Travel agents make scents with Princess Cruises

Princess Cruises hosted perfume-making sessions in South-east Asia as part of its travel advisors’ appreciation programme.

The sessions were designed to provide a mood-lifting and energy-enhancing experience through the creation of hand-made perfumes.

“We wanted to reward our travel advisors who have been working tirelessly to support Princess Cruises. Instead of a typical corporate lunch or dinner, we wanted to give them a unique experience that would be calming and uplifting as their jobs can be quite stressful at times. We also wanted to celebrate Princess Cruises’ expertise in sailing to 380 destinations globally and to evoke the memories from cruising on some of these wonderful journeys,” said Farriek Tawfik, director Southeast Asia, Princess Cruises.

During the sessions, participants could choose from different ingredients ranging from herbs and tea to a variety of floral notes to create their own unique fragrances.

The individual hand-made fragrances were then packaged in a 20ml bottle for travel advisors to take home.

These sessions were tailored by country with localised base scents. For example, in Singapore the orchid floral note was used, in Malaysia the national flower hibiscus and in Indonesia, teak.

New itineraries for the 2020-21 seasons for Asia, Europe, Alaska and Australia/New Zealand were also presented to the travel advisors.

Family Time at Rosewood hotels

Rosewood Hotel Group has developed a Family Time package for families to bond together while connecting with local cultures and communities they visit.

Available at Rosewood’s 27 properties worldwide, rates start from US$400 with a two-night minimum stay.

Each hotel will have a programme of unique experiences, allowing families to discover the destination based on one of three themes – Cultural Exploration, Culinary Bonding, and Active and Balanced.

Experiences range from visiting an elephant sanctuary at a Laotian World Heritage Site to truffle-hunting with trained canines in Tuscany; “adopting” a coral garden in Bermuda’s ocean waters; horseback riding through California’s redwood forest; and walking through the doors of a chef’s own home for an authentic Middle Eastern feast.

For more information, visit the website here.

Hylton Lipkin returns to Fusion’s fold as GM of Hue property

Fusion has hired Hylton Lipkin as the general manager of Alba Wellness Valley by Fusion, a natural hot springs resort and hotel on the outskirts of Vietnam’s imperial capital of Hue.

A South African, Lipkin has spent the last two decades honing his spa and management skills around the globe. His most recent role was as general manager of boutique Lao Poet Hotel in Vientiane.

Prior to that he was part of the Fusion organisation, working as executive assistant manager of Fusion Resort Phu Quoc, and was key in developing the property’s wellness concept.

His experience includes having worked as executive assistant manager and wellness director at Arovada by Akaryn, a private island wellness retreat in Cambodia, and the Ayurah Wellness Centers in Thailand from 2014 to 2016. Prior to that, Lipkin spent a year in India where he was head of operations for Apollo Life.

Before he moved to Asia, Lipkin worked as spa and recreation director at Angsana Resort Balaclava Mauritius from 2011 – 2013, and as regional spa director for Angsana based out of Bahrain, overseeing six spas in Egypt, Morocco, Bahrain, Qatar and the UAE from 2008 – 2011. He has also held spa director positions in Hawaii and French Polynesia.

Thomas Cook says Fosun bailout is its best option

After news of Thomas Cook being approached for takeover by its largest investor Fosun Tourism, the UK travel company reportedly said last week that the proposed £750 million (US$939 million) bailout, despite diluting shareholder value, is its best option.

The proposed deal is expected to give Fosun control of Thomas Cook’s package tour business, and a minority interest in the group’s airline business, in addition to seeing Fosun extending capital injection and new financing facilities to the ailing UK company.

“While this is not the outcome any of us wanted for our shareholders, this proposal is a pragmatic and responsible solution which provides the means to secure the future of the Thomas Cook business for our customers, our suppliers and our employees,” chief executive Peter Fankhauser told journalists.

Following the announcement of the deal, Thomas Cook shares plunged 44 per cent to a record low late last week.

The impact of reorganisation on Thomas Cook’s 22,000 employees remains uncertain, with Fankhauser telling the media that the immediate priority is to complete the refinancing of the business.

According to a report published last week, Thomas Cook has a market value of around £200 million and net debts of £1.25 billion.

The British holiday company’s tour business had 11 million customers in 2018 and produced £7.4 billion in revenue. Its airline business – which includes German holiday carrier Condor – made £3.5 billion in revenue.

The company said last Friday that summer bookings in its tour operations business were down nine per cent, while those at its airline business are down three per cent, according to Reuters.

Thomas Cook expects that cash from the deal would allow it to trade over the winter season and give it flexibility to invest.

The recapitalisation proposal comes a month after news broke of a preliminary approach by the Chinese firm.

Fosun has been purchasing tourism assets including France’s Club Med, as the industry is viewed as key to China’s shift towards a more consumption-driven model of economic growth from an investment and export-led one.

Chinese companies have in recent years been scrutinised by Beijing for debt-fuelled, big-ticket foreign deals.

Wynn Resorts unveils plans for new US$2b complex in Macau

Wynn Resorts has unveiled plans for a US$2 billion expansion of its properties in Macau including new hotel towers, an art museum, and more, Bloomberg reported.

To rise adjacent to the Wynn Palace on the Cotai peninsula, the Crystal Pavilion complex will include two hotel towers, interactive sculptures, gardens and a performance space in a glass and steel structure designed by architect Robert Stern.

Construction on the new complex will begin in 2021, with an opening scheduled for 2024.

Wynn is also planning a US$125 million renovation of its original resort in Macau.

According to the Bloomberg article, Wynn’s casino licence is due in 2022.

Casino operators in Macau are reportedly under pressure from the Chinese government to invest in non-gambling attractions.

Meanwhile, Wynn is also competing for a license in Japan, which recently legalised casino gambling.

The company unveiled an illustration of an urban waterfront resort in Japan on Wednesday as part of presentation to investors at its new Encore Boston Harbor resort.

Travel agency H.I.S. wants up to 40 per cent of developer Unizo

Japanese travel agency H.I.S. has announced plans to purchase up to 40 per cent of real estate developer Unizo’s shares for as much as 42.7 billion yen (US$394 million), in a bid to expand hotel operations, Nikkei reported.

The travel group is offering 3,100 yen a share, about 30 per cent above Unizo’s closing price last Wednesday. The offer will be open until August 23.

H.I.S. said it requested a meeting with Unizo several times between December and April to discuss potential capital and business partnerships.

Nikkei further understands that Unizo did not respond, prompting H.I.S. to acquire its current 4.79 per cent stake in the company. It is already the leading shareholder in Unizo.

In a statement released on Wednesday, Unizo said the tender offer was announced “unilaterally and abruptly”.

While H.I.S. currently earns about 60 per cent of group operating profit from the travel business, its margins are low given the small commissions on hotel and plane bookings.

Travel agencies are also facing mounting OTA competition. JTB, another Japanese brick-and-mortar player, recorded a 15.1 billion yen net loss for the fiscal year ended in March, according to Nikkei.

H.I.S. now operates 33 hotels in Japan and abroad, and is aiming to eventually hit the 100 mark.

Unizo currently owns 25 business hotels across Japan.

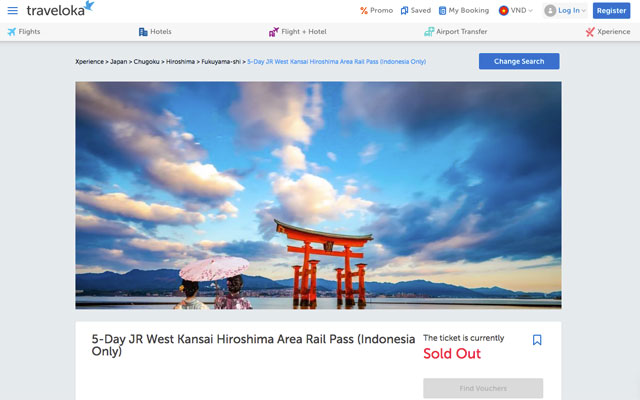

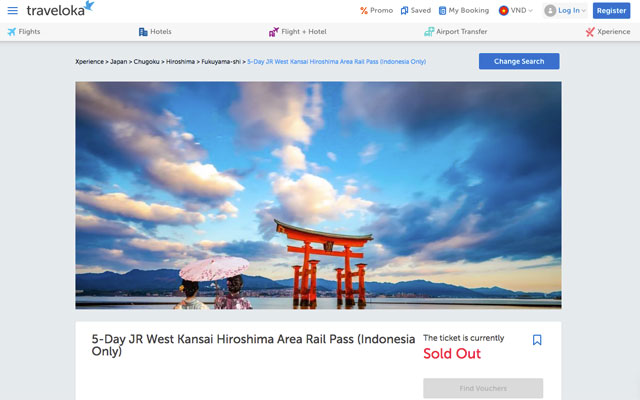

JR West passes now selling on Traveloka

Indonesia’s OTA unicorn Traveloka has become the first online travel booking platform in South-east Asia to partner directly with West Japan Railway Company (JR West) for the in-app sale of the latter’s rail passes.

The Japan Trains feature is currently available in Indonesia, with plans for roll-out to other South-east Asian countries in 2020.

Citing figures from the the Japan National Tourism Organization, KR-Asia reported that Japan has been receiving a growing number of tourists from South-east Asian nations. In May 2019 alone, Japan welcomed more than 317,000 tourists from Thailand, Singapore, Malaysia, the Philippines, Indonesia, and Vietnam.

The JR West train network covers 18 regions and includes both conventional trains and the Shinkansen high-speed train.

Users purchasing JR West passes via the Traveloka app will receive a JR Exchange Order via email, which will then need to be activated in airports or train stations and exchanged for the actual JR Pass.

Travellers can opt to activate the Exchange Order in airports or train stations with Japan Rail exchange offices or have them delivered to their hotel in Japan, according to KR-Asia.

C9 warns of stress in Phuket hotel market with pipeline set to spike

Phuket’s accommodation market is predicted to face stress in the short- to medium-term with soaring hotel supply expected to be challenged by declining tourism demand, according to new analysis by C9 Hotelworks.

The Thai resort destination has a development pipeline of 15,348 keys set to enter the market over the next five years, which represents an 18% push in total supply, C9’s Phuket Hotel Market Update Mid-Year Edition revealed.

During the first four months of 2019, considered a high season, year-on-year international passenger arrivals at Phuket International Airport slipped by 3%, while the domestic segment was down 6%.

A boat accident in Phuket that claimed the lives of Chinese tourists had prompted a sharp decline in arrivals in the second half of 2018 after a record first half of the year.

Mainland China remains at the forefront of any discussion about Phuket and the segment continues to be volatile with a 19% decrease registered this year from January through May. Russian arrivals have also declined.

On the upside, the fast-growing Indian market tripled its tourism arrival trajectory during the same period versus 2018.

Hotel performance has mirrored the current trend. Citing STR data, C9 says there is a 12% retraction of RevPAR, driven largely by lower market occupancy.

While May and September are the two lowest months for Phuket hotels, July and August are projected to experience boosts in occupancy. But the reality remains that non-high season attracts significantly lower room rates. This, C9 predicts, will undoubtedly suppress overall rate growth during the year.

The C9 report also highlights the growing influence of hotel branded residences on the Phuket accommodation market. Over 50% of the incoming pipeline or 8,337 units are being developed. Majority of these are condominium properties, with many affiliated to international hotel groups via management or franchise agreements. Despite the drop in Chinese tourists, a number of Mainland real estate conglomerates have entered the island property sector.

Still, C9 maintains that the development of the new Greater Phuket airport by AoT in Southern Phang Nga bodes well for the destination’s long-term tourism performance. C9 surmises it is probable that the current hotel sector will experience a similar cycle that Bali saw between 2014 through 201, and that new supply will eventually be absorbed on a medium-term basis. In the shorter term, however, demand remains a key risk factor impacting operators and owners.

Ascott continues expansion spree with another 26 properties

CapitaLand’s wholly owned lodging business unit, The Ascott Limited (Ascott), has signed 26 properties, set to add over 6,000 units across 22 cities in 11 countries.

The properties, which will open in phases from 2019 to 2023, are mostly signed under management contracts, with three on franchise agreements.

Through these new signings, Ascott will enter six new cities across Asia-Pacific, Central Asia and Africa. It will foray into Atyrau in Kazakhstan, Nairobi in Kenya, Yokohama in Japan, Seongnam in South Korea, as well as Cam Ranh and Hoi An in Vietnam.

Ascott has also expanded its presence in 14 cities – Melbourne and Sydney in Australia; Chengdu, Dongguan, Guangzhou, Shanghai, Shenzhen, Wuhan and Xi’an in China; Bogor and Jambi in Indonesia; Cyberjaya in Kuala Lumpur; Cebu in the Philippines; and Bangkok in Thailand.

To cater to the burgeoning middle-class segment in the region, Ascott expanded its select service business hotel brand Citadines Connect to Bangkok in Thailand, after Sydney in Australia and New York in the US. Ascott also brought the hotel brands under Tauzia, which it has a majority stake in, to countries such as Malaysia and Vietnam, beyond its predominantly Indonesia market.

In a statement, Ascott revealed that the majority of the new properties are in Asia-Pacific as the region continues to see strong demand for lodging in tandem with lower cost of travel, improving travel infrastructure and the middle-class’s growing disposable income and aspiration to travel. By 2022, global lodging sales are forecast to reach US$812 billion, with Asia-Pacific remaining the second largest market.

Capella Hotels & Resorts has launched its own programme of curated experiences for guests, incorporating interesting characters, traditions and learning opportunities.

Capella Curates’ on- and off-site tours and activities are designed by Capella Culturists, with a focus on giving guests new insights into the destination through experiences.

With vistas across the azure South China Sea, Capella Sanya was inspired by the surrounding elements of nature and Hainan’s famous, and rather mysterious, silk road trade history. The Li people are one of the most predominant ethnic minorities that inhabit Hainan’s culturally rich coast, with their history on the island dating back centuries. The Li people have an abundance of fascinating rituals and traditions, and

For example, at Capella Sanya, culturist Troy will take guests on a behind-the-scenes tour of their villages, presenting the opportunity to mingle with the Li people (an ethnic minority inhabiting Hainan’s coast) and learn more about their rich crafts and cultural heritage.

A highlight of the experience is meeting the tribe’s 79-year-old Grandma, who can share more about the infamous facial tattoo techniques practiced by the tribe.

The Capella Singapore team also created Qi & The City, a sidecar tour whizzing guests around the city to learn about the design and Fengshui principles present throughout the urban architecture. The route will take in the Marina Bay Area, Singapore Flyer, Art Science Museum, and Buddha Tooth Relic Temple, amongst other highlights.

A luxury tented camp designed by Bill Bensley, Capella Ubud offers Confined to Quarters, whereby couples can escape the humdrum of daily life with 24-hours spent in total solitude within their tent. The day begins with a traditional Balinese blessing ritual and yoga session, enabling guests to reconnect with one another and refocus, followed by a two-hour Senja massage. A cook will set up a rustic campfire in the grounds surrounding the tent, and prepare a feast of traditional dishes to be enjoyed al fresco, washed down with tailor-made cocktails. The next morning, guests can take part in a sunrise purification ritual at the property’s Wos River Temple.

Set to open on the eastern bank of the Chao Phraya in 4Q2019, Capella Bangkok offers Little Monks, designed to evoke mindfulness and clarity from an early age. The team is dedicated to encouraging guests to interact with notable characters across the city through their Capella Curates programme.