Singapore reduces stay-home notice for travellers from higher-risk locations

Singapore will shorten the stay-home notice period for travellers from higher-risk countries or regions from 21 days to 14 days, starting June 24.

These travellers will be required to test themselves on days three, seven and 11 of their arrival in Singapore with self-administered antigen rapid test (ART) kits, said the Ministry of Health (MOT). This is in addition to the existing polymerase chain reaction (PCR) tests they have to take on arrival in Singapore, and on day 14, before their stay-home notice ends.

This is “to identify potential infection cases early and provide infected travellers with appropriate medical care as soon as possible”, given the higher transmissibility of new variants of concern, MOT added.

The new testing requirement will be implemented for travellers who arrive from 23.59 on June 27.

All countries and regions are considered higher-risk except Australia, Brunei Darussalam, Hong Kong, Macau, mainland China and New Zealand.

Meanwhile, travellers arriving from Taiwan and Israel will be able to apply to serve their 14-day stay-home notice at their place of residence instead of a dedicated facility. They must apply before arrival and must have spent the last 21 days prior to travel in Taiwan or Israel to be eligible.

Travellers must also be occupying their place of residence alone or with household members with the same travel history who are also serving the same stay-home notice duration. They will also have to undergo testing using the same regular self-administered ART kits and PCR tests.

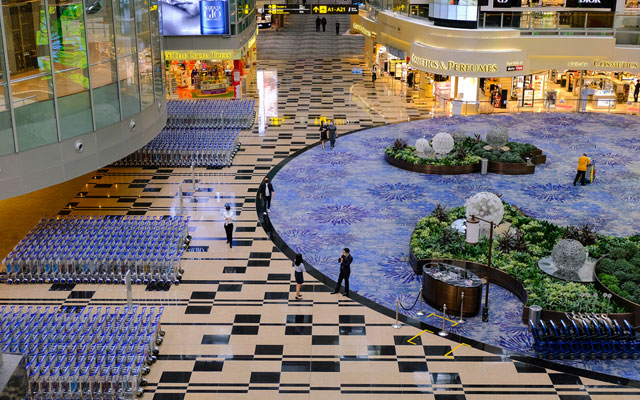

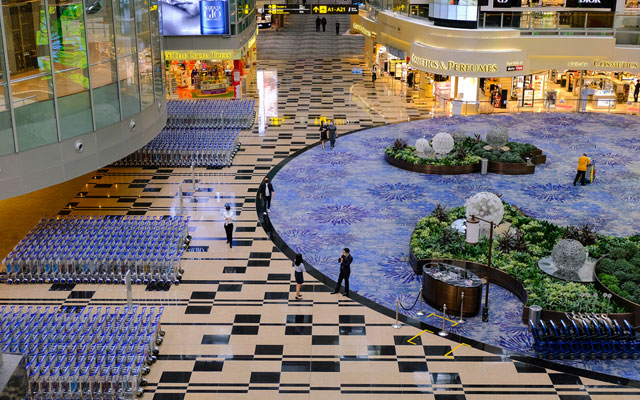

77% of APAC travellers ready to take to the skies again

While pre-pandemic frequent flyers are ready to get back on a plane, travel restrictions and low vaccine uptake remain a serious barrier, according to new research released by Collinson’s Priority Pass.

The global survey, which polled over 46,000 Priority Pass members, found that 77 per cent of travellers in Asia-Pacific expect to travel in the next 12 months (from March 2021).

Yet, despite travellers longing to hit the skies, entry restrictions – such as the need to be a resident – remain in place for many countries in the region; with most requiring several weeks of quarantine upon entry.

The survey also revealed that leisure travel will make up more than half of trips (55 per cent) taken in the next year. While business travel will recover more slowly, there is demand from frequent flyers for it to return, with the expectation that business travel will account for 45 per cent of flights taken in the next year globally.

After more than a year since Covid-19 first hit the travel industry, vaccination rollouts have brought a glimmer of hope – with 41 per cent of Asia-Pacific respondents stating that being vaccinated against Covid-19 would be the top reason for encouraging them to travel, while 33 per cent said that the lifting of international travel bans would be their top reason.

When questioned on the possibility of travelling by air in the next 12 months, 78 per cent of members globally expressed feelings of excitement and 61 per cent felt confident.

Globally, international travel will likely increase year-on-year. However, survey respondents project that domestic travel is still set to make a greater recovery than international travel during the next 12 months – at 64 per cent versus 59 per cent, when compared with 2019 travel levels, respectively.

Around the world, the desire to keep health risks to a minimum has resulted in key changes to the way people experience airport travel, with the aim of keeping external contact to a minimum.

The survey found that since the pandemic began, 24 per cent are more likely to use unmanned facilities, such as biometric passport kiosks, while 48 per cent are more likely to use airport lounge access than they did before the pandemic.

Additionally, 20 per cent are more likely to pre-order and collect their food and drinks before departure, while 49 per cent indicated that social distancing and contactless transactions at the airport are of a relatively high importance when travelling.

Despite Asia’s low vaccination rate in comparison to the EU and US, 79 per cent of travellers cite a growing confidence in the safety of air travel as more people are vaccinated.

While vaccines have yet to be fully rolled out globally, their availability continues to generate hope, as do the discussions around digital health certificates; with 82 per cent of Asia-Pacific respondents saying they would be happy to use one – higher than the global average of 74 per cent.

Globally, 76 per cent of members say they would feel confident to travel internationally if getting vaccinated became a mandatory measure. This sentiment is echoed by a further 64 per cent of travellers who agree that Covid-19 testing and the use of digital health certificates would encourage them to travel abroad.

The survey also showed that while quarantine regulations continue to be enforced around the world, 60 per cent of Asia-Pacific travellers do not feel it is an essential safety measure; while a further 69 per cent see it as a major deterrent for international travel.

When reasons behind this largely negative sentiment towards quarantine are explored in depth, 83 per cent blame the additional costs involved and 69 per cent also cite the unpredictable nature of quarantine rules, while 62 per cent are reluctant to spend so much time indoors; a finding which is likely linked to an increasing emphasis on mental wellbeing when travelling.

Australian domestic tourism projected to reach record high by 2025

The total number of domestic holidays taken across Australia is set to double to 133.4 million in 2025 from 2020 levels, representing a 14 per cent growth on pre-pandemic levels, forecasts GlobalData.

The growth will be driven by Tourism Australia’s Holiday Here, This Year domestic travel campaign, being promoted through several channels including social media, radio and outdoor advertising.

Although the country will not see pre-pandemic levels for inbound trips until 2024, the increase in domestic tourism will cover some of the shortfalls and save thousands of jobs, said GlobalData.

Craig Bradley, associate travel & tourism analyst at GlobalData, commented: “Due to the pandemic, domestic trips in Australia fell by 45 per cent in 2020 from an all-time high of 116.7 million travellers in 2019. In response, Tourism Australia acted promptly to invest in a domestic tourism campaign that will reap benefits from 2021 onwards. The message to residents is simple: get out there and discover everything Australia has to offer.”

According to GlobalData projections, domestic trips will increase at a compound annual growth rate (CAGR) of nine per cent between 2021 and 2025, eventually reaching a record-breaking 133.4 million domestic trips.

Bradley continued: “The clear target marketing campaign rolled out by Tourism Australia will no doubt have had a huge impact on these projections. The organisation has done well to focus on Australia’s key selling points, focusing on various destinations, culture, gastronomy and sightseeing.

“Furthermore, as always, they have used the influence of Australian national celebrities to push their agenda (in this instance, Hamish Blake and Zoe Foster-Blake) to appeal to a wider audience.

“The Australian authorities have been unwavering with their stance on international travel restrictions. However, this strategy has kept infections to a minimum, meaning, the health risks of domestic travel are reduced and will encourage residents to travel domestically. Ultimately, the quick reaction from Tourism Australia in ensuring funds are in place to galvanise a national marketing campaign will have a significant effect on the Australian tourism industry’s short-term future.”

GlobalData concluded that Tourism Australia’s strategic focus could set an example to other DMOs on how to react quickly and decisively during unprecedented times.

Wyndham expands Pakistan portfolio with seven signings

Wyndham Hotels & Resorts will further grow its presence in Pakistan with a number of key signings in some of the country’s most popular destinations including Islamabad, Rawalpindi, Lahore and Hyderabad.

The development plan includes the addition of six Ramada by Wyndham hotels across the country, as well as the launch of the Howard Johnson by Wyndham brand in Pakistan.

The new signings will build on the company’s portfolio of five hotels and over 1,000 rooms in Karachi, Islamabad, Lahore and Multan.

Ramada by Wyndham Murree Lower Topa Resort will be the first of the seven properties to launch in 2022, followed by the Ramada Hotel & Suites by Wyndham Lahore Cooper Road, set for a 2023 debut.

Come 2024, there will be a trio of openings, namely, the Howard Johnson by Wyndham Islamabad Blue Area, Ramada Plaza by Wyndham Islamabad Bahria Town, and Ramada by Wyndham Rawalpindi Ayub Park.

2025 will see the launch of Ramada by Wyndham Rawalpindi Bahria Springs North, and Ramada by Wyndham Hyderabad Qasimabad.

IHG makes triple signing in Thailand

IHG Hotels & Resorts has signed an agreement with Thai real estate group Asset World Corporation to develop three hotels in Thailand.

The multi-property agreement includes the new-build InterContinental Bangkok Chinatown, as well as two further projects in Chinatown and Pattaya, totalling 629 rooms.

Set to open in 2027, the 332-room InterContinental Bangkok Chinatown hotel will be located in historic Verngnakornkhasem within a mixed-use development that will house two hotels, residences and a retail mall, including a 24-hour food centre on Charoen Krung Road.

The hotel will feature three restaurants and bars, as well as a swimming pool, fitness centre and 1,400m² of events and meeting space supplemented by eight private rooms.

The mixed-use development will also boast the second property under this agreement – a 63-room lifestyle boutique hotel, converted from traditional four-storey shophouses.

Another boutique hotel under the agreement will open in Pattaya in early 2024. Located within the Aquatique district, the property will be at the heart of a lifestyle and entertainment complex featuring hotels, retail and dining outlets, and convention spaces. With 234 rooms and suites, the hotel will also feature restaurants, a rooftop bar, a swimming pool, spa and meeting rooms in excess of 670m².

Green financing for hospitality sector thrives in Singapore despite travel downturn

- More hotel groups, hotel developers securing green loans

- Green loans on the rise; finance sector plays its part to support government and private sector’s sustainability agenda

- Green financing encourages sustainable business practices, engagement with responsible travellers

The pandemic may have devastated Singapore’s travel and tourism industry but green financing for hotel properties has remained buoyant and experts expect even stronger investments ahead.

Major financiers and industry players TTG Asia spoke to indicated that sustainability efforts to green properties will likely accelerate post-pandemic and green financing seems poised on an upward trajectory too.

The focus on sustainable financing in the hospitality sector has grown significantly over the years as travellers become more aware of the environmental and social impact they have on local ecosystems and communities, according to Lam Li Min, head of real estate and hospitality, sector solutions group, group wholesale banking, UOB.

Last year, Park Hotel Group secured its first green loan of S$237 million (US$176.1 million) under the UOB Real Estate Sustainable Finance Framework. Launched in 2019, it was the first-of-its-kind for the sector established by a Singapore bank. The framework sets out the eligibility criteria, including sustainability strategy, objectives, ratings and performance targets, for companies to meet when applying for green loans or sustainability-linked loans.

Tan Shin Hui, executive director, Park Hotel Group said: “Sustainable financing for the hospitality sector is like a carrot on a stick for hotel developers and operators to incorporate sustainability in their business strategy and decisions. This development in financing encourages companies to consider environmental impact of their investments and new business initiatives. It also motivates hotel developers and operators to measure and evaluate the positive difference they are making on the environment.”

This month, Worldwide Hotels Group also inked its first green loan facility worth S$405 million for its new hotel and commercial development, 8 Club Street, with Maybank Singapore. The agreement with the Group is one of the largest bilateral green financing for a hospitality asset in Singapore to date.

Maybank Singapore has also dished out S$250 million in Islamic green financing to property investment chain, Royal Group back in March – said to be the world’s first for hospitality. The funds will go towards the upcoming Raffles Sentosa Resort & Spa Singapore and the existing Sofitel Singapore Sentosa Resort & Spa. This marks Royal Group’s first foray into sustainability finance, according to Gregory Seow, head of global banking, Maybank Singapore.

“Within the hospitality sector, there is increasingly more focus given to green financing as the pandemic is a wake-up call for sustainable financing. We do see more clients embedding sustainability into their business models to show their stakeholders that they take ESG (Environmental, Social and Governance) targets seriously and will work towards the desirable outcomes they aim for,” Seow added.

Ascott Residence Trust (ART) will use its S$50 million five-year green loan from DBS Bank in January this year to finance its maiden development project and co-living property, lyf one-north Singapore.

Beh Siew Kim, CEO of ART Management and Ascott Business Trust Management, said: “Being the first hospitality trust in Singapore to secure a green loan reinforces ART’s commitment to do our part for the environment and the communities we operate in. In 2020, we increased the number of green properties in ART’s portfolio by about four times compared to 2019. To date, 21 properties in the ART portfolio have obtained green building ratings and certification.”

According to a 2018 UN World Tourism Organization report, hotels account for about one per cent of global greenhouse gas emissions as an industry – so it is crucial for hospitality businesses to embark on ways to reduce their carbon footprint.

Greening makes business sense

Apart from being able to secure green financing for their projects and combat climate change, integrating green practices into their properties will ultimately benefit the bottomline for hotel owners and operators as guests trend towards travelling sustainably and responsibly too.

Seow pointed out that both government and the private sector have also been advocating the sustainability agenda as a differentiator on the country, as well as on a company level.

From 2019 to 1H2020, the Monetary Authority of Singapore revealed that Singapore corporates have borrowed S$10.2 billion through green and sustainability-linked loans, and S$4.8 billion of green and sustainability bonds were issued from Singapore. There is an increased traction for real estate owners and developers to opt for green loans.

As at mid-2020, the green share of total loan and bond transactions in Singapore remains modest at less than five per cent, reflecting the significant opportunity for growth ahead. Seow added: “The finance sector will continue to play our part in promoting sustainable financing for the hospitality sector.”

Thai cabinet approves further reopening for international arrivals this July

Thailand’s popular tourist islands – Koh Samui, Koh Phangan and Koh Tao – will once again beckon international tourists from July 15, a decision that the Thai cabinet green-lighted today.

The move is expected to bring Thailand’s beleaguered tourism industry closer to recovery, joining an earlier decision to reopen Phuket to tourists from July 1.

Cabinet spokesperson Anucha Burapachaisri said Koh Samui, Koh Phangan and Koh Tao in Surat Thani province are loved for their beaches, dining establishments and Full Moon parties.

On the same day, transport minister Saksayam Chidchob delivered a progress report on Thai aviation capability, in response to prime minister Prayut Chan-o-cha’s commitment last week to reopen the country in the next 120 days.

The Thai Transport Ministry has asked the Civil Aviation Authority of Thailand to allocate flight schedules for Phuket’s airport. Some 134 flights have been scheduled per day initially for summer, and approximately 320 for winter.

Should the reopening take off well, the number of international flights to Thailand is expected to climb to 13,354 in July – from 5,698 flights in May 2021. Passenger numbers are expected to increase from 79,226 in May 2021 to 146,448 in July. Tourist arrivals are expected to grow 10-fold in July 2021 from a year ago.

To ensure the health and safety of locals and fellow travellers, people from low-and medium-risk countries will need to serve a 14-day quarantine upon entry into Thailand while those from elsewhere must serve a 21-day quarantine in a designated facility. The government is deliberating on the definition of low-, medium- and high-risk countries.

High hopes among Japan’s luxury travel sector for 2022 rebound

With Japan’s borders closed to most nations, the country’s high-end inbound tourism is not expected to bounce back until 2022 at the earliest, predicts local luxury travel players.

Yuko Inamasu, representative of high-end cultural experience provider Toki, says interest in Japan remains high among Asia countries, especially Hong Kong. If travel bubbles are established, Toki’s focus will be the Asia market for the rest of 2021 and the rest of the world from spring 2022.

Hiro Miyatake, co-founder and COO of Bear Luxe Corporation, a network connecting Japanese luxury travel suppliers and global travel designers, says 2022 is the “concrete bet” for when the country’s luxury travel rebound will occur, although “the majority of clients are eager to travel to Japan as soon as borders open”.

Luxury travellers who visit post-pandemic are likely to want longer stays in fewer destinations as well as more authentic experiences with a stronger focus on responsible travel.

Miyake predicts visitors will have a more “slow and deliberate” approach and a desire for “meaningful and mindful travel”. There is also likely to be increased demand for social, sustainable and ecological travel, according to Inamasu.

Another priority for the high-end visitor is community engagement, making Japan well-placed to meet their needs. The uptick in unique accommodations, from traditional ryokans to boutique hotels and luxury villas, has seen many lodgings promote their community, including craftspeople, artisans, chefs and farmers.

Japanese destinations that showcase their unique local characteristics can expect to fare well, said Miyake, noting the growing interest among luxury travellers for “gastronomic experiences, not just dining in a special restaurant, but also in learning about farm-to-table (initiatives).”

First-time visitors are expected to continue to prioritise Tokyo, Kyoto, Osaka, Hiroshima and Mount Fuji, but they may also be more interested than before in exploring the regions due to greater ease of social distancing and the slower pace away from crowds.

Among repeaters, Toki is seeing growing demand for rural areas as well as Niseko in Hokkaido, and Okinawa. Bear Luxe is also enjoying interest in Niseko as well as Nikko (Tochigi Prefecture), Setouchi (Okayama Prefecture) and Kyoto, which Miyatake attributes to the investment and development of Japanese luxury hotels in these areas, which was triggered by Tokyo’s hosting of the Olympics.

Eyes on the skies: how payments will power the future of travel

Covid-19 has triggered a demand shock unlike anything the airline industry has ever seen. Industry data shows that Asia-Pacific airlines’ full-year traffic plunged 80.3 per cent in 2020, which was the deepest decline for any region. To stay afloat, airlines are finding new ways to stimulate demand.

‘Travel bubble’ initiatives, such as the one between Australia and New Zealand, and ‘green lanes’ allowing essential and business travel are currently underway in the region.

While airlines opportunistically chase demand, equally important is the need to tailor their payments strategy. Integral to the travel booking experience is the payments process. The way we pay is constantly evolving, and the pandemic has further brought about a shift, accelerating the adoption of alternative payment methods such as digital wallets and buy-now-pay-later (BNPL). As planes gradually begin taking to the skies, offering the right payment types and ensuring a convenient seamless payment experience will be crucial to attract, convert and retain customers.

The right payment mix matters

At least one in four travellers (28 per cent) would drop out at the checkout and book elsewhere if their payment method wasn’t available, according to research by Worldpay from FIS. Another 18 per cent surveyed indicated that they would reluctantly use a different payment method, but they wouldn’t book with that airline again. Effectively, this means that airlines are losing a significant share of customers, sales and loyalty simply by not taking payment preferences into consideration.

So, what is driving travellers’ choice of payments for flights? The research shows credit cards continue to dominate flight payments, with 52 per cent of purchases made across credit cards globally. However, if we dig into the data a little deeper, the payment landscape has considerable variance across different markets even within Asia-Pacific alone. For instance, China bucks the credit and debit card trend with only one-fifth of total payments made on cards; digital wallets such as WeChat and Alipay own this market with 44 per cent and 33 per cent respectively.

Additionally, 44 per cent of travellers indicated they would like to pay for flights in instalments. BNPL has been steadily growing in popularity in the past few years, and it is now taking off in the travel vertical as well. Just last month, American Express launched a BNPL option for air travel for its US customers. Closer to home, in Asia-Pacific, partnerships between Air Asia and Zip, and Jetstar and Afterpay have been formed to offer BNPL to Australian consumers.

Mobile and social journeys are influencing bookings

Consumers are increasingly making purchases on their mobile devices, and travel is no exception. Across all countries surveyed, just under half (46 per cent) of respondents usually purchase flights on a desktop. This figure is even lower in India and China – the two largest countries in terms of population size – with only 23 per cent and 15 per cent of travellers respectively purchasing air travel on a desktop browser. Hence, if airlines do not nail the mobile experience, they risk alienating a huge segment of the market.

Social selling is also moving front and centre, with 43 per cent of travellers indicating that they click through via social media channel such as Facebook, Instagram or YouTube to book a flight. While almost every airline now has its own mobile app, convenience is driving the customer experience – airlines need to ensure that they are providing a seamless transition between social channels and the mobile app to drive conversions.

Trust and convenience go hand-in-hand

A frictionless payment process should not be underestimated. In fact, consumers ranked a smooth payment process as the third most important aspect of their travel booking, almost on par with customer service and a booking confirmation. Examples of “friction” in the payment process include a declined payment without explanation, an unexpected site redirect, or the requirement to populate card details at a later date. For airlines, taking steps to make the payment process as streamlined, efficient and frictionless as possible can improve the user experience and help build loyalty.

Needless to say, the checkout page is a key part of the booking experience, and providing the option to save user details could prove beneficial. 43 per cent of travellers are more likely to book if their personal details are pre-filled on the checkout page, and 40 per cent are more likely to book if they can use payment details saved in their browser.

While it’s essential to make the payments experience convenient, it’s equally important for airlines to gain the trust of their passengers. Apart from allowing a guest checkout, airlines can build trust and promote security throughout the booking process via a range of methods, for example, by offering third-party consumer protection, providing industry regulator logos and digital authentication logos (e.g. Verified by VISA, Mastercard Secure), and showing positive user ratings or reviews.

Another key factor for airlines to consider is the management of cancellations, refunds and chargebacks in these challenging times. One of the best practices for airlines to process quick refunds, should there be changes in travel restrictions, is to adopt real-time payment offerings such as Visa Direct. Being transparent about the refund processes and keeping travellers informed is key to gaining trust.

For airlines, trust and convenience together pave the way forward to repeat bookings online. It’s no longer about striking a balance between the two, nor is it about choosing increased security at the cost of convenience, or vice versa. Instead, it is about delivering an experience that supports the varying expectations of customers in Asia-Pacific and around the world.

What’s next?

The resurgence of the travel industry is not something that will be achieved overnight. Airlines, hotels, and travel companies will take some time to get back to where they were pre-Covid-19. Building trust and loyalty with customers becomes all the more important to aid with the recovery.

The pandemic also offers the industry a chance to reinvent itself. We have seen a great deal of innovation from airlines in their response to the crisis. Some have even pivoted to new segments to diversify their revenue streams, such as Air Asia moving into the food delivery sector and Singapore Airlines leaning into their online retail marketplace.

The travel sector may be changed forever, but what is clear is the role that payments can play to unlock the full potential and power the future of travel. Savvy airline operators will prioritise traveller-centric payments journeys that are secure and convenient, and tailored to the needs and expectations of tomorrow’s digital consumer.

Seven Seas Grandeur, the sixth luxury cruise vessel to join Regent Seven Seas Cruises in 4Q2023, has unveiled sneak peeks of its signature specialty restaurant Compass Rose.

Multi-award-winning Studio DADO has crafted a space that is reminiscent of an enchanted forest. The journey begins with a delicate, cascading waterfall sculpture at the entrance and onwards under a canopy of interwoven crystal and wood-edge illuminated trees.

The interior features floor-to-ceiling illumination by thousands of crystal-faceted leaves which are encrusted on pillars and branches enveloping the restaurant. A star-dusted view of the ocean is provided by hundreds of twinkling lights surrounding the windows.

Adding to the atmospheric dining experience is a custom-designed mural by Confluent Studios. Crafted with gold-leaf and Verre Eglomisé, the mural will depict the flora and fauna at the forest’s edge, allowing the restaurant to appear endless.

“Restaurants on board all Regent ships are exquisite, but for Seven Seas Grandeur’s Compass Rose we wanted to create a space that was truly a feast for the eyes,” said Yohandel Ruiz, founding partner, Studio DADO.

“This new design of Compass Rose will pique guests’ curiosity and sense of wonder before they have even set foot in the restaurant, and go on to delight with a sumptuous, personalised meal in dramatic and beautiful surroundings. It’s a dining experience that they will regale friends and family with time and again.”