With unicorn Airbnb and new players foraying into their turf, traditional players are redesigning tours and boosting their strengths, Raini Hamdi writes

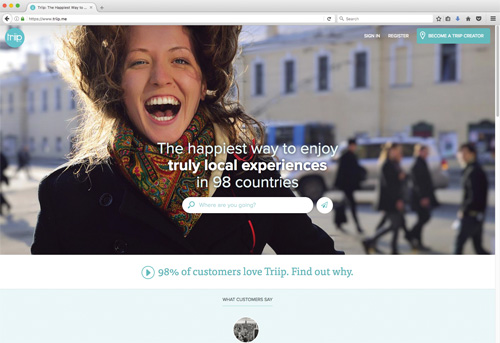

One of the local experiences offered on Triip.me, a peer-to-peer online startup that has amassed over 6,000 local experts in 660 cities in 98 countries, beckons travellers to Taste the Weirdness of Hong Kong. In three hours, Hong Kong resident Bella will take them through such unique experiences as tasting turtle jelly and snake soup, and ‘petty person beating’ – a living culture in Hong Kong where, under a flyover called Ngo Keng Kiu, professional old ladies will ‘beat’ the ‘petty person’ (boss, jealous friend, for some maybe even Trump) out of their life with a shoe.

It’s hard to imagine how ‘experiences’, compared with mere tours, will not appeal to tourists who want to ‘live there’. With the launch of Airbnb Trips last mid-November, this sharing economy space is unlikely to go away. At launch, Airbnb had claimed 500 experiences in 12 cities worldwide, and tour operators recognise it’s just a matter of time before more Asian experiences will be offered and possibly too by unicorns such as Google.

“Looking at the roll-out plans of Airbnb Trips, the focus is more into Europe, the US and South America, but Asia will be on their radar,” said Niels Steeman, Asian Trails Group e-commerce and marketing manager, who expects “a rumble” in the tours industry, just as vacation rentals has disrupted the hotel sector.

New vs traditional

Asian tour operators are watching the development keenly but believe it will take a lot for the new players to disrupt their bread and butter.

Matt Mason, managing director of Buffalo Tours in Singapore, pointed out that the knowledge, experience and connections of a DMC are hard to beat.

“There’s a lot of attention in the tours and activities space. That’s the stronghold of tour operators and DMCs.

“But I think with Airbnb specifically, it’s a big challenge from just letting out a spare room to actually giving a half, full-day or even two- or three-day tours. A lot of training needs to go into that, to deliver the kind of experience DMCs deliver. I know the amount of effort we put in, from guide and driver training, to the audits that we do to make sure all our experiences are safe. There’s a lot of intelligence behind it and it will take time for other players to build that kind of knowledge,” said Masson.

Another strength of traditional players lies in a key word, assurance, particularly in current times when crises are common. A traveller is assured that in the case of an emergency, there is always the travel agent or the land operator to turn to which Airbnb Trips may not necessarily provide, said Dynasty Travel Singapore’s managing director Clifford Neo.

And just as in home sharing, there are issues of licensing and safety standards. Said Steeman: “What worries us is, as soon as they operate tours, hosts become tour operators. In many countries within the Asian Trails Group, you need an appropriate licence to be a guide or tour operator. Another big issue is the insurance coverage of the organisers, should anything happen. At Asian Trails, we offer immersive local trips that are off-the-beaten track, but with the security of operating fully-licensed and fully-insured operations.”

Boosting strengths

With the trips sharing economy being a potential disruptor, tour operators are boosting their strengths, rethinking strategies and remaking tours.

Just like in the peer-to-peer space, Buffalo Tours has reinvented the image of the tour guide as someone in a coach who dishes out historical facts to passive tourists, to “real life” people – a colourful restaurant owner, a passionate art curator, etc – who take insights-hungry clients into their lives.

As far back as in 2014, Buffalo Tours started adapting to new tourist desires by launching Local Life, featuring tours connecting clients with local communities. A lot of these tours are done on foot, bicycle or other forms of public transport. Local Life was followed by Essence in 2015, offering more private touring, and Masterclass last year, featuring even more unique experiences such as a date with the winner of MasterChef Indonesia.

Being on the ground, knowing the hidden places, having the local contacts – “that’s where DMCs can control the experience better than an OTA”, said Masson.

Asian Trails has also reinvented tours by developing the Explore Asia programmes which are designed to deliver out-of-the-ordinary tours for couples, families and those seeking new roads within existing destinations. “The market demand (not Airbnb) constantly pushes us to deliver something new,” Steeman said.

Branding

Others believe it is also time to up their game in branding and marketing, which players such as Airbnb does with wizardry. A retail agency, Urban Rhythms Tour Adventures & Travel, Malaysia, is investing heavily on drones and video publishing software to showcase its specialised inbound tours such as mountain climbing, extreme sports and diving.

Director Nigel Wong explained: “The segment of consumers who are attracted to (the new players) are technology-savvy, looking for a convenient way to plan their holiday without having to spend much. To compete with these disruptors and others who use Facebook and claim to be local experts selling tours, or even specialised activities such as birding and diving, we have taken steps to revamp the way we market and brand our products and services. We started our first shooting in early February to promote soft adventure in Sabah, which includes mountain climbing, ecolodge stays and wildlife spotting. These videos will be uploaded on our website and we hope it will entice potential clients that we offer top-notch service and competitive pricing.”

Agreeing, Agustinus Pake Seko, president director of Bayu Buana Travel, Indonesia, urged tour operators to focus on building “a solid brand”.

“At the end of the day I believe the customer values reliability over pricing.We also need to (evolve) our distribution channel. We cannot rely on the conventional method only. We need to develop an omni-channel strategy to make sure our products and services can be accessed conveniently,” he said.

Yet others believe they should focus on the higher-yield clientele, seeing that the trips sharing economy is more for low-budget, free-and-easy travellers who are willing to take risks and do not mind the hassle of making their own travel plans.

Said Jaclyn Yeoh, managing director of Siam Express in Singapore: “Travellers in this high-end spectrum still need the expertise of travel agents. What we can provide that Airbnb Trips cannot is our personal human touch and experience.”

This article was first published in TTG Asia March 2017 issue. To read more, please view our digital edition or click here to subscribe.

Welcome back to Singapore, Adam.

Welcome back to Singapore, Adam.