Pandemic shutters KL’s Hotel Istana

Hotel Istana Kuala Lumpur, a five-star property in the heart of the city, will close its doors come September 1, following 30 years of operation.

The hotel’s employees will be offered a voluntary separation scheme, general manager Noorazzudin Omar said in a notice of cessation to staff dated June 30.

“We have arrived at this decision after considering the present circumstances and all available options. We are left with little choice other than to proceed with this closure,” he said.

“Many of you will be aware that our competitive advantage has declined over a period of time in the face of stringent competition from new or neighbouring hotels and serviced apartments. The situation has now been aggravated by the Covid-19 pandemic which has and continues to impact our industry and its ability to achieve normality.

“This has impacted our business rates, returns and occupancy, despite our best efforts. Even as a quarantine hotel, we are incurring monthly operational losses. As such, after a proper evaluation of the hotel and its viability, we have decided to cease operations.”

Owned by Tradewinds Corporation, the 486-key hotel started operations in 1992 and ranked as the top five five-star hotels at the time in Jalan Bukit Bintang. It was also the venue of choice for many government and corporate meetings.

Phuket Sandbox kicks off, sparks hope of tourism recovery

Thailand’s traditional low travel season this July and the next two months will take a different turn for Phuket, which kicks off the Phuket Sandbox tourism resumption arrangement today.

In anticipation of the post-pandemic milestone, several hotels in Phuket have rolled out attractive deals to entice guests.

Banyan Tree Group, for one, has aligned its Phuket Is Open Campaign with the Phuket Sandbox programme, with a number of experiential offerings at its Banyan Tree Phuket, Angsana Laguna Phuket and Cassia Phuket resorts.

The Group’s Laguna Phuket integrated resort also joined up with Bangkok Hospital to launch the first hotel-based PCR test centre for Phuket Sandbox arrivals, allowing guests to access and clear their compulsory tests quickly and conveniently.

All Phuket Sandbox arrivals are required to take a PCR test upon arrival at Phuket International Airport, and again on the sixth and 12th day of their stay.

IHG Hotels and Resorts has also rolled out a warm welcome to its IHG Rewards members, who will earn 5,000 bonus points for every stay at a participating Phuket hotel (InterContinental Phuket Resort, Hotel Indigo Phuket Patong, Holiday Inn Resort Phuket and Holiday Inn Express Phuket Patong Beach Central) along with perks such as daily breakfast, guaranteed room upgrade, F&B discounts and early check-in and late check-out, when they book a five-night stay by July 25 for fulfilment between July 4 and December 23 December, 2021.

Group CEO of Dusit Thani, Suphajee Suthumpun, said Dusit Thani Laguna Phuket was one of the first tourism players to support the scheme. Today, the property welcomed the first batch of Phuket Sandbox arrivals, made up of Dutch and Thai residents flying in from Singapore.

In the lead up to July 1, the Dusit Thani team had inspected Phuket to ensure all sectors were ready for the reopening.

“The hotel can learn and prepare for the high season that comes the end of the year. (The Phuket Sandbox) is a model to expand to other areas as well,” Suphajee said.

Presently, Phuket province has 1,389 business establishments awarded with the Amazing Thailand Safety and Health Administration (SHA) Plus Certificate. These include 882 hotels, and some will welcome about 350 to 400 tourists coming to the island under the Phuket Sandbox programme.

Rajit Sukumaran, managing director for South East Asia and Korea at IHG Hotels and Resorts, said the reopening of Phuket to vaccinated travellers marks a positive step not just for Thailand, but for Asia too.

He said in a press statement: “We are making more meaningful progress towards global recovery, with vaccine rollouts, ease of restrictions and an acceleration in economic activity. We are confident that Thailand’s booming tourism industry will return – history has shown us this before as we know there’s pent up demand for travel when people can do so again.”

Access to Phuket over the next four days of reopening will be facilitated by major airlines linking Phuket with important cities such as London, Frankfurt, Dubai, Abu Dhabi, and Singapore. – Additional reporting by Karen Yue

KKday offers cruise perks for vaccinated Singapore residents

Online travel platform KKday is giving away cruise discounts of up to S$250 (US$185.71) to Singapore residents who have been vaccinated, in a bid to support the national Covid-19 vaccination programme.

Available for Dream Cruise or Royal Caribbean Getaway sailings, 600 promo codes will offer customers savings in denominations of S$50, S$100, S$150 and S$250 for the World Dream or Quantum of the Seas Ocean Getaway Cruise.

To qualify, the customer must have received one Covid-19 vaccination jab at the point of booking and show proof by way of a Trace Together app screenshot.

New hotels: Far East Village Hotel Yokohama; Park Inn by Radisson Clark; J Hotel, Shanghai Tower

Far East Village Hotel Yokohama, Japan

Far East Hospitality has taken its second property into Japan with the opening of Far East Village Hotel Yokohama. Located a five-minute walk from Sakuragicho Station on JR Line and Yokohama Municipal Subway or Bashamichi Station on Minatomirai Line, the hotel offers easy access to both tourist attractions and business destinations.

A blend of Singaporean and Japanese cultures runs throughout the hotel, from Singapore’s tea-ware and toys to Yokohama’s famous confectionery and Singaporean snacks.

The hotel provides guests with a Village Passport which details unique experiences that guests can enjoy within the vicinity of the hotel and which are also loved by the locals.

Complimentary drinks and snacks are available all day and night at the lobby lounge, while Wi-fi is available at all areas in the hotel.

Each floor from levels 11 to 14 has a Village Lounge exclusive for guests in higher room categories (Superior Plus, Superior Plus MM21 View, Deluxe Plus). The lounge provides free alcohol for adult guests over 20 years old as well as soft drinks and snacks.

Far East Village Hotel Yokohama is offering complimentary breakfast for three months until the end of August. As a preventive measure against Covid-19, the hotel is suspending the buffet and providing breakfast boxes instead. After September, the hotel will offer a variety of food options in a buffet style, including Japanese, western, Asian as well as Singaporean dishes such as laksa and kaya jam.

Park Inn by Radisson Clark, the Philippines

Park Inn by Radisson has opened its all-new South Wing, adding more accommodation options for domestic and international guests in an up-and-coming destination.

The new wing offers 95 Superior Rooms and five suites. All Superior Rooms feature comfortable bedding, working desks, mini-bars, sensor-activated air-conditioning, in-room technology such as IPTVs, bedside USB ports and complimentary Wi-Fi, and modern bathrooms with standalone rain showers. The Suites offers Nespresso machines and separate living areas.

Guests of the new South Wing can enjoy the hotel’s outdoor pool, fitness centre, HUES all-day restaurant, lobby lounge and “grab & go” snack zone.

J Hotel, Shanghai Tower, China

The new 165-key J Hotel Shanghai Tower sits atop the iconic Shanghai Tower, the tallest skyscraper in China and second-tallest in the world, offering guests some of the most breath-taking views alongside luxurious hospitality.

Guestrooms are located from levels 86 to 98, and vary from 62m2 to 380m2, making them some of the highest and most spacious options in Shanghai.

Nestled into the Shanghai Tower’s spiral, every stateroom has unique views. Beginning at the Huangpu River and cutting through the heart of the city below, guests have access to Shanghai’s diverse and spectacular urban scenery, from the Bund and the Oriental Pearl Tower to the expanses across Puxi and Pudong.

Flexible payment options will boost 2021 travel: Amadeus study

Periods of high cancellation during the pandemic have led to problems refunding travellers, with some refunds taking many months to process. To preserve vital cashflow, travel companies have offered vouchers for future travel, but limited clarity on the lifting of government restrictions has resulted in uncertainty for those travellers seeking to redeem them.

A new study by Amadeus, conducted in May 2021 with 5,000 travellers across the world, highlights the impact that refund uncertainty is having on traveller confidence and bookings during 2021, as the industry begins its recovery.

Eighty-one per cent of travellers confirmed that the increased risk of cancellations due to the pandemic is a barrier to booking travel this year, with refund uncertainty (46 per cent) and the inconvenience of the refund process (38 per cent) topping concerns when a flight is cancelled.

Several airlines are taking proactive steps to overcome refund uncertainty through innovative new payment options. A major European carrier has taken the lead with a Pay When You Fly (PWYF) option, allowing travellers to make a flight reservation – which also includes a hotel or car hire – by paying a small deposit in the region of 15 per cent and then settling the balance a few weeks before travel.

Nicolas Ortiz, head of payment product incubation, Amadeus Payments, said: “We’re entering a critical phase for travel’s recovery, and our industry needs to build confidence at every opportunity. We believe PWYF will drive traveller confidence, encouraging travel planning and booking even in an uncertain environment with changing government restrictions.

“The new approach may also result in higher value bookings because travellers only need to make the balance of the payment when it’s clear the flight will depart as planned.”

According to the Amadeus study, PWYF is the most appealing payment option (39 per cent) compared to traditional pay at booking (36 per cent) and Buy Now Pay Later schemes that require the traveller to enter a credit agreement for the entire balance (24 per cent).

As well as building confidence by overcoming refund uncertainty, PWYF could boost industry revenues with travellers willing to spend 36 per cent more per trip on average, and 49 per cent of travelers more likely to add additional services like meals and bags, if PWYF is offered by the airline.

Minor, Funyard China expansion agreement comes into force

The January signing of an MoU between Bangkok-headquartered Minor Hotels and China’s Funyard Hotels & Resorts to form a hotel management joint venture that will lead the entry of more Minor brands into China, has come into force on June 29.

The agreement will oversee business development, hotel operations, as well as the sales and marketing functions of the seven Minor Hotels brands.

Minor Hotels hopes to bring its forte in experiential luxury travel into China, to offer a new kind of sophisticated product to meet the evolving needs of the domestic traveller.

Owing to the breadth and depth of Minor’s portfolio, the new business entity with Funyard Hotels & Resorts is uniquely placed to offer a wide variety of products, ranging from classic luxury to serviced apartments to experiential brands, each time creating a personalised product for a specific consumer niche.

Among the brands that Minor Hotels is planning to bring to China as part of the partnership are the Millennial-minded Avani; design-centric nhow; NH Collection with its unique brand of eclectic elegance in landmark buildings; and Oaks, a serviced apartment and resort accommodation chain predominantly operating in Australia and New Zealand. Oaks will debut in China with the opening of a property in Hangzhou.

Minor Hotels presently has an Anantara presence in China, with properties in Xishuangbanna, Yunnan and Guiyang, Guizhou, while Chengdu Tivoli is in the final stages of pre-opening.

Dillip Rajakarier, CEO of Minor Hotels, said: “Growing our presence in China has always been one of the top priorities for Minor Hotels. The strategic partnership with Funyard Hotels & Resorts is the perfect opportunity for us to bring quality hotel experiences and exclusive lifestyle products to Chinese consumers just in time for the post-epidemic travel boom. We look forward to creating outstanding travel experiences across China together.”

Ji Hongjun, president of Funyard Hotels & Resorts Group, said: “We were quick to notice a growing demand for high-quality hospitality and tourism projects, with Chinese consumers increasingly expecting a more personalised experience. To successfully meet the demands of China’s modern-day traveller, the hotel sector must diversify its market segmentation by offering a wider choice of brands. As Minor’s brands originate in parts of the world as diverse as Asia, Europe and Australia, they each offer unique positioning, brand concept and core values, which makes the group the perfect partner to deliver on our joint vision.”

Raising RedDoorz

RedDoorz has just stepped into the midscale accommodation playground with the launch of Sunerra. Was this something you had imagined RedDoorz would eventually do when the company first started out on budget hotels?

RedDoorz has just stepped into the midscale accommodation playground with the launch of Sunerra. Was this something you had imagined RedDoorz would eventually do when the company first started out on budget hotels?

Sunerra is an extension of our customer base. When we started in 2015, we had a whole bunch of youngsters as our customers. Over the last six years they have progressed in their lives. As a business, we see an opportunity to grow with them, and offer something slightly more than the basic property.

The other thing is, over a period of time, we felt that some other asset owners could benefit from the technology we have developed – the kind of hardcore technology that never happened in the hospitality industry before.

How much farther will the company go with its multi-brand strategy?

One thing I’ve learnt over the years is never say never (laughs), but for sure I don’t think we will go beyond Sunerra any time soon and in a hurry.

What’s in it for property owners that decide to go with RedDoorz instead of other traditional multi-brand hospitality companies that you now compete with?

The number one concern asset owners have is performance. RedDoorz is a mass consumer brand, so it gets a lot of direct traffic.

If we were to draw parallels between traditional hospitality companies and RedDoorz, the former have a fairly significant revenue stream that can continue to generate (income) even if the properties don’t do well. In our case, revenue is very much aligned with the property performance. Hence, we are very aggressive with customer acquisition although we charge a small fee.

When the customer is acquired, we have a revenue share. We moved away from traditional forms of revenue sharing with hotel asset owners.

Will growing into economy lifestyle with SANS, co-living with KoolKost and midscale accommodation with Sunerra take RedDoorz’s focus away from the no-frills product the company set off with?

No. When you look at the number of properties we have, our focus will continue to be on our no-frills accommodation. Ninety-five per cent of our portfolio is still made up of no-frills RedDoorz properties. That is our bread and butter.

In Indonesia, Gojek (ride-hailing service) started off first with motorcycles, not cars. We are like Gojek.

Having said that, there are opportunities in the hospitality industry that we should not ignore. Such opportunities would include the rise in economy lifestyle, extended stay, and so on.

While we will continue to evolve our brands in a concerted manner, the core will continue to be no-frills RedDoorz.

Getting back to Sunerra, what is the story behind the name?

I don’t have a grand story to tell, if you are hoping for one (laughs). Sunerra means ‘golden’ in Hindi. We thought that from that standpoint, it would make an interesting name.

Our other brand, SANS, is derived from the Bahasa Indonesian word ‘santai’, which means ‘to chill’. So, Sunerra is a better offering compared SANS. While we are not Marriott and do not have The Ritz-Carlton, Sunerra is RedDoorz’s golden product for our customers.

The name Sunerra has an exotic tinge to it, don’t you think?

Yes, and I can imagine a Hollywood baby being named Sunerra. You have chosen to debut Sunerra, SANS and KoolKost in Indonesia. Why such great faith in Indonesia?

Let’s put the hospitality industry aside for a year or two, during this very bad period. Besides hospitality, South-east Asia is benefitting a lot from investments coming in from overseas, technology adoption, etc. South-east Asia itself is a huge and exciting market with 650 million people, and Indonesia is the largest market.

If you want to create a South-east Asia business, you need to have a strong Indonesia strategy. We have great faith in other South-east Asia markets too, like the Philippines where we operate in as well, but there is no taking away the fact that Indonesia is the largest real economy in this region. There are 250 to 270 million people across at least 100 viable cities.

The domestic consumer is our primary audience, and Indonesia has a great domestic audience. This segment repeats a lot and understands a brand very well, so we can build strong loyalty out of them.

Your decision to launch three new brands during some of the toughest times the travel and tourism industry is facing must mean you are seeing more opportunities than challenges. What’s feeding your confidence

One, asset owners have found it very difficult to go alone. So, independents will need to get banded together.

Two, the consumer concept of service has changed. Today, touch-less service is desired. Consumers don’t want to see you (the service staff), they just want to get right into their room.

The combination of these situations presents the perfect opportunity for a technology-enabled business like us. We are a technology company at heart, and we chose to enter an industry that has not been penetrated by technology innovations.

I used to be an hotelier, and then I joined MakeMyTrip which was a pure technology-driven OTA. I hear a lot of talk about technology in hospitality but the actual implementation is very poor, even in the larger brands. Hence, we see growth opportunities in this space.

Three, if you look at what has happened in China, South Korea, the US and Europe, you will see that people will travel once they can. Like it or not, governments will have to reopen their borders in the next six months. Travel will resume with a vengeance then, and we want to be ready with different solutions for different asset owners before that happens.

SANS is expanding into the Philippines this month. Will we see Sunerra and KoolKost elsewhere in Asia?

KoolKost is going to be very Indonesia focused, while SANS and Sunerra were conceptualised to be available across geographies.

I see Sunerra going into leisure destinations, like Bali and Jogjakarta. Perhaps even the main cities will see a Sunerra presence in the future, but intuitively now I think leisure destinations have the strongest potential.

As RedDoorz scales up, how do you see the company shaping up as a travel and tourism industry employer?

I expect more people to work for us on the platform in roles handling technology, product development, human resource, relationship training, etc. However, RedDoorz will remain asset-light, which means we will never have a huge workforce working for us directly.

As a company, we are enablers – we give skills to locals to improve their employability in the hospitality industry. When we enter a smaller city with our property, we teach the local staff the importance of hygiene, basic language skills including English, standard customer service, such as how to greet the customer, etc. Many who started with a RedDoorz property were unskilled labour, but they have been able to move on to bigger properties later.

We have a vision of providing a formal certification for staff who undergo the RedDoorz hotel training programme, so that they can get employed elsewhere in future.

Do you find your leadership approach changing as a result of the pandemic and resulting challenges in the travel and tourism landscape?

I think our entire leadership has become a lot more patient.

People in the army often feel that once they get into battle, nothing scares them anymore. Once the first shot is fired, there is no going back. In our case, the pandemic has forced so many changes upon us; many shots have been fired. I think we have learnt to take everything in our stride.

In the past year we have worked very, very hard to improve our systems internally. The launch of the new brands is a manifestation of that improvement in how we operate. We are now more efficient, more revenue-centric than ever.

Lastly, if you possessed the power to do one thing – except making Covid-19 disappear, what would you do to speed the travel and tourism industry towards pre-pandemic recovery?

I will make it easier for people to travel. The way some governments have responded to the pandemic has been rather weird. They have made it very difficult (for people) to get into the country.

The Phuket Sandbox arrangement, for example, is complex even though it sounds so good on paper. To get into Phuket, one needs to be on a list of approved countries, secure a visa and (medical clearance), etc.

Safety first, of course. The PCR test is the gold standard, but we have to simplify the process so more people can come and go with ease.

Hilton signs fourth resort in the Maldives

Hilton has signed a management agreement with Amingiri Holdings, a hospitality-focused subsidiary of Maldivian company Amin Construction, to launch the 109 all-villa Hilton Maldives Amingiri.

Scheduled to open at the end of this year, Hilton Maldives Amingiri will mark the entry of Hilton’s flagship Hilton Hotels & Resorts brand into the Maldives.

It will be the fourth resort under the company’s portfolio of brands in the Maldives, joining Waldorf Astoria Maldives Ithaafushi, Conrad Maldives Rangali Island and SAii Lagoon Maldives, Curio Collection by Hilton.

Located on Amingiri Island in the Male Atoll, the resort will feature 109 beach and water villas, each with a private pool, including an exclusive six-bedroom villa. A pool, spa, kids’ club, fitness centre and salon will also be available.

Guests can enjoy an array of dining options from the resort’s six restaurants and bars, including Habitat, the resort’s all-day dining restaurant; Re-Fuel, a teens-only zone with a rooftop deck; and Eden, an adults-only destination bar specialising in champagne and gin-based drinks.

Malaysia hotel sector deems new stimulus insufficient

The government should provide broader support to help hospitality players tide through the current nationwide lockdown, say the chiefs of two Malaysian hotel associations in response to the government’s latest round of stimulus aid.

The RM150 billion (US$36.1 billion) stimulus package, known as Pemulih, was announced by prime minister Muhyiddin Yassin on Monday (June 28), and is meant to provide aid to individuals and businesses affected by the extended movement control order 3.0.

Highlights of the package include a wage subsidy programme where the government will support up to 500 workers per employer, with assistance of RM600 per worker for a period of four months. This applies to all sectors for a period of two months in the second phase of the National Recovery Plan (NRP) and a further two months in the third phase of the NRP.

Currently, Malaysia is under phase one of the NRP and will only transition to the second phase when three key threshold value indicators are achieved, namely, the average daily Covid-19 cases drop below 4,000, the rate of bed usage in ICUs remains at a moderate level, and 10 per cent of the population has completed both doses of Covid-19 vaccinations.

Other highlights include a six-month loan moratorium for all income groups with no documents or conditions required in the application, and a 10 per cent discount on electricity bills for three months for economic sectors most affected by the lockdown, namely, hotel and theme park operators, convention centres, shopping malls, and travel and tourism agencies.

There is also a one-off grant of RM3,000 for travel agencies to help them kick-start their business in the third phase of the NRP. In this phase, all economic activities will be allowed to operate, except high-risk activities listed in the ‘negative’ list such as spas, pedicure and manicure providers, pubs and nightclubs.

While the new measures announced will provide some relief to the hospitality industry, hotel associations have noted that it is insufficient to help their members survive in the coming months.

N Subramaniam, president, Malaysian Association of Hotels (MAH), said that the Pemulih package did not address the specific needs of the tourism and hotel industries.

He stressed that the fixed quantum of 10 per cent discount on electricity bills is hardly sufficient, considering average hotel occupancy is at most 20 per cent for the coming months due to extended travel restrictions.

He added: “Although the government recognises the impact on the tourism industry, the one-off financial assistance of RM3,000 is only offered to travel and tour operators. Hotels are not included, although they are sustaining heavy losses and cash flow burden.”

While MAH welcomed the “blanket” loan moratorium that could provide much-needed relief, Subramaniam opined that it should be interest-free to ensure borrowers do not fall into deeper debts.

Malaysian Association of Hotel Owners executive director, Shaharuddin M Saaid, shared there was nothing “extra” or “special” in the stimulus package that could help hotels survive in the coming months.

He asked: “How are hotels to survive when inter-district and interstate travel are not allowed? Hotels are allowed to operate but not allowed to take guests for tourism and no dine-ins are allowed.”

Shaharuddin also pointed out that the wage subsidy programme will only kick-in when the NRP moves into Phases 2 and 3, with the timeline uncertain. He added that the way forward would be for the government to meet with industry players to devise a workable tourism restart plan.

The crash in international tourism due to the coronavirus pandemic could cause the global economy to lose more than US$4 trillion for the years 2020 and 2021, according to a recent United Nations Conference on Trade and Development (UNCTAD) report.

The estimated loss has been caused by the pandemic’s direct impact on tourism and its ripple effect on other sectors closely linked to it.

The report, jointly presented with the UN World Tourism Organization (UNWTO), said international tourism and its closely linked sectors suffered an estimated loss of US$2.4 trillion in 2020 due to direct and indirect impacts of a steep drop in international tourist arrivals.

UNCTAD warned that a similar loss may occur this year, and that the tourism sector’s recovery will largely depend on the uptake of Covid-19 vaccines globally.

“The world needs a global vaccination effort that will protect workers, mitigate adverse social effects and make strategic decisions regarding tourism, taking potential structural changes into account,” UNCTAD acting secretary-general Isabelle Durant said.

UNWTO secretary-general Zurab Pololikashvili said: “Tourism is a lifeline for millions, and advancing vaccination to protect communities and support tourism’s safe restart is critical to the recovery of jobs and generation of much-needed resources, especially in developing countries, many of which are highly dependent on international tourism.”

The report also noted that tourism losses are reduced in most developed countries where Covid-19 vaccinations are more pronounced, but vaccine inequality has left developing countries still reeling in the doldrums.

Covid-19 vaccination rates are uneven across countries, ranging from below one per cent of the population in some countries to above 60 per cent in others.

According to the report, the asymmetric rollout of vaccines magnifies the economic blow tourism has suffered in developing countries, as they could account for up to 60 per cent of the global GDP losses.

A faster tourism recovery is expected in countries with high vaccination rates, such as France, Germany, Switzerland, the UK and the US, said the report.

However, UNWTO highlighted that experts don’t expect a return to pre-Covid international tourist arrival levels until 2023 at the earliest, due to travel restrictions, slow virus containment, low traveller confidence and a poor economic environment.

While a rebound in international tourism is expected in the second half of this year, the UNCTAD report still showed a loss of between US$1.7 trillion and US$2.4 trillion in 2021, compared with 2019 levels.

The report assessed the economic effects of three possible scenarios – all reflecting reductions in international arrivals – in the tourism sector in 2021.

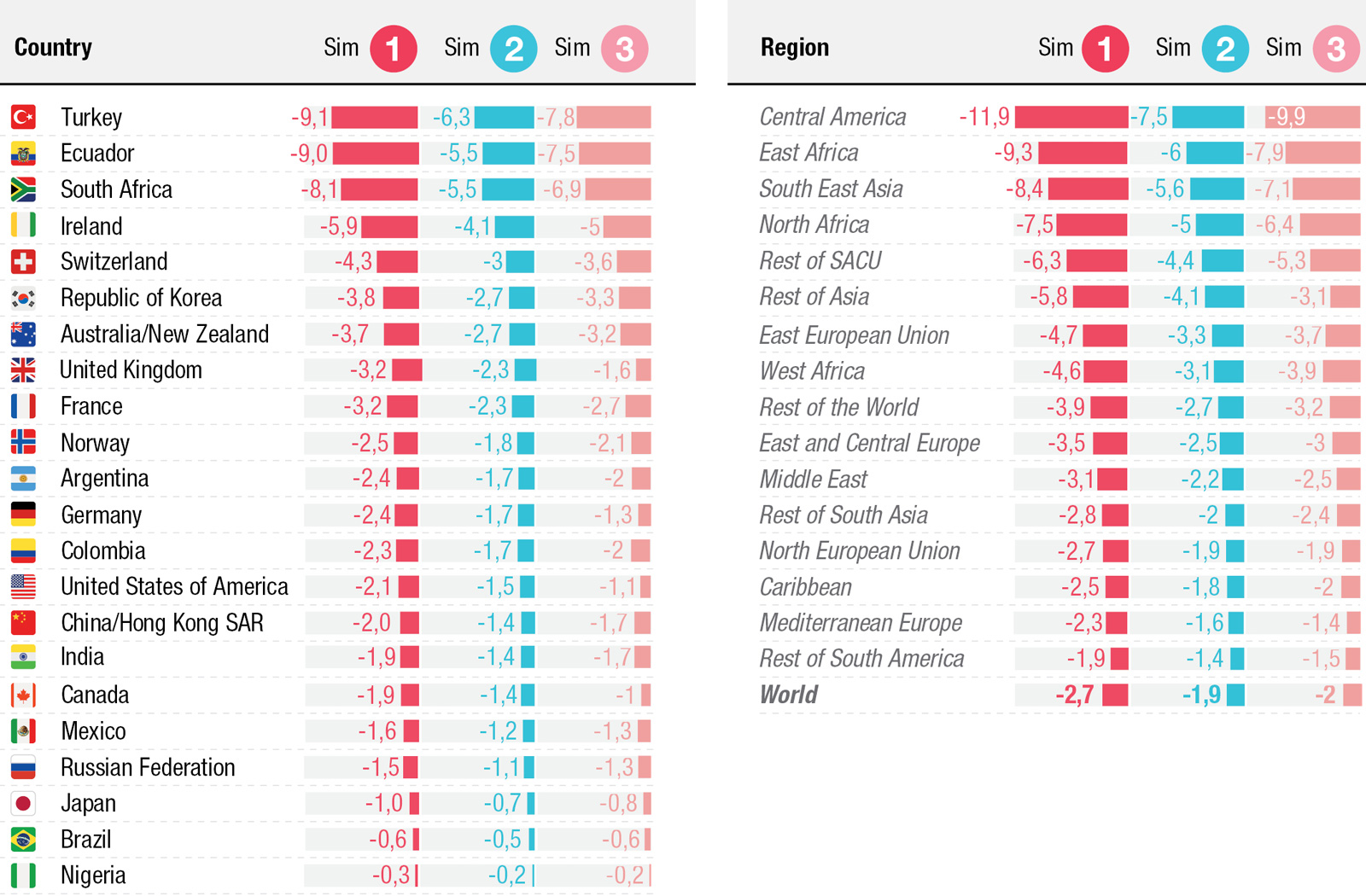

Figure 1: As tourism falls world GDP takes a hit in 2021 (3 alternative scenarios)

The first one, projected by UNWTO, reflects a reduction of 75 per cent in international tourist arrivals – the most pessimistic forecast – based on the tourist reductions observed in 2020.

In this scenario, a drop in global tourist receipts of US$948 billion causes a loss in real GDP of US$2.4 trillion, a two-and-a-half-fold increase. This ratio varies greatly across countries, from onefold to threefold or fourfold.

Figure 2: Estimated losses in GDP by region from reduction in tourism (percentage)

The second scenario reflects a 63 per cent reduction in international tourist arrivals, a less pessimistic forecast by UNWTO.

And the third scenario, formulated by UNCTAD, considers varying rates of domestic and regional tourism in 2021.

It assumes a 75 per cent reduction of tourism in countries with low vaccination rates, and a 37 per cent reduction in countries with relatively high vaccination rates, mostly developed countries and some smaller economies.

UNCTAD said that losses are worse than previously expected. In July last year, the conference estimated that a four- to 12-month standstill in international tourism would cost the global economy between US$1.2 trillion and US$3.3 trillion, including indirect costs.

But that projection has turned out to be “optimistic”, as international travel remains low more than 15 months after the pandemic started, UNCTAD said.

According to UNWTO, international tourist arrivals declined by about one billion or 73 per cent between January and December 2020. In the 1Q2021, the UNWTO World Tourism Barometer points to a decline of 84 per cent.

Figure 3: International tourist arrivals (in thousands)

Developing countries have borne the biggest brunt of the pandemic’s impact on tourism. They suffered the largest reductions in tourist arrivals in 2020, estimated at between 60 per cent and 80 per cent.

The most-affected regions are North-east Asia, South-east Asia, Oceania, North Africa and South Asia, while the least-affected ones are North America, Western Europe and the Caribbean.