Oakwood plants first Bangladesh flag in Dhaka

Oakwood will be making its entry into Bangladesh with the signing of Oakwood Hotel & Apartments Dhaka, scheduled to open in April 2022.

Located on Gulshan Avenue within Dhaka’s affluent precinct, Oakwood Hotel & Apartments Dhaka will feature a collection of 89 hotel rooms and serviced apartments, from studios to two-bedroom units.

The property will offer a range of F&B outlets, including a split-level rooftop bar, all-day restaurant, lobby lounge-café and cigar divan bar; as well as meeting and event facilities.

Oakwood Hotel & Apartments Dhaka will add to Oakwood’s enlarging footprint across South Asia in support of its goal to double the global portfolio of managed properties by 2025.

Dusit expands China footprint with Hangzhou signing

Thailand’s Dusit International has signed a hotel management agreement with Zhejiang Dahua Group to operate Dusit Thani Tianmu Mountain, Hangzhou, a luxury resort in Lin’an County within Hangzhou, China.

Slated to open in 2Q2022, the resort will comprise 160 villas and guestrooms on the outskirts of the Tianmu Mountain National Nature Reserve – a UNESCO Biosphere Reserve.

The property is located an hour’s drive from Hangzhou city centre, and 90 minutes from Hangzhou Xiaoshan International Airport. The new high-speed rail station, which links with Shanghai, is just a 20-minute drive from the property.

Resort facilities will include an all-day dining restaurant, a Chinese restaurant, an outdoor swimming pool, hot mineral pools, a gymnasium, the deluxe Namm Spa, and two ballrooms with adjoining function rooms.

Dusit International’s portfolio now includes more than 300 properties operating under six brands across 16 countries. In China, the company currently operates 10 hotels and has more than 20 properties in the pipeline.

ForwardKeys finds 2021 travel and tourism recovery to be “bumpy, patchy”

A new report from ForwardKeys, drawing on its collection of the latest and most comprehensive air ticketing data available, has identified some top developments of 2021 as the travel and tourism industry moves towards recovery.

US leisure travel leads recovery

A comparison of the world’s top destination cities, before the pandemic in 2019 and throughout 2021, illustrates the strong trend towards leisure travel leading the recovery.

Several major cities have been pushed down or out of the top 20 rankings, whereas major leisure destinations, particularly for US holidaymakers, have climbed high. While Dubai – a major leisure destination as well as a substantial travel and commerce hub – remains at the top of the list, the most notable rises include Miami from 18th to 5th, and Madrid from 16th to 10th. New entrants are Cancun (Mexico) at 2nd, Cairo (Egypt) at 9th, Punta Cana (Dominical Republic) at 12th, San Juan (Puerto Rico) at 13th, Lisbon at 14th, Athens at 15th, Mexico City at 16th, Palma Mallorca at 17th, and Frankfurt at 20th.

The two highest risers, Cancun and Miami, are major leisure destinations popular with US holidaymakers. Most of the new entrants lower down the list are also leading leisure destinations, popular with European holidaymakers. Doha, which entered at 7th, has done particularly well as a hub for transits.

Major pre-pandemic destinations, which have fallen out of the top 20 list include Bangkok, Tokyo, Seoul, Singapore, Hong Kong, Taipei, Shanghai, Jeddah, Los Angeles and Osaka.

Paralysis of Asia-Pacific

A review of worldwide travel in 2021, broken down by region, reveals the extent to which international travel was paralysed. Overall, international air travel was just over a quarter (26%) of its pre-pandemic level. The Asia-Pacific region reached just 8%; whereas Europe achieved 30%, Africa & the Middle East 36% and the Americas 40%.

A comparison of travel between the first and second halves of the year shows that global international travel more than doubled from 16% of pre-pandemic levels to 36%. However, the recovery was extremely uneven. In the Asia-Pacific region, flight arrivals grew from 5% of their 2019 level in the first-half to 10% in the second-half. In Europe, they grew from 14% to 45%; in the Middle East & Africa, they grew from 24% to 48%; and in the Americas, from 30% to 52%.

Within the regions, some countries were much more resilient to the impact of Covid-19 on travel than others. The stand-out destinations which best maintained their visitor numbers were Central America, particularly El Salvador and Belize, and the Caribbean – all holiday hotspots for US tourists. Many of them managed to record visitation rates in excess of 60% of 2019 levels throughout the year. The same degree of travel resilience was true of around two dozen countries in Africa. However, their level of resilience is a little less noteworthy because many of them have economies which are much less dependent on tourism.

A Middle East revival

Travel to various Middle East destinations has exceeded the 60% benchmark in the second-half of the year. Most notably, travel to Turkey climbed from 33% in 1H2021 to 67% in 2H2021 of pre-pandemic levels and travel to Egypt grew from 37% to 72%. Dubai held its position as the top city destination; and Doha overtook Dubai as an air transit hub.

Domestic travel has been dominant, particularly in large countries

While many countries have been able to impose severe restrictions on international travel, citing the need to keep their own populations safe, imposing equally stiff constraints on one’s own populations is politically more challenging.

Consequently, there has been a relative rise in domestic travel, particularly in geographically large countries such as Brazil, China, Russia and the US, where it is possible to fly for a few hours without crossing the border.

In China, domestic travel volumes returned to pre-pandemic levels as early as September 2020; however, they fell back in January and again in August, owing to a resurgence in Covid cases.

In Brazil, Russia, the US and China, domestic travel rose respectively to 148%, 128%, 87% and 76% of pre-pandemic levels in 2H2021, compared to 50%, 28%, 39% and 1% for international travel.

Major European airlines have struggled disproportionately

Major European airlines have struggled disproportionately

Largely due to the trend towards domestic travel in large countries, airlines in those markets have managed to weather the Covid storm better than carriers whose business has been more oriented towards shorthaul international travel.

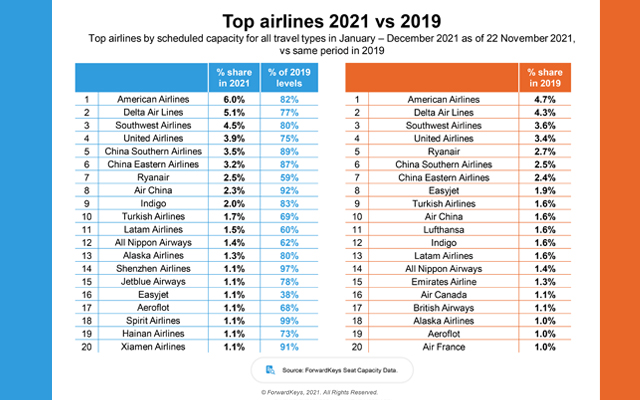

This is illustrated by an analysis of the top 20 airlines in 2021 compared to 2019. The major European carriers have all fallen down or out of the ranking; and they have been replaced by airlines which have substantial business in China and the US, which have been better able to maintain capacity.

For example, Ryanair and easyJet, the two largest European carriers, have fallen from 5th and 8th position respectively, to 7th and 16th. Lufthansa, British Airways and Air France, Europe’s largest legacy carriers, have fallen out of the top 20 list, as have Emirates and Air Canada. They have been replaced by Shenzhen, JetBlue, Spirit, Hainan and Xiamen.

Relative decline in longhaul travel

A comparison of international travel within the major world regions, intra-regional travel, and between world regions, extra-regional (or longhaul) travel, reveals a shift away from longhaul travel during the pandemic.

In 2019, the ratio of intra-regional to extra-regional travel was 56%:44%; but in 2021, that had changed to 62%:38%. The pattern has also changed, with a greater proportion of people within Europe and the Americas travelling intra-regionally rather than longhaul.

The trend can be explained by a combination of several factors, including the effective closure of Asia-Pacific, the increased cost and difficulty of travelling longhaul during the pandemic, and frequently changing pandemic travel regulations, which disproportionately deter people from booking longhaul travel, as it is typically booked and planned with much longer lead times.

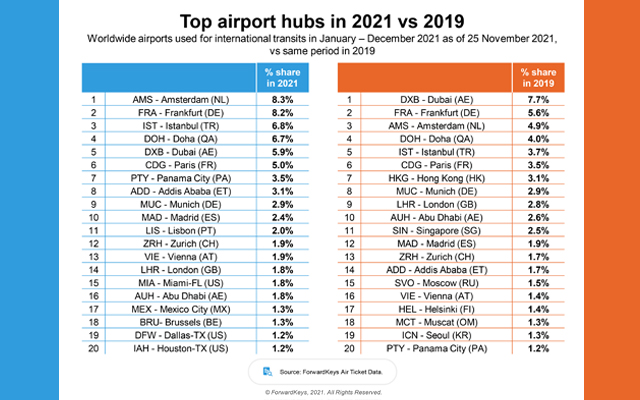

Doha, Amsterdam advancing in the battle of the hubs

In the battle of air hubs, Doha overtook Dubai to become the preeminent hub airport in the Middle East, connecting air traffic between South Asia, Middle East, North America and Sub-Saharan Africa.

In Europe, Amsterdam closed the gap on Frankfurt for intra-European transits and connections with North America.

Pre-pandemic, the top 10 list of global hub airports was headed by Dubai with 7.7% market share of intercontinental flight connections. It was followed by Frankfurt, Amsterdam, Doha, Istanbul, Paris, Hong Kong, Munich, London and Abu Dhabi. In 2021, it was headed by Amsterdam, with 8.3% share of intercontinental flight connections. Amsterdam is now followed by Frankfurt, 8.2%; Istanbul, 6.8%; Doha, 6.7%; Dubai, 5.9%; Paris, 5.0%; Panama City, 3.5%; Addis Ababa, 3.1%; Munich, 2.9%; and Madrid, 2.4%.

Analysis of monthly traffic in 2021 shows that Amsterdam briefly overtook Frankfurt in September and October, but it fell back in November. In the same month, Dubai recovered its lead over Doha for the first time since February.

New variants continue to pose a potent threat

A chart plotting the recovery in air travel shows relatively steady growth from 1Q2021, when traffic was less than 20% of 2019 levels, to 4Q2021, when it had climbed to over 50%.

However, there were two setbacks. The first began during the week of March 12, when the growth in weekly bookings turned from +11% to -10%, as the Delta variant began to sweep around the world.

The second began in the last week of October, when weekly bookings reached their highest point, 64% of same week in 2019. Bookings have been slowing down ever since; and in late November, they were down to 54% of 2019 levels, which was closely correlated with a fresh rise in Covid-19 cases since late October. It is now likely that the emergence of the new Omicron variant, and the travel restrictions introduced in response, will inhibit demand for last minute travel over the Christmas period.

Olivier Ponti, vice president, insights, ForwardKeys, said: “2021 has definitely been a year of travel recovery; but that recovery has been bumpy and patchy, with many established destinations displaced and several tourism-dependent destinations making valiant efforts to retain the patronage of leisure travellers. It has also been a tug of war between a strong pent-up demand to travel on the one hand and travel restrictions, imposed by governments to inhibit to the spread of Covid-19 on the other.”

Queensland to reopen borders earlier than planned

With Queensland fast approaching 80 per cent of residents being fully vaccinated, the Australian state has decided to reopen its borders to fully vaccinated interstate travellers from Covid-19 hotspots from December 13 at 1.00 – four days ahead of initial schedule.

Queensland premier Annastacia Palaszczuk told local media that “nominating a time and date provides travellers and business with certainty to make their plans”.

Fully vaccinated interstate travellers can arrive by road or air, and must provide a negative Covid test in the previous 72 hours. They will not need to serve quarantine.

Fully vaccinated International arrivals must provide a negative Covid test within 72 hours of departure for Queensland, and fulfil a test on arrival. These travellers are required to serve a 14-day home or hotel quarantine.

Travellers no longer have to wait two weeks to be considered fully vaccinated; one is enough. However, all travellers from hotspots must get a test on day 5 after their arrival.

Vaccinated border zone residents will also be allowed to move freely across the border without the need for a PCR test.

Unvaccinated residents will continue to face travel restrictions.

“We will live with Covid – but on our terms,” Palaszczuk said.

Only fully vaccinated people will be permitted to enter pubs, clubs, cinemas, festivals and theme parks in Queensland from December 17.

Laguna Phuket scores on sports tourism with three volleyball tournaments

Laguna Phuket integrated resort will deliver three major international beach volleyball tournaments before the year is out, further solidifying its reputation as a destination for sports tourism.

The AVC 2021 Asian Senior Beach Volleyball Championships was held November 23 to 27, drawing athletes, coaches and officials from 10 countries in Asia-Pacific. Organised in partnership with the Sports Authority of Thailand – Phuket province, Thailand Volleyball Association (TVA), Asian Volleyball Confederation (AVC) and PPTV HD, the occasion highlighted the ability of Laguna Phuket to stage exceptional events and accommodate international visitors for safe, seamless and salubrious seafront stays.

The FIVB Beach Volleyball U19 World Championship is ongoing this week, and the FIVB Beach Volleyball U20 World Championship will follow on from December 14 to 16. Both events feature 28 male teams and 28 female teams from 48 countries and five continents.

The three events were hosted at Angsana Laguna Phuket.

Sports tourism has helped to put Phuket on the global map in recent years, and it will play a key role in the island’s recovery in the post-pandemic era.

Notable sports events hosted in the destination include the Asian Tour golf tournaments, the Laguna Phuket Marathon and Laguna Phuket Triathlon – the latter two will return in 2022.

Ravi Chandran, CEO of Laguna Resorts & Hotels, said: “Phuket is a global hub for sports tourism. With the island’s outstanding infrastructure, year-round outdoor climate and world-class hospitality, we have proved that we can stage any size of event, from small groups of active travellers to major international competitions.

“Laguna Phuket is at the heart of this sector, so we are delighted to have been able to welcome the AVB and FIVB back to the island for these important tournaments. I am confident that this will help to kickstart the recovery of Phuket’s tourism industry in 2022 and beyond.”

Hello again, elephants and otters!

Cardamom Tented Camp in Cambodia has witnessed the return of a herd of nine elephants to its conservation area, after an absence of five years, as well as a large group of smooth coated otters.

Evidence of the elephants’ return have been captured inside the 18,000-hectare forest concession, which the camp protects, with help from Wildlife Alliance and the Golden Triangle Asian Elephant Foundation (GTAEF).

While it is uncertain if the elephants are on a long migration or looking for a new home, GTAEF’s John Roberts said the herd is very much welcomed in the forests and grasslands, where there is “zero harassment”.

While it is uncertain if the elephants are on a long migration or looking for a new home, GTAEF’s John Roberts said the herd is very much welcomed in the forests and grasslands, where there is “zero harassment”.

The group of 15 to 18 otters were spotted by lodge manager Allan Michaud, and they have made Cardamom Tented Camp the centre of their territory.

Guests often see otters, macaque monkeys, kingfishers and hornbills from their boat when they travel to the camp, which is only accessible by river. The camp has created a new 4km trail, a continuation of an existing one, which now allows adventurous guests to take an 8km guided walk through the forest and return via kayak, with rest options at the main ranger station in each direction.

Part of the income collected by Cardamom Tented Camp is used to fund 12 forest rangers who protect the area from loggers, poachers and river sandbank dredgers.

Norwegian Cruise Line releases peak number of itineraries for sale

Eager to help customers make up for lost vacation time, Norwegian Cruise Line (NCL) has opened for sale the most itineraries at once in its 55-year history, with sailings from 35 departure ports, including new homeports for the company.

On offer now are cruises to Australia and New Zealand in the Asia-Pacific region as well as to Northern Europe, the Mediterranean, Alaska, the Caribbean through to October 2024, and Hawaii up to December 2025.

Highlights include new-to-brand homeport destinations, Haifa in Israel and La Romana in Dominican Republic, via Norwegian Epic and Norwegian Sky.

Norwegian Epic will make her debut in Haifa come November 2022, offering 11- and-12-day Mediterranean open-jaw sailings to and from Haifa and Civitavecchia in Rome, Italy. This itinerary will also feature 17 hours of port time in Ashdod, Israel allowing guests time to tour Tel Aviv and Jerusalem.

Norwegian Sky set off with a series of seven-day roundtrip Southern Caribbean cruises from La Romana, from January 8, 2024 through April 22, 2024, making NCL the only major cruise company sailing the region with no sea days.

Closer to home, Norwegian Spirit will return to Australian and New Zealand waters, offering 12-day itineraries that depart from Sydney and Auckland. More Asian deployments will soon be announced.

“We are proud to be able to provide our guests with an even greater selection of sailings and the best value at sea to help them plan an unforgettable cruise vacation,” said Harry Sommer, president and chief executive officer of NCL.

“So many travellers have been looking to make up for lost time and now we’re providing them with unique itineraries to check off those bucket-list destinations they may have longed for over the last year and a half. These port-rich itineraries allow our guests more time to explore unique destinations like a local and indulge in the cultural experiences around them.”

Malaysia’s on and off Omicron travel ban worries tourism players

Malaysia’s tourism stakeholders have voiced out against the federal government’s decision on December 2 to ban travellers from 26 countries from joining the Langkawi Tourism Bubble.

The announcement came after Omicron variant infections were reported in the affected countries, which include the UK, Australia, Saudi Arabia and the UAE. The health ministry said in a statement that the move was part of prevention and control measures to curb any possible spread of Omicron infection.

A day later, however, the government backtracked and announced that only eight countries – South Africa, Botswana, Eswatini, Lesotho, Mozambique, Namibia, Zimbabwe and Malawi – would be imposed with travel bans.

Tourism stakeholders expressed concern that such “flip flop stands” could jeopardise the nascent recovery of Langkawi’s tourism industry.

Anthony Wong, secretary, Malaysian Association of Hotel Owners, said the government’s flip flop decisions on the countries under the travel ban gave confusing signals to the international travel trade and the travel community.

He added: “International travel trade and the travellers will lose confidence in the destination.”

Wong, who is also the managing director of Cottage by the Sea by Frangipani Langkawi, said the property’s year-end holiday bookings from Europe have been affected by the discovery of the Omicron variant, which has also derailed the property’s marketing and promotional efforts.

Some agents from overseas have made cancellations, he shared.

Mint Leong, managing director, Sunflower Holidays, said that while she supported the government’s move to beef up border security amid Omicron’s emergence, she agreed that flip flop decisions would dent international travellers’ confidence in Langkawi and cause them to choose another destination.

She urged the government to take a firm stand and prioritise the health of its citizens.

She said: “If a decision had been made to issue a travel ban on the 26 countries to minimise the risk of the Omicron variant from entering the country through Langkawi, then the government should stick to it. It should not bow to any pressure and overturn its decision within 24 hours.”

Mega Water Sports & Holidays’ director of sales and marketing, Sharmini Violet, emphasised that tourism players in Langkawi are operating under strict safety measures and the destination is ready to continue to welcome international travellers safely.

“I hope the government would not make any rash decisions to close our key winter markets in Scandinavia and other European countries due to the small numbers of Omicron infections recorded in those countries,” she said.

Marriott to establish presence in Nagasaki come 2023

Kyushu Railway Company has signed Marriott International on for the management of its hotel in Nagasaki, Japan, which will be part of a 13-storey mixed-use development and connected to the new Nagasaki Station.

The 200-room Nagasaki Marriott Hotel is expected to open in 2023. It will be the first Marriott International property in Nagasaki, and the ninth hotel under the Marriott Hotels brand to enter Japan.

Karl Hudson, area vice president, Japan, and Guam with Marriott International, said: “This signing further underscores Marriott International’s commitment to expand its presence in Japan and we look forward to providing travelers with more opportunities to create inspiring connections and moments of self-discovery while traveling in Japan.”

Facilities at Nagasaki Marriott Hotel will include several distinct culinary dining outlets, the brand’s signature M Club executive lounge, a fitness centre, and a customisable function room for business or social gatherings.

Pan Pacific Hotels Group (PPHG) is redefining the loyalty game with the revamped Pan Pacific Discovery, as part of Global Hotel Alliance (GHA)’s reimagination of the Discovery loyalty programme.

With this elevation, members of Pan Pacific Discovery can now savour more benefits with a new easy-to-use digital rewards currency, Discovery Dollars (D$); enjoy additional discounts on room rates, dining experiences and more; move up with faster tier progression; as well as earn and spend D$ on premium hotel amenities and experiences, including all PPHG-owned dining outlets across its global portfolio.

The overhaul of Pan Pacific Discovery marks a significant shift from the previous programme, which provided member recognition based on stays and accumulated room nights.

Cinn Tan, chief sales & marketing officer, PPHG, said: “The new Pan Pacific Discovery is built around the evolving expectations of our customers, who told us that they would like a rewards-based loyalty programme.”

Under the revamp, Pan Pacific Discovery has rolled out new rewards currency Discovery Dollars, or D$. At check-out, D$ earned on previous stays can be used towards the hotel room, room upgrades, dining, spa treatments, and more. The percentage earned on eligible spend increases with membership tier status, starting at four per cent and rising to seven per cent.

Pan Pacific Discovery now offers an expanded four tiers of membership: Silver, Gold, Platinum, and Titanium. New members achieve Silver status upon joining the programme and are entitled to benefits from their first stay. Tier progression can be achieved more easily and faster through three ways: number of stays, spend across eligible purchases, and number of GHA hotel brands stayed in.

Additionally, Titanium members can now benefit from status sharing, with the option to gift their tier to a friend or family member each year. All members are eligible for additional room rate savings of 10 per cent or more.