Move to house foreign workers in Malaysia hotels draws criticism

Hotel associations in Malaysia have hit out at a government-led initiative to temporarily house foreign workers at hotels to curb the escalating Covid-19 cases caused by cramped living conditions at workers’ dormitories.

The Ministry of Tourism, Arts and Culture Malaysia (MOTAC) said the initiative was “the best alternative at the moment” as it would also provide a lifeline to hotel operators suffering the brunt of the virus crisis.

The cost to rent a hotel room will be RM200 (US$49) per person per month, and there will be an additional RM20 charge to cover water and electricity. This is regardless of hotel category.

MOTAC’s initiative in collaboration with the Department of Manpower Peninsular Malaysia will be carried out in accordance to the Minimum Standards on Housing, Accommodation and Workers’ Standards Act (Act 446).

Applications have been opened to interested hotels that meet the requirements. However, instead of welcoming the initiative as a saviour to their struggling businesses, hotel associations have criticised the move, citing the low room rates and impracticality of the solution as reasons.

Malaysia Budget & Business Hotel Association (formerly known as Malaysia Budget Hotel Association) national deputy president, Sri Ganesh Michiel, explained: “The hotel rate fixed by the government is very low and hotels will be on the losing end. There is a high possibility that the workers, who had been living in hostels in the past, will damage the hotel rooms and the hotel will have to bear the (repair) cost.”

When asked what would be a good rate, he suggested RM50 per person, per night for hotels in the budget to mid-tier category.

Yap Lip Seng, CEO, Malaysian Association of Hotels, shared that the government’s initiative may not be in hotels’ best interests.

He said: “Various factors need to be taken into consideration (when housing foreign workers), including the expected high wear and tear as well as different needs of these workers, in comparison with normal hotel guests. Capacity of hotel rooms is also limited by bed set-up, while special control measures are needed to ensure physical distancing is practiced.”

Equity in vaccine distribution key to speedy global recovery: AAPA

As the Covid-19 vaccine rollout promises a glimpse of travel rebound, the Association of Asia Pacific Airlines (AAPA) warns that global economic recovery may likely be hampered by inequality of immunisation in developing countries.

Its director-general, Subhas Menon, cautioned: “Everyone is pinning their hopes on the vaccine and mass immunisation. No one is safe until everyone is safe. Unfortunately, this is not the approach taken by many. It seems like – with regard to immunisation – while the developed world will be done and dusted by the end of the year, the developing and emerging world is on a very long and slow road to achieving the same result. Even large economies that have vaccine production like India, China and Russia are struggling to remain on the chart (of mass immunisation).”

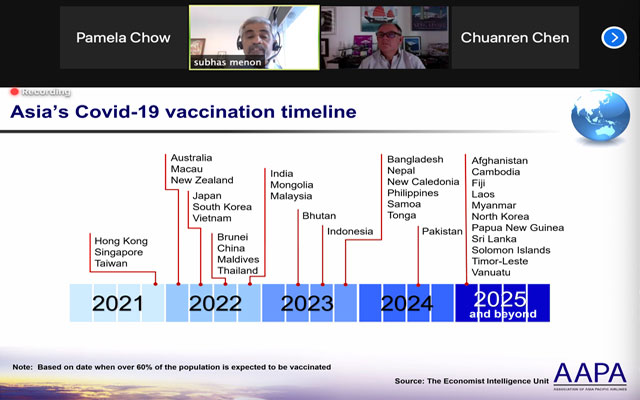

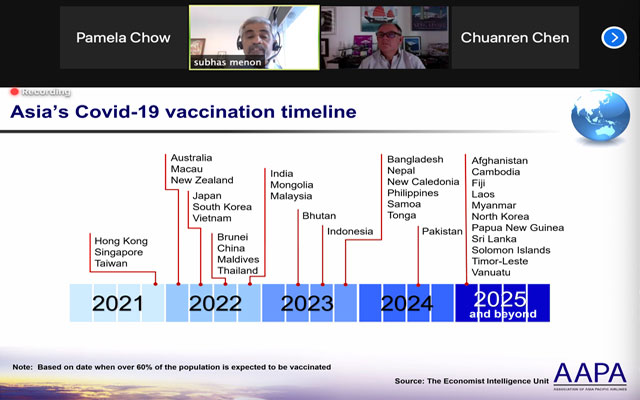

Data from the Economist Intelligence Unit predicts that the first countries in Asia-Pacific to have vaccinated 60 per cent of their populations by end-2021 are Hong Kong, Singapore and Taiwan. Australia, New Zealand, Japan, South Korea, Vietnam, Brunei, Thailand, India, Malaysia and China are expected to follow in 2022; with Bhutan, Indonesia, Bangladesh, the Philippines and Pakistan potentially achieving the milestone in 2023-2024.

Countries such as Afghanistan, Cambodia, Laos, Myanmar and Sri Lanka may only reach the target in 2025 and beyond. Menon observed: “(These) tourism-dependent countries are all very far down the road to mass immunisation. WHO has recognised the situation and is raising its voice for something to be done about this, but we need the whole world to go back to the basics of interconnectivity and globalisation to find a way forward.

“Economic recovery cannot just hinge on the recovery of the developed world, nor can air travel recovery just proceed with travel (within) the developed world.”

He also clarified that while vaccination has not been proven to stem the infectiousness of Covid-19, mass immunisation can give a destination the ability to safely receive travellers, regardless if they have been inoculated. This would afford a country the flexibility to reject the “no jab, no fly” stance.

As the industry looks towards taking flight once again, AAPA is pumping research into an integrated smart app that will provide travel identification, health status authentication, border control authorisation and other information for travellers of the future. This “Travel Pass” may also provide access to testing centres as well as necessary certifications.

It joins a brimming roster of other smart solutions in the making, such as IATA’s Digital Health App and SITA’s Automatic Border Control, spotlighting the need for these systems to undergo tight audits and standardisation before market launch.

“A very important aspect of the travel pass is the standardisation of the format for (immunity) certification, as well as authentication and audit of test certificates and testing centres. We would need (the involvement of) WHO and ICAO – who are working on this as we speak – and a multilateral agreement will be required for governments to sign. This will be a necessary condition for any travel pass,” asserted Menon.

How the tours and activities industry can future-proof their business following a rollercoaster ride

It’s not often you see an industry that’s been around for decades and carved a place for itself, come of age. In the last three years or so, tours and activities is one such industry that has moved up the ladder and is now recognised as a major player in the travel business. A player worth an estimated US$180 billion annually, and as such, travel retailers and investors have shown a great deal of interest in this sector.

Then along came Covid.

Following a horrendous year, the travel industry is now feeling the very early signs of recovery, but as tourism starts to grow it will need to adjust to a world where everything we do, including all activities, will change. As travellers start to explore the world again, the desire to book tours, theme parks and trips will feature in their plans, however the likelihood is that they won’t be experienced in quite the same way as before. Heading into the new year and beyond, tour providers will need to make changes to future-proof their business and in order to do so they will need to focus on three key areas – product offering, pricing and sales channels.

Product

Many regional businesses compare prices with local competition. Two operators offering similar boat trips are likely to price their product at the same or possibly slightly lower level. But tours are about experiences and there are many opportunities to make your tour stand out at little or no extra cost – add a lunch or refreshment to the trip or a bit of theatre into the commentary and you have made a difference.

As tours and activities reopen for business, many will need to be managed in a very different way from what they have known before. Crowds are expected to be much smaller – and more controlled. In a coronavirus era, tours will be Covid-friendly, with smaller or private groups enjoying experiences in the open air. Theme parks may include mandatory temperature checks; visitors and guides in masks and seats spaced to allow for social distancing. Whether families, students, more mature or retired, know your market. Create products that these groups value and make the changes necessary to ensure trust and safety.

Pricing

In recent years, tour operators have penetrated the OTA industry, but while this has been a leap forward for many, they need to be cautious. Every business should understand its costs and profit margins, debts and so on. Selling product requires an understanding of the market, and tour operators are no different. However, they may struggle to market their product(s) to what could be a very diverse and disparate market. Distribution costs, fixed and variable costs and post-pandemic smaller group sizes are just a few areas that need to be factored into the cost of a tour, especially for operators that sell through third parties and not through direct sales channels.

Sales channels

According to a report last year by Arival, the percentage of bookings made online still sits below 30 per cent but continues to grow at a rapid rate. Walk ups will no longer work, and as people plan ahead and research the safety of tours, more sales channels will go digital.

New solutions are available, enabling tour providers to manage their inventory and sell directly online or through third parties – including OTAs.

They connect activity providers with travellers who have become accustomed to planning and securing their travel needs online. Some of the more advanced systems, such as our own reservation system TripAdmit Thrive, also enable operators to administer seasonal pricing variables.

Systems like these are designed to enhance online sales and distribution capabilities and are helping tour operators reach markets on a global scale. Great news for this multi-billion dollar industry whose shift to online is reminiscent of the early days of online hotel and airline booking.

The tours industry is fragmented, with the majority of businesses run by small teams of two to 10 people. These businesses are longing for travel to return to a sense of normality, as we all are, but in many ways, they are better equipped to deal with this crisis. With little monthly costs, many can sit tight and wait for the recovery to start. As most predict that this will be driven in the order of local, regional and international travel, tours and activities are best placed for each stage of the recovery.

Those businesses that are digitally focused, are adaptable and offer outstanding and safe experiences will succeed and secure their future when this crisis comes to an end. The operators that are also strategic in their product pricing will be the ones making a very healthy profit on top.

TTG Asia breaks for Lunar New Year

TTG Asia will be taking a break from February 12-15, 2021, for the Lunar New Year holidays. News will resume on Tuesday, February 16, 2021.

From all of us at TTG Asia Media, we wish all of our readers a happy and prosperous Lunar New Year!

SIA welcomes new GM for China market

Singapore Airlines has appointed Ng Boon Kiat Melvin as its general manager for China, effective since February 8, 2021.

Based in Beijing, Ng is responsible for the airline’s strategic planning and market expansion in China.

Having been with the airline for nearly two decades since 2002, Ng has successively held several positions including sales and distribution executive, corporate account manager, regional marketing manager for North Asia, and manager for Northern China.

He has also taken on the general manager role across several markets, namely, Sri Lanka, Russia, Vietnam, and Taiwan.

Tang’s Living Group bolsters senior management team

Tang’s Living Group has appointed two new group general managers to its senior management team.

Henry Tse, current general manager of Hotel COZi, steps into his new role as the group general manager – hotel operations & brand development of Hotel COZi, Bay Bridge Lifestyle Retreat and Commune. His new role will see him managing five hotels and a co-living space.

Prior to joining Hotel COZi as hotel manager and serving as part of the hotel’s pre-opening management team back in 2017, Tse has over 30 years of hospitality experience. He previously held management positions at hotels such as Dorsett Tsuen Wan Hong Kong and Silka Far East Hotel.

Meanwhile, Alfred Chan, also a 30-year hospitality veteran, assumes the position of group general manager – hotel operations & brand development of Hotel Ease, Hotel Ease Access and Minimal Hotels. In total, he will be managing 10 hotels.

Chan joined Tang’s Living Group in 2018 as the general manager of Hotel Ease‧Tsuen Wan and Hotel Ease Access‧Tsuen Wan, where he helped to enhance brand awareness and development. He has also held leadership roles in Metropark Hotel Kowloon and Kew Green Hotel Wanchai.

Singapore delays segregated travel lane

Delays have set in for a new segregated travel lane allowing short-term business travellers to stay, work and meet at dedicated facilities in Singapore.

According to national papers, The Straits Times, the Connect@Singapore initiative has been delayed at least until February 21. It was scheduled to launch last month, with the first travellers under the scheme arriving in Singapore from the second half of January.

The first dedicated facility these travellers will be put up in under the scheme is now expected to open for check-in only from February 21, sources told The Straits Times.

The Ministry of Trade and Industry (MTI), which is overseeing the Connect @ Singapore scheme, did not say why the scheme has been delayed.

An MTI spokesman would only say that the start date for applications for the scheme will be “broadly aligned with the estimated operational start date of the first Connect @ Singapore facility”.

Singapore Tourism Board’s executive director for infrastructure planning and management, Chew Tiong Heng, told the broadsheet that assessments on the first facility – Connect @ Changi facility at Singapore Expo – are in the final stage and no reservations have been taken from the travellers yet.

Indonesian tourism players split on government recovery plans

Government directions to salvage Indonesia’s ailing tourism industry by speeding up development of five super priority destinations as well as nursing Bali back to health have inspired debate among industry stakeholders.

At a recent Reviving the Tourism Industry Webinar, minister of tourism and creative economy Sandiaga Uno stressed the importance of Bali as a critical contributor to the country’s tourism and creative economic sector. As such, he intended to share his recovery focus on both Bali as well as the five super priority destinations, being Lake Toba in North Sumatra, Borobudur in Central Java, Labuan Bajo in East Nusa Tenggara, Mandalika in West Nusa Tenggara and Likupang in North Sulawesi.

Objecting the approach, Hariyadi Sukamdani, chairman of Indonesia Hotel and Restaurant Association, opined that the government should focus solely on Bali first in its recovery efforts.

“(Doing both at the same time) will require (too much energy) and may not be effective,” Hariyadi explained.

He asserted that Bali alone can restart Indonesia’s tourism industry quickly, as the destination has complete infrastructure and attractions while the five super priority destinations are still in development.

Citing some examples, Hariyadi said Lake Toba still needed hotels and restaurants with “decent service” while Borobudur Temple Ground and Komodo Island, which have a capacity limit, needed more events and attractions in the surrounding areas to stimulate demand.

Likupang also lacks infrastructure and tourist attractions as traffic pullers,” he added.

On the other hand, Viktor Laiskodat, governor of East Nusa Tenggara (NTT), supports the government’s move, saying that the current travel downtime presents an opportunity to develop new destinations such as Labuan Bajo and Komodo National Park.

“(Now) is the right time to develop facilities, infrastructure and connectivity (to allow) NTT to catch up with the other provinces. When the pandemic is over, tourists can see NTT’s transformation,” he said.

Nurdin Abdullah, governor of South Sulawesi, also hopes that the national tourism authority will consider developing his region, which boasts popular attractions such as Toraja, Selayar island and Taka Bonerate National Park. He added that South Sulawesi’s new airport aids accessibility and is capable of accommodating ATR-72 aircraft.

What could have Chinese New Year travel looked like?

There were high hopes for travel during this typically popular period, especially after a strong travel recovery in the domestic sector by the end of 3Q2020. But local Covid-19 outbreaks have resulted in official policies throughout the country requiring people not to leave the areas where they live, and as such travel bookings have dropped dramatically.

The outlook is quickly deteriorating for Chinese New Year domestic travel.

Nan Dai, China market expert at ForwardKeys, noted that the number of tickets issued to travel within China for the Chinese New Year monitored throughout December 2020 was down 57.3 per cent from the same period in 2019.

Nan Dai, China market expert at ForwardKeys, noted that the number of tickets issued to travel within China for the Chinese New Year monitored throughout December 2020 was down 57.3 per cent from the same period in 2019.

As of January 28, issued tickets plunged 75.9%.

Travel agencies have been restricted from selling group tours or packages to high- or medium-risk areas, and some tourist attractions have closed.

Sienna Parulis-Cook, associate director of communications at Dragon Trail Interactive, added that as of January 18, air and rail departures from Beijing over the Spring Festival period were already down by 43 per cent compared to 2020, and 69 per cent compared to 2019.

The National Railway Group has shared dismal results: tickets for the three days from January 28-30 were only a quarter of what they were in 2020, and tickets for January 31 were down by 75 per cent.

What could have happened?

Looking at WeChat marketing for international hotel brands (as tracked weekly by Dragon Trail Interactive) over the past two months, the main promotional theme was “Sun or Snow.” This means the very extensive promotion of wintery, ski-oriented destinations in north-eastern China, as well as the tropical island climate and tax-free shopping in the south, in Hainan.

This was demonstrated by the issued tickets leading up to the Chinese New Year, before the new strains of Covid-19 appeared and drew travel restrictions between provinces.

“Travel to southern parts of China with warmer weather and fewer new cases witnessed the most advanced bookings. Guangdong tops the list and Hainan jumps to the second place with 33 per cent recovery in ticket volume as of 14 January,” said Dai.

“Travel to southern parts of China with warmer weather and fewer new cases witnessed the most advanced bookings. Guangdong tops the list and Hainan jumps to the second place with 33 per cent recovery in ticket volume as of 14 January,” said Dai.

The team at Dragon Trail monitored online a host of activities by five-star hotels promoting the south or north. Marriott published an article on WeChat in January recommending the Harbin Ice and Snow Festival, skiing in Changbaishan and Chongli, and winter beauty in Changchun. A recent report by travel website Qyer.com listed Changbaishan, a mountainous area in Jilin Province, as 2020’s eighth fastest-growing travel destination in China.

Shangri-la also promoted hotels in Harbin in December, while Ibis promoted Changchun and Harbin. At the same time, Hilton publicised its extensive selection of properties throughout China, as well as dreamy holidays in Sanya, Hainan.

The international hotel brand to promote this “Sun or Snow” concept most heavily for winter tourism was IHG Hotels & Resorts. In December, it published posts offering a choice between a tropical winter break in Hainan, and snowy travel in the north of China. On January 4, it again integrated this concept into an interactive post showing how much better 2021 would be compared to 2020. Through illustrations, it shows consumers stuck at home in 2020 but out surfing or learning to ski in 2021.

The optimism was unfortunately premature.

The Great Spring festival staycation

There is still some push for Hainan travel – on February 1, the Sanya government announced that travellers from low-risk areas with a green Hainan health QR code will be able to skip the PCR test before coming to the island.

At the end of January, Marriott was still promoting little family reunions in Hainan, and Shangri-la Sanya rolled out Chinese New Year family packages while stressing its high hygiene standards.

However, travel from other provinces seems increasingly unlikely, despite the desire to do so. The most up-voted comments on an Agoda Chinese New Year promotion for Sanya published on a WeChat travel blog in mid-January included: “Schools, work units, and organisations are all forbidding travel outside the city – who would dare to go?” and “It’s so cheap! But we’re not allowed to leave our area.”

Parulis-Cook predicts that staycation will lead the Chinese New Year travel trend in 2021.

“As of January 22, the Trip.com Group reported that Spring Festival staycation bookings were up 260 per cent, with searches for local travel up by 40 per cent. 80 per cent of their users will stay local over Chinese New Year, they said, with increases all over the country,” she shared.

At the same time, OTA Tongcheng reported that cancellations had become more common, with a trend to stay local, stay isolated, and do slow travel in the area. They also identified a trend of staycations in hotels, with customers booking family suites and high-tech offerings like e-sports rooms or audio-visual rooms popular. They reported that in the previous 10 days, searches for local travel products had increased eight-fold, with a six-fold growth in searches for local accommodation plus sightseeing packages.

Dai added: “Indeed, this is the holiday period when families most often travel together. Our issued tickets back this further by showing that on February 13, passengers travelling in family size (two to five people per booking) represents around 60 per cent of all departures, and the share of passengers travelling alone represents only 10 per cent, down by 20 per cent from the day before the holiday.”

Hotels have had to be quick to adapt their marketing. As late as January 19, IHG was still promoting skiing holidays in Jilin and Hebei. By January 27, the messaging had changed. “Not going home for Spring Festival? You can still have a great celebration where you are,” read the WeChat article’s headline, with suggestions for short, local trips to quiet places should travel plans be cancelled.

The summer outlook

“One thing we have learned from this pandemic is that the Chinese travel market is resilient and that the domestic travel market will be the first to bounce back when it can,” said Dai.

Looking at 2H2020 to predict the future potential for domestic travel in China in terms of issued air tickets, the most resilient destination provinces (or destinations with the fastest recovery rates) were Tibet, Hainan and Chongqing.

“Nostalgic travel is having a comeback. Strolling in ancient laneways, eating traditional cuisine typical to a region is really in among the younger generation at the moment,” added Dai. Another trend to keep in mind is Red Tourism, particularly for the older generation as the Chinese Communist Party celebrates its 100th birthday this year.

“Nostalgic travel is having a comeback. Strolling in ancient laneways, eating traditional cuisine typical to a region is really in among the younger generation at the moment,” added Dai. Another trend to keep in mind is Red Tourism, particularly for the older generation as the Chinese Communist Party celebrates its 100th birthday this year.

Chinese New Year travel has not stopped this year; it has had to take a different turn. It is clear that pent-up demand exists, and many await the moment when the dormant Dragon awakens to shake up the travel industry again.

“The Chinese government has more experience in dealing with the outbreak situation now and people have started to administer the vaccine… I believe when the winter’s gone, the outlook for Chinese domestic travel in summer is still looking optimistic,” Dai concluded.

Royal Caribbean International (RCI) has extended the Singapore season for Quantum of the Seas by another three months until June 21, 2021.

With the success of its safe cruises pilot programme, which launched in December 2020, Quantum will continue to offer two-, three- and four-night Ocean Getaways to Singapore residents.

The additional sailings, kicking off on March 22, will continue to operate with stringent health and safety measures in place, such as mandatory Covid-19 testing, reduced sailing capacity and safe distancing measures.

The Singapore sailings has earned many repeat bookings among local cruisers, according to Angie Stephen, managing director, Asia Pacific, RCI.

For bookings made before April 30, changes and cancellations are allowed up to 48 hours before the cruise. Should a guest or any member of their travel party test positive for Covid-19 during the three weeks prior to their booked cruise, they will each get a 100 per cent credit towards a future cruise. As well, a full refund will be given if a guest, or any member of their travel party, tests positive during their voyage.

Royal Caribbean will continue to cover Covid-19-related costs up to S$25,000 (US$18,800) per person for onboard medical expenses, including quarantine fees, and travel costs to get home.