Vietnam-based tech startup Luxstay has completed its bridge round of funding with the participation of two new investors from South Korea – GS Home Shopping (GS Shop) and BonAngels – worth US$4.5 million.

Other top-tier capital investors for the home-sharing platform include CyberAgent Venture (Japan), Genesia Ventures (Japan), ESP Capital (Singapore), Founders Capital (Singapore), and Nextrans (South Korea).

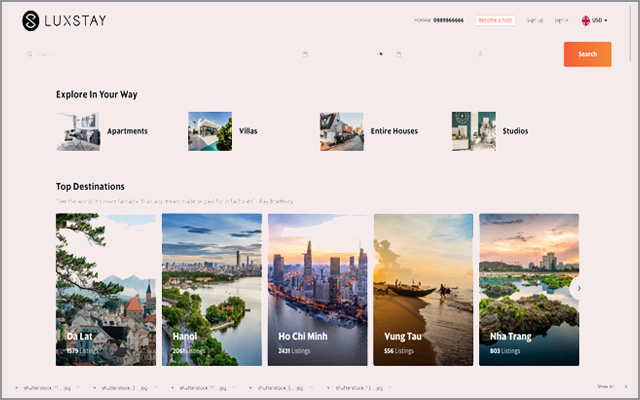

Luxstay differentiates itself by focusing on premium products and domestic tourists, and is collaborating with local partners in countries with a large number of inbound tourists to Vietnam, such as South Korea and Japan.

GS Home Shopping, part of the GS Group, is South Korea’s foremost multimedia retailer, as well as a global leader in TV home shopping. Its Corporate Venture Capital arm is a global strategic investor, investing through fund as well as direct investments. Next, BonAngels is a venture capital fund that focuses on investing in early-stage companies startups in South Korea such as Woowa Brothers, Daily Hotels, and My Real Trip.

These investors will be important connections for Luxstay to other strategic partners and investors in South Korea to implement the company’s ambition and expand its scale.

After a two-year development, Luxstay is in the process of working with financial investors and strategic partners to deploy the next round of capital, looking at raising their Series A this year. The company is also targeting an annual turnover of over US$300 million in 2023, accounting for about 30 per cent of the market share.

According to the Vietnam National Administration of Tourism, Vietnam served about 80 million domestic and 15.6 million foreign tourists in 2018. In particular, there were 3.5 million South Korean tourists, a growth rate of 44 per cent since 2017 – the fastest ever, while the overall growth rate of foreign visitors is 20 per cent yearly. Total spending for tourism in 2018 amounted to US$25 billion, of which the accommodation sector accounted for 28 per cent, equivalent to about US$7 billion, and this is expected to increase to US$13 billion by 2025.

While the market of homesharing is still fairly new in Vietnam, the revenue from these short-term rental activities in 2018 amounts to over US$100 million (according to Statista reports), which signifies substantial growth yet is quite moderate compared to the total accommodation market of US$7 billion. In developed countries, homesharing accounts for 10 per cent to 20 per cent of the home-rental market. This shows a huge opportunity for this industry in Vietnam, which is expected to reach US$2 to US$4 billion in 2025.