Brought to you by Norwegian Cruise Line

Soft adventure tourism making waves in Asian markets

Industry experts predict Asia’s younger generation will lead the tourism recovery charge as they seek unique soft adventure experiences abroad.

At PATA’s hybrid Adventure Travel Conference and Mart, this was predicted across the outbound Chinese, Indian and Malaysian markets, where experts note the trend has been emerging in domestic travel during the pandemic.

Dan Sandoval, co-founder of Perspective China, said the huge growth in domestic tourism in the country caused by Covid-19 travel restrictions has triggered a swathe of new products. This includes an explosion of adventure activities that travellers aged 25 to 44 are particularly keen to explore.

He noted: “We’re seeing a huge demand for products that didn’t traditionally exist. China was more of a conservative travel market but we’re seeing this huge shift towards experiences. This says there will be a huge demand for these as an international experience.”

For example, the surf scene has exploded in Sanya; while in Yunnan, safari-style camps are emerging, and are proving popular with the country’s younger generations.

Said Sandoval: “We will see a huge surge in people looking for these niche products in unique locations, especially this age group. This is a wonderful playland for the adventure and experiential travel industry.”

In India, a similar shift in demand from the 25 to 44 demographic is being driven by the “bragging factor”.

Deeya Bajaj, director of operations and business development at Snow Leopard Adventures, said: “Indian youth are now more willing to spend on experiences. There’s the bragging factor that comes from being able to do something unique rather than buying a luxury item.”

Sandoval noted a similar movement in China, where investing in a unique adventure holiday or travel experience is the new designer item.

He said: “There used to be a time when you’d brag about having a Louis Vuitton bag but that time, for the most part, is gone. Now, we’re seeing experiences are what people want to brag about.”

Bajaj said younger generations in India are showing a desire to try soft-adventure holidays and excursions in undiscovered destinations – all new experiences for the market.

She added: “They don’t want long or hardcore adventures. They want to go to offbeat places, but be comfortable. They’re excited to try new things, but they’re not as self-sufficient as American or European adventure travellers. There will need to be some handholding involved as the average Indian adventurer is trying these activities for the first time.”

In Malaysia, Jessica Yew, co-founder and director of Sticky Rice Travel, noted the devastating financial impact brought on by continued lockdowns and other restrictions has left younger generations with less disposable income to spend on travel.

However, she said the pent-up demand can be seen in the domestic market, with more Malaysians aged 25 to 44 opting for soft adventures. She said glamping, slow travel, as well as environmentally-friendly and community-based travel programmes are on the rise.

Yew said: “Travel is a lifestyle for this segment; it’s not a luxury item. A lot of people with the disposable income to travel live in the city and it forms part of their work-life balance. People in this age group are now looking for authentic experiences and soft adventures.”

She added that it is imperative the industry remains active on social media to capture this tech-savvy segment.

This sentiment is strongly echoed by Sandoval. With the lack of exposure to the outside world due to cancelled trade shows, limited fam trips and tourism and destination marketing companies slashing promotion budgets, China’s young is turning to social media to source travel information.

He advised: “Getting on the social media train is so important right now. Keep social media accounts active, you have to stay in people’s minds. Wave that delicious smelling platter in front of their faces so that when the cafeteria opens, you get a surge of people coming. It will be this segment who lead the charge, and you need to be ready.”

New GM and DOSM for Sofitel Kuala Lumpur Damansara

Sofitel Kuala Lumpur Damansara has appointed George Koumendakos as general manager, and Vivian Choa as director of sales and marketing.

In his new role, Koumendakos is responsible for the daily operations and strategic directions of the hotel. Koumendakos’ main priority is to ensure a safe and secure environment for his guests and colleagues, while driving more business opportunities in the domestic market.

A 35-year veteran of the hospitality industry, Koumendakos was most recently the general manager at Mövenpick Hotel Colombo, Sri Lanka.

Meanwhile, Choa is responsible for overseeing all sales, marketing, communications, and events management activities for the hotel, reporting to Koumendakos.

With over 20 years of experience in hotel sales and marketing, Choa most recently headed the sales and marketing team at Invito Hotel & Residence, overseeing the repositioning and rebranding of the hotel.

Other hotel groups Choa has worked for include Marriott International, Hilton Hotels & Resorts, and Starwood Hotels & Resorts.

Remote working, greater sustainability focus to drive slow travel post-pandemic

Pent-up demand for immersive travel experiences with no set time limit could help slow travel become the next big tourism trend, predicts GlobalData.

The analytics company noted that with tourists opting for longer stays due to many being able to work remotely, and sustainability featuring more heavily in travel decisions, slow travel could be a global phenomenon in the next few years.

Slow travel mainly refers to the speed of which a trip is taken, where travellers take a train through Europe instead of flying, for example. However, it also has a broader meaning of tourists staying in destinations for longer, emphasising a connection with local people, culture, food and music. This means that slow travel is also more sustainable for local communities and the environment.

Johanna Bonhill-Smith, travel and tourism analyst at GlobalData, said: “Various consumer trends already suggest that slow travel could take off post-pandemic.”

According to a GlobalData poll, a trip longer than ten nights is more highly desired (22 per cent) than a day visit (10 per cent) or short break away from one to three nights (14 per cent).

Bonhill-Smith added: “The added hassle and cost of additional Covid-19-related travel requirements such as PCR tests and potential quarantine periods means that short trips lose value, justifying a longer trip.”

The shift to more remote work operations brought on by the pandemic will also be another driving force to the growth of slow travel. In another GlobalData poll, over 70 per cent of global respondents opted to work remotely full time or have a mixture of both remote and office work.

Many offices are likely to be more flexible regarding working hours and the location of an employee as a result of the pandemic, meaning blending work and leisure will be easier for employees.

Sustainability is also at the forefront of consumers’ decisions. ‘Supporting social causes’ was identified as a key driver in product purchases for 25 per cent of global respondents in GlobalData’s 1Q2021 consumer survey, and for 45 per cent this was ‘nice to have’. Preference for products can reflect on service trends and this identifies that consumers may feel more inclined to support local communities post-pandemic, which is a gap that slow travel can fill.

Bonhill-Smith opined: “Competition is already intensifying between both niche and major travel intermediaries, suggesting that slow travel is sure to make its mark in post-pandemic travel. Travel intermediaries that offer ‘slow travel’ holidays range from niche operators such as Intrepid Travel and Responsible Travel to more mainstream providers such as Airbnb and Expedia Group.

“This niche trend reflects consumers’ growing desire for more experiential forms of travel, going above and beyond the hordes of tourists gathered for sun, sea and sand. Its potential growth could further rival the concept of mass tourism and the all-inclusive package holiday concept in travel’s recovery post-Covid-19.”

PATA successfully concludes its first hybrid ATCM

The recently-concluded Hybrid PATA Adventure Travel Conference and Mart (ATCM) 2021, which focused on regenerating the adventure industry, took place through online formats and on-ground activities in Clark, Philippines.

The two-day niche event, which launched on May 26, attracted 582 delegates from 53 destinations, with international delegates making up 56 per cent of the total in attendance. With both travel mart and conference elements, the B2B trade mart welcomed 67 seller organisations from 13 destinations and 65 buyer organisations from 28 source markets.

The event, which was organised by the PATA, in partnership with the Philippine Department of Tourism (DOT), brought together international experts at the forefront of the adventure travel industry to explore the trends and dynamics of one of the fastest-growing tourism sectors.

The conference was opened by Soon Hwa Wong, chair of PATA, and DOT secretary Bernadette Romulo-Puyat.

Under the theme Re-Generation for the Adventure Industry, the event covered topics such as “The Re-Generation Opportunity”, “Delivering what the next generation of adventure travellers want”, “Recalibrating Tourism’s Standards”, “Can local cuisine drive travel recovery?”, “Ensuring a more equal recovery”, “The future of online experiences”, “Putting our communities first”, and “Resiliency is the new sustainability”.

Discover NCL’s newest ship, Norwegian Prima

Welcome aboard Norwegian Prima, the first in a new class of ships by Norwegian Cruise Line (NCL), designed to elevate every expectation. Be the first to explore the greater wide open and enjoy the expansive outdoor deck space on the most spacious new cruise ship at sea. Stroll seaside along Ocean Boulevard, that encircles the entire ship, or stretch out in NCL’s roomiest rooms, with the most spacious accommodation in its fleet. Designed by world-class architects, designers and artists, elegance is woven into every detail, from the grandeur of The Haven to the interactive seaside sculpture garden. And with the highest staff levels of any new ship, enjoy service that puts you first. Be the first to discover a new experience at sea on board Norwegian Prima, setting sail to Northern Europe, The Caribbean and Bermuda from August 2022.

First-class luxury: The Haven by Norwegian®

Discover unparalleled luxury in The Haven, NCL’s most premium and spacious accommodation. Private elevators whisk you away to your exclusive enclave where your personal concierge and 24-hour butler cater to every craving. Take in sweeping ocean views as you swim in the private infinity pool, relax in the sauna, or savour the dishes from The Haven restaurant. No matter how you plan to spend your time, this private sanctuary – exclusive for Haven guests – provides the perfect escape.

Ocean Boulevard

Explore the greater wide open with the most outdoor deck space of any new cruise ship. Enjoy 360° views as you stroll along the breathtaking Ocean Boulevard, the expansive outdoor space that encircles Norwegian Prima. Swim up to the horizon in one of the infinity pools, designed to blend into the ocean, or walk over water across NCL’s first glass bridge – Oceanwalk. Take your tastebuds on a delicious journey through the Indulge Food Hall, where you can grab a seat, hammock, daybed or private cabana and enjoy your fill of customisable small plates from a diverse range of mouth-watering cuisines. At night, kick back with the stars at the outdoor movie nights, or circle around the fire pit to unwind after another incredible day at sea.

Dine along the seaside

Indulge in a modern Italian culinary experience at Onda by Scarpetta. Onda, or “wave” in Italian, brings the charm and effortless elegance of its critically acclaimed sister restaurant, Scarpetta, to sea. Or head over to Los Lobos, a premium Mexican restaurant, for traditional flavours with a modern twist – such as the Carne Asada marinated in guajillo chiles and tequila, and the Tres Leches Cake with Coconut Cream. For something more casual, visit The Local with its beach club atmosphere and live music, located on Ocean Boulevard by Infinity Beach.

Cruise Northern Europe, Bermuda and The Caribbean, from August 2022

Be the first to set sail aboard Norwegian Prima to the natural wonders of Northern Europe, the warm turquoise sands of the Western Caribbean or the pink sands of Bermuda. Discover the incredible landscapes of Iceland and Norway on an 8-Day cruise from Amsterdam to Reykjavik, or explore the ancient ruins of Costa Maya, Mexico, on a 5-day Caribbean itinerary. And until 30 June, book your clients’ future cruise and they can save 30% on the cruise fare plus they will receive 5 Free Offers – including Free Specialty Dining, Free Excursions, Free Open Bar and more, valued at US$2,900*.

*Offer correct as at 1 June 2021 and subject to change or withdrawal. Offer ends 30 June 2021. For full terms and conditions click here.

Fourth Imperial Hotel to land in Kyoto

Imperial Hotel is set to open a 60-key property in the Gion district in Kyoto, following the renovation of a historic landmark.

Scheduled to open in the spring of 2026, Imperial Hotel Kyoto will be the company’s first hotel since 1996 and its fourth property after its Tokyo, Kamikochi, and Osaka hotels.

The new hotel will occupy the site of Yasaka Kaikan – a historic building that was originally completed in 1936 – and the land on the north side of its main building and north building. It will house recreational facilities such as restaurants, bar, spa and gym.

Renovation of the building, which will begin in April 2022, will preserve the structure’s existing skeleton, including its iconic, multi-layered roof. Additionally, the newly added north side will be designed with due consideration for the existing design and the local landscape.

Absolute Hotel Services targets senior market with new extended-stay brand

Absolute Hotel Services (AHS) Group has launched the Eastin Estates brand, a luxury long-stay residential brand in the assisted living segment.

Eastin Estates aims to provide a residential community experience to meet the growing needs of the active senior market, with services and facilities for residents that encourage health and social connections. AHS Group claims to be the first hospitality management company to launch a brand dedicated to this segment in Asia.

Eastin Estates is designed to provide active seniors looking for personal home care assistance with a safe place to work, rest and play with like-minded residents, while serviced by a professional community crew. Daily activities and high-end facilities help residents keep fit, active and mobile.

Karan Kaul, vice president of business development for AHS, said: “Eastin Estates will grow via management agreements and is an ideal concept for conversions of existing hotels and residential projects in urban and resort settings. We are launching this product in response to the evolving demographics of the region”.

All developments under the Eastin Estate brand will feature safe, comfortable and appropriate design features made from sustainable materials. All public areas and facilities will cater for easy access and will be wheelchair-accessible. Accommodations range from 40-50m² studios to 80-100m² two-bedroom units, all fitted with kitchenette, bathroom, and balcony or terrace. Units and facilities are pet-friendly, and a la carte pet grooming and meal services can be provided.

Facilities include a health centre with a 24/7 nurse and emergency support, all-day dining restaurant with healthy menu options, lounge area with library, meeting room, outdoor garden, swimming pool, yoga area, minimart, fitness centre with steam and sauna rooms, as well as entertainment and service laundry facilities. Nature is well-integrated within the living spaces and large landscaped communal areas feature throughout the development.

According to Jonathan Wigley, CEO of the AHS Group, the company plans to expand the Eastin Estates brand in Thailand, Vietnam and Indonesia.

Bright spots in APAC tourism recovery in 2022: PATA

The new mid-year revision of the Asia Pacific Visitor Forecasts 2021-2023 from the PATA indicates a hard year ahead in 2021 but with recovery occurring thereafter, albeit in a very uneven fashion.

The latest prediction is based on the most recent data and information at its base, amid the extreme volatility in the travel and tourism sector brought on by the Covid-19 pandemic and the resultant containment policies and measures enacted in order to prevent its continued spread.

With the original PATA Asia Pacific Visitor Forecasts 2021-2023 report, projections for that period were made using estimated baseline data for 2020, albeit on the latest data for each of the 39 destinations within Asia-Pacific. During the intervening months to date, however, not only have new data become available, but a range of other factors have surfaced as well, leading to this scheduled review of the forecasts with these new developments factored into them.

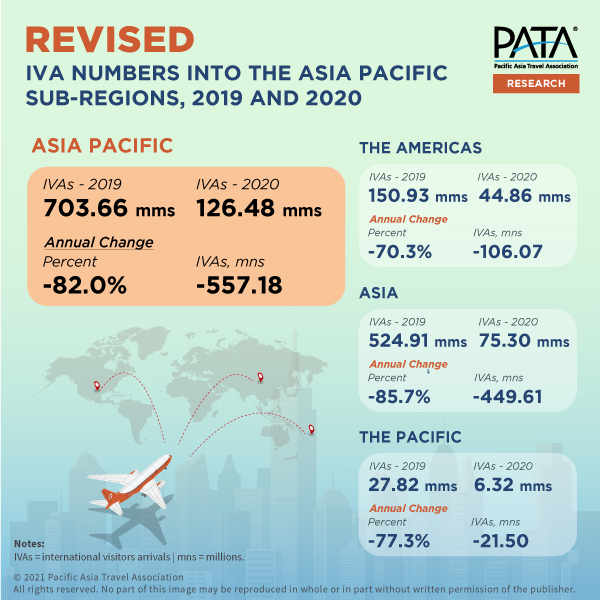

Across all 39 Asia-Pacific destinations, the difference in the estimated values used in the original forecasts and those with the most recently released official arrivals data was a positive gain of 3.8 per cent between the two. From an initial forecast of 121.843 million international visitor arrivals (IVAs) in 2020 in the original series, the actuals can now be updated at 126.475 million.

The contraction rates and loss of arrivals still remains severe however, with an overall reduction between 2019 and 2020 of more than 577 million foreign arrivals. Those losses, unfortunately, are forecast to continue throughout 2021 for most sub-regions, under all scenarios. The exception is Asia, which is predicted to have a positive annual growth of almost 51 per cent year-over-year, under the mild scenario.

That singular result can be expected to move the Asia-Pacific overall position to an annual increase of a little more than 27 per cent, between 2020 and 2021, but only under the mild scenario. All other positions remain negative over that period.

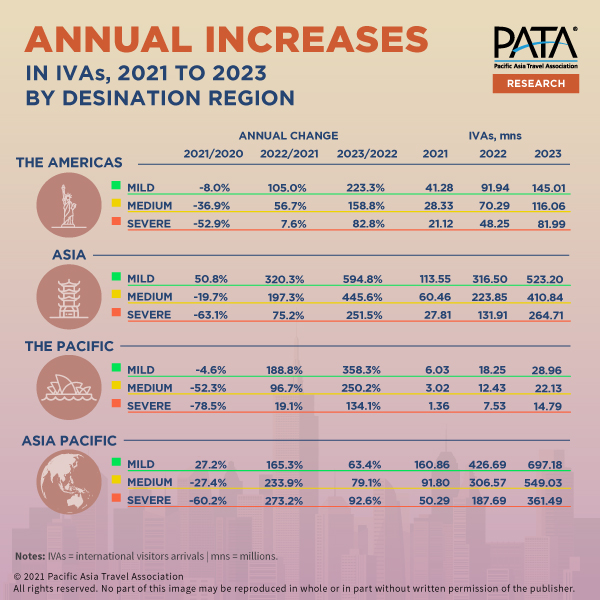

The good news, however, is that 2022 looks to be promising, with annual increases across the board, ranging from gains of 105 per cent to 320 per cent under the mild scenario, to between eight per cent and 75 per cent even under the severe scenario. It is important not to be seduced by such large annual percentage increases however, as despite those gains, the absolute volume of arrivals remains well below the 2019 benchmark for IVAs, even out to 2023 under some scenarios.

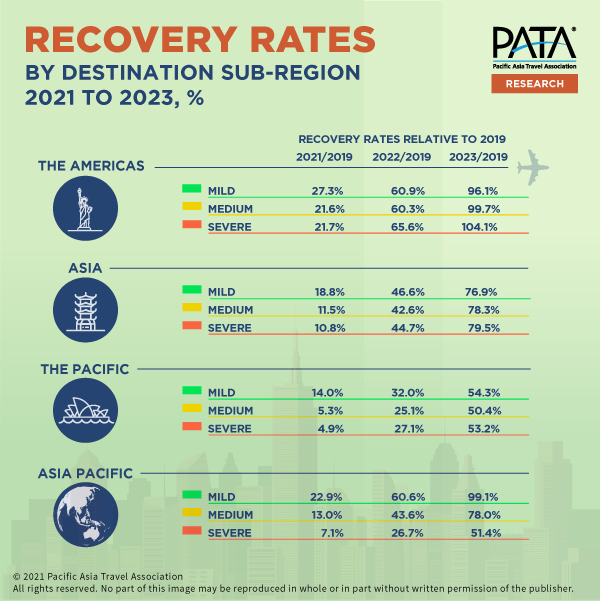

The expected results for 2021 average just 23 per cent of the 2019 volume at best. During 2022, that is expected to increase to between 27 per cent and 61 per cent depending on the scenario, reaching between 51 per cent and 99 per cent by 2023, again, depending on the prevailing scenario at that time.

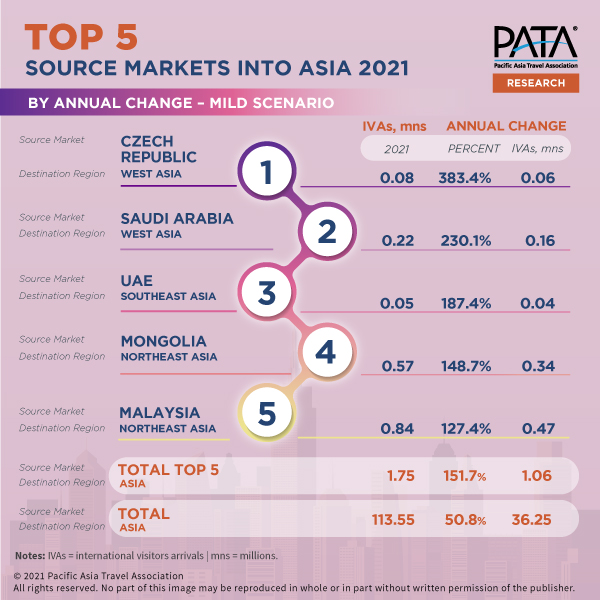

The surge in annual arrivals between 2020 and 2021 into Asia under the mild scenario is expected to come from mostly Northeast Asia source markets, with the Russian Federation also adding a welcome boost in numbers. Collectively, this top five source market cluster is expected to add an additional 29 million IVAs into Asia between 2020 and 2021, representing some 80 per cent of the predicted increase into the region over that period.

Along with the volume increases, there are likely to be some significant annual percentage growth gains into Asia between 2020 and 2021. Although these increases are more than robust, the actual impact on the absolute volume of arrivals is minimal, however, they do represent strong interest in the destination region and are certainly worth tracking over time to evaluate longer-term potential.

Liz Ortiguera, CEO of PATA, explained: “Expectations for a return to the past should be shelved and more attention paid to those source and destination markets best preparing to drive recovery within Asia-Pacific. Travel recovery is being driven by a complex range of factors from the varying market policies regarding virus control and containment to local citizens’ sentiments on vaccine take-up.

“Success will come to those that efficiently implement science-based best practices to control the pandemic in their home markets to restore both source market government and consumer confidence. In the travel industry, a ‘duty of care’-based approach in delivering services and products will support a more sustainable recovery.

“On a positive note, our forecast projects a pent-up demand for travel experiences in the Asia-Pacific region. Flexibility in marketing and delivering new experiences to engage travellers as corridors open up will be critical.”

As room demand weakens, new hotel revenue sources awaken

For almost two decades since 2002, Singapore-based Global Hospitality Solutions (GHS) has established a profitable business in helping hotel partners be present in the entire customer journey in travel and tourism, from engaging travellers to driving purchase and eventually rewarding for loyalty.

But with a large part of their business being in room bookings, GHS found its existence challenged when the pandemic hit in early 2020.

“There was zero tourism. And so, our work suddenly became focused on helping our hotel partners survive – which in turn ensures our own survival,” recalled CEO Bernard Quek.

To develop different and more stable ways for hotels to get business amid recurring lockdowns and continued international travel restrictions, GHS adjusted its technology platforms to facilitate F&B orders and delivery, voucher sales and e-gifting services.

GHS’s transformation birthed Social Media Hospitality Salesbot, which enables hotel room bookings and voucher sales via Facebook and Messenger, online F&B ordering for takeaway or delivery, and restaurant reservations via a chatbot as well as WhyQueue Hotel e-Store, which powers a private e-store for both hotel companies and individual properties.

However, Quek discovered that the business pivot required more than just a technology change. By stepping into F&B purchase and delivery services, GHS now has to put on a new operational hat and play the role of a coordinator that connects customers with transport vendors and hotel partners.

He detailed: “When it comes to selling a room, the customer puts in arrival and departure dates, selects rooms, books, pays, and the transaction is complete. With online F&B purchases, the customer selects what he wants, and puts in his delivery address which must be linked to Google Map for us to instruct our delivery partners. This process can get complex beyond Singapore, such as in the Philippines where there are many regions and zones.

“We have to work with our transport partner – in Singapore, it is Lalamove – to ensure the hotel meal, chocolates or wines are delivered to the customer in good condition and in accordance to our hotel partners’ brand and service standards. And should there be delays, we must sort things out.”

GHS’s WhyQueue Hotel e-Store now supports various hotel companies and properties, such as Grand Hyatt Singapore, Grand Hyatt Jakarta in Indonesia and Wyndham Hotels and Resorts across Asia-Pacific. It recently won over Marco Polo Hotels and will be establishing an online store for the chain’s properties in Manila.

According to Quek, hotels have a lot to gain by moving into online retailing. Citing an example, he said a hotel client in Singapore generated seven-digit revenue “over the last couple of months” from just F&B delivery alone.

Online retailing can also cushion hotels from recurring lockdowns. When Singapore went into Phase 2 partial lockdown on May 16, which restricted staycation guest movement and prohibited dining in at eateries, Hyatt’s online orders grew 300 per cent in a day.

For now, Quek observed that major hotel companies and high-end properties were more open to the idea of shifting to online retailing and F&B delivery, compared to smaller, local properties. But even with a more open mind, it was not easy for these companies and hotels to move out of their traditional business in room sales.

“Most have never done F&B delivery as a key segment of their business, so we must guide them in every step of the way. Today, F&B is a very important part of hotel business. To do F&B business now requires hotels to relearn concepts. For example, hotels cannot sell a delivered meal at the same price as a dine-in meal because the customer is not paying for the hotel ambience and service,” said Quek.

He said Hyatt properties have done well in transitioning a part of their F&B business to takeaway and home delivery. They had the foresight to set a much lower, more practical price range for food orders. An Impossible Burger served at a Hyatt hotel restaurant would cost about S$30 (US$22.70) or S$40; the same meal for takeaway costs S$12.

Quek opined that e-gifting is another valuable lifeline for hotels. The service allows corporate clients to purchase hotel vouchers for their staff and/or business partners, which can be used to redeem a specific product – such as a two-night stay in a deluxe room at a specific hotel – or a range of products, such as premium toiletries or gourmet treats.

“E-gifting supports the future of work. Many people are working from home, so bonding is gone and organisations are looking to make up for that loss of engagement through thoughtful gifts that their staff or business partners can enjoy at home, be it a nice meal or a bottle of wine,” said Quek.

Even when movement restrictions ease and post-pandemic travel resumes, Quek is confident that online retail will remain useful for hotels. “Consumers have formed a habit to send gifts of food, wine and other goodies to people they love and miss during the pandemic, and e-gifting will continue to have a place even as movement restrictions ease. There is still room for improvement in overseas e-gifting, and what we do can help to enable this service,” he said.

GHS is growing its Social Media Hospitality Salesbot and WhyQueue Hotel e-Store solutions most prominently in Singapore, Indonesia and the Philippines now, with plans to expand into Vietnam, Hong Kong and Taiwan soon.

Josun Palace, a Luxury Collection Hotel, Seoul Gangnam; South Korea

The Luxury Collection has debuted in South Korea with the opening of Josun Palace, a Luxury Collection Hotel, Seoul Gangnam. Located in the Seoul district of Gangnam, the hotel was originally built in 1914 as one of Korea’s first luxury hotels, Chosun Hotel. Each of the property’s 254 rooms and suites features a specialised private bar for guests who enjoy crafting their own cocktails and other drinks in-room.

Five F&B options are available on-site. For Cantonese fine dining, The Great Hong Yuan serves curated seasonal menus, while new Korean contemporary food is showcased in Eatanic Garden. All-day eatery Constans offers local and international menu favourites. Elsewhere, 1914 Lounge & Bar serves tea and light meals in the afternoons, and cocktails and spirits come evening. Josun Deli the Boutique features pastries and cakes, along with gourmet coffee and tea for an afternoon treat.

Facilities include the Josun Wellness Club featuring a heated indoor pool and a deck area, a fitness centre, and sauna facility. Josun Palace also offers bespoke function rooms and facilities for hosting events, including The Great Hall which seats up to 300 guests and has a foyer for pre-function cocktails. For more intimate gatherings, the hotel features the Royal Chamber, which seats up to 140 guests, and the Private Chamber which can accommodate up to 110 guests.

Centara Mirage Resort Mui Ne, Vietnam

Thailand’s Centara Hotels & Resorts has expanded its family-themed resort brand with the world’s second Centara Mirage opening in a popular beach destination in southern Vietnam. Located a few hours’ drive from Ho Chi Minh City, the 984-key Centara Mirage Resort Mui Ne is a Spanish Mediterranean themed waterpark resort. Family-friendly facilities include diverse dining; an observatory tower café; separate playgrounds and kids’ clubs for younger and older children; Cenvaree Spa; and Spa Candy, a wellness destination catering to children. The resort’s waterpark features a lazy river, water slides, splash pool, cliff jumping pool and kids’ pool.

Oakwood Premier Tonglu, China

Situated beside the picturesque Fuchun River, Oakwood Premier Tonglu features 45 hotel rooms alongside 154 serviced apartments. Its location just outside Hangzhou is in the region’s new cultural and creative hub for the digital technology industry, LIT City. On-site facilities include an all-day restaurant, steak house, swimming pool, fitness centre as well as meeting and event spaces.

Oakwood Hotel & Residence Bangkok, Thailand

Oakwood Hotel & Residence Bangkok marks the brand’s seventh property in Thailand, and fourth in the capital. Located near the iconic Chao Phraya River, the property houses 142 studios and one-bedroom apartments. Oakwood Hotel & Residence Bangkok sits a short distance away from popular shopping malls Asiatique The Riverfront and Iconsiam. On-site amenities include an outdoor swimming pool, fitness centre, sauna, two meeting venues, lobby bar, restaurant as well as a Residence Lounge.