndham Hotels & Resorts

IHG adds Holiday Inn hotel to Singapore portfolio

IHG Hotels & Resorts has extended its partnership with RB Capital to bring the Holiday Inn brand to Singapore with the rebranding of a property in Little India.

The 300-room Holiday Inn Singapore Little India, formerly the Park Hotel Farrer Park, will undergo a renovation before relaunching with a vibrant fresh identity and positioning.

The hotel is situated in the heart of Little India – adjacent to Farrer Park Hospital and next to 24-hour shopping mall Mustafa Centre and City Square Mall – providing direct access to Farrer Park MRT station through its lobby.

Holiday Inn Singapore Little India will be the first in Singapore to introduce the new Holiday Inn brand hallmarks including a new dining and workspace concept with a globally recognised F&B partner.

With the new signing, IHG now manages three of RB Capital’s Singapore hotels, including Holiday Inn Express Clarke Quay and InterContinental Singapore Robertson Quay.

Wyndham is ready to welcome guests back whenever, wherever

With approximately 1,600 hotels spanning 14 trusted brands across Asia Pacific, Wyndham Hotels & Resorts holds a leading presence in key business and leisure destinations across the region. Wyndham is committed to elevating hotel experiences at every price point through its vast global scale enabling guests to enjoy more choices and better value.

Check out these latest openings:

The rebranded hotel is equipped with a total of 278 high-quality and elegant guestrooms and suites. Rooms are decorated with ink and wash style combined with modern design, full of Jiangnan charm and oriental flavour. It is located in Fenhu Lake, an ancient lake with history that can be traced back to 770BC.

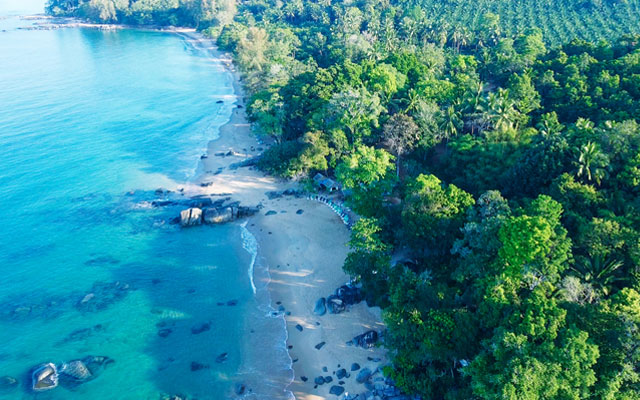

This 317-room luxury beachfront resort is located on Cat Ba Island in north-east Vietnam. Guests can enjoy a wealth of facilities including an indoor swimming pool, Japanese onsen, spa, fitness centre, and multiple restaurants.

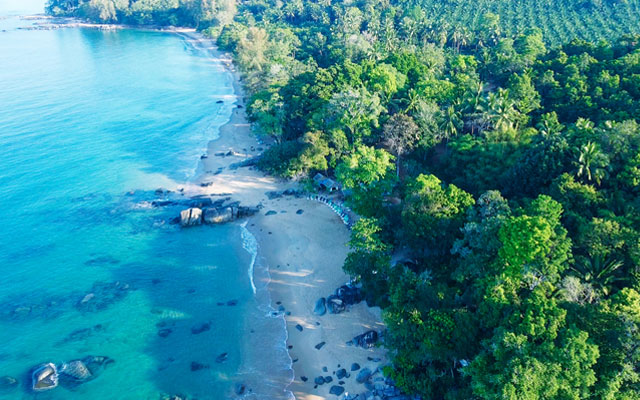

This 241-room hotel is nestled on the scenic Cam Ranh Peninsula, overlooking the golden sands of Long Beach. The resort features a collection of spacious villas and premium amenities to ensure a comfortable and relaxing stay.

This newly-built 256-room hotel forms part of a major commercial complex, adjacent to a 17,000m2 convention centre in the Nanjing Airport Economic Core. The hotel is a convenient 15 minutes’ drive from Nanjing Lukou International Airport.

Located in the popular business precinct of Newmarket just off the Auckland motorway, this 93-room hotel is perfectly positioned to cater to both corporate and leisure guests. It features apartment-style rooms and onsite parking.

Located in the heart of New Zealand’s capital city, this new 117-room hotel is walking distance from the scenic Wellington Waterfront Walk and Museum of New Zealand. There’s also an on-site gym for guests.

Although leisure holidays and business trips aren’t happening just yet, whenever – or wherever – the decision is made to travel, be assured that Wyndham Hotels & Resorts will provide the best available rates, flexible booking policies, and member perks when booking direct.

Wyndham Hotels & Resorts is also committed to the health and safety of their guests and team members, and have taken important steps to ensure health and safety protocols are in place under the global Count on Us initiative.

Loyalty is very highly regarded at Wyndham Hotels & Resorts, which is why Wyndham Rewards offers a guaranteed 1,000 points with every qualified stay. The programme’s free nights, starting at just 7,500 points, are among the most attainable in the industry.

Sri Lanka Tourism returns to overseas trade show floors

Sri Lankan tourism officials will resume attending physical overseas trade exhibitions and fairs, kicking off with Moscow’s three-day International Trade Fair for Tourism and Travel starting today (September 7).

Sri Lanka has been represented only virtually at these fairs over the past 18 months, after the Covid-19 pandemic restricted global travel.

Officials of state-run Sri Lanka Tourism (SLT) said about 13 Sri Lankan companies are participating in the Moscow fair, with the delegation including tourism minister Prassanna Ranatunga and SLT chairperson Kirmali Fernando, both of whom will also be attending a travel show in Ukraine thereafter.

Plans are also underway to send delegations to attend the IFTM fair in France (October 5-8) and the World Travel Mart (November 1-3) in the UK, but vaccination requirements in host countries could pose a stumbling block, officials said.

While about 10 companies have already confirmed their participation at the IFTM fair, officials say that there are entry issues since France, for example, has not approved the Sinopharm vaccine which has been the most widely-administered Covid-19 vaccine in Sri Lanka.

They added that in the case that entry is not permitted, overseas representatives of these companies along with officials from the Sri Lankan embassy will represent the country instead.

Chandra Wickramasinghe, hotelier and chairman of travel firm Connaisance De Ceylon, stressed on the importance of a physical presence at international trade shows. “Travel fairs have a major influence on tourism destinations,” he said.

Nalin Jayasundere, managing director of Aitken Spence Travels, Sri Lanka’s biggest inbound travel agency, said it was important to attend these fairs for marketing purposes.

Sri Lanka’s physical presence at travel trade fairs comes at a time when the industry is hoping for tourism to recover by the coming winter season by which time 75 per cent of those aged above 30 in the country would have been fully vaccinated.

Air France and Swiss carrier Edelweiss have announced plans to restart flights to Sri Lanka in November.

Meanwhile, health authorities said on Sunday that fully vaccinated tourists will be permitted to visit places of interest across the island and patronise restaurants amid a nationwide lockdown enforced since August 20. The initial 10-day lockdown has been extended twice, and is due to end on September 13.

Trade reacts to Philippine Airlines’ restructuring plan

While Philippine Airlines’ (PAL) financial restructuring has no immediate impact on the travel sector, it will be a smaller airline with its future determined by the pandemic’s duration and how long its recovery plan can be sustained, according to the travel trade.

Tourism Congress of the Philippines president, Jojo Clemente, does not see an immediate effect to the airline pursuing a corporate rehabilitation programme, “especially if PAL can manage to keep fares competitive and affordable”.

In the medium term, however, PAL’s recovery “will depend on how the measures they adopt in the short-term pan out,” Clemente said. “If they are able to keep demand or if the pandemic situation gradually improves, they may be able to sustain the recovery programme.

“However, if the current situation persists a few more months, emerging from the rehabilitation may prove to be more difficult. They, and other players in the aviation industry, may be in deep waters.”

Agreeing, Ritchie Tuano, immediate past president of the Philippine Travel Agencies Association, opined that “(the situation) is just so fluid as of this time and forecasting what is going to unfold in the medium and long-term is nothing but a guess”.

Former tourism secretary and founder of consultancy Asia Pacific Projects, Narzalina Lim, said “PAL will be a smaller airline”. The airline’s fleet will shrink by 25 per cent, as it will return 22 aircraft, leaving it with a fleet of 70. PAL will also delay the delivery or cancel orders for 13 Airbus aircraft.

Lim believed that with PAL chairman Lucio Tan infusing US$505 million – a portion of which will be converted to equity – into the restructuring plan, alongside US$150 million of additional debt financing from new investors, the airline will not require the help of the Philippine government to bail it out.

At any rate, Tuano said that “the government has just too much on its plate right now and I am uncertain they should drop everything to throw a lifeline to a single company”.

If passenger demand does not pick up as expected next year, an option is for PAL to convert some of its aircraft into cargo aircraft as “the cargo business can be more lucrative than passenger”, said Lim. “Companies always have to reinvent themselves to survive and PAL is no exception,” she added.

The government has to act on the request of the Air Carriers Association of the Philippines – PAL, Cebu Pacific and AirAsia Philippines – for loan guarantees so that banks can open their credit lines to airlines, considered as poor credit risk in this time of pandemic.

Hospitality consultant Jerome de la Fuente said the government should have come in by now to help PAL as the airline is “the pride and glory of the country”. “It is the national flag carrier, and the oldest airline in Asia with 80 years of history. It is a legacy carrier. Can you imagine a flag carrier owned by a foreigner?” he added.

He said many airlines will be interested to buy out PAL, which is partly owned by Japan’s ANA, because of those attributes alongside having Asian routes that PAL already flies to.

De la Fuente said that somewhere along the line, more money had to be pump into PAL to keep it afloat, just like Malaysian Airlines, Japan Airlines and other carriers that are still surviving after having declared bankruptcy.

Cambodia aims to welcome vaccinated foreigners by November

Cambodia is working towards a possible reopening of borders for fully vaccinated international travellers by November this year, with Phnom Penh on track to becoming the most vaccinated city in South-east Asia.

The Cambodian tourism ministry recently announced that fully vaccinated international tourists with proof of their inoculation could be allowed into Cambodia as soon as November 2021.

The country’s authorities are also mulling the reduction or full removal of the 14-day quarantine policy for fully vaccinated tourists who show proof of a negative Covid test taken 72 hours before travel and test negative for the virus upon arrival at Phnom Penh International Airport.

Cambodia is currently the second most vaccinated country in South-east Asia after Singapore. The Kingdom has already inoculated more than 60 per cent of its 16.5 million people, while over 95 per cent of its 2.1 million residents in the capital Phnom Penh are already fully vaccinated.

The country anticipates it will reach herd immunity with 75 per cent of its population double vaccinated by the end of September this year.

Thailand eyes full reopening by January

Thailand’s Ministry of Tourism and Sports is planning to reopen the whole country without quarantine by January next year, however, that move hinges on high vaccination coverage in order to reach herd immunity.

Tourism and sports minister Phiphat Ratchakitprakarn was quoted by the Bangkok Post as saying that Bangkok’s reopening in October has been pushed back to November, as most residents will not receive their second vaccine dose until the end of October.

However, Phiphat said that the reopening of Chiang Mai, Prachuap Khiri Khan (Hua Hin) and Chon Buri (Pattaya) will go ahead as planned on October 1. Phetchaburi will also reopen on the same day, but officials will need to speed up the implementation of SOPs in the province beforehand, he added.

Phiphat was also quoted by the report as saying that the ministry and the Tourism Authority of Thailand have agreed to add some provinces to the third phase of reopening under the 7+7 extension programme.

From October 15, there are 25 additional provinces tourists can enter via the sandbox programme as second destinations after spending seven days in one of these destinations: Phuket, Samui, Chiang Mai, Chon Buri, Prachuap Khiri Khan, Phetchaburi and Bangkok.

However, Phiphat said that vaccination uptake in these provinces will need to hit a certain target prior to reopening, otherwise select districts can be isolated or a sealed route plan can be implemented.

“Only safe areas can reopen to Thai tourists on November 1, while international tourists are expected to enter without quarantine from January, led by travel bubbles with neighbouring countries starting on January 15,” Phiphat said, adding that herd immunity will be a prerequisite for the country’s reopening.

Off-the-beaten-track destinations piquing Thai travellers’ interests

More Thais are travelling to lesser-known destinations, as domestic travel dominated travel agendas amid the pandemic.

According to Agoda’s booking data, while Bangkok, Pattaya and Chiang Mai remain the top three most booked domestic destinations in Thailand, there has also been a shift towards more off-the-beaten-track domestic destinations in the year ending June 2021, compared with the previous year.

Agoda compared booking data to identify destination trends and found Khao Lak saw the biggest jump, moving 23 spots to #22. Meanwhile, Nakhon Nayok moved up 15 places to #46, while Sukhothai landed at #30, jumping 14 spots. These destinations might not be in the domestic top ten but they signified Thai travellers’ desire to seek new domestic experiences.

Additionally, top 20 movers included Nakhon Si Thammarat moving up from #20 to #12, while Koh Chang entered the top 20, skipping up from 23rd to 18th spot.

During the past year, when domestic tourism became more popular, Thai travellers got more adventurous in their travels, and this saw new destinations joining the top 50 including Koh Kood (#44), Nakhon Nayok (#46), Lopburi (#49), and Loei (#50).

Between June 2020 and 2021, Phuket and Chonburi dropped marginally in the top ten, both slipping one spot. Meanwhile, more off-beat destinations like Kanchanaburi knocked Chiang Rai out the top 10 in 2021. Overall, the top ten destinations continue to be dominated by Thailand’s most popular and well-known holiday beach and coastal destinations including Phuket, Hua Hin, Khao Yai, and Krabi.

Conversely, the destinations that saw the sharpest dips in ranking for domestic travel are Koh Phi Phi, Koh Phangan, Koh Tao, Koh Lanta, and Pai, slipping more than ten spots in the ranking.

Gold Coast tourism operators “hanging on by a thread”

One in five tourism jobs across the Gold Coast have been cut in a year, according to new research by the Tourism and Transport Forum.

That amounts to a 20 per cent loss of the 20,094 full and part-time direct tourism jobs on the Gold Coast, over a 12-month period to June 2021.

Destination Gold Coast chairman Paul Donovan said his heart goes out to the 4,600 tourism businesses suffering during this time. “We are proudly Australia’s favourite holiday destination, but our operators are hanging on by a thread,” he said.

“Our local tourism industry relies on people travelling to enjoy what the region has to offer and with more than half of Australia’s population under travel restrictions, the impact on the Gold Coast is significant.”

Destination Gold Coast CEO Patricia O’Callaghan said the city is in the fight of its life, as mum and dad operators right through to major hoteliers and theme parks struggle to hold on financially and retain a skilled workforce.

“These figures are heartbreaking,” she said. “We know the industry will bounce back once people are able to travel again, but until that happens, the industry is requesting targeted financial support from the government.

“We appreciate the government’s support to date and the announced A$600 million (US$446.5 million) Business Support Package recently. Measures around business hardship grants and financial mechanisms that allow employers to retain skilled staff and keep them connected to the business until economic conditions improve will be critical.”

Following 18 months of hardship, tourism employment on the Gold Coast is forecast to drop by a further 20 per cent, or 4,000 jobs, from now until Christmas, due to state lockdowns and ongoing international border closures.

Now is the time to look at integrated resorts

Travel restrictions. Vaccine shortages. Reimposed lockdowns.

It’s been a rocky road for tourism in South-east Asia the last 18 months. We’ve seen new waves of coronavirus hampering both domestic and international travel. Many of the larger Asian countries have fallen behind their counterparts in Europe and the US when it comes to vaccine rollouts, and the Delta variant is causing a serious rise in infections rates across much of South-east Asia.

Looking beyond the pandemic and making bold statements about the future is tricky. However, there is confidence in the market that tourism will make a comeback in 2022. And when it does, one sector is particularly rife for growth: integrated resorts.

A favoured destination

We know that there is a substantial amount of money sitting with private equity funds and owner operators ready to be invested in the South-east Asian hospitality sector, and a pent-up consumer demand for travel to resume. Set against this backdrop is a growing number of Chinese tourists in the region, which is driving investment in casinos and integrated resorts in markets like Singapore, Macau, Japan, Vietnam and the Philippines.

Now is a good time for the construction industry who will deliver on these projects to not just establish where the opportunities are but how they will be completed on time, on budget and to the highest quality standards, in markets with often challenging operating environments.

It’s not uncommon to hear that ‘anyone can build a hotel’. Whether that is true or not, it is an indisputable fact that integrated resorts are a completely different beast. An integrated resort is a destination, which incorporates not just more complex aspects of the built environment, such as gaming facilities, shopping experiences and convention centres, but more importantly it’s based on a vision. And that vision must be delivered.

Transforming delivery

How you make good on that vision for clients in South-east Asia largely depends on project management teams with long-standing local knowledge and the backing of global best practice.

Investors usually have support on the acquisition side, but when it comes to the actual development or repurposing of assets, they need guidance. Projects need to be delivered with integrity, process and procedures, but a Western approach alone can be incongruous with how business is conducted.

Building trust, understanding the pace at which business is conducted, and fostering strong relationships with contractors are cornerstones of success in this part of the world. More specifically when it comes to construction, the team’s technical expertise and ability to implement the highest standards of safety and quality during the project lifecycle is vital to a successful outcome.

This is where the backing of a large organisation with international best practice in innovation, health and safety and sustainability adds an important layer. Setting the right objectives from the beginning and managing the different stages of the project by integrating all the data in one place can smooth out difficulties further down the line.

Integrated resorts in Asia are more than just gaming facilities. They are complex and large-scale developments that turn into destinations, bringing different experiences together for people from around the world. The local teams leave the completed projects with new skills which they transfer onto their next venture.

In sum, as we eagerly await the escalation of vaccine rollouts in Asia and a return to tourism, hospitality investors must hone their strategies for how they will see integrated resorts to fruition in response to post-pandemic demands.

It’s impossible to say when the door to travel will reopen, but we know with certainty how we need to transform delivery to provide tourists in South-east Asia with the destinations that they so eagerly crave.

Plaza Premium Group (PPG) has been appointed by Bangalore International Airport (BIAL) to manage and enhance passenger services at the Kempegowda International Airport, Bengaluru (BLR Airport).

The 10-year full-service management appointment covers the entire portfolio of BLR Airport’s 22 services. The 360-degree airport service delivery scope includes: service delivery, control centre, training centre, customer engagement, marketing communications, sales and distribution as well as technology. More services will also be introduced to enable an end-to-end and globally connected passenger journey.

The 360-degree airport service delivery scope includes: service delivery, control centre, training centre, customer engagement, marketing communications, sales and distribution as well as technology.

BIAL and PPG will collaborate in addressing the desires of travelling in the new normal – with seamless service delivery, world-class standards and quality, technology and innovation, as well as commercialisation optimisation.

In order to deliver seamless, optimal and data-driven operation excellence, PPG has teamed up with global IT services provider Tata Consultancy Services to develop an end-to-end passenger services technology platform. The new platform will be built based on the existing PPG operating platform with tailored architecture that suits the needs of BIAL’s passengers.

The platform will include an omni-channel booking engine which enables worldwide sales and distribution; a customer engagement centre with customer profiling and personalisation capabilities; a service delivery platform for dispatch and real-time incident management; and a back office system which powers HR, administration, asset and information management.

PPG is also partnered with one-stop customer engagement technology service provider oneDirect to ensure passenger interactions are managed through one-single platform via various touchpoints.

Song-Hoi-see, founder & CEO of PPG, said: “PPG is no stranger to the Indian travel market and we see huge potential in the travel market, therefore we have strategised to invest over US$15 million and will deploy a workforce of over 800 staff over the 10 years, supported by our Hong Kong-based headquarters with the hope to grow with BIAL in the years to come.”