After two turbulent years, new research from the Mastercard Economics Institute reveals that for the first time since the pandemic, global leisure and business flight bookings surpassed pre-pandemic levels, while spending on cruise lines, buses and trains saw sharp improvements this year, signalling a key milestone in the global travel recovery.

Spanning 37 markets across the globe and nine markets in Asia Pacific, the Travel 2022: Trends and Transitions report delivers critical insights about the global state of travel in a less restricted, post-vaccine chapter of the Covid-19 pandemic era. The report compares the current state of global travel to two key inflection points: the pre-pandemic levels of 2019, and trends from the period when border restrictions began to ease and international travel resumed across most geographies.

Drawing on a unique analysis of publicly available travel data, as well as aggregated and anonymised sales activity in the Mastercard network, the third annual travel report from the Mastercard Economics Institute dives into key elements of the traveller journey. This includes the tailwinds propelling travel recovery, consumer considerations when making travel-related purchasing decisions, and macroeconomic trends such as inflation, hybrid work, healthcare risks, and geopolitical disruptions that could influence the travel recovery.

Key findings through April 2022 for Asia-Pacific include:

Reopening of borders puts Asia back on the tourist map

According to the Mastercard Economics Institute analysis, if flight booking trends continue at the current pace, an estimated 430 million more passengers will fly in Asia-Pacific compared to last year. The travel outlook for the region is optimistic, even with markets across North Asia and mainland China yet to relax border measures.

Pent-up demand is expected to fuel the travel recovery

Following two years of little to no travel for Asia-Pacific in 2022, the loosening of travel restrictions and reopening of borders has sparked a surge in demand for both inbound and outbound travel. A trend observed in markets across the region is consumers’ release of excess savings on travel. In 2022, borders opened in Australia, resulting in a sudden ability to travel. Flight bookings from Australia to Indonesia, for example, spiked nearly 200% in 2022, and flights to the US more than doubled.

Travel spending swings towards experiences

Globally, for the majority of the year, international tourists were seen spending more on experiences rather than things when in destination. This trend was also witnessed in Asia, where Singapore recorded one of the highest international tourist spending on experiences in destination globally, with a 60% increase in spending from pre-pandemic levels through March 2022. Other markets across the region, however, revealed a more mixed picture, with low levels of inbound tourism seen in Indonesia and South Korea, whose borders opened in April 2022. This will be an important trend to watch for the rest of the year as ongoing travel restrictions across the region are gradually lifted, and Asia Pacific tourists begin to shop and spend abroad.

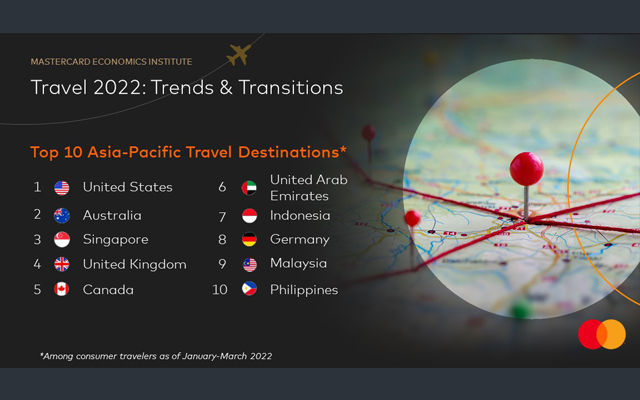

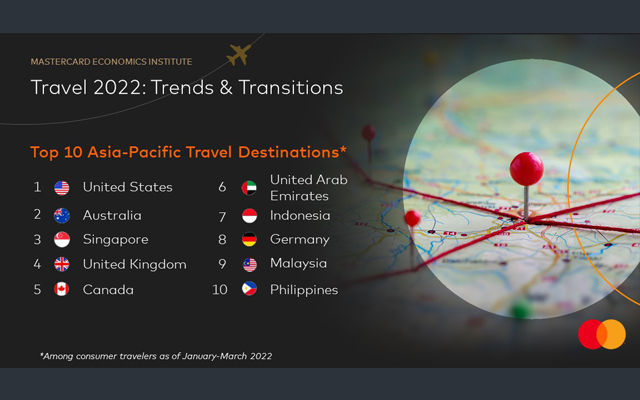

Choice of travel destinations influenced by mobility restrictions

Since the onset of the pandemic, trends reveal that people have been favouring travel destinations that are less complex to navigate amid confusing entry and quarantine requirements, travel restrictions, and testing procedures. As such, the US remained the most popular choice for Asia-Pacific travellers, followed by Australia, Singapore, the UK, and Canada. In the months to come, however, this trend is likely to shift in favour of intra-regional travel as restrictions are relaxed and domestic travel picks up once again.

Cost of travel remains elevated due to supply chain disruption and higher operating costs

Travel deficits triggered by the pandemic have expanded the operating expense burden for airlines and the broader transportation industry, resulting in higher fares for travellers in Asia-Pacific compared to their global counterparts. The average airfares in Asia-Pacific remain elevated – roughly 11% and 27% above 2019 levels in Australia and Singapore respectively – due to supply-side constraints such as air transportation employment, which continues to remain below pre-pandemic levels across the region.

Domestic spending picks up momentum across hard-hit transportation industries

With people increasingly relying on domestic modes of transportation, particularly cars, for mobility during the pandemic, the spending on auto rentals and tolls consistently exceeded 2019 levels throughout the past two years. Domestic ground travel has seen a robust demand in many Asia-Pacific markets where road trips have retained their appeal. Fuel spending has steadily increased in Singapore, Hong Kong, Australia and the Philippines, while public transportation and cruise lines have also firmly stepped back onto the road to recovery, after an initial slow start due to restrictions surrounding group travel.

“Despite a delayed recovery, and numerous risks such as inflation impacting discretionary spending, travellers in Asia-Pacific have demonstrated a strong desire to return to travel,” said David Mann, chief economist, Asia-Pacific and Middle East Africa of the Mastercard Economics Institute.

“2022 will prove to be a significant year for the travel industry in Asia-Pacific. As border restrictions relax, we have witnessed an accelerated return to travel that indicates cause for optimism, with the region poised to swiftly catch up with the rest of the world.”