Corporate travel in Asia stays buoyant but interest in policy compliance and cheaper options heightens as prices rise

Courtesy of Park Hotel Group

Despite an anticipated economic slowdown in Asia this year, airfares and hotel rates are continuing to rise across the region, representing another year of consecutive increase.

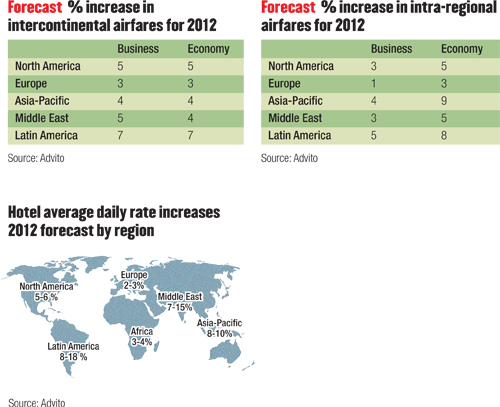

Carlson Wagonlit Travel (CWT) predicts a three to four per cent rise for Asia-Pacific airfares this year, while hotel rates in the region are expected to jump by up to 15 per cent.

But contrary to popular belief that a hike in hotel rates and airfares would curtail corporate travel, business travel demand in Asia is expected to remain fairly robust.

Large Asian economies, with the exception of Japan, have so far appeared to be spared the full impact of the economic turmoil erupting across the US and Europe.

Preliminary data from Pegasus revealed that, as of February 28, advanced corporate net reservations for June 2012 in Asia-Pacific rose by 27.9 per cent over 2011, compared to 7.6 per cent in North America, 8.5 per cent in Europe and a decline of 15 per cent in the Middle East and North Africa.

Looking further ahead, the Global Business Travel Association (GBTA) anticipates corporate travel expenditure in Asia-Pacific to grow by up to 11 per cent by 2015, almost three times the predicted rate for the US.

Against a backdrop of more expensive airfares and hotel rates, corporate travel managers are tightening travel polices to keep costs at a manageable level.

Travel management companies (TMCs) that TTG Asia spoke to all agreed that while companies and the travel managers they deal with in Asia have not trimmed their travel budgets this year, they are now intent on sniffing out ground and air savings.

“As airfares and hotel rates go up, corporates tend to examine their travel policies more closely, making tweaks to optimise spending and returns, for instance, by telling their staff to downgrade from business class to economy, or by switching to four-star from five-star hotels.

“This is happening to a degree at the moment (in Asia) as airfares and hotel rates escalate, but it is not evident across all sectors and organisations,” said Greg Treasure, Hogg Robinson Group’s managing director for the Asia-Pacific region.

Mike Orchard, senior director, CWT Solutions Group, Asia-Pacific, said more clients were considering integrating low-cost airlines into their travel programmes to reap the substantial cost savings that could be derived by switching to such carriers, especially on shorthaul routes.

“Companies can expect to save up to 20 per cent on their airline expenditures simply by using low-cost airlines,” he said.

Alternatively, some firms are reducing the frequency in which employees undertake business trips, replacing face-to-face meetings with technology such as video conferencing or by combining multiple destinations into a single trip, according to a spokesperson for FCm Travel Solutions.

Adherence takes centre stage

The renewed interest on cost control has given precedence to travel compliance. A CWT survey found that improving traveller compliance ranked the top priority for Asia-based travel managers in 2012, as they often face an uphill battle in ensuring that travel policies are being adhered to.

GBTA’s regional director for Asia-Pacific Welf Ebeling said: “Asia is still woefully behind the US and Europe when it comes to getting employees to toe the line, and in utilising online tools to keep travel expenses in check, even though they might have a travel programme and policies in place.”

This point was reiterated by Advito (see related article below, left), which said in its 2012 industry forecast that Asia was 15 to 20 years behind the West in its travel management evolution.

Orchard argued that the laissez-faire approach to travel policies among Asian employees was rooted in the perception that booking directly with suppliers was the cheapest option. “However, our research found that average hotel rates offered by TMCs are around 18 per cent lower than those directly quoted by hotels,” he said.

Policy restrictions are also a cause for employees skirting the rules. “Multinational firms that have not adapted their global travel policies to accommodate local cultural differences and idiosyncrasies usually see more incidents of travel policy defiance,” Orchard said.

Best road to compliance

While adherence to travel policies is crucial, travel managers should not be overzealous when clamping down on employees, said Carl Jones, director of advisory services, Japan, Asia-Pacific, Australia, American Express Business Travel.

Instead of wielding the stick, employees should be encouraged to follow policies through constant communication and engagement. “After all, (business) travel is a prime motivator, and if policies become too restrictive, this will demoralise workers, which could in turn affect retention rates,” he said.

Orchard, on the other hand, prefers “gamification” techniques. “Persuade employees to accumulate points in exchange for rewards for good travel behaviour, instead of harking on about rules and regulations.”

“Alternatively, give employees a traveller score card that lists exactly where their behaviours are driving savings – it’s a good solution to keep employees on the straight and narrow.”