Holiday Inn Singapore Atrium appoints new DOSM

Carina Toh has been named director of sales & marketing at Holiday Inn Singapore Atrium.

An experienced hotelier with over a decade of experience in sales and marketing, she has worked in China since 2008 and was most recently director of sales & marketing at W Xi’an.

An experienced hotelier with over a decade of experience in sales and marketing, she has worked in China since 2008 and was most recently director of sales & marketing at W Xi’an.

Hong Kong unveils more support for travel and tourism industry

More initiatives to support Hong Kong’s travel and tourism industry have been detailed, following the government’s 2023/24 budget announcement last week.

The Travel Agents Incentive Scheme, which is due to expire end of March 2023, will be extended by three months. New schemes for fully guaranteed loans will be offered to eligible passenger transport operators and licensed travel agents, with about HK$2.7 billion (US$344 million) set aside for this purpose. Furthermore, some HK$30 million will be injected into the Information Technology Development Matching Fund Scheme for Travel Agents.

Hong Kong Tourism Board (HKTB) will also get an additional HK$200 million to fund its fight for more international business events and high value‑added visitors, allowing it to consolidate Hong Kong’s position as the premier business events destination in the region.

In response to these measures, Travel Industry Council (TIC) chairman Gianna Hsu told TTG Asia that the industry is disappointed that the proposed Travel Industry Resumption Fund had fallen through.

The fund, first put forward to secretary for culture, sports and tourism Kevin Yeung by Legislative Council member Perry Yiu Pak-leung in a meeting last November, was meant to support the beleaguered travel and tourism industry in relaunching their business.

Yiu recognised that the industry needed to recruit manpower and carry out repair and maintenance for equipment and facilities that have been left idle for a long period of time, putting them under tremendous cash flow pressure as they prepare for tourism recovery.

In a press statement, TIC reiterated the financial and manpower challenges faced by its stakeholders in the present early stage of tourism recovery.

Hsu also told TTG Asia: “We wish for more supportive measures to be deployed in future. Hopefully, the government will keep monitoring our business situation and lend its support in a timely manner.”

The return of arrivals from China, a major source market, is still slow, according to Hsu. While Chinese tour groups are now allowed to travel to Hong Kong, the destination receives no more than 20 tour groups from China daily.

“It is hoped that the numbers will triple in March,” she said.

PATA forecasts bright tourism future in Asia-Pacific

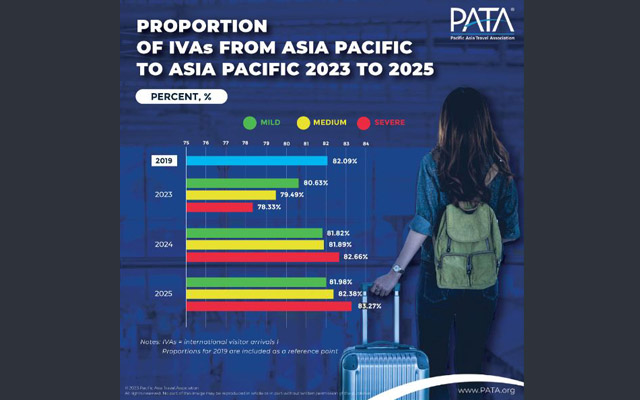

PATA’s latest forecasts predict strong annual increases in inbound visitor numbers for Asia-Pacific under each of the mild, medium, and severe scenarios in 2023, with growth rates ranging from 71% under the latter scenario conditions to as much as 104% under the mild scenario.

The report gives a deeper quantitative overview of the international visitor landscape into and across the Asia-Pacific region at the regional, sub-regional and destination levels out to 2025. This is done at both the annual and quarterly levels over the same period, and by scenario. In addition, the growth in key source markets between 2023 and 2025 is forecast for Asia-Pacific as a whole, and for each of the regions/sub-regions.

The annual increase in the absolute number of international visitor arrivals (IVAs) in 2023 is predicted to range from 158.7 million to 437.5 million under the severe and mild scenarios respectively, lifting the total volume of visitor arrivals to between 382.9 million and 712.7 million, under those same scenarios.

Substantial annual increases in IVA numbers are also forecast for 2024 and 2025, under all three scenarios, although the volume of these gains will slowly reduce over the years as the absolute volume base of foreign arrivals increases.

The impact of these increases is such that under the mild scenario, a return to better than the benchmark number of IVAs in 2019 is predicted to occur in 2023, while under the medium scenario that position is projected for 2024. Under the severe scenario, however, even by 2025, the volume of international visitors into and across Asia-Pacific is forecast to still fall short of the 2019 benchmark by around 12%.

The mix of source regions is forecast to remain dominated by flows from Asia-Pacific markets into Asia-Pacific destinations, with 2025 expected to return to roughly similar proportions as that of 2019, under all three scenarios.

These intra-regional proportionate flows differ for each Asia-Pacific destination region, however, especially for the Americas and Asia, both of which rely heavily on intra-regional visitors. The Americas accounted for 55.4% of visitor numbers in 2019, and this is predicted to gradually increase to between 56% and 57% in 2025, depending on the scenario that plays out at that time. The Asia-to-Asia flows accounted for 80.4% of total IVAs for that region in 2019, and this is forecast to reach between 80% and 82% by the end of 2025.

The Pacific as a destination region within Asia-Pacific is somewhat different, however, since its source regions in 2019 were dominated by Asia which had a slim margin over the Americas. Those positions are forecast to change over the years to 2025, at which time both source regions under the mild scenario are predicted to generate roughly equal proportionate shares of IVAs into the Pacific. Under the medium and severe scenarios, however, the Americas is projected to have a slight relative share dominance in delivering IVAs into the Pacific by the end of 2025.

As IVA growth builds between 2023 and 2025, it is worth noting that the source markets of Asia collectively generate the bulk of the additional annual increases in absolute numbers of arrivals across Asia-Pacific each year. Under the mild scenario, for example, the annual increase in IVAs from Asia in 2023 are forecast to number 330.7 million and account for three-quarters of the net increase in total IVAs between 2022 and 2023.

Across the years and under all scenarios, the visitor footprint of the Asian source markets, at the aggregate Asia-Pacific level, is predicted to remain very strong. The Americas already has a strong intra-regional visitor flow, and forecast to receive more than half of its annual increase in IVAs in both 2023 and 2025, under the mild scenario, from source markets within that same region. That proportion is predicted to reach as much as 68% under the medium scenario in 2024 and 78% under the severe scenario in that same year, and although the proportions may reduce a little by 2025, they are still predicted to favour the Americas as the main generator of annual IVA growth in absolute numbers into that same region.

“These current forecasts are easily the most positive since 2019 and while inbound numbers are predicted to strongly increase each year to 2025, they will not do so evenly across the Asia-Pacific destinations nor at the same rates. In addition, growth will not necessarily be by passive osmosis; work needs to be done for destinations to remain competitive and to deliver experiences to these visitors that consistently rate above and beyond their expectations. A blatant profit-grab at this time will resonate badly with visitors now and will work against destinations and operators in the future,” noted PATA chair Peter Semone.

“Now more than ever before, destinations need to work with host communities, operators, and visitors to deliver results and experiences that bring the best of the travel and tourism sector to the fore, across all involved parties and in a responsible, equitable, meaningful, and thereby sustainable manner. Such an approach will also create a certain resilience to future shocks as and when they appear, and rest assured that they will,” he added.

View the PATA Asia Pacific Visitor Forecasts Full Report 2023-2025 here.

Thai hospitality industry players split on new tourism fee

The Thai government’s decision to charge international travellers an entry fee of up to 300 baht (US$9) from this June has attracted mixed views from the country’s travel and tourism players.

Dan Fraser, founder of destination management and tour company, Smiling Albino, believes the fee is justifiable.

“It is reasonable to have a tax on inbound arrivals, many countries do it, and it is almost always built into the cost of an airline ticket or similar. I think if we look into the data, we’ll see that studies probably review it has almost zero net effect on tourism members. Much like the cost of expressways, people need to get places, and the cost probably doesn’t deter participation,” he told TTG Asia.

Fraser added that the entry fee is a way for Thailand to boost tourism revenue after years of pandemic struggles.

He said: “Introducing fees like this is a reasonable way to bring in some additional revenue on a per-user basis rather than an additional tax on the population.

“Short-term or long-term, it will have zero effect on people’s decisions to travel to Thailand, and very quickly, people will forget that there is even a fee, as it is not visible.”

On the other hand, Hat Yai Songkhla Hotels Association’s president Sitthiphong Sitthiphatprapha had stated in the Bangkok Post that the entry fee could impede tourists, especially those from Malaysia.

“A family of four would have to pay 600 baht to enter by land, which would result in a longer decision-making period for travelling families. Although an exemption has been made for those holding border passes, 80 per cent of arrivals over the border are using their passports,” he said.

Reserving his judgment for now, Dieter Ruckenbauer, general manager, Le Méridien Bangkok, wants clarity on how the collected fees will be spent.

“If the funds are used to enhance the tourism industry, such as the development of local attractions, investment in tourist services, and business support, then it could be a good idea. But we need to wait for the government to reveal its budget and spending information to the public before we can make a judgment,” Ruckenbauer stated.

Dirk De Cuyper, CEO of S Hotels & Resorts, suggested identifying this tourism fee as a green tax or development tax to reverse the negative narrative.

“Using taxes to enhance sustainability is something we should all get behind and get used to. However, there should be a transparent approach which shows how these funds will support the development of tourist destinations and encourage a shift towards longer-staying, higher-spending guests,” he added.

In earlier news reports, Phiphat Ratchakitprakarn, minister for tourism and sport, justified the charge, saying that the fees would be used to support the care of tourists while in the country. The government expects to collect up to US$115 million this year from the tourism fee.

The minister cited reports of the two-year period between 2017 and 2019, when tourists’ use of public hospitals cost the country 300 to 400 million baht.

The process of collection worries a Bangkok-based industry veteran, who leads one of the region’s top DMCs. “I don’t see how it can be levied practically. The only way for it to be collected efficiently is for it to be done by the airlines. But, as the government has said they won’t charge Thais and residents with work permits when they fly into the country, it isn’t reasonable to expect carriers to carry out this level of bureaucracy,” he commented.

AirAsia, Plusgrade to offer upgrade choices for travellers

AirAsia and Plusgrade have teamed up to allow AirAsia customers to bid for upgrades and reserve the seat(s) beside them for extra space and comfort.

The deal was unveiled at the Aviation Festival Asia held in Singapore.

The partnership will offer ancillary services to customers such as upgrades or the ability to reserve open seats beside them, and enable them to experience premium products and services that might otherwise be out of reach – which in turn helps drive revenue for the airline too.

Ken Harris, CEO of Plusgrade, said: “We look forward to supporting AirAsia as they continue to innovate and develop new products and services for their customers, and to expanding our footprint in the thriving Asia-Pacific region.”

Karen Chan, group chief commercial officer at AirAsia shared that the collaboration “will enable us to offer more passengers the chance to access our premium products and services” such as flatbeds or popular seats with extra legroom.

“We are confident that our guests will love this innovative and seamless way to enhance their travel experience,” she added.

Arival | Activate conference to be held in Bangkok in June

The Arival | Activate conference will take place from June 12 to 14 at the Bangkok Marriott Marquis Queen’s Park in Thailand this year.

The event will bring together leaders from the experiences industry – tours, activities and attractions – to delve into the major trends shaping travel’s third-largest and fastest-growing sector.

It aims to help experience creators and sellers re-activate their businesses after the pandemic, and will highlight shifts in consumer behaviour that are shaping travel experiences across Asia-Pacific and Oceania in 2023 and beyond.

“Experiences are now a primary driver of travel, with three in five Gen-Z and millennial travellers prioritising experiences over things,” said Douglas Quinby, co-founder and CEO of Arival. “But traveller expectations and behaviour have changed dramatically as the Asia and Oceania regions have emerged from the pandemic.

“The Arival | Activate Bangkok conference will deliver the insights, tools and connections that tour, activity and attraction businesses need to gain a competitive edge in this dynamic new landscape.”

The conference – which has secured Klook, Viator, Go City, TUI Musement, BeMyGuest and Headout as partners – will feature an impressive speaker roster spanning many of the experience sector’s most well-known brands.

More than 500 attendees from across the tours, activities, attractions and experiences sectors are expected to attend.

Quinby noted that travellers are “prioritising memorable activities that connect them with local cultures, history and people” post-lockdown.

“They are prepared to pay more for meaningful experiences, and areas such as outdoor pursuits, sightseeing and small group or private tours have grown significantly in popularity since the pandemic. This puts the experiences sector in the limelight, creating a golden opportunity for companies that can give their customers what they want.”

Delegates can expect to gain an in-depth understanding of the entire online ecosystem, alongside the most pertinent trends that are shaping travel in the Asia-Pacific region. Topics will include tapping into revenue opportunities from pent-up travel demand, how new technologies can help enable growth, and how food tourism continues to gain traction in the dynamic new experience-focused travel industry.

Princess Cruises sails to Japan for 2024 season

For Princess Cruises 2024’s season, Royal Princess will mark the first Royal-Class ship to sail in Japan, with a series of cruises on offer as well as four breath-taking summer festivals to experience.

Royal Princess will sail a new Japan and North Pacific Crossing, calling to the northern Tohoku and Hokkaido regions during the cherry blossom season with the option to combine with the cruise line’s popular Voyage of the Glaciers cruise to witness the glaciers of Alaska. Guests can opt to disembark in Anchorage (Whittier) for a 15-day voyage or continue to Vancouver for a 22-day cruise. The cruise departs Tokyo (Yokohama) on April 27, 2024.

Diamond Princess returns to Japan for a March through August 2024 season, sailing roundtrip from Tokyo (Yokohama), calling to 35 destinations in three countries on 31 itineraries and 36 departures, ranging from seven to 23 days.

Diamond Princess will offer a series of four 10-day Spring Flowers voyages, calling at all four of Japan’s main islands to experience various festivals with late-night stays in each port, such as the Kumano Fireworks Festival (August 17), a display of over 10,000 fireworks visible from the decks of the ship.

Additionally, Diamond Princess will sail on nine-day Southern Islands voyages that call to two Okinawan ports and two Taiwan ports; nine-day and 10-day Sea of Japan voyages that will feature ports along the historic Kitamaebune trading route; 10-day Hokkaido voyages that will visit Otaru (for Sapporo), Hakodate and Kushiro; and the 10-day Japan Explorer voyages that will call on destinations like Shimizu (for Mt Fuji), Osaka or Kobe (for Kyoto), Hiroshima, and more.

For more information, visit Princess Cruises.

Centara Ubon welcomes guests with exclusive introductory rates

To celebrate the opening of Centara Ubon, the 160-key hotel is offering nightly rates from only 2,555 baht (US$72).

Guests will also enjoy complimentary hotel credit of 555 baht per day, early check-in and late check-out, complimentary minibar and more.

Located in Ubon Ratchathani in Thailand, the hotel features an all-day dining restaurant, outdoor swimming pool and pool bar, fitness centre, and event spaces.

Nearby are food and shopping experiences at the adjacent Central Ubon shopping centre.

This offer runs from now to June 30 for stays from March 10 to June 30.

For more information, visit Centara Ubon.

Tourism Tasmania names new CEO

Sarah Clark has been appointed the role of chief executive officer of Tourism Tasmania.

Clark has served on Tourism Tasmania’s board since September 2021 and brings significant skills and global experience to the role, having been a leader in the tourism industry specialising in travel and marketing across multiple continents.

Before joining Tourism Tasmania, she was managing director ANZ at Intrepid Travel.

Before joining Tourism Tasmania, she was managing director ANZ at Intrepid Travel.

The 15th edition of the the HSBC Women’s World Championship this March will bring on the HSBC Women’s World Championship Fan Village – the first public spectator engagement since 2019.

Held at Sentosa Golf Club from March 2 to 5, tournament welcomes spectators and golf fans to partake in a variety of golf-centric experiences for all ages.

The Fan Village will include Par & Bar, a lounge where spectators can relax and enjoy signature ‘Kultails’, craft beers and artisan coffee; Putt the Skyline, where guests can putt against Singapore’s skyline; a range of local food trucks; and booths hosted by tournament partners Lexus, Ecco, F&N and Puma where experiential activities are made available.

Another highlight is the HSBC Experience centre, which will feature a pop-up store curated by The Art Faculty, a social enterprise that retails art pieces and functional gifts created and designed by individuals on the autism spectrum.

Event and ticketing information can be found at hsbcgolf.com/womens/tickets.