Asiatravel.com Holdings (Asiatravel) believes there is a turnaround opportunity for the company and assures creditors it is committed to settling its debts when the sources of funds it is actively sourcing materialise.

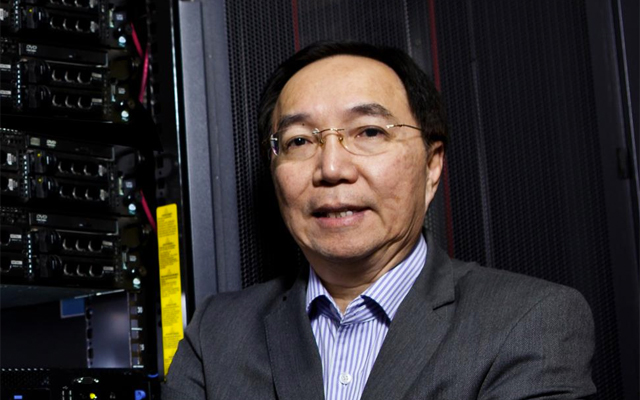

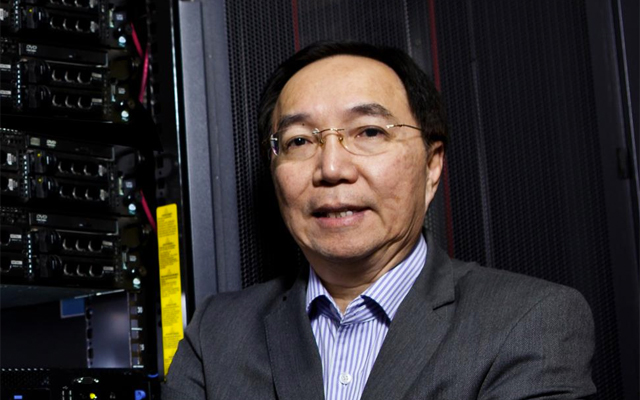

Executive chairman and CEO Boh Tuang Poh, addressing trade concerns exclusively with TTG Asia, said: “Other than managing existing business, our other biggest activity is on deep discussions with our controlling shareholder on their payment schedule and retrieving our various funds locked in deposits and security with payment gateways and suppliers as quickly as possible. We truly thank those who have been most supportive during this most difficult time of our 23 years of operations and will endeavour to keep all parties concerned updated.”

Asiatravel was forced to suspend trading on the Singapore Stock Exchange when its controlling shareholder, China-based ZhongHong Holdings, missed a scheduled payment of S$7.4 million (US$5.4 million) on June 30, which the company said was critical to its continuing operations and payment of its debts.

The news generally took agents and suppliers TTG Asia interviewed by surprise, fuelling uncertainty about the company and confusion whether it was still operating.

It is, though at present on a scaled-back mode. Said Boh: “All our offices are still in operation (albeit with) only leaner staff strength because we have already scaled back on B2C operations and focusing mainly on B2B online business. Plans to resume full-scale business are in place once we start receiving our funds.”

A pioneer in the Asian online travel sector, the group started in 1995 as a B2C player with Asiatravel.com, but started to pivot to B2B in 2012 as more OTAs entered the sector. In an interview with this editor in October 2012, Boh said: “We did well in the first 10-15 years on room reservations. But in the last two years (2010-2012), the business dynamics changed. As Europe faced difficulties and growth continued in Asia, more players started coming in here and, to gain a foothold, they are willing to spend massive amounts of marketing dollars. Asia is now their core and they want it fast.”

Competition has only increased since, with the likes of Expedia, Booking.com and Agoda putting even greater focus on the region. Its B2B pivot proved a saviour for Asiatravel. In its Annual Report FY2017 filed on the Singapore Stock Exchange on July 9, the group’s revenue from sale of services was S$168.6 million, a 72.7 per cent increase compared to FY2016, mainly due to its online B2B business, TAcentre.com, which rose 142.8 per cent to S$80.9 million in FY2017. “The increase was mainly due to contribution from the PRC market,” said the company.

But despite the increase in revenue, Asiatravel incurred a net loss of S$34.6 million in FY2017. Answering TTG Asia’s query on the loss, Boh said: “Much of our losses last year is attributed to our China startup operations, to become a major OTA in China, as mandated by the same controlling shareholder whose business was under a transformation from a traditional property developer into a tourism-based developer and operator. This is evident in their subsequent acquisitions of other major travel companies after investing into Asiatravel.”

Boh said Asiatravel had every reason to believe the balance amount (S$7.4 million) of the bond, which was signed a year ago, would be paid up by June 30 as ZhongHong Holdings had already funded a total of S$34 million over the course of last three years though there have been some delays due to the Chinese government’s restriction on foreign remittances.

“Up to as recently as a couple months ago, we were still assured that they were working on the remittance of funds to us and there wasn’t any indication that it could be further delayed,” Boh said. “But as fluid as how matters such as regulations and the economic situation can be in China, we have been actively engaging potential investors from more of a business strategic angle than for the funds. Unfortunately these discussions are still ongoing and couldn’t buffer the delay of ZhongHong’s funds.

“In our contingency plan for such a delay which is in place now, our operating priority becomes managing existing business already booked by our clients and to cease accepting new bookings. Although we had accumulated outstanding invoices with some suppliers such as hotels, we had been forefront in explaining that once our shareholder’s funds are on hand, we will make settlements as a first order. In this outturn of event, we seek these suppliers’ understanding that it will be further delayed,” said Boh.

Boh also allayed rumours in the trade that Asiatravel was in trouble. He said: “From beginning of this year, we had announced a major transformation internally to focus only on profitable lines and to expand our B2B business which now has supply partnerships with major agencies around the world. In the course of transformation, we had shut unprofitable business units such as transportation and tour operations and terminated offline wholesale subsidiaries, but unfortunately this created various speculations in the marketplace.

“We understand the concerns and uncertainty in the marketplace and especially when we had to announce (last Friday) our external auditor’s note regarding going concerns and we have accordingly prepared our financial statement using going concern assumption. Hence in the same announcement we had listed seven reasons why the company believes there is a turnaround opportunity. With this, we are assuring creditors that we are still committed to settling the debts when these few sources of funds materialise.

Meanwhile, in the Annual Report FY2017, Boh reiterated the group would expand its B2B platform, TAcentre.com, and would develop augmented reality digital tours in Asian destinations with its technology partner, Yaturu, following the launch of its first ‘digital theatrical tour’ to Israel recently which he said had “received very positive responses”.

Asiatravel had also completed the placement of S$1 million with the partner on April 6 to develop these tours.

With its online B2C channel, Boh said it would focus only on destinations where it had leading position. For other emerging online markets which it had previously not covered, it would work with strategic partners with sizeable customer base to undertake marketing of its system and inventory.

“These corporate actions will stabilise the group as it undertakes a major restructuring exercise to strengthen its cashflow for the next financial year,” said Boh.

Additional reporting by Pamela Chow in Singapore and Rosa Ocampo in Manila