IHG opens first Vignette Collection hotel in Asia

IHG Hotels & Resorts and Siam Sindhorn has designated Sindhorn Midtown Hotel Bangkok – previously an independent property – as the first Vignette Collection hotel to open in Asia.

Vignette Collection is IHG’s newest luxury & lifestyle collection brand, where each hotel has its own distinct outlook and story to tell.

Daily complimentary rituals at each Vignette Collection property create a sense of anticipation and connection and meet growing demand for more thoughtful travel experiences.

A complimentary Lao Khao shot is served with a mixed selection of pickled fruits from 1700 to 1800 daily at The Black Cat. Younger guests can dial the Emergency Popsicle Line located on the hotel’s second floor to receive a complimentary iced treat, delivered promptly by a dedicated Popsicle Butler.

Each of Sindhorn Midtown Hotel Bangkok’s 393 rooms feature bathroom amenities from Karl Lagerfeld and modern comforts such as Fritz Hansen’s iconic Drop chairs. The Fitness Centre offers panoramic city views, as does the Horizon Pool, which is located on the 18th floor.

The hotel also recently introduced three new dining offerings; The Black Cat is an atmospheric Thai Liquor bar, with a live band playing on selected evenings. Inspired by the golden age of Thailand, Bangkok’78 presents the city’s greatest culinary hits in a retro-inspired concept, while Sip & Co. adds to Langsuan’s flourishing café culture.

Sindhorn Midtown also partners with Kuvanant Foundation, which aims to provide educational opportunities for local students and those living with disabilities in rural areas of Thailand. The hotel will provide internship opportunities for the foundation’s students to earn first-hand work experience and offers career opportunities and insights into the hospitality industry.

Ascott acquires Oakwood Worldwide

CapitaLand Investment Limited’s (CLI) wholly owned lodging business unit, The Ascott Limited (Ascott), has acquired Oakwood Worldwide (Oakwood), a global serviced apartment provider, from Mapletree Investments

The acquisition increases Ascott’s global portfolio by 81 properties and about 15,000 units. Oakwood’s approximately 8,500 operational units will immediately contribute to Ascott’s recurring fee income streams upon completion of the transaction slated in 3Q2022.

Ascott’s acquisition of Oakwood will leapfrog Ascott’s global presence to more than 150,000 units in about 900 properties across over 200 cities in 39 countries. It will add new markets which include Cheongju in South Korea; Zhangjiakou and Qingdao in China; Dhaka in Bangladesh as well as Washington DC, US.

Kevin Goh, CLI’s CEO for lodging, said: “We intend to build on the strong reputation and heritage of the Oakwood brand, especially in markets across South-east Asia, North Asia and North America. Oakwood will continue to grow alongside Ascott’s current portfolio of global brands as we continue to build growth momentum for our lodging business.”

“Besides strategic alignment… Ascott’s acquisition of Oakwood brings about an immediate boost to our units under management and franchise contracts. The Oakwood portfolio will accelerate the growth of our asset-light business, with added recurring fee income streams, expanded lodging offerings and increased customer base,” added Goh.

China tightens Covid curbs again

Eastern Chinese cities have tightened Covid-19 curbs on July 3 in response to new infection clusters, setting fresh delays to the country’s tourism and economic recovery.

Cities impacted by China’s latest restrictions include Wuxi, a city near Shanghai; Si county in Anhui province; and Yiwu in Central Zhejiang Province.

In Wuxi, operations at public facilities, such as restaurants and shops, are halted, while flights between Yiwu and Beijing are cancelled.

Si county, which contributes the bulk of infections in the latest wave, has locked down its 760,000 residents and suspended public traffic.

This comes as China announced on June 28 the decision to cut quarantine period for international travellers by half, to one week, and reduce the post-quarantine home monitoring period from seven days to just three.

Gilles Cretallaz moves to Dusit International

Dusit International has appointed Gilles Cretallaz as its new chief operating officer, replacing Lim Boon Kwee, who retired from the position in May 2022.

In this new role, Cretallaz will be responsible for overseeing the financial and operational responsibilities of Dusit’s hotel business unit, including all Dusit Hotels and Resorts, ASAI Hotels, Elite Havens, White Label properties, and condominiums/residences under Property Management, at both corporate and property levels.

The French national brings to the role more than 30 years of experience leading hotels for the Accor group across Turkey, China, and South-east Asia. Before moving to Dusit, Cretallaz served as senior vice president operations – South-east Asia where he headed Accor’s Bangkok Office and oversaw the operations of 150 hotels.

The French national brings to the role more than 30 years of experience leading hotels for the Accor group across Turkey, China, and South-east Asia. Before moving to Dusit, Cretallaz served as senior vice president operations – South-east Asia where he headed Accor’s Bangkok Office and oversaw the operations of 150 hotels.

Indonesia’s tourism recovery marred by clipped wings

Demand for Indonesia, particularly Bali, is high but Indonesian travel industry members are concerned that the lack of seat capacity and skyrocketing airfares will hamper further growth.

Wayan Sukasih, director of sales and marketing, Grand Mirage Resort & Thalasso Bali, told TTG Asia that while business is growing, with occupancy as of mid-June standing at 30 to 50 per cent, “not all of our markets are back yet”.

“Currently the Australians and Indians have started to come again, while Europe, Japan and particularly China have not. They are either still not able to travel, or they cannot fly because there is no seat or the airfare is too expensive,” said Wayan.

Eduardo Castro, general manager, Meliá Bali Indonesia, is cautious with his expectations since half of the hotel’s occupied rooms now are taken by groups hailing from Jakarta and attendees of the events related to the G20 Summit. A clearer picture of international travel recovery will show when the G20 Summit concludes.

Castro’s concerns stem from international flights into Bali that are not yet fully reinstated.

International flights to Bali have been on the rise since April but current services are still at around 30 per cent of 2019’s operations, according to the Bali Regional Tourism Office.

Although travellers are keen on Bali, they have been forced to look at other destinations due to the lack of flights.

“This is definitely a threat for the destination,” said Castro, adding that global inflation, rising fuel prices and steep airfares are putting even greater pressure on travel recovery.

Classic Tours in Lombok, which markets adventure travel to consumers in Europe and the US, have found airfares from Europe triple that of pre-pandemic prices, while domestic airfares within Indonesia are highly inflated.

Classic Tours’ travel consultant, Nawasier Tralala, said domestic flights are in shortage but necessary for adventure travellers to access remote destinations.

As a result of rising airfares, Tralala is forced to recalculate his package rates, which are thrice as high. For customers who are looking to travel now on postponed 2020 trips, the fare difference is causing friction.

“I cannot run the programme with the old budget, and (customers) are not willing to top up that much. So, we have agreed to postpone the trip again, towards the end of the year. Hopefully flights will be back to normal by then,” he said.

When asking about this predicament, Putu Winastra, chairman of Association of the Indonesian Tours and Travel Agencies Bali Chapter, recommended that the government negotiate with international airlines to ramp up flights to Bali.

Asia Concierge aims to reinvent the DMC model

- Former Destination Asia leaders regroup to launch Asia Concierge

- The new kid on the block is determined to challenge the way traditional DMCs work

- The rise of travel designers will benefit the travel sector in the long term

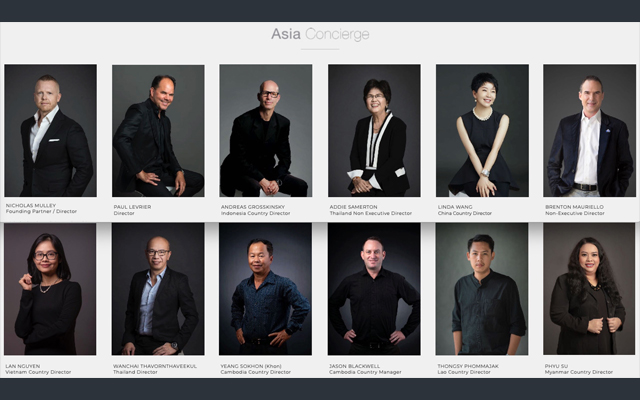

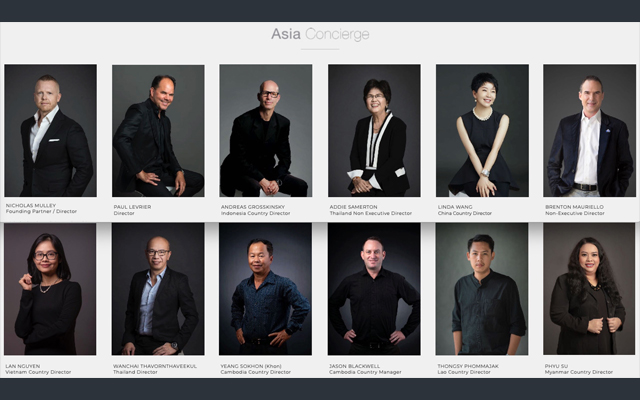

A new DMC, Asia Concierge, has launched in Asia, led by former leaders of Destination Asia who see an opportunity to create a “travel design company” that reimagines the DMC model and the Asia travel experience for upmarket clients.

While the opportunity may be timely due to changing consumer behaviours, sources say a key catalyst for the birth of Asia Concierge was the completion of the sale of Destination Asia to Dnata Travel Group at the end of 2020.

Dnata announced the acquisition of Destination Asia – excluding operating companies in Cambodia, Laos, Myanmar and China – in 2016. Destination Asia’s complex shareholding structure, with as many as 36 shareholders, could be a reason for the protracted sale.

The completion, plus the pandemic’s impact on business, saw shareholders and senior executives leaving Destination Asia, including its chief operating officer, Nicholas Mulley, and Paul Levrier, a partner since the DMC’s inception more than 25 years ago.

Mulley and Levrier, along with Andreas Grosskinsky, former Destination Asia general manager Indonesia, and Brenton Mauriello, executive chairman of Design World Partnership, are now the main partners of the holding company Asia Concierge, which in turn owns stakes in each of Asia Concierge’s seven operating companies.

This included the four that were not part of the Destination Asia sale to Dnata. The other three are Thailand, Indonesia and Vietnam. Addie Samerton, a long-time Destination Asia leader, has also joined as a partner in Asia Concierge Thailand.

“Setting aside Myanmar, Cambodia, Laos and China from the acquisition allows, or encourages, Nicholas and Paul to set up Asia Concierge. So Dnata has only itself to thank for this emerging competitor,” a source told TTG Asia.

Not a breakaway team

Asia Concierge now has 35 staff and expects to expand the team to 50 people by year end, said Mulley in an interview.

He does not see Asia Concierge as a breakaway team, rather, as the birth of a new company with a new vision and strategy.

“We’ve all been working in the industry for 10 to 20 years and we’re still passionate about it. We saw this as more of an opportunity to collectively come together, step back and think of what we want to do, not to recreate another Destination Asia or another DMC.

“We want to create a travel design company that focuses on a smaller number of clients – FITs, couples and corporate meetings — and deliver a high level of service, a lot more creative product and showcase the Asia that we know.”

Asia Concierge is working with specialised tour operators and agents in the UK, the US and Australia whose clients want a curated experience in Asia.

“There is a place for everybody. We’re starting on a clean slate and are not competing with the previous company. We have different market segments,” he added.

Staying fighting fit

Meanwhile, Destination Asia remains agile, with new teams joining across the region, said its group marketing and communications director David Andrews.

Destination Asia continues to operate in 11 countries, although China and Myanmar have been “temporarily suspended” since April 2022.

Throughout the pandemic, the company invested heavily in technology to provide tour operator clients with an online one-stop booking centre, and put staff through an extensive online training to ensure they can help grow partners’ business in an ever-evolving travel landscape.

The product team recently launched 11 new travel styles, including Offbeat and Self-Guided tours, allowing for greater customisation and flexibility. Responsible travel has been integrated across all travel styles, Andrews said.

Complacency?

Have DMCs, like hotels, been complacent through years of growth until Covid-19 put a brake on the boom in 2019?

Asia Concierge believes so. A line in its corporate profile said: “The DMC world is one of complacency. We aim to change that.”

Asked to elaborate, Mulley said: “We are making the point that so often the same product is offered over and over again with no real thought on how mass tourism has impacted the industry, and finding ways to spread out the interest to less commercial areas. We also want to challenge ourselves to create a new and innovative product that focuses on soft touch tourism and the art of slow, immersive yet authentic travel experiences.”

If the pandemic spurs the rise of new “travel designers” and jolts existing DMCs to be better, the sector will be stronger in the long term. Currently, however, it is still a fight for survival and the dust is far from settled on winners and losers.

Said a veteran DMC on the condition of anonymity: “Inbound markets are still tentative (in recovery) and shorthaul travel will be the guide post. But shorthaul travel has not always favoured DMC use.

“For many Caucasians, and some Asian travellers, Asian destinations are still seen as exotic, requiring more assistance. This favours the DMC business. However (DMC partners) value reputation, depth of product, and price. And now, they are looking for post-Covid preparedness and resilience. No planner wants to bet their job on a new supplier who promises a lot but has no track record. This favours the long-established company who is still in business.”

Global air travel set to recover 65% in 3Q; beach holidays in the lead

The World Travel Market (WTM) report by ForwardKeys reveals that in the third quarter of the year, global air travel is set to reach 65% of where it was before the pandemic in 2019, with some parts of the world doing much better than others. It also shows beach holidays as a more popular choice compared to urban city visits and sightseeing.

Africa and the Middle East have been deemed to recover most strongly, with arrivals in 3Q expected to reach 83% of 2019 levels, followed by the Americas, where summer arrivals are expected to reach 76%, and then by Europe, 71%, and Asia-Pacific, just 35%.

The current preference for beach holidays is illustrated by a comparison of the top ten beach and urban destinations in Europe, ranked by 3Q flight bookings compared to 2019. All those on the beach list – led by Antalya, 81% ahead; Tirana, 36% ahead; and Mikonos, 29% ahead – are showing extremely healthy demand, whereas, in the urban list, only Naples is ahead. Furthermore, the four leading urban destinations – Naples, 5% ahead; Istanbul, flat; Athens, 5% behind; and Lisbon, 8% behind – are all also gateways to beach resorts too.

A similar trend is exhibited in the Americas, where 3Q bookings for air travel to the Caribbean, Central America and Mexico are 5% ahead of 2019 levels, whereas flight bookings to South America and to the US and Canada are 25% and 31% behind respectively. The destinations set to perform most strongly are Costa Rica, 24% ahead; Jamaica, 17% ahead; and the Dominican Republic, 13% ahead.

Enthusiasm to travel again internationally is so strong that a rise in air fares has done relatively little to dampen demand. For example, the average fare from the US to Europe climbed by over 35% between January and May with no noticeable slowing in booking rates – these fares were nearly 60% above the previous year.

Fares for shorter haul, intraregional travel – within the Americas – also increased substantially by 47%, which is less than for longhaul. However, the demand for those tickets peaked in March.

Helpfully for the travel industry and for many destinations, American travellers are planning to stay longer and spend more than they did in 2019 but not as much as they did during the pandemic. The average planned length of stay in 3Q is 12 days, up from 11 days in 2019. Last year, it was 16 days, but fewer people with a more affluent profile were travelling then. The proportion of people flying in premium cabin classes in 3Q is also set to rise, from 12% in 2019 to 15% this year (although, it reached 19% in 2021).

The relatively promising outlook for summer travel to Africa and the Middle East is due to a combination of factors: several Middle Eastern airports act as hubs for travel between Asia-Pacific and Europe, which has led to the Middle East benefitting from the revival of intercontinental travel, particularly driven by people returning to Asian countries to visit friends and relatives.

The closure of Russian airspace has also contributed to the uplift in hub traffic. Cairo, 23% ahead, has increased connectivity to European markets. Nigeria, 14% ahead; Ghana, 8% ahead; and Ivory Coast, 1% ahead, with large diasporas in Europe and the US, are seeing expats return to visit friends and family. Tanzania, 3% ahead; Cape Verde, flat; and the Seychelles, just 2% behind, are successfully attracting longhaul visitors from Europe.

Travel to and within the Asia-Pacific region is recovering more slowly, owing to stiffer Covid-19 travel restrictions remaining in force for longer.

Olivier Ponti, VP Insights, ForwardKeys, said: “With 2022 seeing travel restrictions lifted, connectivity re-established, and consumer confidence regained, demand for international travel is on the rise once more, marking a departure from the domestic travel trend that dominated in recent years. In 3Q this year, holidaymakers are relatively much keener to leave the pandemic behind with a relaxing break on the beach than they are to consume culture, cities, and sightseeing.”

New luxury booking service launches to draw elite travellers

AQBooking.com is a new luxury booking service that has hit the market, targeting “elite global travellers” who value personal service and bespoke experiences.

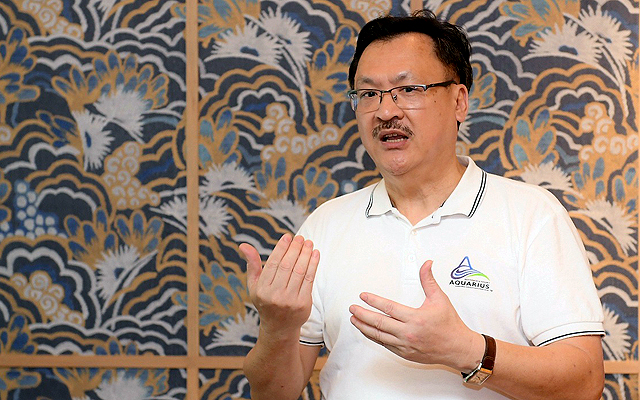

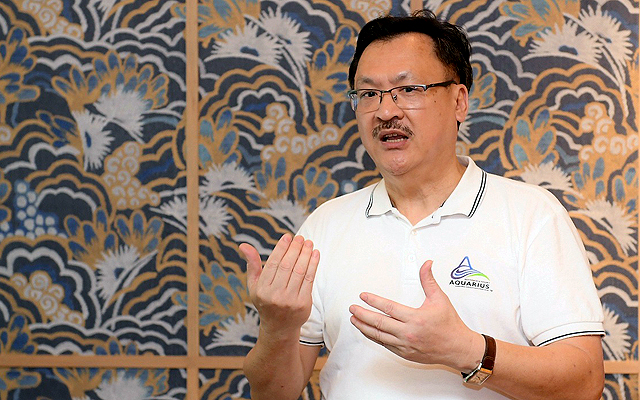

The website is owned by Aquarius International, part of Norcal Thailand, a division of Hong Kong-based Norcal Venture Capital Group (NVC).

AQBooking.com will not compete with traditional OTAs. Instead, it will focus on quality over quantity by creating an exclusive community of like-minded globetrotters, which fits squarely in the sights of the Thai government’s plans to attract high-spending individuals and investors looking to sink large amounts of capital into the country.

“Today’s luxury travellers require more than just premium products; they desire personalised experiences,” said Edward Chi, founder of Aquarius International.

“As the world starts to travel again, we foresee strong pent-up demand from high-end guests who have been unable to explore the world over the last two years. AQBooking.com will enable its members to create unique itineraries, including luxury hotels, private jets, yacht charters, limousine transfers and fine dining. Our aim is to create the ultimate VIP travel club for today’s first-class adventurers.”

Hyatt to launch in Sapporo

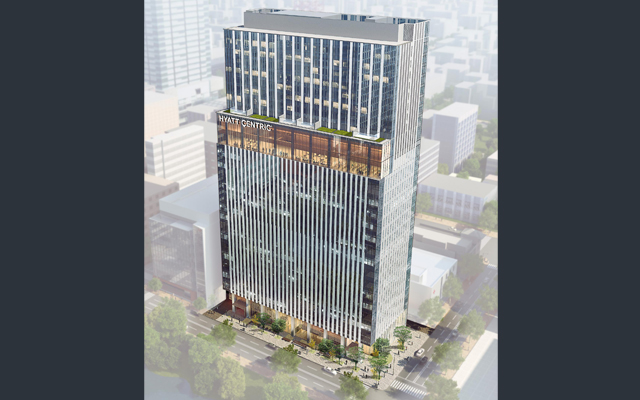

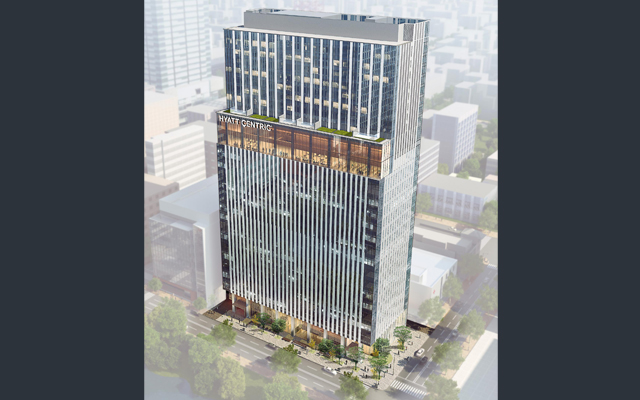

Hyatt Hotels Corporation, together with NTT Urban Development Corporation, will launch Hyatt Centric Sapporo in 2024.

The 216-room hotel will be the first Hyatt Centric hotel in Hokkaido, and the third in Japan, following Hyatt Centric Ginza Tokyo and Hyatt Centric Kanazawa.

Located in the heart of the city, Hyatt Centric Sapporo will sit adjacent to the historic Akarenga-chosha, formerly Hokkaido’s government office, and situated near Odori Park. The hotel will also be within walking distance to the Odori subway station and JR Sapporo station.

The hotel will be part of a new 26-storey building complex that is currently under construction. Hyatt Centric Sapporo will occupy the complex’s upper floors, offering accommodation, two dining outlets, and multifunctional spaces for banquets and events.

Desaru Coast Destination Resort is celebrating the commencement of new ferry services between Singapore and the destination with a series of daycation and stay packages inclusive of return ferry tickets.

Daycation packages are priced from RM378 (US$86), and includes Desaru Coast experiences such as golf on the fairways of its world-class courses, resort-style dining at any of the destination’s restaurants, play day on pristine beaches or at the waterpark.

For more days of fun, staycation packages packs in hotel stays, an array of Desaru Coast activities and return ferry tickets. These are priced from RM2,379.

Further to the newly introduced packages, The Els Club Desaru Coast has rolled out a three-month promotion for its popular Golf Privilege Pass. For RM10,800, pass holders can enjoy daily rounds on the greens at both the Ocean and Valley Courses.

More activity-driven day packages will be introduced, and travellers can look forward to spa, brunch and cycling escapes.

Email concierge@desarucoast.com for more information.