Local tourism partnerships key to kindle international Chinese travel demand: GlobalData

Adapting to Chinese preferences, including promoting on China’s prime social media channels, and engaging with Chinese tour operators, will play a crucial role to stimulating international travel demand among Chinese tourists, according to GlobalData.

The company’s latest report, Tourism Source Market Insight: China, revealed that China’s international departures declined by 52.5 per cent in 2020 due to the outbreak of Covid-19.

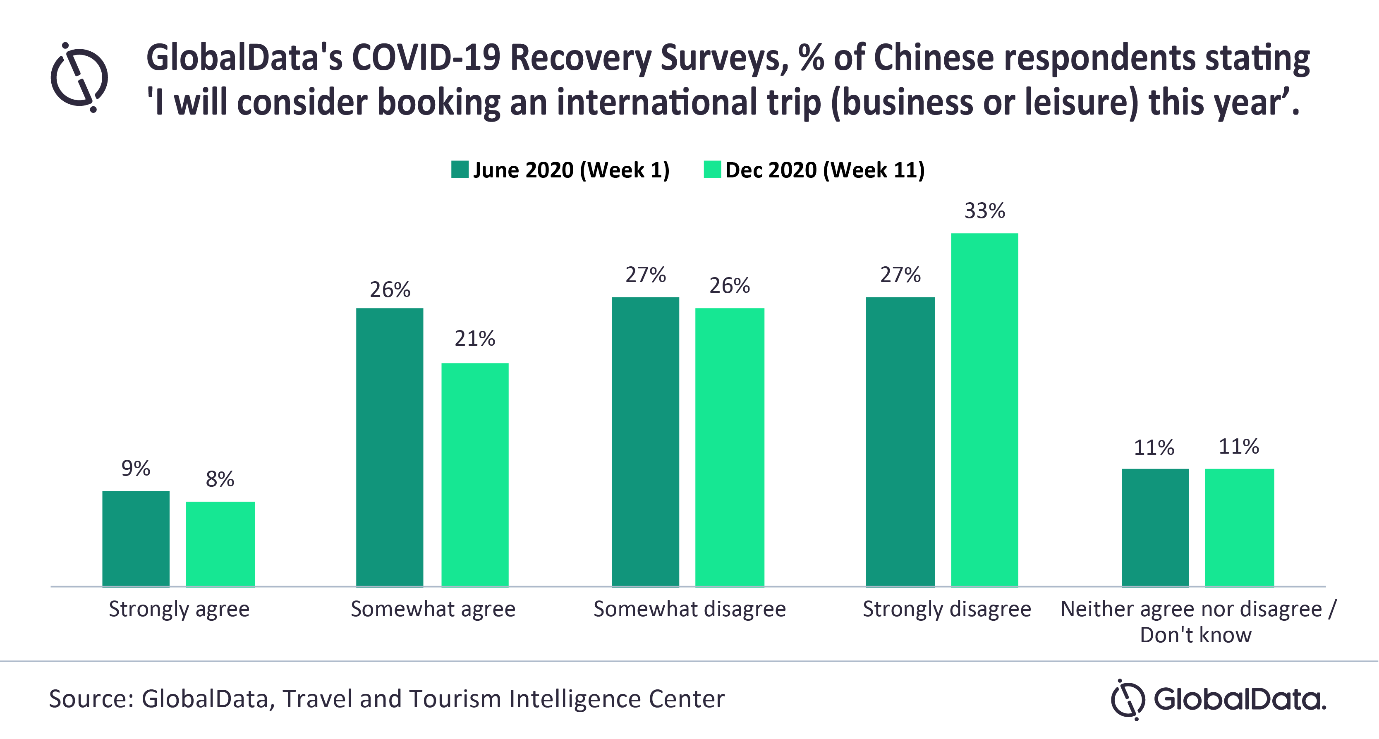

GlobalData’s Covid-19 Recovery surveys found that demand for international travel among Chinese respondents was lower in December 2020 compared to June 2020. The surveys suggested that 59 per cent of 500 Chinese respondents polled declared they would ‘somewhat’ or ‘strongly disagree’ with the statement ‘I will consider booking an international trip this year’ in December compared to 54 per cent in June.

Johanna Bonhill-Smith, travel and tourism analyst at GlobalData, commented: “Covid-19 and fears of xenophobia are both threatening the prospects of international departures from China. Additional steps are critical to interact with Chinese citizens to help spark international travel demand when travel is more easily accessible.

“Adapting to Chinese offerings such as hosting a website with Chinese language preferences or selling local tours and excursions in Mandarin can all add to the quality of a Chinese tourist’s experience. A destination that makes Chinese tourists feel welcome may be the first to see an increase in post-pandemic travel.

“Digital engagement across all verticals such as promotion, payment, advice and general experiences have always been desirable factors for Chinese tourists, but for post-pandemic travel, this will grow in importance. China’s prime social media channels differ from the Western world with apps such as WeChat, Weibo and Douyin that are heavily used. Accepting payments from WeChat or Alipay, for example, can benefit across the travel and tourism supply chain – from a company and destination perspective.”

Partnerships with Chinese tour operators is another route that can be taken, GlobalData said, citing a strong desire for familiar and trustworthy products among Chinese travellers surveyed in the aforementioned poll. Local operators will typically have first-hand experience in promoting to Chinese individuals, and therefore, have greater leverage when servicing this market. Trip.Com Group, for example, dominates the OTA market across China and has repeatedly formed partnerships with companies worldwide.

Bonhill-Smith concluded: “Even though 85 per cent of its international departures are focused on destinations across the Asia-Pacific region, China regularly features in the top 10 international arrivals for destinations across the Middle East and Europe. It is the largest and most lucrative source market globally, so engagement is now critical to battle any anti-Chinese/racism fears and stimulate future travel demand of the Chinese tourists.”

Building a future-ready hospitality workforce through upskilling

Prior to the Covid-19 pandemic, the hospitality industry had already faced severe challenges, such as the lack in digitisation, data analytics and focus on customer orientation, among other aspects.

The pandemic hit this industry in a way that’s never seen before, and this was not helped by further government interventions and regulations.

Unlike other industries, the hospitality industry couldn’t easily digitise its products and offerings (hotels, dine-in establishments, etc.) and also relied heavily on international travel, both for business and leisure. As the world came to a standstill, the hospitality industry suffered the most. Expectedly, domestic demand was not sufficient to compensate for losses, such as in the MICE sector.

So, what is the overall outlook currently? This depends on the region in question. Developed countries are in the midst of running their vaccination programmes. The expectations are that towards the end of 2021 (latest 2022), some level of normalcy in travel can be expected. Travel bubbles, which are travel arrangements on a bilateral basis, as well as some opportunities for leisure travel, are expected to be established.

Business travel is not yet expected to recover any time soon at a large scale, and same goes for the MICE industry. The situation is, unfortunately, different for developing countries, where vaccination programmes are difficult to execute due to logistical challenges, and resources for funding such vaccination programmes are limited.

There still is light at the end of the tunnel. The hospitality industry can use this time to prepare itself. A good start would be to review and refine its business models and processes, and seize the opportunity to reskill and upskill its workforce. So that once the upswing in travel and activity happens, the hospitality industry will be prepared to handle customer expectations and business environments that would have changed drastically by then.

What are the skills needed to handle these changes, and why? Customers will probably demand for more safety, flexibility, transparency, and experiences. The workforce must learn how to reach out to potential customers, win them over, manage their expectations, and retain them in the new normal. Moreover, businesses must learn to thrive in the domains of digital marketing, data analytics, and advanced operations to keep afloat.

Take the example of digital marketing. Customers are online, 24/7. The pertinent question to answer is: Is the industry ready to meet the customers there? Knowing the mechanism of the internet, such as search engines and social media, is essential.

A rigorous and extensive training of these essential skills, such as digital marketing, data analytics, and not to forget revenue management, are needed not only to acquire new customers and retain them, but also to optimise processes. And most importantly, to sell more and to sell better.

These times are challenging, and it can be argued that there are major areas of interest and focus for the hospitality industry.

Firstly, one key focus is to generate revenues while maintaining strict cost management, to allow a business to recover sooner than later, as well as repaying accumulated debts. Hence, having the right skill sets and mindsets to optimise revenues, for example, by identifying ancillary revenue opportunities, upselling and cross selling, are essential. The idea is to place emphasis on winning and retaining new customers in a cost-effective way.

The Executive Leadership Programme for Hospitality Transformation, developed by SITLEARN Professional Development as an SGUnited Skills programme, offers modules specific to revenue management and optimising financial performance that would prepare its participants explicitly for this.

Secondly, it is also important to focus on the means of reaching out to and engaging customers, and converting them into active bookers and guests. In this age of data, we should take advantage of the huge amount of data already available and learn how to utilise it for decision-making, enabling optimisation in all core areas. For this, skills in data analytics and digital marketing are essential. These topics are addressed in the Executive Leadership Programme for Hospitality Transformation, taught by the Singapore Institute of Technology faculty with vast experience in the hospitality industry.

The new generation of leaders needed in the hospitality industry must have the knowledge and skills in dealing with the challenges of digitisation, and be able to transform the industry in a way to take full advantage of it. To generate more revenue, more customers, and more profit, as simple as it sounds, are the keys to success for the hospitality industry, and skills like revenue management and digital marketing will help leaders in this industry adapt to the challenges post-Covid-19.

New hotels: W Osaka; Lux* Chongzuo, Guangxi Resort & Villas; and more

W Osaka, Japan

W Hotels Worldwide, part of Marriott International, has lifted the curtains on Japan’s first-ever W hotel. Making its debut along vibrant Midosuji Boulevard, W Osaka features 337 guestrooms and suites, all equipped with floor-to-ceiling windows, and spacious bathrooms with rain showers and luxe amenities. Situated atop the hotel’s 27th floor, the Extreme WOW Penthouse Suite – the brand’s take on the traditional Presidential Suite – is 200m2 with a 5.4m-high ceiling and five sequenced rooms divided by oak portals. The suite also features an open kitchen and a built-in DJ booth.

W Osaka’s two bars and four restaurants is led by bistro-diner Oh.Lala, helmed by acclaimed chef Yusuke Takada. Elsewhere, the Living Room serves a lineup of cocktails and the hotel’s own private-label champagne, while Teppanyakimydo offers its spin on local soul food in addition to exquisite Japanese Kuroge and Akaushi Wagyu beef. There is also Mixup offering pastries, coffee, tea and cocktails; omakase-style restaurant Sushi Ukiyo; and the Wet Bar, featuring creative cocktails. Leisure amenities include a gym, yoga room, an indoor swimming pool, and spa. Guests can also avail of four event and meeting spaces, including a 390m2 ballroom; or customise their wedding on an entire private floor at W Osaka.

Lux* Chongzuo, Guangxi Resort & Villas, China

Surrounded by lush tropical gardens with vistas of the majestic karst formations sits the Lux* Chongzuo, Guangxi Resort & Villas, Daxin County’s first international luxury resort. Located in Guangxi province separated from Vietnam by the Mingshi River, the resort will feature 50 suites and six villas in the first phase, with sizes ranging between 80 and 180m2. Led by executive chef George Qu, the resort’s five F&B venues include an all-day dining restaurant, a speciality steakhouse, a rooftop bar, and pool bar. Inspired by the European cafés and bars in France and Italy, Maison Lux* serves coffee, homemade pastries and artisanal ice cream by day, and turn into a lounge bar in the evenings offering aperitifs and digestifs. Amenities include a 35m infinity pool, a gym, kids’ club, and a spa offering traditional Vietnamese spa treatments which will open from April 2021.

The Royal Park Hotel Kyoto Umekoji, Japan

Located in Kyoto’s Shimogyo-ku district, and in close proximity to Kyoto Station, The Royal Park Hotel Kyoto Umekoji is the group’s third hotel in Kyoto, targeting particularly families with small children and friend groups. Child-friendly services and amenities include the rental of outdoor toys at the nearby Umekoji Park, auxiliary child toilet seat, diapers, kid-sized slippers, pyjamas rental, baby soaps, and toothbrush sets. The property features 246 rooms spread over six floors. Hotel facilities include a traditional public bath; a private banquet room for up to 100 people; and a restaurant providing breakfast, lunch, and afternoon snacks.

Maitria Hotel Rama 9 Bangkok – A Chatrium Collection, Thailand

Chatrium Hospitality has welcomed a new Maitria hotel to the Chatrium family. Maitria Hotel Rama 9 Bangkok – A Chatrium Collection sits just steps away from Bangkok’s latest business district, Rama 9. The newly-built hotel has all the modern conveniences. Coffee & Crumble Eatery is open from morning to evening, serving a variety of South-east Asian flavours alongside coffee and pastries. Guests can also unwind at the outdoor saltwater pool, or work up a sweat at the 24-hour fitness centre.

Marriott to add 70 hotels to Collection brands in 2021

Marriott International plans to open nearly 70 properties globally under its trio of Collection brands – Autograph Collection, Tribute Portfolio and Luxury Collection – this year.

The global expansion will include 24 new market entries.

Of the 70 properties, a total of 48 hotels are expected to join the Autograph Collection in various locations around the world, from ski resorts to European capitals and all-inclusive beach destinations.

In China, CAST Nanjing, Autograph Collection is slated for a spring opening. Set on the site of a century-old cement factory, the 110-room hotel will boast select guestrooms featuring a private hot spring.

Other locations where Autograph Collection expects to open its doors in 2021 include Singapore, Seoul, Berlin, Antwerp and Istanbul. Nineteen of Autograph Collection’s expected hotel openings this year will be immersive getaways under Marriott’s new all-inclusive platform in locations in Mexico, the Dominican Republic, Jamaica, St. Lucia, Antigua and Costa Rica.

Under the Tribute Portfolio brand, 15 new properties are planned to open in locations across the globe, from the buzzing streets of Chattanooga to the beaches of Ibiza.

Across the Pacific, The Hiyori Chapter, A Tribute Portfolio Hotel is slated to open come summer in Kyoto, Japan as the tenth Tribute Portfolio hotel in Asia. The 203-room hotel will be located in Kawaramachi Nijo, on the banks of the Kamo River.

Other locations where Tribute Portfolio plans to welcome hotels to the portfolio this year include Washington DC and Atlanta in the US, Seville in Spain, and Shenzhen in China.

Meanwhile, The Luxury Collection expects to debut four hotels in 2021, including its 120th property, Matild Palace, A Luxury Collection Hotel, in Budapest, Hungary this spring. The 130-room Matild Palace is listed as a UNESCO world heritage site and is under monumental protection.

Also in the line-up is the brand’s first-ever hotel in Tasmania, with The Tasman, a Luxury Collection Hotel, in Hobart slated to open in fall. The hotel will boast 152 guestrooms and suites residing in repurposed heritage buildings in Parliament Square.

The brand also expects to expand its footprint in Asia this spring with Josun Palace, A Luxury Collection Hotel, in Seoul, South Korea. Located in the Gangnam district of central Seoul, Josun Palace will feature 254 guestrooms, five F&B outlets and a wellness club.

TFE names new GMs for two Melbourne properties

TFE Hotels has made several appointments for two of its newest properties in Melbourne.

Lucy Ockleston has been appointed general manager of the 99-room Adina Apartment Hotel West Melbourne. Ockleston commenced his journey with TFE in New Zealand in 2011 at the Travelodge Wellington where she progressed from a F&B role to assistant hotel manager. She has also held key roles at the Travelodge Sydney and the Travelodge Hotel Newcastle.

Meanwhile, Adina Apartment Hotel Melbourne Southbank has welcomed Nigel Maxey to the position of general manager, and Emma Jarrett to the supporting role of assistant hotel manager.

Maxey has extensive experience in hospitality as both a hotel general manager and F&B specialist, including roles at Werribee Mansion and as general manager of The Jasper Melbourne. He started his TFE Hotels career in 2018 working across a variety of brands – Adina, Travelodge, Rendezvous, Vibe and The Savoy – taking him to Victoria, South Australia and Tasmania for the group.

Since joining TFE Hotels in 2013, Jarrett has worked across multiple Melbourne properties, including The Savoy on Little Collins, and was previously based in Queensland at Adina Apartment Hotel Brisbane Anzac Square for a time as assistant hotel manager.

Indonesia plans Covid-19 ‘green zones’ in Bali, five-year visas to drive tourism recovery

Indonesia’s Ministry of Tourism and Creative Economy has embarked on an aggressive effort to initiate tourism recovery, including proposing a soft loan programme worth 9.9 trillion rupiah (US$712 million), giving out a second tranche of grant funding with an expanded recipient list, as well as prioritising vaccination for tourism frontliners.

The authority has also brought up potential plans for Covid-19 ‘green zones’ in Bali, areas where travellers can visit and stay.

Additionally, Sandiaga Uno, minister of tourism and creative economy, has proposed to the related ministries for the issuance of a visa with a five-year validity targeting international visitors.

The long-term visa, Sandiaga said, would specifically target business travellers and visitors, including digital nomads, who wish to spend three or four months per year in Indonesia.

Under the plan, each individual will have to pay a deposit of one billion rupiah or 2.5 billion rupiah for their entire family. Visa holders will also be allowed to conduct investment activities in Indonesia.

Meanwhile, the government is ensuring strict compliance with Covid-19 safety protocols by issuing penalties for tourists who flout the rules.

Umberto Cadamuro, COO Inbound of Pacto, said that it is critical that the government establish “simple, clear, and strict regulations” to stem the virus spread, citing the Maldives and Dubai as role models.

He also hopes that the government will set a date for the reopening of borders to international travellers, so that the trade could plan for sales.

Budijanto Ardiansjah, director of My Duta Tour, stressed the need for a cautious approach to welcoming tourists back into Indonesia. A clear plan for post-border reopening needs to be set up by the government, including ensuring that incoming travellers are Covid-19-free, he added.

Sri Lanka revises 2021 target arrivals to 800,000

Sri Lanka has set a reduced, but still, ambitious target of 800,000 foreign tourist arrivals for 2021, far below the earlier planned 2.5 million laid out a few years back, as the Covid-19 pandemic continues to bite.

The revised target was set by the country’s Presidential Task Force for Tourism, according to an official at Sri Lanka’s Tourism Promotion Bureau.

The official, who declined to be named, said the authorities had pointed out to the Task Force that 800,000 is an “ambitious” target as based on current arrivals, the country looks set to receiving only up to 350,000 tourists this year, even with an expected surge during summer.

Sri Lanka reopened its borders on January 21 after a 10-month pandemic closure, and recorded 5,048 foreign arrivals in January-February – a steep drop from the 420,941 visitors in the same 2020 period. Total arrivals in 2020 (for the few months the border was open) was 507,704, as compared to 1.9 million in 2019.

The main source markets this year were Kazakhstan, Ukraine, Germany and Russia, according to official data.

Under current rules, there is no mandatory quarantine period on arrival but visitors must get visas online with confirmed hotel booking. They are also required to pre-purchase PCR tests and a mandatory Covid-19 insurance cover costing US$12 which covers US$50,000 worth of hospitalisation or medical bills for a month. In addition, all arrivals must present a valid PCR test taken 96 hours before arrival, while tourists have to stay in the same hotel for the first 14 days of their stay. To date, more than 30 hotels have been approved as Covid-19 certified.

To woo international travellers back, some resorts are dangling various incentives. Recently, Cinnamon Hotels & Resorts – which runs 15 properties in Sri Lanka and the Maldives – became the first hotel chain in Sri Lanka to offer free PCR tests and Covid-19 insurance for all foreign visitors to its properties in Sri Lanka.

While some industry players are urging the authorities to relax the safety guidelines, others believe that the country is still seeing too many fresh Covid-19 cases to drop its guard.

“I think it is still premature to relax the health guidelines as Sri Lanka has not come out of the woods in this pandemic and there are still many Covid-19 cases,” said Anura Lokuhetty, former president of the Tourist Hotels Association of Sri Lanka.

At least 800,000 Sri Lankans have received the Oxford-AstraZeneca vaccine, while more supplies are coming from India’s Serum Institute.

Sri Lanka has reported 88,238 Covid-19 cases and 532 deaths.

Scoot launches pre-departure Covid-19 testing trial

From March 17, all outbound Scoot passengers flying from Singapore, Indonesia and Hong Kong will be able to book Covid-19 pre-departure RT-PCR and serology tests as part of a trial service run by Collinson.

The service builds upon the pilot recently launched for Singapore Airlines, Scoot’s parent company.

The Collinson online portal, accessible via the Scoot website or mobile app, will allow passengers departing on flights to book pre-departure testing appointments with recognised and accredited partner clinics and digitally receive results within 36 hours.

Passengers will receive their serology test results directly from the clinic. However, RT-PCR test results can be obtained through the portal, with QR codes embedded within the RT-PCR result certificates, enabling digital authentication, streamlining verification and strengthening the integrity of the process.

There are plans to expand the service to other destinations in the Scoot network post-trial.

A digital verification solution from Affinidi, a Temasek-founded technology company, is also being trialled by Scoot at check-in for selected flights from Singapore, Malaysia, and Indonesia. By scanning the QR code with a secure app, check-in agents are able to quickly and reliably determine the authenticity of digital or printed Covid-19 test results bearing a verifiable QR code, issued by selected clinics. This will reduce the check-in time for passengers, thereby, improving their travel experience.

Todd Handcock, president, Asia Pacific, Collinson, said: “Helping to reopen key routes for travellers in a safe way is our utmost priority and this partnership is another step forward in our aim of achieving the long-term return of global travel.”

Campbell Wilson, Scoot CEO, added: “Through both solutions, we hope our customers can be assured of a more convenient, efficient and reliable experience when they travel with us.”

Argentina banks on Trip.com deal to lure Chinese tourists

Trip.com Group has signed a five-year MOU with the Argentina Ministry of Tourism and Sports to strengthen tourism exchange between China, Argentina and across Trip.com Group’s networks of users and partners.

Over the next five years, the two parties will collaborate on travel marketing initiatives, products and data, and fully optimise the travel experience for tourists in Argentina. This cooperation project will be launched in stages, based on the tourism industry in different target markets and in line with current tourism policies.

Leveraging Trip.com Group’s global network as an international online travel services provider, the partnership aims to drive visitation to Argentina once international travel restrictions have been lifted.

The Argentinian minister of tourism and sports, Matías Lammens, joined the signing ceremony online with his colleagues, the Argentine ambassador to China, Sabino Vaca Narvaja, and the head of the Argentine Investment Office, Leandro Compagnucci who visited Trip.com Group’s headquarters in Shanghai.

They met with Trip.com Group’s CEO Jane Sun and overseas destination marketing and government relations director Edison Chen, to discuss the future cooperation plan and jointly participate in the signing ceremony.

Sun said: “Argentina is renowned worldwide as a beautiful, must-visit destination which welcomed over seven million travellers in 2019. Once international travel resumes, we believe Argentina will be high on the list of destinations for travellers to visit due to its rich culture, breathtaking natural landscapes and incredible people.”

Lammens added: “The tourism industry plays a vital role in the economic recovery of Argentina following the pandemic. At present, the Argentine government is actively creating a secure business environment for tourism to increase the number of international tourists.”

Malaysia’s prime minister, Muhyiddin Yassin, has unveiled a fresh RM20 billion (US$4.8 billion) economic stimulus package – one year after the country imposed its first lockdown in response to the Covid-19 pandemic.

This is the sixth package to be rolled out to tackle the pandemic fallout. Dubbed The People and Strategic Empowerment Programme (or ‘Pemerkasa’ for short), the RM20 billion package will include targeted assistance to the tourism sector which has been deeply impacted by lockdowns and travel restrictions imposed to stem the Covid-19 spread.

To support the recovery of the tourism industry, the government will extend tourism tax and service tax exemptions on accommodation provided by hotel operators until year-end. Tourism companies can also defer their monthly income tax instalment from April 1 to December 31.

Muhyiddin said the tourism sector will also be provided entertainment duty exemption on admission fees to entertainment venues, including theme parks, sporting events and competitions.

The government will also give a one-off special assistance grant of RM3,000 to tourism businesses registered with the Ministry of Tourism, Arts and Culture Malaysia.

Further, the scope of special relief on individual income tax of up to RM1,000 will be expanded to include expenses on travel packages purchased from travel agents registered under the Tourism, Arts and Culture Ministry.

To assist cash flow and reduce operating costs for hotels and theme park operators, convention centres, shopping malls, local airline offices and travel and tour agencies, a special 10 per cent discount on electricity bills will be further extended by three months until June 30.

The wage subsidy programme for the tourism industry has also been extended for another three months up to end of June.

Muhyiddin also said the government will no longer impose a blanket movement control order (MCO) which restricts travel movements across the country. Instead, the government will implement a more targeted Covid-19 containment strategy backed by science and data to reduce the negative impact on the country’s economy.

The government has also beefed up its budget for the national Covid-19 immunisation programme from RM3 billion to RM5 billion to achieve herd immunity by December, rather than the initial target of 1Q2022.

While some travel trade organisations have welcomed the various stimulus initiatives, especially the easing of travel restrictions, others have bemoaned the inadequate funding for the tourism and hospitality sector.

Lauding the government’s announcement that no more blanket MCO will be imposed, KL Tan, president of the Malaysian Association of Tour and Travel Agents (MATTA), said: “MATTA has long been advocating the application of an analytical risk-based approach based on scientific data towards managing people’s movements as opposed to blanket travel restrictions. This is a positive step forward to rejuvenating domestic travel.

“The industry is also looking forward to the managed reopening of international borders now that the vaccine rollout is underway.”

Malaysian Association of Hotels president, N Subramaniam, hoped the government will consider giving higher subsidies to the tourism sector. He said: “The extension of the 10 per cent discount on electricity bills until June is insignificant, especially at times when hotels are operating at low occupancy rates.”

Agreeing, the Malaysian Budget & Business Hotel Association national deputy president, Sri Ganesh Michiel, opined that the initiatives offered little help to the struggling tourism and hospitality industry.

He proposed that efforts undertaken by the federal government should also be followed by all state governments and all government agencies that can provide assistance to the tourism and hospitality industry, as this will help to revitalise the hard-hit sector.