Google poses ongoing threat to OTAs: GlobalData

The pandemic’s impact on OTAs has amplified their existing concerns around the growing presence of Google in the market, and how the tech giant’s control could impact competitivity and, therefore, consumer choice.

According to GlobalData, the OTA market value decreased by a gruesome 60.4 per cent year-on-year (YoY) in 2020.

Ralph Hollister, travel and tourism analyst at GlobalData, said: “Google’s growing presence in online travel will be ominous for OTAs that have no choice but to rely on the search engine for web traffic.

“Regulators are starting to control Google’s practices, but the company has to be treated differently due to its position as a dominant search engine, as well as the fact that it is not offering directly competing services. Low competition can lead to rising prices, so it is vital for all travellers that the right balance is achieved.”

Laura Petrone, thematic analyst at GlobalData, added: “Google certainly has a huge responsibility when it comes to competitivity. Google has a monopoly over internet searches, and it has been accused many times of violating competition law to preserve this monopoly.

“Digital platforms like Google can use data generated knowledge from one market and taking advantage of their scale, they can expand their services to new markets. However, they need to be careful: in doing so they end up attracting even more regulatory scrutiny, as they are viewed as data monopolies in whichever sector they move into.”

GlobalData notes that from 2015 to 2019, the OTA market was seeing growth of 9.4 per cent compound annual growth rate (CAGR), reaching US$480.3 billion. This rapid growth rate and future growth potential intensified Google’s focus on online travel, it said.

By 2019, the OTA market was already blaming weakened visibility in Google search results for poor third quarter earnings. Expedia Group’s net income fell by 22 per cent YoY in 3Q2019, which it partially blamed on changes to Google’s algorithm, resulting in lost visibility.

Hollister continued: “Google really ramped up its activity in online travel prior to the pandemic. When looking at 2019 alone, Google launched its Travel Hub, added flight check-in and hotel booking abilities to Google Assistant, attached lodging listings to its Maps function, created a search site for hotel availability by destination, and Alphabet (Google’s parent company) even launched its own ride-hailing app.

“Google clearly has both the business model and capital needed to better weather an event like Covid-19: by 2020, Alphabet’s revenue was over 15 times the amount of Booking’s and Expedia’s combined.

“Struggling OTAs will rely more and more heavily on Google search traffic as they look to recover from the impact of the pandemic. Google will have to be mindful not to expand or act too aggressively in the short-term, or it will face more frequent anti-competitive claims, lawsuits, and fines.”

Jayson Heron-Smith takes on dual role at The Langham Hospitality Group

Langham Hotels and Resorts has appointed Jayson Heron-Smith to wear the dual roles of director of sales & marketing, The Langham, Sydney and director of sales Australia, global sales office at Langham Hospitality Group.

Heron-Smith brings over 25 years of experience and a wealth of knowledge to his new role; from starting out in F&B to working as an event manager and then through the ranks of sales and marketing to his current position today.

The Australian started with The Langham Hospitality Group across the pond in Auckland in November 2019 as director of sales and marketing at The Langham’s sister property, Cordis.

Before working for The Langham Hotels and Resorts, Heron-Smith worked for companies including Hyatt, Crown Melbourne, Hilton and The Star Sydney.

First person: What it’s like travelling to France under VTL scheme

As the Boeing 787 taxied down Changi Airport’s runway and the plane’s engines rumbled to life, a surreal feeling washed over me. This was my first overseas trip in 21 months, made possible thanks to a vaccinated travel lane (VTL) established between my hometown Singapore and France.

But getting to this point wasn’t easy; there was a degree of nervousness and hesitancy leading up to my three-week trip to France in December. In late November, South Africa shared their discovery of the Omicron strain, prompting knee-jerk reactions from countries that quickly shut their borders, resulting in many cancelled hotel bookings and flights.

Days before our departure, France announced that incoming vaccinated travellers from Singapore would now be required to present a negative antigen rapid test (ART) result, but will still get to skip quarantine.

Despite the uncertainties, my travel companion, H, and I decided to take the plunge. So we scrambled to find a clinic to get a last-minute ART appointment (three out of the four I checked were fully booked), as well as make several last-minute transport bookings in France.

Finally, the big day arrived. At the airport, checking in took about 20 minutes longer than usual, because in addition to our passports, staff also asked to see our vaccination certificates, sworn statements required by the French authorities, and ART results. The transit terminal, once a bustling place, was depressingly deserted with many shops shuttered.

On board our Air France plane, apart from a mask mandate, the flight experience was similar to pre-pandemic times. H and I were lucky to each snag a row of three economy class seats, so we could enjoy our own “lie-flat seats” à la business class. Our return flight however, was packed to the gills. I suspect it was because there were only three VTL Air France flights a week, and many were using Singapore as a transit point to fly onward to Australia.

When we touched down in Paris after a 12-hour flight, the immigration officer waved us through after a cursory check of our passports, but didn’t ask for our sworn statements, vaccination proofs, or ART results.

To an extent, this felt like a sense of normalcy had returned, but there is no denying the world has changed. The majority of French people wore masks both indoors and outdoors, and the TousAntiCovid app was keenly checked at all tourist attractions and restaurants. Numerous white tents were also erected outside pharmacies, where ARTs could be conveniently done for €25 (US$38) a pop.

The thinner than usual crowds at tourist attractions were also another sign of the times, but it was a pleasant silver lining as it made for a safer, more relishable experience. We spent nearly three glorious weeks basking in France’s majestic scenery, from the landmark Eiffel Tower and sandy beaches of Nice, to the towering Calanques of Marseille and snow-capped mountain ranges of Chamonix.

Many times, when I stood still to soak in the scenery, I felt absolutely refreshed, recharged and alive to be hitting the road again after an extended travel drought of two years.

There were a couple more protocols that H and I had to adhere to upon our return to Singapore, including taking a polymerase chain reaction (PCR) test upon arrival at the airport, followed by six days of self-administered ARTs where we had to upload the results onto a government website. We also had to refrain from dining out and going to the gym, and avoid meeting large groups of people.

Also, travelling during the Covid era meant additional costs incurred. These include travel insurance with a steeper price tag – I purchased mine from Sompo Insurance Singapore for S$236 – as it came with Covid coverage which would come in handy in case of border closures, flight delays, and cancelled activities; as well as a grand total of eight ART tests and one PCR test which added up to about S$250.

It is worth noting that France is one of the VTL destinations that allow travellers to take the ART, a more affordable option compared to PCR testing which is required by other VTL destinations like Malaysia and South Korea.

Despite these minor inconveniences and extra costs, the rewards that come with travelling abroad again to disconnect and mentally recharge are extremely worth it. While some might deem it irresponsible to travel during a pandemic, I believe that safe holiday travel is achievable as long as one observes proper protocols and exercise prudence everywhere they go.

Travel and tourism is an economic lifeline for millions, generating 10 per cent of employment around the world, according to the World Travel & Tourism Council. In 2020, a staggering 62 million jobs were lost globally, and WTTC data shows a rise of a meagre 0.7 per cent in 2021. While domestic travel has been a saving grace for the sector, it is not enough to achieve a full economic recovery.

Our presence in France, then, must have been more than welcome by hospitality and tourism operators, all of whom greeted us warmly wherever we went.

It is my hope that readers will keep an open mind about travelling in post-pandemic times, as it can serve as a positive force to help rebuild millions of livelihoods across the globe.

NCL to welcome new ship Norwegian Viva to fleet

Norwegian Cruise Line (NCL) has unveiled Norwegian Viva, the second of six Prima Class vessels, scheduled to embark on its maiden voyage in 2023.

Norwegian Viva will begin sailing Mediterranean itineraries in June 2023, homeporting in key Southern European port cities including Lisbon, Portugal; Venice (Trieste) and Rome (Civitavecchia), Italy; and Athens (Piraeus), Greece.

She will then sail the Southern Caribbean for her 2023-2024 northern hemisphere winter season, offering getaways from San Juan, Puerto Rico.

Just like its sister ship Norwegian Prima, Norwegian Viva will be built by Italian shipbuilder Fincantieri in Marghera, Italy. The ship will be 294m long, 42,500 gross tons and able to accommodate up to 3,219 guests.

Besides offering the largest variety of suite categories available at sea, the vessel will also boast a redefined The Haven by Norwegian, NCL’s ship-within-a-ship concept. The Haven’s public areas and 107 suites will feature a sundeck, infinity pool, and an outdoor spa with a sauna and cold room.

Onboard experiences will include the freefall drop dry slides, The Rush and The Drop; and three-level racetrack, Viva Speedway.

Norwegian Viva will also feature Ocean Boulevard, the 4,087m² outdoor walkway which wraps around the entire ship; Indulge Food Hall featuring 11 varieties of eateries; The Concourse boasting an outdoor sculpture garden; as well as pool decks and infinity-style pools at Infinity Beach and Oceanwalk, showcasing glass bridges above water.

Hong Kong to ban transit passengers from high-risk countries

Hong Kong’s international airport is set to ban transit by passengers from designated high-risk countries to keep Omicron out, according to a Bloomberg News report which cited people familiar with the matter.

The report quoted the people as saying that airport officials recently briefed carriers about the plan, which is set to start on Saturday (January 15) and run through February 14, with the end date subject to review.

This comes as Hong Kong battles a relatively small number of Omicron cases, which has led authorities to impose a semi-lockdown in keeping with its zero-tolerance Covid-19 strategy.

Hong Kong has designated around 150 countries and territories as high-risk, including the eight nations that have specific route flight bans in place due to Covid-19 cases on board. Those eight are Australia, Canada, France, India, the Philippines, Pakistan, Britain and the US.

The ban, however, will not apply to diplomats, government officials, athletes and staff participating in the Winter Olympics, which open on February 4 in Beijing.

New hotels: Homm Bliss Southbeach Patong, Oakwood Premier Melbourne, and more

Homm Bliss Southbeach Patong, Thailand

Banyan Tree Group has unveiled its latest concept, Homm, with Phuket serving as the brand’s first-ever location. Sitting on the southern end of Patong Bay, the 71-key beachfront property has 39 rooms that boast sea-facing private balconies or terraces, or ground-floor plunge pools. There are two outdoor pools on-site, and culinary offerings include quick bites and grab n’ go snacks, like HOMM’s signature breakfast buns from Seagulls on Southbeach, or all-day dining at Rice Bowl, best known for authentic Thai cuisine.

Oakwood Premier Melbourne, Australia

A debut for the Oakwood Premier brand in Australasia, this new-build soars 140 metres and 40 storeys with views of the CBD and the Yarra River, South Melbourne, Albert Park and Port Phillip Bay.

There are a total of 132 hotel rooms and 260 serviced apartments with fully-equipped kitchens for both extended and short-stay guests. In addition to the all-day dining restaurant Fifth, other amenities include a Sky Bar, fitness centre, three meeting rooms, two multipurpose event venues, co-working space, games centre fitted with modern entertainment for those looking to play snooker or video games.

Mandarin Oriental, Shenzhen, China

The hotel is located on the upper floors of a new 79-storey building in Futian business district. Each of the 178 luxurious rooms and suites – among the largest in the city – provide vistas of the cityscape, greenery of Lotus Hill Park, Bijia Mountain Park and Shenzhen Bay. The Mandarin Club, located on the 78th floor, provides a private lounge experience. Amenities include eight F&B options, The Mandarin Club lounge, a fitness centre, and indoor swimming pool.

Event planners will be able to organise functions at The Cube, an independent meeting space offering 1,500m2 of event space. They also have the option of booking The Gallery on the 77th floor, which is the highest banquet space in the city.

OMO3 Tokyo Akasaka, Japan

This newly-opened property under Hoshino Resorts is located in Akasaka, less than a five-minute walk from the Akasaka-Mitsuke Station and Akasaka-Station on the Tokyo Metro Lines. There are 140 rooms across several categories, and guests exploring the city will be able to avail the Go-Kinjo Map, an original map of the Akasaka neighbourhood with recommendations by staff members.

Although the property does not have a restaurant, OMO3 Tokyo Akasaka has collaborated with nearby restaurants such as Ueshima Coffee Shop to provide a scrambled egg sandwich with sea bream to guests in the morning, and the Yona Yona Beer Works Akasaka for a free welcome beer and special small bites.

Chinese consumers make move on travel plans for 2022

Chinese consumers are progressing from merely dreaming of travel in 2022 to setting clearer travel plans, according to Dragon Trail International’s latest China Travel Market Monitor, which surveys 1,045 Chinese citizens who have had recent international travel experience.

The results, gathered for TTG Asia in a survey conducted in December 2021, found that 78% of respondents are considering outbound travel in the new year, with 55% having a destination in mind and will go ahead once outbound travel is made possible.

An additional 17% even have a date in mind and are waiting for international restrictions to be lifted; while five per cent have started to plan their itinerary.

Only one per cent – or 12 respondents – have gone ahead to book some or all of their next outbound trip components.

Respondents have identified several factors that will inspire the return of their travel confidence, with the most popular conditions being the safe resumption of international travel for several months (60%), end of quarantine requirements both ways (58%), lifting of China’s restrictions on outbound group tours (41%), and resumption of destinations’ visa issuance (40%).

Some respondents are also likely to travel overseas once China replaces quarantine in government facility with home isolation, when the price is right for international flights, or when international flight frequencies are up.

Travellers in China’s second-tier cities are found to be more conservative than others when it comes to travel approaches. Tier Two residents primarily require international travel to resume safely for several months before they will regain confidence to make an overseas trip.

At the same time, male Chinese travellers are less likely than females to travel as soon as outbound trips are permitted.

When asked whom they would want to take their first post-pandemic outbound trip with, 49% of respondents pointed to their family, including children, while a holiday with their significant other came in a far second (29%).

Eleven per cent of respondents want to travel alone when they can return to travel, while 22% are keen to mark the occasion with friends or colleagues, implying that their first overseas trip could be business related.

Male travellers are more likely to take their first international trip with family and children, while those in the higher income bracket – with a personal monthly income of RMB30,000 (US$4,713) and above – are least likely to travel with partners and family without children.

Japan takes pole position as the destination of choice among Chinese respondents, with 17% of votes or 177 in total. It is also the only destination to score a double-digit percentage vote.

Other destinations that respondents are eyeing for their first post-pandemic outbound trip include Thailand (eight per cent), Australia (eight per cent), France (seven per cent), and South Korea (six per cent).

Tier One residents (24%) are more likely than their Tier Two peers (14%) to make a trip to Japan. Dragon Trail International’s research manager, Mengfan Wang, explained that this could be due to Tier Two travellers being generally more conservative about travelling outbound.

In selecting their destination of choice, respondents pay greatest attention to the destination’s track record in pandemic management (59%). The quality of the destination’s sanitation measures is also crucial (51%), so is a low level of Covid-19 infections in the destination over several months (47%) and the destination’s perceived welcome for Chinese travellers (41%).

Other factors under consideration include the destination’s strong reputation in medical services (37%), value for money (36%), variety of tourist experiences (35%), and availability of direct flights to destination (33%).

Some 32% of respondents would consider all the above factors equally.

In forming their post-pandemic travel plans, a majority of respondents (83%) rely strongly on online travel agency or travel review sites (such as Trip.com, Mafengwo, Fliggy) for information. National tourism board official channels (such as website, WeChat or mini-programme) come in second (63%) as the most favoured source of information.

Commercial entities, specifically travel agents or agencies (54%) and airline, hotel, car rental company official channels (51%) are also deemed reliable sources of information.

Word-of-mouth sources, such as friends and family (22%) and travel bloggers/travel media (23%) are favoured by a smaller segment of respondents.

Further defining how Chinese travellers are obtaining their travel information, the China Travel Market Monitor found that Tier One and Two residents are more likely to rely on OTAs, while New Tier One residents are keener on national tourism board official channels.

Tier Two consumers are more likely to rely on word-of-mouth sources than their peers in Tier One cities.

Among age groups, those in the 21-30s bracket rely the least on travel agents and travel agencies, which is most preferred by those aged 41 and above.

Travellers married without children or unmarried are more likely consult travel blogs than those married with children.

The China Travel Market Monitor is the only specialised travel market survey that gains insights directly from China’s outbound travellers, with surveys launched each month and allowing multiple brands to join at the same time for a cost-effective solution to getting the most up-to-date information on this segment of consumers.

Dragon Trail International is an award-winning marketing solutions company with roots in China and extensive experience in the global travel and MICE sectors.

Lufthansa Group ramps up APAC operations, banks on organisational transformation in march to recovery

Despite Asia-Pacific’s cautious approach to travel and tourism resumption relative to Europe and the US, Lufthansa Group continues to regard the region as an critical market and has maintained agility in ramping up services along with changes to border restrictions.

In an interview with TTG Asia during his recent business trip to Singapore, Stefan Kreuzpaintner, chief commercial officer with Lufthansa Group, emphasised the region’s importance – one where the group used to operate 253 weekly flights to 18 destinations pre-pandemic and where it has many important joint venture partners, specifically All Nippon Airways, Air China and Singapore Airlines.

Even with Asia-Pacific’s careful reopening, the group has been able to resume close to 30 per cent of its pre-pandemic frequency – with 71 weekly flights in operation today to 14 destinations.

Kreuzpaintner noted that travel demand is moving very closely with travel restrictions, with any easing of measures resulting in a spike in flight searches and bookings on all Lufthansa Group airline websites.

“Singapore’s Vaccinated Travel Lane (VTL) is a good example. As soon as the announcement was made in August 2021 about a VTL between Singapore and Germany, we saw demand kicked in,” he recalled.

“Therefore, as soon as markets reopened here in Asia-Pacific, we responded by putting capacity back in. Our flights serving China and India are fully packed – sold out – and we are prepared to bring in additional capacity.”

When asked if top source market rankings in the region would change post-pandemic, Kreuzpaintner said no; he expects India and China to “keep their weight and return to their original strength soon” after the pandemic, and acknowledges Singapore’s continued importance as a destination and source of origin”, especially with the successful implementation of the VTLs.

Besides responding swiftly to changing border conditions, the group has kept a prominent market presence in the region throughout the pandemic with help from its sales force.

Kreuzpaintner said the decision was a conscious one to ensure the group remains close to its travel agent partners – a community that has an even more important role to play in post-pandemic travel and tourism. The pandemic has altered the role of travel agents, he noted, moving them past ticketing functions to responsibilities in “providing travel counsel to their end customers and fulfilling important services”.

The group’s recovery also relies heavily on an organisation-wide transformation that was rolled out pre-pandemic and accelerated by the crisis.

According to Kreuzpaintner, a major achievement of the transformation was the group’s implementation of a capital increase on November 12 last year, which allowed it to exit its state subsidies.

“I think that is an enormous positive step for the company. While we are very appreciative of the support given to us by Germany and the state throughout the pandemic, we are glad to be able to refinance ourselves on the capital market,” he remarked.

The second milestone is the group’s fulfillment of a promise to keep more than 100,000 jobs amid tough cost-cutting measures deployed throughout 2021.

Lufthansa Group’s transformation also involves boosting its products and services. It has kept more than 650 airplanes post-pandemic and continues to invest in new aircraft. More than 170 airplanes are expected to join the fleet up to 2030, with all capable of serving longhaul and shorthaul routes.

“Our focus on offering premium products and services (have not wavered) during the pandemic,” Kreuzpaintner said, pointing to the reopening of its own First Class Terminal at Frankfurt Airport on September 1, recent introduction of a new catering concept for economy and business class products across all Lufthansa Group airlines, resumption of longhaul service in all seat classes, and a soon-to-launch business class product with the next delivery of its longhaul aircraft. The latter initiative will begin with Lufthansa and progress through other airlines in the group.

Kreuzpaintner observed that appetite for premium air travel has grown globally, with the “front of the cabin booked more than the rear of the cabin”. He explained that this could be driven by the robust return of corporate travel, a segment of the market that favours premium products, as well as a growing appreciation for more airport and inflight comforts during longer journeys.

“The one exception to this trend is in our flights to North Atlantic and the US – they are sold out across all cabins, especially after November 8 when the US reopened to European travellers,” revealed Kreuzpaintner.

In view of growing preference for premium products, the group will continue to evaluate seat and space configurations. For instance, all Swiss aircraft will have first class cabins in the future.

The group also continues to pursue a sustainable strategy in response to growing customer expectations for airlines to use sustainable fuel and to offer sustainable compensation in their booking flow.

It is now the largest sustainable aviation fuel (SAF) customer in Europe and second worldwide. In mid-November, the group secured US$250,000 worth of sustainable kerosene in order to meet the foreseeable increase in demand in the coming years.

This is the largest pure sustainability investment in the history of the group.

“We see the same expectations for responsible travel and sustainable air travel globally, be it in Asia-Pacific or Europe or the Americas. This is a good thing for our industry,” he said.

In identifying challenges to the group’s CO2-neutral travel approach, Kreuzpaintner said there needs to have the same sustainability measures and restrictions across the world – something the group is lobbying for – as well as greater access to SAF.

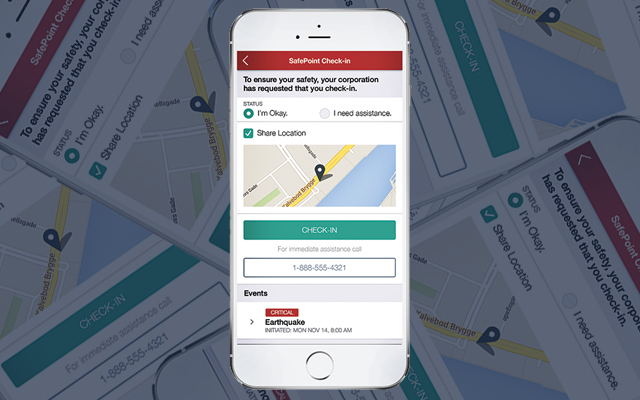

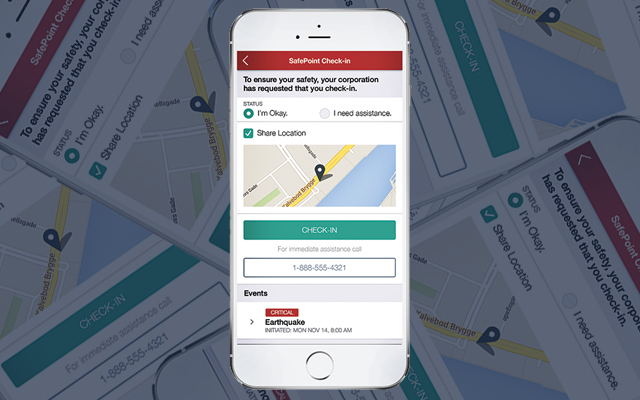

Sabre SafePoint adds travel restriction tracking capability

Sabre Corporation has expanded SafePoint, its travel risk management product, to include global travel restriction tracking.

The solution is not limited to a singular event, and instead, provides information regarding the spread of Covid-19 and new variants, as well as destination entry restrictions imposed by countries including masks, vaccinations, health documentation and quarantine requirements.

SafePoint monitors world events in near real-time, 24/7. It utilises hundreds of data sources for events and restrictions that may impact travel arrangements and/or traveller safety. This would help Sabre’s travel agencies and corporate customers make more informed decisions and enhance the safety of their travellers by alerting them to restrictions that may impact their itinerary. Travellers will then be able to use the information to take action at any stage of their trip.

“As travel rebounds, we believe a duty-of-care and crisis alerting solution is imperative to any travel business, especially in a world where travel advisories can change rapidly,” said Saunvit Pandya, senior director of product management, Sabre. “SafePoint is designed to keep travellers and corporate travel managers apprised of critical events in a fast-moving world.”

Hyatt Hotels Corporation has unveiled plans to open China’s first Hello Kitty Hotel in Sanya, Hainan.

Slated to open by 2025, the hotel will form part of the 21ha Sanya Hello Kitty Resort, the first Hello Kitty theme park in Hainan Province. It will be developed by Hong Kong-based Keyestone Group and added to the JdV by Hyatt brand.

The hotel will feature 221 rooms and villas adorned with Hello Kitty designs and other Sanrio characters, alongside amenities including three restaurants and bar, a ballroom, swimming pool, spa and fitness centre.

The property will offer an immersive experience connected to and reflective of the theme park, with interactive experiences and story-telling elements. It will also showcase seasonal events, activities and menus to mark key festivals throughout the year.