Sri Lanka placed on lockdown as Covid-19 cases spike

Sri Lanka has imposed a 10-day lockdown allowing only essential services to operate as authorities battle to contain a wave of Delta variant cases.

During the lockdown, which kicked in at 22.00 on Friday (August 20) and will last until 04.00 on August 30, all public and private sector establishments are closed, with only essential and emergency services allowed to remain open.

Sri Lankan authorities has since last Monday imposed an indefinite nationwide night curfew from 22.00 to 04.00 daily, along with a ban on social gatherings, public events and seminars.

The latest lockdown follows appeals from the medical profession, trade unions, civil society groups and Buddhist religious dignitaries for tighter mobility restrictions in the face of worsening Covid-19 case numbers.

On Friday (August 20), Sri Lanka reported a record daily rise in Covid-19 cases for the third consecutive day, reporting 3,839 new cases, up from 3,435 a day on August 15; with 195 deaths. The new infections bring the total tally to 381,812 and 6,985 deaths.

Opposition parties and trade unions in the country have accused the government of under-reporting the number of Covid-19 cases.

Meanwhile, Sri Lanka Tourism (SLT) officials said only fully vaccinated Indians would be allowed entry into Sri Lanka, in effect since August 19. India is Sri Lanka’s biggest source market but the rising number of Covid-19 cases in India has led to this cautious approach.

In a statement, SLT said that Sri Lanka will continue welcoming international travellers during the lockdown with majority of the tourist attractions to remain open. Since reopening to tourism in January this year up to July 31, the country has received a mere 19,337 arrivals, a sharp drop from last year.

In another circular, SLT said nationals of South American countries and South African countries – South Africa, Angola, Botswana, Lesotho, Mozambique, Namibia, Swaziland, Zambia and Zimbabwe – are not allowed entry into Sri Lanka.

Phuket readies to welcome Russian tourists with nod for Sputnik vaccine

Tourism stakeholders in Phuket are anticipating the return of Russian tourists to the southern Thai island, following the approval of the Sputnik vaccine by the Thailand’s Centre for Covid-19 Situation Administration.

Phuket has for years been a very popular destination with Russian travellers, peaking in 2019 with more than 700,000 arrivals over a short five-month period, all arriving on direct flights from Russia. A total of 1.4 million Russians visited Phuket in 2019.

The traditional snowbird period from November to March is when temperatures drop severely in Russia and also in many parts of northern Europe, signalling travelers to take flight for the tropical chimes and clear blue skies of Phuket.

“This is great news for Phuket. It’s time to go beyond the Sandbox and build a foundation for a broader tourism initiative,” said Phuket Tourist Association president, Bhummikitti Ruktaengam. “The industry can now get back to basics and focus on the northern European winter season. This is a big opportunity for Phuket. These are our legacy markets.”

Laguna Phuket, an integrated destination in the popular Bangtao Beach area, consisting of seven hotels and a Bangkok Hospital-operated PCR test centre, has already been a beneficiary of the Phuket Sandbox, but this is a major step up, according to its managing director, Ravi Chandran.

“The acceptance of the Sputnik vaccine is a game-changer for Phuket,” he said. “The outbound Russian market is the biggest one in the world outside of China and the timing is perfect with the high season starting in November this year. Phuket Sandbox has proven to be a success and this will now take these achievements to greater heights still for all hotels, tourism stakeholders and the local community on the island.”

Since July 1, more than 300,000 hotel rooms have been booked up until the end of August by international visitors arriving via the Phuket Sandbox initiative. The number of foreign tourists is expected to rapidly rise as the high season approaches, with scheduled and chartered Russian carriers set to arrive in Phuket from October 2021.

Talking about ‘ready-made’ market potential, C9 Hotelworks managing director, Bill Barnett, said that “coming into the 2021 winter wonderland, and changing marketplace, the Russians, who typically have a 11-12-night average length of stay, are a perfect fit for the Sandbox.”

Singapore-Hong Kong travel bubble bursts

Singapore and Hong Kong have shelved plans to launch the twice-delayed travel bubble that would have allowed quarantine-free travel between the two cities.

The decision was reached following a discussion between Singapore’s transport minister S Iswaran and Hong Kong’s secretary for commerce and economic development Edward Yau, Singapore’s Ministry of Transport (MOT) said in a statement. Both sides agreed not to pursue further discussions on the air travel bubble (ATB) at this point, it added.

“In Singapore, a substantial proportion of our population is fully vaccinated. Hong Kong too is progressively vaccinating its population. Both sides are focused on keeping our populations safe and preventing the risk of imported cases,” MOT said.

“But our strategies differ, with Singapore now taking steps towards becoming a Covid-resilient nation. Against this backdrop, both parties agreed that it would not be possible to launch or sustain the ATB in its present form.”

Both Singapore and Hong Kong reaffirmed the importance of maintaining connectivity between the two cities, given that both are major aviation hubs.

Singapore announced last week that all travellers from Hong Kong and Macau will be able to enter the city-state without having to serve quarantine if they test negative for Covid-19 upon arrival.

However, Hong Kong has tightened its border control measures, with vaccinated travellers from Singapore now having to serve a 14-day quarantine, up from seven days.

MOT said that Singapore and Hong Kong will continue to explore new ways of strengthening connectivity and links with each other, and revive the air travel between the two cities.

Varying Covid-19 restrictions nationwide hamper Indonesia’s tourism recovery

The Indonesian government’s ever-changing pandemic rules, coupled with restrictions of varying levels nationwide, have stirred up confusion among industry players, and sparked concerns that it could serve as a major deterrent to travel.

In North Sumatra, for example, the government has imposed public mobility restrictions or PPKM level 4 – the highest level of restrictions – in Medan and Pematangsiantar cities, while other cities in the province are in level 3 category, due to different infection rates.

Under the regulation, cities categorised as level 4 areas must close tourist attractions while those under level 3 restrictions may remain open with a limited number of visitors.

However, there are inconsistencies with regulation implementation, according to tour manager of Horas Tours, Christine Kowandi. She noted, for instance, that tourist attractions in Samosir are closed, despite the city being in the level 3 category.

Furthermore, Samosir Tourism Agency has announced that only travellers with proof of vaccination plus a negative Covid-19 antigen test result would be allowed entry when the attractions reopen.

Christine questioned the need for vaccinated travellers to present an additional negative Covid-19 test result, given that the tests, and in particular PCR tests, are expensive and have short validities.

She also pointed out a lack of standardisation in Covid measures applied to areas under the same category of level restriction. For instance, while Medan and Bali are both classified as level 4, travellers are required to show a negative PCR test result to visit Medan, while those looking to enter Bali can present a negative result of a rapid antigen test, which costs less.

In addition, although Bali and Jakarta are both under level 4 curbs, travellers checking into Jakarta hotels will need to show their vaccination certificate, while Bali hotels do not require that as only vaccinated travellers are allowed to enter the resort island.

That lack of a common regulatory framework, alongside costly Covid-19 tests, would quash travel appetite, opined Christine.

Agreeing, Fransiska Handoko, vice chairman of the Bali Hotels Association (BHA), said: “When antigen test was replaced with (the costlier) PCR test as a travel requirement during the early period of PPKM, hotels in Bali faced a wave of cancellations from domestic travellers.”

To help travellers to Bali track regulation changes, BHA has launched the welcomebacktobali.com platform which contains the latest updates and information on entry requirements for the island.

Malaysia looks to develop common framework for Muslim-friendly tourism with Indonesia and Thailand

Malaysia is keen to collaborate with the travel industry in Indonesia and Thailand to develop a common set of Muslim-friendly tourism standards in hopes of attracting more Muslim travellers to the destinations.

The initiative, proposed by the Ministry of Tourism, Arts and Culture Malaysia (MOTAC), would enhance cooperation within the Indonesia-Malaysia-Thailand Growth Triangle (IMT-GT).

Noor Zari Hamat, MOTAC secretary-general, shared that his ministry, through its agency, Islamic Tourism Centre (ITC), is willing to take the lead.

ITC was set up in 2009 with the aim of developing the Islamic tourism industry through research, capacity building, standards and certification, training and branding.

Noor Zari noted that the three countries had the potential to appeal to a greater segment of Muslim tourists – Malaysia and Indonesia ranked among the top five Muslim-friendly tourist destinations in the Global Muslim Travel Index 2021, while Thailand was among the top five non-OIC countries deemed Muslim-friendly.

Speaking at an ITC webinar entitled Understanding Muslim Friendly Tourism, he said: “As a sub-region, Indonesia, Malaysia and Thailand have rich resources in terms of beautiful and attractive natural landscapes, unique culture, history and world-renowned heritage sites, delicious cuisine, warm and wonderful hospitality and exciting events, among many others.

“These are all assets that have potential to draw the interests of not only conventional tourists, but also the lucrative Muslim tourist market.”

He called on stakeholders from Malaysia, Indonesia and Thailand to leverage each country’s strengths to establish a compelling and attractive sub-regional tourist destination so as to capitalise on the pent-up travel demand among Muslim tourists post-pandemic.

Uzaidi Udanis, president of the Malaysian Inbound Tourism Association, welcomed MOTAC’s proposal. He said: “Having a common standard assures Muslim travellers from the South-east Asia region and beyond that their faith-based needs will be met when they visit Indonesia, Thailand or Malaysia – three countries that are actively wooing the Muslim traveller.”

ITC has developed a halal standard for Muslim-friendly accommodations and is working towards establishing similar standards in other areas such as spas, tour packages and healthcare.

Rare tourism-led vaccine perks in Singapore see encouraging interest

Serviced residence Oakwood Premier AMTD Singapore is the latest tourism business to support Singapore’s fervent national vaccination drive with discounts and perks made exclusive to fully vaccinated customers.

The property’s It’s Worth The Shot offer, available from now until December 22, grants vaccinated Singapore residents S$30 (US$22) off Best Available Rate, along with a three-course dinner at the in-house restaurant, and access to hotel facilities.

While there have been many tourism companies supporting national vaccination efforts elsewhere in Asia, such as in Hong Kong where tourism giants like Ocean Park, Hong Kong Disneyland, Genting Cruise Lines and Langham Hospitality Group have conducted campaigns encouraging locals to get vaccinated, the same extent is not seen in Singapore.

Since the start of Singapore’s national vaccination drive in January 2021, most of the private sector support had come from non-tourism businesses, such as home cleaning services, car sharing providers and eateries.

Online travel platform KKDay was among the first tourism businesses in Singapore to do so. For a full month in July 2021, it gave away cruise discounts of up to S$250 to residents who have been fully vaccinated.

Co-founder Liu Weichun said: “Many Singapore residents, particularly the younger ones, are sitting on the fence as they do not see the need to get vaccinated. We believe that tourism-led vaccination perks may incentivise people to get their vaccination done earlier to enjoy the perks.”

Liu revealed that the cruise campaign attracted strong interest. “Many people even sent direct messages to us on Instagram with their vaccination status to enquire about the promo codes for cruise discounts,” she said.

KKDay continues to support the national vaccination programme with seven per cent storewide discount for vaccinated customers, promoted through the iamvaccinated.sg platform.

“The redemption rate is healthy and we do see continuous traction from this offer,” she said, adding that KKDay is exploring the possibility of securing tier-up offers from partners.

Beyond rewarding residents who have responded to the nation’s vaccination call, such initiatives also help to encourage domestic tourism spend – the only reliable source of income for Singapore’s tourism players while international travel remains largely restricted.

After Millennium Hotels and Resorts kicked off its month-long vaccination promotions for stays and dining across its six properties in the lead up to Singapore’s National Day on August 9, it saw a 20 per cent increase in staycation bookings for the month, compared to the previous month.

Paul Er, vice president sales, Asia, noted that F&B earnings benefitted too, especially over the weekends.

He said: “The new rules where only fully vaccinated patrons are allowed to dine in have definitely increased the take-up rate for our vaccination promotions. This trend indicates Singapore’s effective vaccine rollout is restoring consumer demand to pre-pandemic levels, fuelled by rising consumer confidence, pent-up demand, and accumulated savings.”

Although the hotel group’s vaccination promotions are coming to an end, Er said the company remains “committed to supporting the government’s vaccination drive through increased responsiveness and accountability”.

In the works are “creative ways for community outreach to educate, dispel misinformation, and influence behaviours”, shared Er.

At press time, Singapore’s national vaccination programme has achieved a 77 per cent fully vaccinated population, with 82 per cent having received at least one of two vaccine doses. The government has set a target of inoculating 80 per cent of its residents by September, in order to facilitate a progressive transition to endemic Covid state.

Saudi tourism opens first SE Asia office in Malaysia

The Saudi Tourism Authority (STA) has opened a commercial office in Malaysia covering the South-east Asia region as part of its strategy to engage the travel trade to raise awareness of the destination in key source markets in the region.

The Malaysia office will be responsible for trade and consumer marketing activities, expanding the reach and relevance of Saudi’s tourism offer and working with tour operators, travel agents and other industry stakeholders to build awareness and drive conversion in line with STA’s strategy and mission.

STA’s new office is being set up with the support of aviation and destination marketing representative company, AVIAREPS Malaysia, as its in-market representative covering the South-east Asia region.

“We are confident that Saudi’s diverse offering will be appealing to all demographics from the region,” said Shazlin Ahmad, country manager for STA in Southeast Asia. “We have already begun outreach into the South-east Asia’s tourism trade ecosystem and the response has been very positive. We are actively seeking opportunities to co-invest with partners who are keen to add Saudi as an exciting new destination in their portfolio.”

Since opening its borders to international tourism in September 2019, Saudi rapidly established itself as the fastest growing tourism destination in the world, according to the World Travel and Tourism Council.

Despite the global shutdown of leisure tourism in the wake of the pandemic, STA continued to invest to prepare the destination for a return to normalcy. An international brand awareness campaign launched at the beginning of 2021 extends across 26 countries and 13 languages, with significant investment in outdoor, broadcast and digital advertising.

Saudi Arabia reopened to vaccinated international visitors at the beginning of August.

To support the tourism trade ecosystem, STA is introducing Saudi Expert, a comprehensive digital platform providing partner companies such as DMCs, tour operators and other stakeholders with data, insights, destination information and creative assets in real-time to help build their businesses.

STA now has representative offices in eleven markets serving 21 countries, with an eventual goal of having 15 offices around the world.

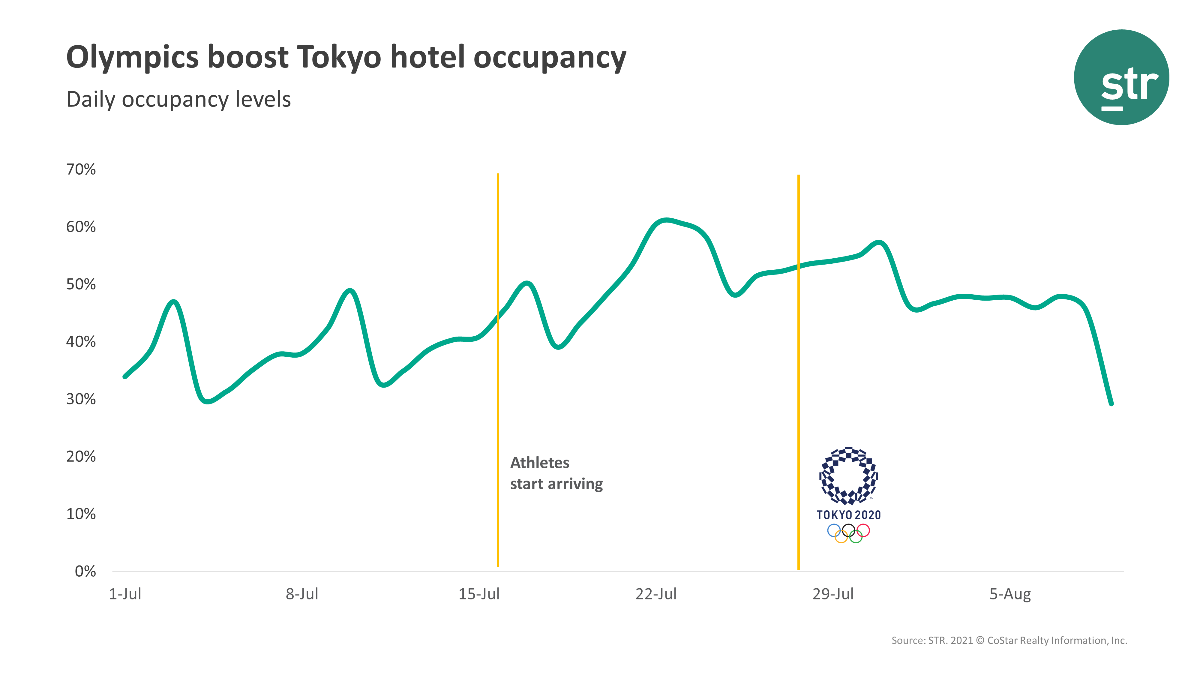

Tokyo hotels see Olympics boost

Tokyo’s hotel industry recorded its highest occupancy in 17 months when the country played host to the delayed summer Olympics, and saw a pair of days with levels that approached the peak of the state-funded Go To Travel subsidy campaign in 2020, according to data and analysis from STR.

Tokyo’s 47.2 per cent occupancy level for July was the market’s highest monthly level since February 2020. Daily occupancy reached 60.5 per cent and 60.6 per cent on the night before and the night of the opening ceremony (July 22-23). The last time Tokyo had passed the 60 per cent daily occupancy threshold was during the Go To Travel campaign on November 21, 2020.

Preliminary data for August shows that occupancy lessened over the course of the Olympics and slipped to 45.4 per cent on the night of the closing ceremony (August 8) and 29.2 per cent the night after (August 9).

“This Olympics was obviously different because of the closed-door nature of the competition, but there was still a substantial performance lift as hotels housed media, staff and a number of high-profile teams that did not stay in the athlete village,” said Shiori Sakurai, STR’s business development manager.

“This Olympics was obviously different because of the closed-door nature of the competition, but there was still a substantial performance lift as hotels housed media, staff and a number of high-profile teams that did not stay in the athlete village,” said Shiori Sakurai, STR’s business development manager.

“Aligned with our expectations and past Olympic Games, data shows an even greater lift in average daily rate as per contracts negotiated before the pandemic. However, there was no doubt a material lift to occupancy even with a number of no-shows due to the spectator restrictions and with the state of emergency in Tokyo.”

TTG Conversations: Five Questions with Donovan Soon, FDAT

Hotel architecture is getting greener, fuelled by developers’ own corporate social responsibility as well as need to align with customers’ growing preference for eco-friendly and nature experiences.

In this episode of TTG Conversations: Five Questions, Donovan Soon, director of FDAT, an award-winning architecture and design studio based in Singapore, discusses how environmental awareness is impacting sustainable architecture design, how sustainable hotel designs can shape the guest experience, and how his team has been able to work greenery and open spaces into typically enclosed hotel buildings.

JLL Hotels & Hospitality Group has launched its dedicated South Korea advisory and investment services office in Seoul, becoming the first international advisor to offer a dedicated hospitality real estate practice in the country.

Min Joon Kim, vice president, will lead the South Korea Hotels & Hospitality practice, delivering advisory, asset management, and investment sales services for the hospitality sector. He will also assist in directing Korean outbound capital as Korean institutional capital becomes increasingly important globally.

He will report to Xander Nijnens, managing director, head of advisory & asset management, Asia Pacific, JLL Hotels & Hospitality Group; and Corey Hamabata, senior vice president, investment sales, Asia Pacific, JLL Hotels & Hospitality Group.

According to JLL, the decision to establish a dedicated presence was driven by heightened activity in the South Korea market and interest from domestic and international investors.

South Korea is ranked fourth in terms of hotel transaction volume in Asia-Pacific, with US$1.4 billion transacted in 2019 and US$770 million in 2020. JLL analysis also shows that investment volumes in South Korea reached US$849 million in 1H2021, a year-on-year increase of over 55 per cent.

In establishing a local presence, JLL will look to advise clients deploying capital into hotel development projects and help facilitate increasing investment into the hotel sector through advising on all stages of the capital cycle, from acquisition to optimisation and disposition.