Brian Higgs peeks into the future of global alliances, which until now still exclude the three Gulf giants

During an era where airlines are haemorrhaging millions of dollars due to volatile fuel prices, growing competition and the global economic slowdown, carriers are seeking ways to cut costs and increase scale in order to stem the bleeding.

Signing up with a global alliance may be a tried-and-tested solution, given that an expanded reach caters to the needs of high-value frequent travellers, but also delivers increased revenue generation and cost-saving opportunities through rationalisation of members’ networks, as well as joint purchasing and marketing initiatives.

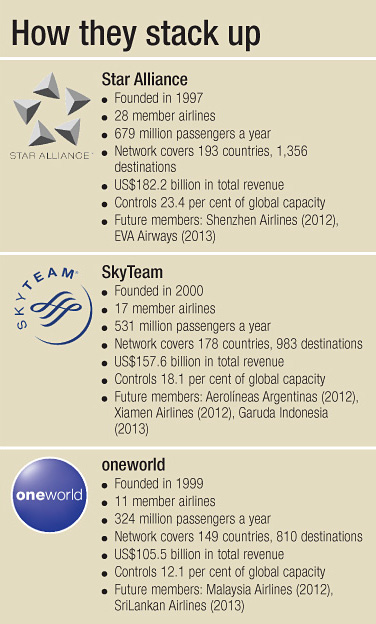

Today, the three largest passenger airline alliances in the world, Star Alliance, SkyTeam and oneworld, jointly control 53.6 per cent of global air capacity, according to CAPA – Centre for Aviation.

None, however, has managed to capture the hearts of Middle East carriers, such as Etihad Airways, Qatar Airways and Emirates, all of which have thus far refrained from entering into alliances.

These three airlines, backed by their oil-rich government supporters, have expanded their respective networks so quickly and successfully, raising the question of whether alliances are becoming irrelevant, especially in the face of increasing competition from these ‘superconnectors’.

Independence prized

Earlier at this year’s IATA’s 68th AGM & World Air Transport Summit in Beijing, Emirates president, Tim Clark, insisted that the days of alliances were numbered, especially if they failed to keep pace with fast-evolving market dynamics. “Over the past few years, there has been evidence of a new force emerging in civil aviation,” he said.

Clark pointed out that the sixth-freedom Gulf carriers, which were trying to achieve a truly global scale, would independently reach into geographical regions where alliances had carved out separate spheres of influence among members.

Emirates, for instance, has thrived on carrying passengers from West to East and vice versa via Dubai, bypassing the traditional London, Paris and Frankfurt hubs.

“There will be an (increasing) acceptance of these kind of business models, which are likely to become more prolific in the next 10 to 15 years. There are a lot of airlines, even in alliances today, that want to chart their own destiny and will want to perhaps disengage from the old way of doing business in the alliance structures,” he added.

In an earlier speech to the European Aviation Club in 2009, Clark had even gone so far as to state that “Emirates has never belonged to and does not have any plans to join an alliance”. He explained: “We see alliances as having significant anti-competitive elements and believe that our membership in one would be an artificial brake on our own business plans.”

“There are a lot of airlines, even in alliances today, that want to chart their own destiny.”

Tim Clark

President, Emirates

Winds of change

It remains to be seen if Emirates’ counterparts are indeed of the same mind. Rumours have been swirling in recent months that oneworld is exploring bringing either Qatar Airways or Etihad Airways into its fold. Even though CAPA predicts that adding Etihad Airways will only boost oneworld’s share of the world’s available seats from 12.1 per cent to 12.5 per cent, while adding Qatar Airways will boost it to 12.7 per cent, the impact of one of the Middle East carriers finally breaking ranks to join a global alliance would be truly game-changing.

What’s certain for sure is that there will be an evolution in alliance structures in the near future, which will enable individual members to express creativity in the way they grow their businesses.

“I believe that alliance structures are going to change over time, to the extent that (member) airlines will have more opportunities to expand their reach in areas where the market makes sense,” said John Slosar, chief executive, Cathay Pacific, a founding member of the oneworld alliance.

“(Alliances) will (eventually) allow growth in certain areas when players within their grouping want to do their own thing at their own pace. I see this happening because more and more carriers are reacting to the way the world is moving, with regards to the aspirations of the travelling public and multi-segmentation,” added Emirates’ Clark.

“If you align yourselves in the way that alliance structures have done in the past, which is to follow the traditional segmentation of markets, then that’s not going to be the way to survive.

“You’ve got to align to this huge opportunity that we have, which is multiple segmentation – there are far more people coming to the market and they want to travel farther than they ever did before,” he added.

Unbeatable clout

Meanwhile, advocates of global alliances continue to hold fast to their beliefs that the model is a viable one. Christian Klick, vice president, corporate office, Star Alliance said such groupings remained relevant because they feature “advantages which no single airline can offer and which frequent travellers do appreciate”.

“Only the alliances offer truly global travel solutions, where passengers are able to travel within one system to any corner of the globe, have access to more flights and routing alternatives, priority services and lounges, and superior mileage programmes that allow them to earn and redeem miles on every flight within the alliance,” he said.

Cathay Pacific’s Slosar was also adamant about the enduring value of alliances. “Alliances generate (clear) benefits (for their member airlines). They certainly generate benefits for us, and there are good ways of tracking these benefits. No airline is yet global enough to cover all the segments that customers in the various markets would like to cover.

“The point where an individual airline has enough global presence everywhere, including domestic areas, to really offer a truly global brand…that still seems to be a long way off, and till we get to that point, there’s still going to be value in alliances,” he said.

National carriers such as Malaysia Airlines, SriLankan Airlines and Garuda Indonesia seem to agree, given that the first two have signed up to join oneworld in 2012 and 2013 respectively, while the third will enter SkyTeam’s ranks next year.

SriLankan Airlines CEO, Kapila Chandrasena, said: “Joining the (oneworld) alliance will put SriLankan firmly on the global aviation map and improve Sri Lanka’s connections with the rest of the world.”

This article was first published in TTG Asia, August 24, 2012, on page 12. To read more, please view our digital edition or click here to subscribe.