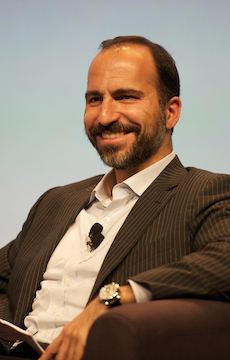

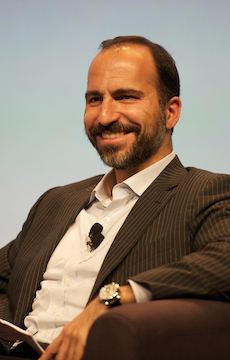

Expedia Group CEO Dara Khosrowshahi expects commissions to come down as the OTA looks to pass on lower fixed costs achieved through growth not only to shareholders but hotel partners.

Speaking at the International Hotel Investment Forum (IHIF) in Berlin last week, Khosrowshahi said Expedia has been lowering industry commissions over the last 10 years as its business grows.

“As we scale our fixed costs relative to demand, we want to make sure we pass on those economics not just to our shareholders but to our partners,” he said.

“We’ve been in the business for 20 years and we wouldn’t be without (our) partners… We don’t have thousands of people working in the field but we get to market the products of our partners and the partnership is growing.”

However, Khosrowshahi believed the industry must change its pricing structure, specifically unbundle its pricing the way airlines have unbundled airfare pricing, so prices won’t “differ wildly” when a customer books through a franchise, Expedia or Booking.com, etc, and so that the pricing would truly reflect its value.

“I think the premier issue as it relates to commissions and brands is the pricing structure of the industry. It really hasn’t adjusted to the realities of the new economics of distribution. Airlines are de-bundling their products – seat, check-in bag, food, etc – into basic economy fares that are much cheaper.”

While fixed costs are down, Expedia is faced with enormous costs of going from a web to a platform company. “The market is consolidating and demand is consolidating into larger and larger platforms. We’ve gone from web company to a platform company and we have to essentially take in every single piece of travel inventory in the world – hotels, air, cars – and offer it in any way consumers want, website, mobile, WeChat, voice.

“Going from web to platform (entails) enormous costs, so in order to defray the cost, we try to bring more volume into our platform.”

Hence, the company in 2015 bought seven companies, among them Travelocity, Orbitz Worldwide and HomeAway, although it bought nothing last year.

With consolidation comes disruption, he said, and the HomeAway acquisition for example is an “extension of audience and supply into alternative lodging which we think will be very important over the next five to 10 years”.

Twice during the session Khosrowshahi said that the home-sharing economy will be professionalised and what we’re seeing right now “is just the beginning”, where it’s more like e-Bay 15 years ago which saw mostly entrepreneurs at home engaged in a marketplace.

“I think alternate lodging will be professionalised not only in terms of brands, but ownership. Combine technology and the distribution, the possibility for owners is tremendous,” he said.

There are threats and opportunities for the industry. One threat clearly is the pricing pressure, when massive supply of homes are made available to global travel, depressing prices. However, the opportunity that home-sharing brings, he said, is introducing new demand.

“My own kids, when they travel, it’s more about experiences. This can be the start of a new wave of travel growth and the opportunity for new brands and owners is tremendous,” he said.

Meanwhile, on opportunities for Expedia in China and Asia, Khosrowshahi said the company’s strategy is clear, focusing on middle-class China outbound while domestic is “essentially Ctrip’s business”. Travel agents is one of Expedia’s fastest-growing markets for China outbound, he said. South-East Asia outbound is also “truly extraordinary”.

On how he foresees Google’s inroads into travel, Khosrowshahi said: “Google is a marketing platform. They have indicated they want to stay at the top of the consumer consideration and are not going to be deep into customer service, it’s not what they do.

“They are a very important partner but also a very expensive distribution channel. We try to convert the customers (acquired through Google) over a number of interactions with us into direct customers. So they are a giant customer acquisition platform for us.”