According to a new study by Klook, while almost four in five travellers in Asia are anxious about travelling in 2023, concerns around inflation and rising costs are not stopping travellers from packing their bags.

A majority (81%) are eager to travel internationally in the new year, with one third planning to take at least two to four trips.

In Singapore, even though 80% are worried about travel given economic uncertainties, 92% are eager to travel, with one in three Singaporeans having already booked a holiday in 2023, the highest across Asia.

Covid-19 vs rising costs of travel

In Asia, 63% of travellers are worried about the increasing price tags associated with travel, but the desire to travel appears to be even stronger, with more than 80% planning to spend the same or more on travel.

Other concerns include worrying about catching Covid-19 or falling ill while travelling (39%), language barriers (35%), and having the right travel documentation (33%).

For Singapore travellers, the top concerns are the cost of travel (70%), followed by catching Covid-19 while travelling (47%), flight delays and lost baggage (37%), transportation (37%), and availability of flights (35%).

Among the respondents, Malaysia, Singapore and Japan travellers ranked the highest for cost as a concern. However, Singaporeans are among the most excited to travel despite their worries, with 40% intending to spend more on travel in 2023.

Vacation all the way, no matter the obstacles

Despite feeling anxious about travel in the face of a looming global recession, travellers in Asia are not giving up on their travel plans just yet. 35% will opt for a nearer destination or travel during off-peak seasons, while 34% are willing to cut back on other expenses in order to save more for travel.

To allay concerns, 50% of travellers aim to plan their itinerary ahead of time to maximise the experiences during their trips, 43% will ensure that they purchase travel insurance, and 35% will look to explore less crowded places within their destinations to minimise risk and exposure.

The most popular travel length for a break for travellers in Asia is three to five days (45%), followed by six to nine days (34%), then 10 or more days (25%).

Among Singapore travellers, the most popular travel length for a break is three to five days (44%), followed by six to nine days (38%), 10 or more days (29%), and then one to two days (18%).

The year of ‘travelsilience’

Marcus Yong, vice president, global marketing at Klook shared that 2023 is the year of ‘travelsilience’ (travel and resilience), where “travellers pursue travel to create new memorable experiences, despite all struggles and any headwinds”.

Across Asia, a common thread of discovery and family-centric activities take centre stage, with museums, theme parks, zoos and animal parks leading the way for the top experiences in Asia.

There has also been strong demand for car rentals and outdoor experiences such as walking tours and trekking, suggesting that travellers are going beyond metropolitan areas and exploring areas beyond the city.

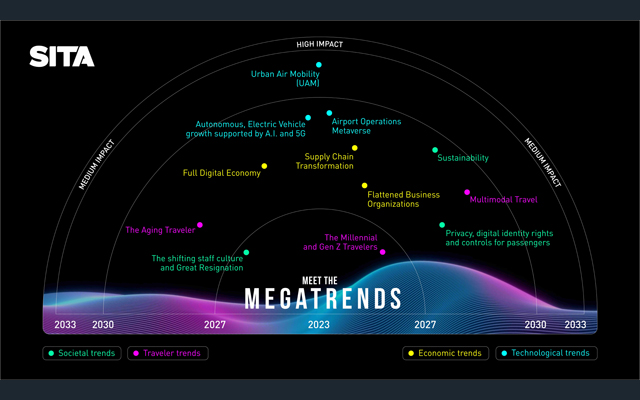

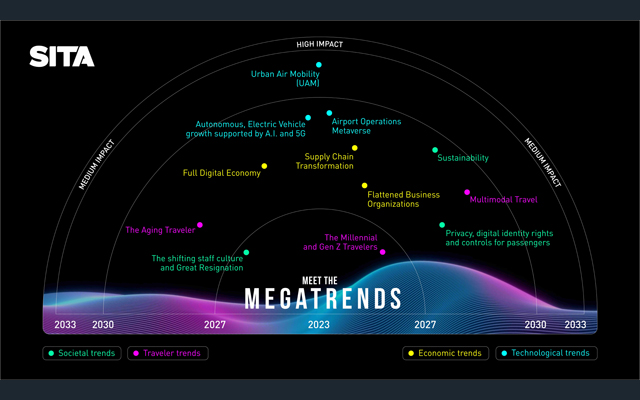

With data at the heart of this ecosystem, the increasing willingness of providers to share intelligence across the wider travel industry will help further accelerate these trends and pave the way to the more connected, seamless travel experience that passengers want.

With data at the heart of this ecosystem, the increasing willingness of providers to share intelligence across the wider travel industry will help further accelerate these trends and pave the way to the more connected, seamless travel experience that passengers want.

Bagan and Mandalay took centre stage at a recent fam trip for travel agents and social influencers from Vietnam and Thailand.

Myanmar eased its travel restrictions further in November, requiring travellers arriving on international commercial flights to show proof of full vaccination for entry instead of a negative result from an RDT.