The ailing economies of Europe and the US notwithstanding, Asian airlines continue to grow and upgrade their fleet in anticipation of a stronger performance in the second half of 2012 and beyond.

Many of Asia’s airlines have garnered top accolades around the world and, apart from inflight service and food, a key contributor to this trend is their younger fleet of more fuel-efficient aircraft, which helps reduce downtime and the cost of maintenance.

Not surprisingly, Asian carriers are the first to operate new aircraft types such as the Airbus A380 (Singapore Airlines) and the B787 Dreamliner (All Nippon Airways) and feature strongly in the order books of the B747-8 Intercontinental and A350XWBs.

By the end of November 2011, a total of 1,745 aircraft were operated by airlines in China, 148 more than the previous year.

Air China is one of the three major Chinese airlines, the other two being China Eastern Airlines and China Southern Airlines. Air China currently operates 297 aircraft and has outstanding orders for another 129 aircraft.

Of its current fleet, 120 aircraft are based at Beijing Capital Airport, 27 at Tianjin Binhai Airport, nine at Hohhot Baita Airport, 66 at Chengdu Shuangliu International Airport, 30 at Chongqing Jiangbei International Airport, 24 at Hangzhou Airport, six at Wuhan Airport, three at Shanghai Hongqiao Airport and one at Tianjin Airport.

Air China also established a joint venture in August 2010 with Dalian Airlines, operating two B737-800s based at Dalian International Airport. Another subsidiary operating 10 business jets of various types was recently re-branded as Beijing Airlines. These aircraft are offered for charter.

Cathay Pacific Airways has thus far refrained from joining its competitors in ordering very large aircraft (VLAs) such as the Airbus A380 or Boeing 747 Intercontinental even as home-grown competitor Hong Kong Airlines – with the backing of the Hainan Airlines group – has ordered 10 A380s valued at USD3.8 billion.

Cathay Pacific’s CEO John Slosar said: “Both the 777-300ERs and A350s will form the backbone of our long and ultra-longhaul fleet, enabling Cathay Pacific to replace older, less fuel-efficient aircraft progressively. We will continue to evaluate all available aircraft models for our fleet needs beyond this decade but for now the fleet mix suits our business model perfectly.”

The retirement of the aging B747-400 and A340-300 fleet will pick up pace as more B777-300ERs are delivered. Cathay expects to fully retire the former by the end of the decade.

From January to November 2011, combined report by Cathay and subsidiary Dragonair shows strong growth on flights to North America and South-east Asia – 14.5 and 11.8 per cent respectively. A new air services agreement between Hong Kong and Taiwan has boosted expectations of more flights between the two. Cathay now operates 108 weekly services to Taipei and hopes to add frequencies to Taipei and inaugurate services to other Taiwanese cities. Dragonair runs thrice-daily to Taipei and six-daily flights to Kaohsiung.

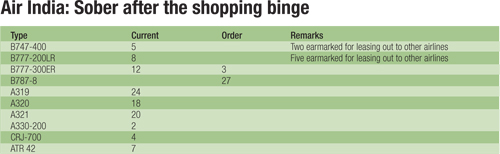

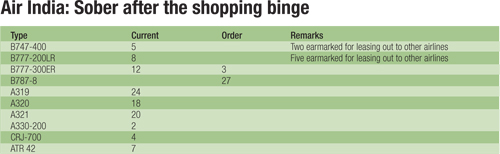

The make-up of Air India’s existing domestic and regional fleet is very much the product of its merger with Indian Airlines, while its order frenzy in the last few years has resulted in a flurry of wide-body aircraft deliveries that seem to surpass its needs.

With a fleet of B787-8 Dreamliners on the verge of being delivered – one each in January, March and April and two each in May and June – Air India has decided to sell some of these and lease them back, a move that will ease its cashflow. It has also issued a tender to lease out five B777-200LRs for a period of eight to 10 years as well as a pair of B747-400s.

Air India’s fully-owned LCC subsidiary, Air India Express, operates a fleet of 21 B737-800s.

Meanwhile, the Reserve Bank of India has approved Air India’s restructuring plans, a move that paves the way for the airline to access government funding of up to Rs30,000 crore (about US$5.6 billion) over a 10-year period.

Last year, Air India terminated its practice of operating flights from various Indian cities to Frankfurt, where passengers transfered onto various Air India flights heading to destinations in North America. Such transfers now take place at New Delhi. During the year, Air India’s preparation for entry into Star Alliance was terminated as a result of the airline’s failure to meet some of the alliance’s stringent entry requirements. Recent press reports suggested that representatives from Air India and Star Alliance were back at the negotiation table.

Air India’s domestic operation accounts for 17.4 per cent of the domestic aviation market, third after the Jet Air group (Jet Airways and Jetlite) and IndiGo Airlines with a marketshare of 27.1 and 19.8 per cent respectively.

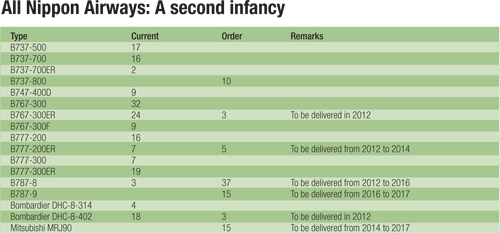

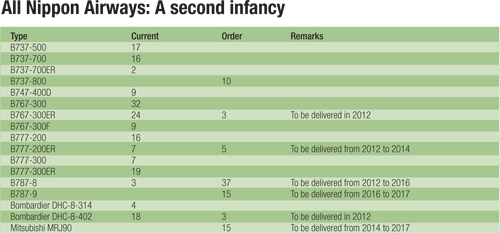

This year marks the 60th anniversary of All Nippon Airways (ANA), a milestone which traditionally is referred to as kanreki, a return to second infancy and one’s birth sign.

The airline triumphed the negative effects of the Japan earthquake of March 2011. It also ended the year with three Boeing 787-8 Dreamliners – the first airline in the world to operate this technologically-superior airplane.

Over the past few years, ANA, like many other Asian carriers, has been replacing its B747-400 fleet with more fuel-efficient B777-300ERs. Today, a handful of B747-400Ds are operated exclusively on domestic routes. ANA has committed itself to a total of 55 B787 Dreamliners and continues to eye the Airbus A350 XWB with strong interest. A plan announced in April 2008 to acquire the Airbus A380 was shelved later that year. Vice president for the Americas Satoru Fujiki said: “We are evaluating both the B747-8 Intercontinental and the A380 but we do not have any plans to introduce these big aircraft until we are more confident about stability and growth of the world economy and how these planes fit into the Japanese market.”

ANA continues to tap into the new opportunities offered by Haneda Airport. Services through this airport are reportedly popular due to its location nearer downtown Tokyo and convenient rail links. The dual-hub strategy resulted in a 31.1 per cent growth in international revenue during the fiscal year ending March 31, 2011. Going forward, ANA faces greater competition not only from a growing number of international airlines, including those from the Middle East, but from Japan Airlines, which has emerged from its re-organisation a stronger, leaner and profitable airline.

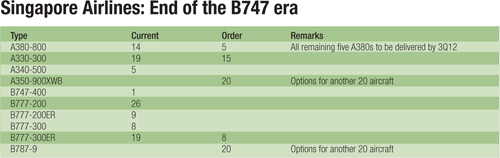

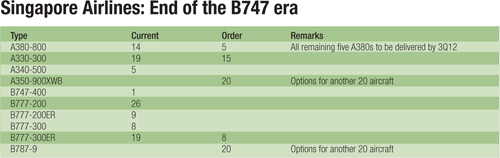

With over four years of A380 operation under its belt, Singapore Airlines adds this month Frankfurt and New York-John F. Kennedy Airport to the list of destinations served by this super jumbo. With this, another two B747-400s were decommissioned, sold to Transaero Airlines. Melbourne will be the final destination served by the B747-400 until the A380 takes over in late March. This will bring to an end 38 years of B747 passenger service since 1973. Barring any delay, the final five of SIA’s fleet of 19 A380s will be delivered by the third quarter and it holds an option for another six.

SIA’s nonstop flights to Los Angeles and New York continue to be the world’s longest commercial air routes. These use the Airbus A340-500 in an all business-class 100-seat configuration. As SIA’s fleet of B777-200s shrinks further – and as many as 10 of these aircraft are earmarked for its LCC subsidiary Scoot, the A330-300s becomes the backbone of its short- and medium-haul fleet.

SIA’s alliance with Virgin Australia has given it an all-important and much sought-after foothold in the Australian market. SIA and fully-owned subsidiary SilkAir have also beefed up their operation to Greater China with SIA now operating 70 weekly services to mainland China and 49 weekly services to Hong Kong, and SilkAir operating a further 27 weekly services to six second-tier Chinese cities.

SIA has also steadily added flights to India, now operating 51 weekly services to six Indian destinations while SilkAir operates a further 34 weekly services to seven Indian cities.

Thai Airways International (THAI) will join the A380 club in September when it receives its first 507-seat A380. This will initially be deployed on regional flights to Hong Kong before eventually serving the Bangkok-Frankfurt route. Subsequent deliveries will allow for A380 operation to London-Heathrow and Sydney. The injection of capacity by the A380 may be untimely as the airline is reportedly already struggling to fill the B747-400s presently deployed on these routes. THAI’s new regional airline, Thai Smile, will operate the A320 aircraft. The airline decided to call off an LCC cooperation with Tiger Airways, confirming what has been speculated for months.

Like most of its Asian counterparts, THAI is facing multiple challenges posed by high fuel prices, reduced demand from Europe and North America, and increased competition from Middle Eastern carriers which have deployed larger aircraft on the Bangkok route. After braving the negative impact of political riots in recent years, THAI’s hopes of turning its fortunes were dented by floods in and around Bangkok last year.

This article was first published in TTG Asia, January 27 issue, on page 8. To read more, please view our digital edition or click here to subscribe.